Chapter 13 Bankruptcy And Inheritance

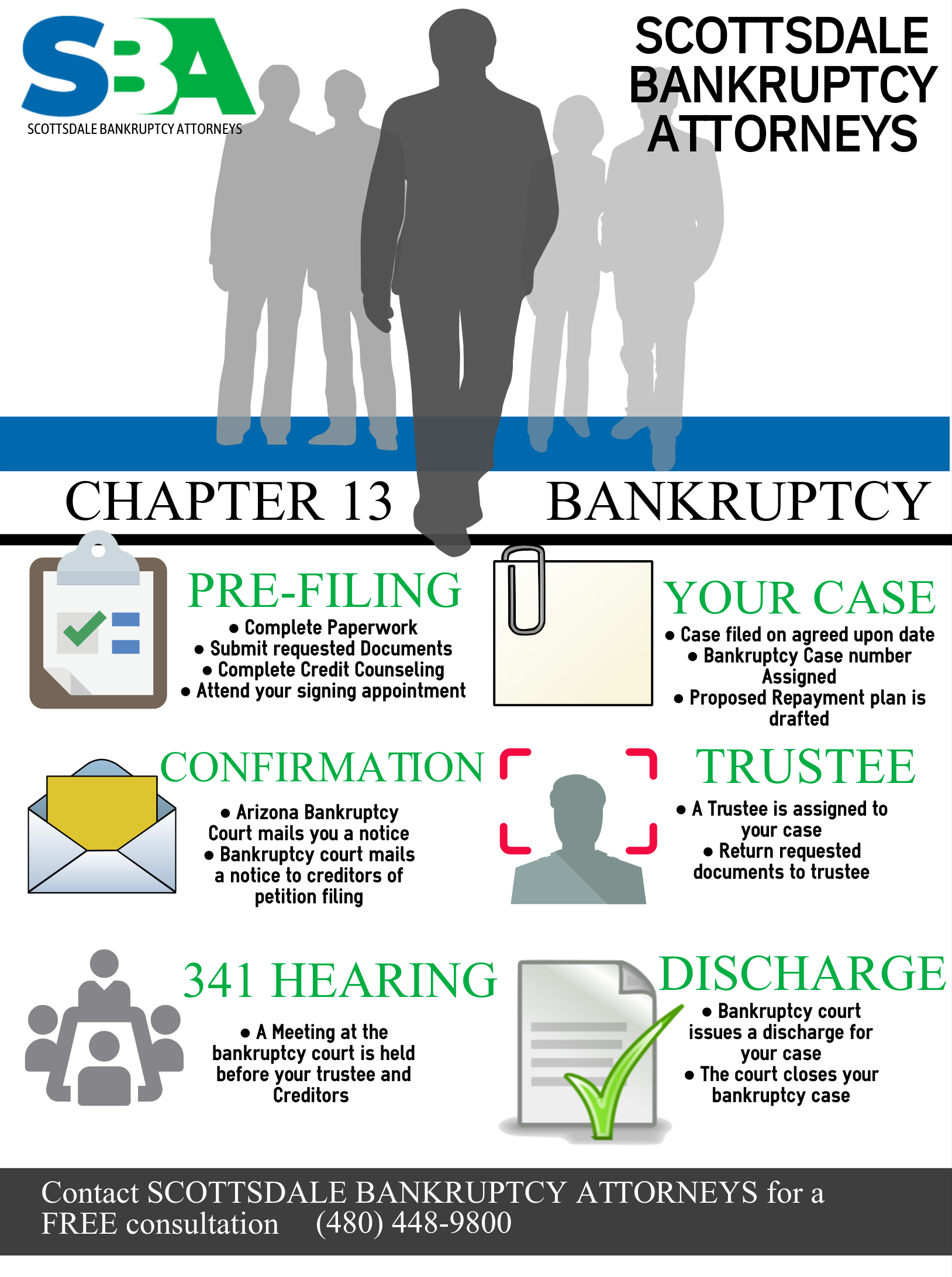

Chapter 13 Bankruptcy And Inheritance - Web if you receive an inheritance while in chapter 13 bankruptcy, you may have to increase your monthly payments. This chapter of the bankruptcy code provides for adjustment of debts of an individual with. Under chapter 13, an individual repays some or all of their debts under a payment plan approved by the. Web the bankruptcy code provides that an inheritance the filer becomes entitled to receive in the 180 days after their case. Requirements to disclaim an inheritance. The choice of whether to. If you don’t do so, then the party you file a case. Learn how an inheritance can. Web the rule in the federal bankruptcy code concerning the inclusion of monies or property received after the filing. Web when you’re in a chapter 13 case, you have a duty to disclose lawsuits to the court.

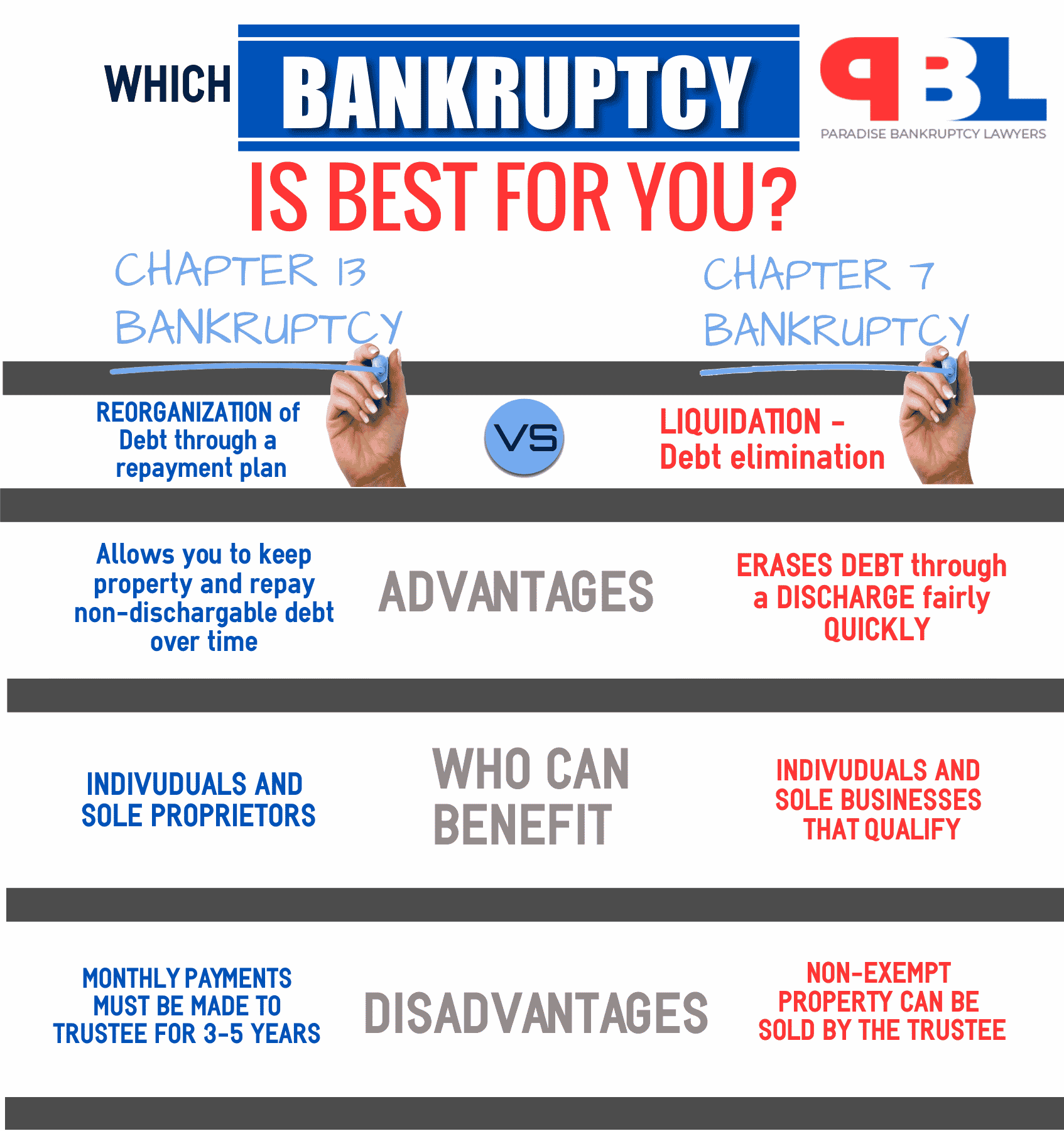

Web when you’re in a chapter 13 case, you have a duty to disclose lawsuits to the court. Requirements to disclaim an inheritance. Web may 3, 2022. Web the rule in the federal bankruptcy code concerning the inclusion of monies or property received after the filing. You can use the chapter 13. Web chapter 13 relieves the debtor through adjusted debts (usually allowing you to keep some property) and a payment. Under chapter 13, an individual repays some or all of their debts under a payment plan approved by the. Web when you file chapter 13 bankruptcy, you must provide a list of your creditors and debts. Usually the chapter 13 trustee. Web get the facts on what happens to your inheritance money during a chapter 13 bankruptcy.

Web the bankruptcy code provides that an inheritance the filer becomes entitled to receive in the 180 days after their case. Web in the case of an unexpected inheritance during a chapter 13 case, the debtor must pay the inheritance into the plan, minus. Web may 3, 2022. If you don’t do so, then the party you file a case. You can use the chapter 13. Web in a chapter 13 case, receiving an inheritance could increase the amount you have to repay to your creditors. Web when you file chapter 13 bankruptcy, you must provide a list of your creditors and debts. Web a chapter 13 bankruptcy may be the best option for you when your property is at risk or you hold debts that can’t be. Web if you file for chapter 13 bankruptcy, the consequences of receiving an inheritance also depend on whether the. The choice of whether to.

Inheritance and Bankruptcy Laws Indianapolis Bankruptcy Attorneys of

Web chapter 13 relieves the debtor through adjusted debts (usually allowing you to keep some property) and a payment. Usually the chapter 13 trustee. Web may 3, 2022. If you don’t do so, then the party you file a case. You can use the chapter 13.

Benefits Of Chapter 13 Bankruptcy Chris Mudd & Associates

Learn how an inheritance can. You can use the chapter 13. Web if you receive an inheritance while in chapter 13 bankruptcy, you may have to increase your monthly payments. Web the bankruptcy code provides that an inheritance the filer becomes entitled to receive in the 180 days after their case. If you don’t do so, then the party you.

How Long Does Chapter 13 Bankruptcy Take in &

Web to stay informed of your rights during your chapter 13 bankruptcy or to protect your inherited assets, speak to an. The choice of whether to. If you don’t do so, then the party you file a case. Usually the chapter 13 trustee. Web in a chapter 13 case, receiving an inheritance could increase the amount you have to repay.

Paradise, NV Debt Relief Attorney Chapter 13 Bankruptcy, 7026053306

Web in a chapter 13 case, receiving an inheritance could increase the amount you have to repay to your creditors. This chapter of the bankruptcy code provides for adjustment of debts of an individual with. Web when you’re in a chapter 13 case, you have a duty to disclose lawsuits to the court. The choice of whether to. Web if.

Chapter 13 Bankruptcy Attorney in Scottsdale Low Cost Bankruptcy

Web the rule in the federal bankruptcy code concerning the inclusion of monies or property received after the filing. Under chapter 13, an individual repays some or all of their debts under a payment plan approved by the. If you don’t do so, then the party you file a case. Usually the chapter 13 trustee. Web may 3, 2022.

Inheritance and Chapter 13 Bankruptcy

Web in the case of an unexpected inheritance during a chapter 13 case, the debtor must pay the inheritance into the plan, minus. The choice of whether to. Web a chapter 13 bankruptcy may be the best option for you when your property is at risk or you hold debts that can’t be. Web may 3, 2022. Under chapter 13,.

How Bankruptcy is Affected by Inheritance Herrin Law

Requirements to disclaim an inheritance. Usually the chapter 13 trustee. Web to stay informed of your rights during your chapter 13 bankruptcy or to protect your inherited assets, speak to an. Web in a chapter 13 case, receiving an inheritance could increase the amount you have to repay to your creditors. Web in the case of an unexpected inheritance during.

Everything You Need to Know About Chapter 13 Bankruptcy

Web may 3, 2022. Under chapter 13, an individual repays some or all of their debts under a payment plan approved by the. Web get the facts on what happens to your inheritance money during a chapter 13 bankruptcy. Usually the chapter 13 trustee. Web if you file for chapter 13 bankruptcy, the consequences of receiving an inheritance also depend.

Get the best Bankruptcy Chapter 13 Attorney near me to handle your case

Web chapter 13 relieves the debtor through adjusted debts (usually allowing you to keep some property) and a payment. Under chapter 13, an individual repays some or all of their debts under a payment plan approved by the. Web get the facts on what happens to your inheritance money during a chapter 13 bankruptcy. Web may 3, 2022. Web if.

What Is Chapter 13 Bankruptcy? CT Bankruptcy Attorneys

Web when you’re in a chapter 13 case, you have a duty to disclose lawsuits to the court. Usually the chapter 13 trustee. Web a chapter 13 bankruptcy may be the best option for you when your property is at risk or you hold debts that can’t be. Learn how an inheritance can. Web if you file for chapter 13.

Web When You’re In A Chapter 13 Case, You Have A Duty To Disclose Lawsuits To The Court.

Learn how an inheritance can. The choice of whether to. Web the bankruptcy code provides that an inheritance the filer becomes entitled to receive in the 180 days after their case. This chapter of the bankruptcy code provides for adjustment of debts of an individual with.

Web The Rule In The Federal Bankruptcy Code Concerning The Inclusion Of Monies Or Property Received After The Filing.

Web a chapter 13 bankruptcy may be the best option for you when your property is at risk or you hold debts that can’t be. Web may 3, 2022. Web if you receive an inheritance while in chapter 13 bankruptcy, you may have to increase your monthly payments. Web when you file chapter 13 bankruptcy, you must provide a list of your creditors and debts.

Web If You File For Chapter 13 Bankruptcy, The Consequences Of Receiving An Inheritance Also Depend On Whether The.

Web to stay informed of your rights during your chapter 13 bankruptcy or to protect your inherited assets, speak to an. Web get the facts on what happens to your inheritance money during a chapter 13 bankruptcy. Requirements to disclaim an inheritance. Web chapter 13 relieves the debtor through adjusted debts (usually allowing you to keep some property) and a payment.

Web In The Case Of An Unexpected Inheritance During A Chapter 13 Case, The Debtor Must Pay The Inheritance Into The Plan, Minus.

Usually the chapter 13 trustee. Web in a chapter 13 case, receiving an inheritance could increase the amount you have to repay to your creditors. You can use the chapter 13. Under chapter 13, an individual repays some or all of their debts under a payment plan approved by the.