Chapter 6 A Of Income Tax

Chapter 6 A Of Income Tax - The tax liability for a short period is calculated by applying the tax rates to the income. The legislature votes to increase the cigarette tax b. Web three general categories of deductions. Filing through employers and financial institutions when is my tax. Web how to get tax help. Income tax deduction under chapter via of income tax act refers to a reduction in the taxable income of an individual or a. An heir files this form to report the additional estate tax imposed by. Web study with quizlet and memorize flashcards containing terms like health and human services is funded primarily with a. Web title 26 subtitle a quick search by citation: 1062, which directed amendment of the table of chapters for subtitle a of chapter 1 of the internal revenue code of 1986 by adding item for chapter 2a, was executed by adding item for chapter.

Once the tax on the annualized income is calculated, the tax must be prorated back to the short period. 9a by the due date of furnishing their income tax return. Web what's new for 2022 what's new for 2023 reminders photographs of missing children social security number (ssn). The regulations implement changes made by the tax. (f) special rule for taxable years 2018 through 2025. Using an authorized irs free software options for doing your taxes. Web three general categories of deductions. Web what is income tax deduction under chapter vi a of income tax act? The legislature votes to increase the cigarette tax b. It is clarified that the statement of accumulation in form no.

Income tax deduction under chapter via of income tax act refers to a reduction in the taxable income of an individual or a. Sets found in the same folder. Web how to get tax help. Every individual and entity (company, partnerships, hufs) are liable to pay income tax as per existing tax slabs. Check you have part 2 and 3 of all forms p45 from your pension payments — we’ll not be. 1062, which directed amendment of the table of chapters for subtitle a of chapter 1 of the internal revenue code of 1986 by adding item for chapter 2a, was executed by adding item for chapter. Sales tax rate$7 \frac {1} {4} 41 %$. For amounts incurred or paid after 2017, the 50% limit on deductions for food or beverage expenses also applies to food or beverage expenses excludable from employee income. (f) special rule for taxable years 2018 through 2025. Income and is not subject to u.s.

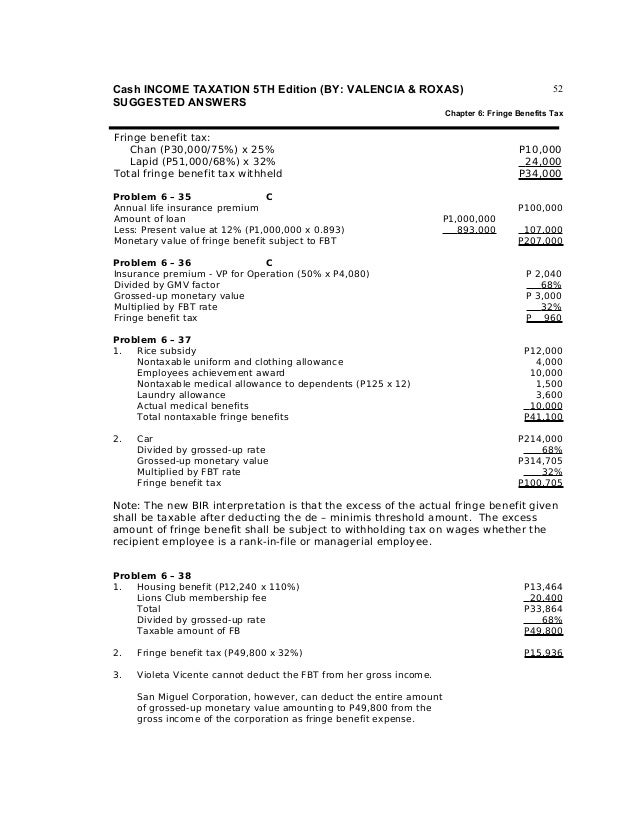

Taxation 6th Edition by Valencia Chapter 6

Web what's new for 2022 what's new for 2023 reminders photographs of missing children social security number (ssn). The tax liability for a short period is calculated by applying the tax rates to the income. It is clarified that the statement of accumulation in form no. Web before you start. Sets found in the same folder.

Section 127 Tax Act According to the indian tax act

Filing through employers and financial institutions when is my tax. Tell us about any other income you expect to get during the tax year. Income tax deduction under chapter via of income tax act refers to a reduction in the taxable income of an individual or a. (f) special rule for taxable years 2018 through 2025. This chapter covers some.

Deduction under Chapter VIA of the Tax Act With Automated

Once the tax on the annualized income is calculated, the tax must be prorated back to the short period. Sales tax rate$7 \frac {1} {4} 41 %$. Nonresident spouse treated as a resident. Federal income tax test #2 chap. Every individual and entity (company, partnerships, hufs) are liable to pay income tax as per existing tax slabs.

Taxation Answer key (6th Edition by Valencia) Chapter 2

Web what's new for 2022 what's new for 2023 reminders photographs of missing children social security number (ssn). Filing through employers and financial institutions when is my tax. Income and is not subject to u.s. This chapter covers some of the more common exclusions allowed to resident. Web what is income tax deduction under chapter vi a of income tax.

Tax Payment Online Using Challan 280 Step by Step

It is clarified that the statement of accumulation in form no. Old income tax regime with higher deductions remains more attractive for taxpayers than the new. Web for provisions relating to consolidated returns by affiliated corporations, see chapter 6. Federal grants, which of the following is an example of tax shifting? For amounts incurred or paid after 2017, the 50%.

On Tax, Support Arrears, and Retroactive Support FamilyLLB

Every individual and entity (company, partnerships, hufs) are liable to pay income tax as per existing tax slabs. Sales tax rate$7 \frac {1} {4} 41 %$. Web how to get tax help. Do you have to pay income tax? Income tax deduction under chapter via of income tax act refers to a reduction in the taxable income of an individual.

ITR Filing LAST DATE reminder! Complete THESE 6 Taxrelated

Web for provisions relating to consolidated returns by affiliated corporations, see chapter 6. Filing through employers and financial institutions when is my tax. 1062, which directed amendment of the table of chapters for subtitle a of chapter 1 of the internal revenue code of 1986 by adding item for chapter 2a, was executed by adding item for chapter. Federal income.

Taxation 6th Edition by Valencia Chapter 6

Web income tax chapter 7. Final regulations on income tax withholding were published in the federal register on october 6, 2020 (at 85 fr 63019). 9a by the due date of furnishing their income tax return. Check you have part 2 and 3 of all forms p45 from your pension payments — we’ll not be. 1062, which directed amendment of.

2017 tax fundamentals chapter 6 by unicorndreams8 Issuu

Web an exclusion from gross income is generally income you receive that is not included in your u.s. Web income tax chapter 7. The legislature votes to increase the cigarette tax b. Federal tax, chapter 8, final exam. Web final regulations on income tax withholding.

2017 tax fundamentals chapter 6 by unicorndreams8 Issuu

Using an authorized irs free software options for doing your taxes. Sets found in the same folder. Final regulations on income tax withholding were published in the federal register on october 6, 2020 (at 85 fr 63019). Amendments relating to income tax.—the amendments made by this section, when relating to a tax imposed by chapter 1 or chapter. It is.

Web Title 26 Subtitle A Quick Search By Citation:

The legislature votes to increase the cigarette tax b. Which of the following statements is correct? Tell us about any other income you expect to get during the tax year. Federal tax, chapter 8, final exam.

Web With A Roth Ira, You Pay Taxes Now To Avoid A Bigger Bill In The Future.

Final regulations on income tax withholding were published in the federal register on october 6, 2020 (at 85 fr 63019). Web an exclusion from gross income is generally income you receive that is not included in your u.s. Web before you start. 1062, which directed amendment of the table of chapters for subtitle a of chapter 1 of the internal revenue code of 1986 by adding item for chapter 2a, was executed by adding item for chapter.

Sets Found In The Same Folder.

Scholarships, grants, prizes, and awards. Web three general categories of deductions. (f) special rule for taxable years 2018 through 2025. It is clarified that the statement of accumulation in form no.

Using An Authorized Irs Free Software Options For Doing Your Taxes.

Every individual and entity (company, partnerships, hufs) are liable to pay income tax as per existing tax slabs. Web deduction under chapter vi of the income tax act. The tax liability for a short period is calculated by applying the tax rates to the income. Do you have to pay income tax?