Chapter 13 Bankruptcy And Car Loans

Chapter 13 Bankruptcy And Car Loans - Ad experience the better way to finance & purchase a vehicle at drivetime®. Web if you have a car loan, the amount you owe on it may be reduced in the chapter 13 bankruptcy process if you owe more on it than its current value. However, you can expect there. Adding your car loan to the repayment plan. Web a chapter 13 bankruptcy is also called a wage earner's plan. Web pros of switching to chapter 7. Web chapter 13 bankruptcy: You'll need permission from the court to finance a car. Web what happens to your car, truck, van, motorcycle, or another vehicle if you file for chapter 13 bankruptcy? For a more detailed explanation of how cramdowns work for car loans, see car loan.

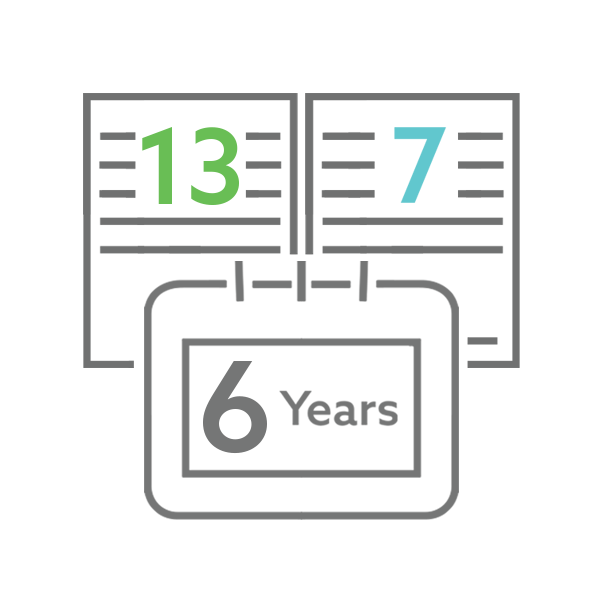

Free unlimited protection that goes wherever you go. Web chapter 13 bankruptcy allows you to consolidate and settle debt for just pennies on the dollar. Web chapter 13 bankruptcy: Web chapter 13 bankruptcy, meanwhile, can stay on your credit for up to seven years. Web can you get a car loan or new credit card, or incur medical or other debts during your chapter 13 bankruptcy? For a more detailed explanation of how cramdowns work for car loans, see car loan. It enables individuals with regular income to develop a plan to repay all or part of their debts. Car loan cramdowns in bankruptcy. Web june 2, 2023 at 9:00 am · 7 min read when you file chapter 13 bankruptcy — also known as repayment bankruptcy — your credit will take a hit, and it will stay on your credit profile for. Chapter 13 bankruptcy filings stay on your credit.

Web the process of financing a car during a chapter 13 bankruptcy to get the court's permission, a specific series of steps must be followed: Prepare for an interest rate that may shock you. Web chapter 13 and car loans. You may want to work with a legal aid organization if you aren’t comfortable filling out the chapter. Web yes, you can get a car loan after bankruptcy. It enables individuals with regular income to develop a plan to repay all or part of their debts. Debtors may take advantage of a bankruptcy process known as a cram down. You must pay your monthly car payment in chapter 13,. Web what happens to your car, truck, van, motorcycle, or another vehicle if you file for chapter 13 bankruptcy? For a more detailed explanation of how cramdowns work for car loans, see car loan.

Car Loans While In Chapter 13, Chapter 13 Bankruptcy Car Loan YouTube

“in over 20 years of the law practice, 5 star auto plaza is the only auto dealer that received our endorsement. Also, if you can qualify for a repayment plan and get caught up on your loan… Dream nissan we care we delight. Web follow these steps for getting a car loan in chapter 13 bankruptcy: That doesn’t mean you’ll.

Filing for Chapter 13 Bankruptcy in GA to Reduce Your Car Loan and

Chapter 13 bankruptcy is a type of debt consolidation that eliminates or reduces all of the same debts as chapter 7 bankruptcy while also stopping foreclosure and repossessions, deferring student loans, and even reducing car interest rates and payments. The reason is relatively simple. Free unlimited protection that goes wherever you go. Web yes, you can get a car loan.

Get a Chapter 7 Car Loan Car Loan After Chapter 7 Chapter 7

Ad bad credit auto loans are no problem for dream nissan. Web chapter 13 bankruptcy, meanwhile, can stay on your credit for up to seven years. Web a chapter 13 bankruptcy is also called a wage earner's plan. Under this chapter, debtors propose a repayment plan. Web can you get a car loan or new credit card, or incur medical.

Can You Stop Car Payments in Chapter 13 Bankruptcy?

Learn how filing for chapter 13 bankruptcy can help you keep your vehicle from being repossessed and when you can use a cramdown to decrease the loan amount you'll need to pay. For instance, if you owe $10,000 on a car worth $8,000, a cramdown will let you pay it off for $8,000. A cram down can be used when.

Best Cars Choices for Bankruptcy Car Loans Day One Credit

Web june 2, 2023 at 9:00 am · 7 min read when you file chapter 13 bankruptcy — also known as repayment bankruptcy — your credit will take a hit, and it will stay on your credit profile for. Ad experience the better way to finance & purchase a vehicle at drivetime®. Get a buyer's order from a dealership: You.

Using Chapter 13 Bankruptcy to Lower Your Car Interest Rate

It can be possible to buy a vehicle while in chapter 13 bankruptcy, as long as you continue to make your chapter 13 payments (this type of bankruptcy involves a payment plan). Web whether you are in an open bankruptcy chapter 7, chapter 13 or your bankruptcy has been discharged, we have a finance program to fit you. Dream nissan.

What Happens to Student Loans in Chapter 13 Bankruptcy?

Get a buyer's order from a dealership: Web can you get a car loan or new credit card, or incur medical or other debts during your chapter 13 bankruptcy? Free unlimited protection that goes wherever you go. For a more detailed explanation of how cramdowns work for car loans, see car loan. Web the process of financing a car during.

Bankruptcy and Car Loans in Arizona Lerner and Rowe Law Group

Discharging most unsecured debts such as credit card balances and medical debt, which saves money. Essentially, this type of bankruptcy lets you discharge certain debts, such as credit card and medical debt, and force some of your creditors into giving you a streamlined repayment plan for other debts, like your mortgage and car loan. The first step is finding a.

How to Keep Your Car in Chapter 13 Bankruptcy CMC Law

Web chapter 13 bankruptcy: Web if you have a car loan, the amount you owe on it may be reduced in the chapter 13 bankruptcy process if you owe more on it than its current value. Web follow these steps for getting a car loan in chapter 13 bankruptcy: Learn how filing for chapter 13 bankruptcy can help you keep.

Getting a car loan during chapter 13 bankruptcy http//www

Prepare for an interest rate that may shock you. Shop our selection of competitively priced, low miles, late model cars online! Dream nissan we care we delight. Chapter 13 bankruptcy filings stay on your credit. Web chapter 13 bankruptcy is known as the reorganization bankruptcy, and it gives you a chance to repay your creditors through the help of a.

The Reason Is Relatively Simple.

That doesn’t mean you’ll need to wait seven to 10 years to get a car loan. Subprime lenders that are signed up with special finance. 5 star knows what the courts require to approve loans… Dream nissan we care we delight.

But Because Of The Financial Hardships That Often Lead To Bankruptcy, Lenders Who Do Approve You Will Almost Certainly Charge A High Interest.

Ad experience the better way to finance & purchase a vehicle at drivetime®. For a more detailed explanation of how cramdowns work for car loans, see car loan. Web chapter 13 bankruptcy allows you to consolidate and settle debt for just pennies on the dollar. Web yes, many people pay off car loans in chapter 13 and emerge from bankruptcy owning their vehicle free and clear.

By Cara O'neill, Attorney A Chapter 13 Bankruptcy Debtor Can Buy A Needed Car Or Appliance On Credit If Approved By The Bankruptcy.

A chapter 7 bankruptcy stays on your credit report for 10 years. Essentially, this type of bankruptcy lets you discharge certain debts, such as credit card and medical debt, and force some of your creditors into giving you a streamlined repayment plan for other debts, like your mortgage and car loan. Web june 2, 2023 at 9:00 am · 7 min read when you file chapter 13 bankruptcy — also known as repayment bankruptcy — your credit will take a hit, and it will stay on your credit profile for. Debtors may take advantage of a bankruptcy process known as a cram down.

Car Loan Cramdowns In Bankruptcy.

You may want to work with a legal aid organization if you aren’t comfortable filling out the chapter. Web follow these steps for getting a car loan in chapter 13 bankruptcy: Web there's no easy way around it: Chapter 13 bankruptcy filings stay on your credit.