Chapter 6 Cash Purchases Answers

Chapter 6 Cash Purchases Answers - Web this quiz is incomplete! Merchandising businesses acquire merchandise for resale to customers. Usually expressed as a percent. Cash purchases in this chapter: A tax on the selling price of an item or service your purchase. Web terms in this set (23) what is purchasing? Cash purchases practice tests your results: Web chapter 6 accounting for merchandising businesses 1. Form used to report that ordered goods are received and to describe their quantity and condition. Cash purchases spreadsheet application answers.

Something that is not expensive. Enter the length or pattern for better results. Web terms in this set (23) what is purchasing? Form used to report that ordered goods are received and to describe their quantity and condition. Web this quiz is incomplete! To play this quiz, please finish editing it. Sales tax = total selling price x sales tax rate total purchase price = total selling price + sales tax short cut: Usually expressed as a percent. Total amount of your purchase. It is the selling of merchandise, instead of.

Sales tax = total selling price x sales tax rate total purchase price = total selling price + sales tax short cut: Enter the length or pattern for better results. Web in chapter 6, documents trigger transaction analysis. Web 46.3 × 6.72 = a) 6.889: It is the selling of merchandise, instead of. Form used to report that ordered goods are received and to describe their quantity and condition. Web mathematics for business and personal finance graphic organizers 6 chapter 6 cash purchases strategies for cash purchases unit pricing comparison shopping coupons and rebates. Web chapter 6 accounting for merchandising businesses 1. 6.1 sales tax 6.2 total purchase price most states charge sales tax on goods sold. Web study with quizlet and memorize flashcards containing terms like sales tax, sales receipt, total purchase price and more.

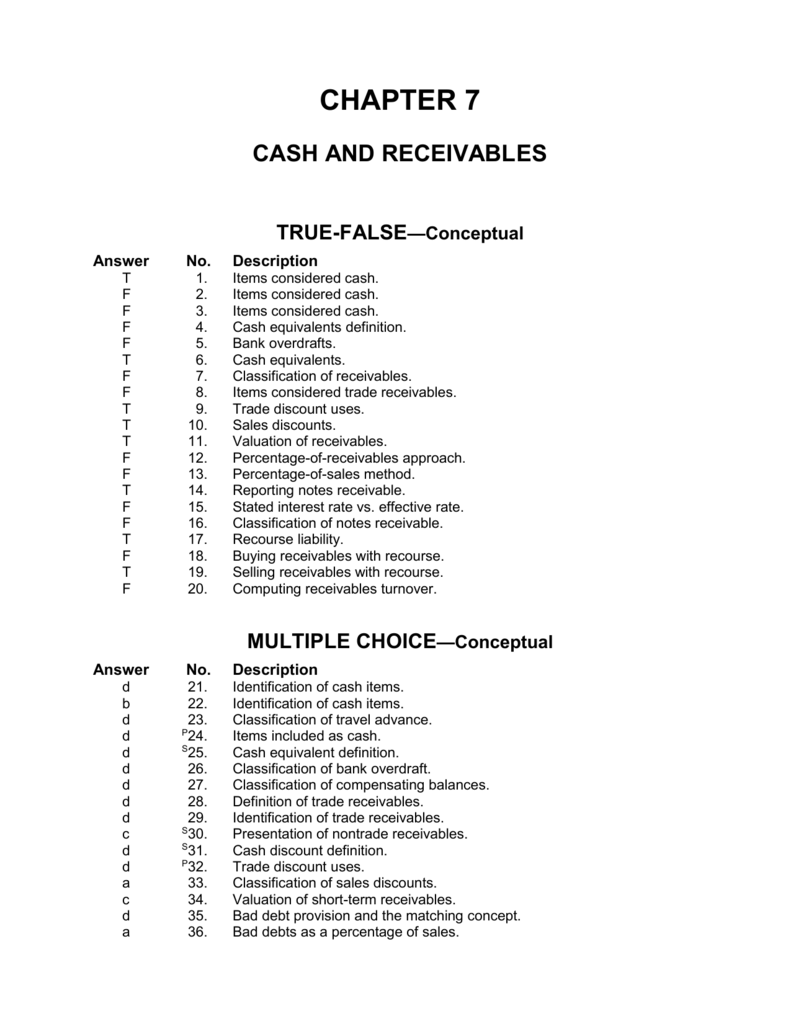

ch07cashandreceivables

Expense resulting from failing to take advantage of cash discounts on purchases… Sales tax = total selling price x sales tax rate total purchase price = total selling price + sales tax short cut: It is the selling of merchandise, instead of. Find the state tax and city tax. Comparing state sales tax rates.

5 Cash Purchases We Made in 2015 That Saved Us Money Queen of Free

Example 1 sales tax 232 chapter 6 cash purchases. Expense resulting from failing to take advantage of cash discounts on purchases… The selling price plus the sales tax calculations: Web cashier (6) crossword clue. Web in chapter 6, documents trigger transaction analysis.

Entering cash purchases YouTube

Web in chapter 6, documents trigger transaction analysis. 28.3136 ÷ 4.424 = a) 23.8896: Web this quiz is incomplete! Web chapter 6 accounting for merchandising businesses 1. Form used to report that ordered goods are received and to describe their quantity and condition.

Max Verstappen KirstineRachell

Web complete the problems, then check your answers at the end of the chapter. When determining the final cost of a major purchase, you have to figure in the additional money you will pay depending on your. Tax is on the selling price of an item. Web 46.3 × 6.72 = a) 6.889: Web terms in this set (23) what.

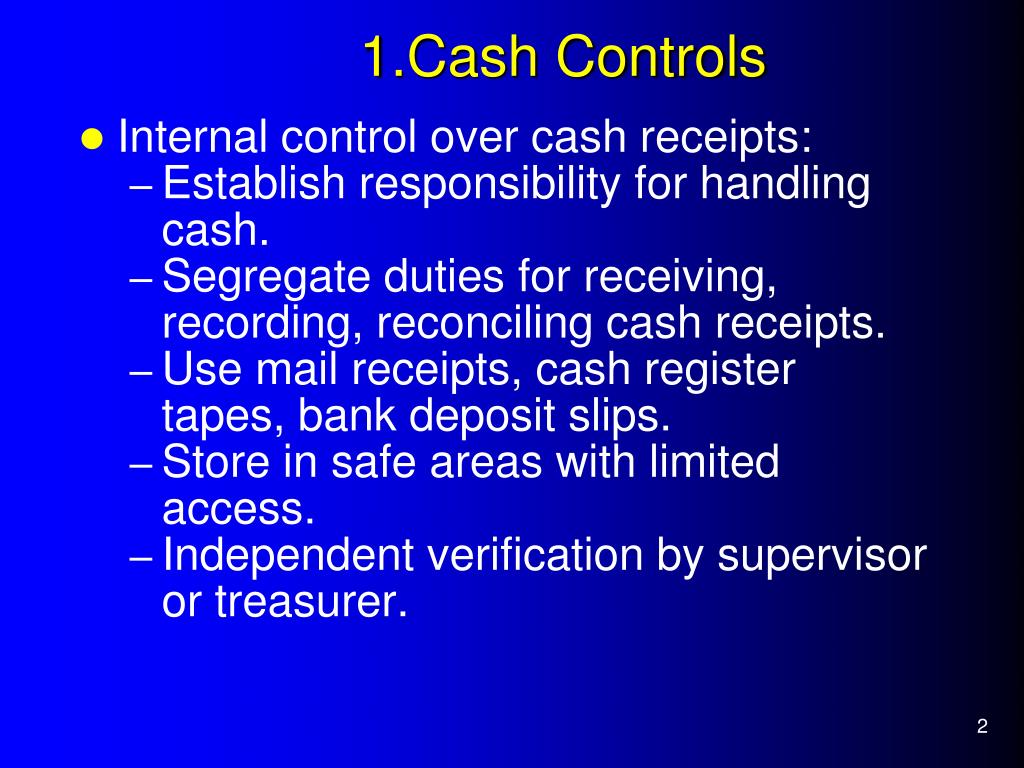

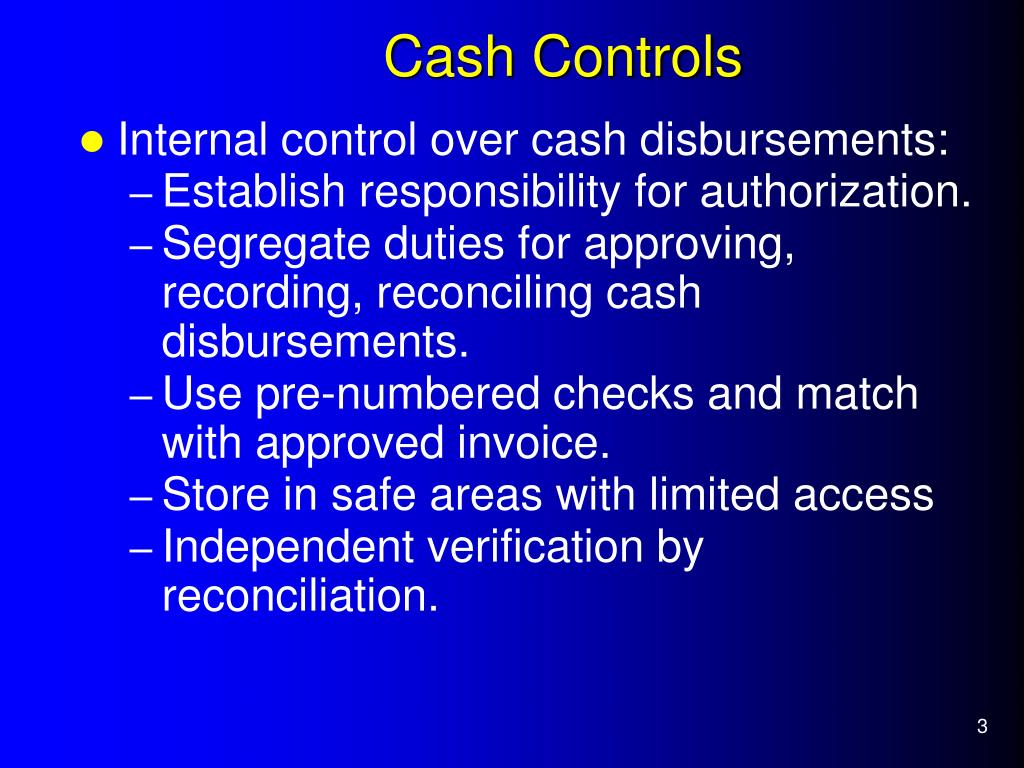

PPT CHAPTER 6 CASH CONTROL SYSTEMS PowerPoint Presentation, free

Something that is not expensive. Web in chapter 6, documents trigger transaction analysis. 28.3136 ÷ 4.424 = a) 23.8896: Total amount of your purchase. The selling price plus the sales tax calculations:

PPT Chapter 6 Cash and Control of Cash PowerPoint Presentation, free

6.1 sales tax 6.2 total purchase price most states charge sales tax on goods sold. Merchandising businesses acquire merchandise for resale to customers. A remittance is the action of sending money in payment of a bill. To make sure you are starting in the correct place, display the 11/2/20xx to 11/30/20xx trial balance. Sales tax = total selling price x.

PPT Chapter 6 Cash and Control of Cash PowerPoint Presentation, free

Enter the length or pattern for better results. Merchandising businesses acquire merchandise for resale to customers. Web this quiz is incomplete! Web terms in this set (23) what is purchasing? Tax is on the selling price of an item.

PPT Chapter 6 Cash and Accounts Receivable PowerPoint Presentation

Web study with quizlet and memorize flashcards containing terms like sales tax, sales receipt, total purchase price and more. Cash purchases in this chapter: The crossword solver found 50 answers to cashier (6), 6 letters crossword clue. Web its cash and cash equivalents decreased from 32,111,442 at decem ₩ ber 31, 2016, to ₩30,545,130 at december 31, 2017 (all in.

PPT Chapter 6 Cash and Accounts Receivable PowerPoint Presentation

Expense resulting from failing to take advantage of cash discounts on purchases… Web chapter 6 accounting for merchandising businesses 1. Tax is on the selling price of an item. Cash purchases practice tests your results: Web mathematics for business and personal finance chapter 6:

Pin on ui

A tax on the selling price of an item or service your purchase. Web its cash and cash equivalents decreased from 32,111,442 at decem ₩ ber 31, 2016, to ₩30,545,130 at december 31, 2017 (all in krw millions). As a percent of total current assets, its cash balance decreased from. Cash purchases spreadsheet application answers. Cash purchases in this chapter:

Web Study With Quizlet And Memorize Flashcards Containing Terms Like Sales Tax, Sales Receipt, Total Purchase Price And More.

The crossword solver finds answers to classic crosswords and cryptic crossword puzzles. Web cashier (6) crossword clue. The correct answer for each question is indicated by a. Cash purchases in this chapter:

Web Its Cash And Cash Equivalents Decreased From 32,111,442 At Decem ₩ Ber 31, 2016, To ₩30,545,130 At December 31, 2017 (All In Krw Millions).

Web chapter 6 accounting for merchandising businesses 1. Web this quiz is incomplete! Something that is not expensive. 28.3136 ÷ 4.424 = a) 23.8896:

Web Mathematics For Business And Personal Finance Chapter 6:

As a percent of total current assets, its cash balance decreased from. Cash purchases practice tests your results: The selling price plus the sales tax calculations: Total amount of your purchase.

Sales Tax = Total Selling Price X Sales Tax Rate Total Purchase Price = Total Selling Price + Sales Tax Short Cut:

Usually expressed as a percent. Enter the length or pattern for better results. A tax on the selling price of an item or service your purchase. Web complete the problems, then check your answers at the end of the chapter.