Charles Schwab Simple Ira Contribution Transmittal Form

Charles Schwab Simple Ira Contribution Transmittal Form - Web this notice describes your employer's simple ira plan and provides you with information about the type of contribution your employer will make to your simple ira in the. Type text, add images, blackout confidential details, add comments, highlights and more. Web individual 401(k) contribution transmittal form download: Are ira contributions tax deductible? (schwab) (member sipc), is registered by the securities and exchange commission (sec) in the united states of. Web edit, sign, and share charles schwab simple ira contribution transmittal form online. (“schwab”) when sending contributions made by. Web what's the maximum ira contribution? Web charles schwab forms eligible for esignature. 2 of 8 form category form o account.

What if you contribute too much? Getting a legal specialist, making a scheduled visit and coming to the office for a personal conference makes completing a simple ira. Web overview what are the benefits of a simple ira? Simple ira contribution transmittal form download: Edit your schwab simple ira contribution transmittal form online type text, add images, blackout confidential details, add comments, highlights and more. Type text, add images, blackout confidential details, add comments, highlights and more. Easily sign the charles schwab contribution transmittal form with your finger. Web simple ira contribution transmittal form to the employer: Are ira contributions tax deductible? Edit your charles schwab simple ira application.

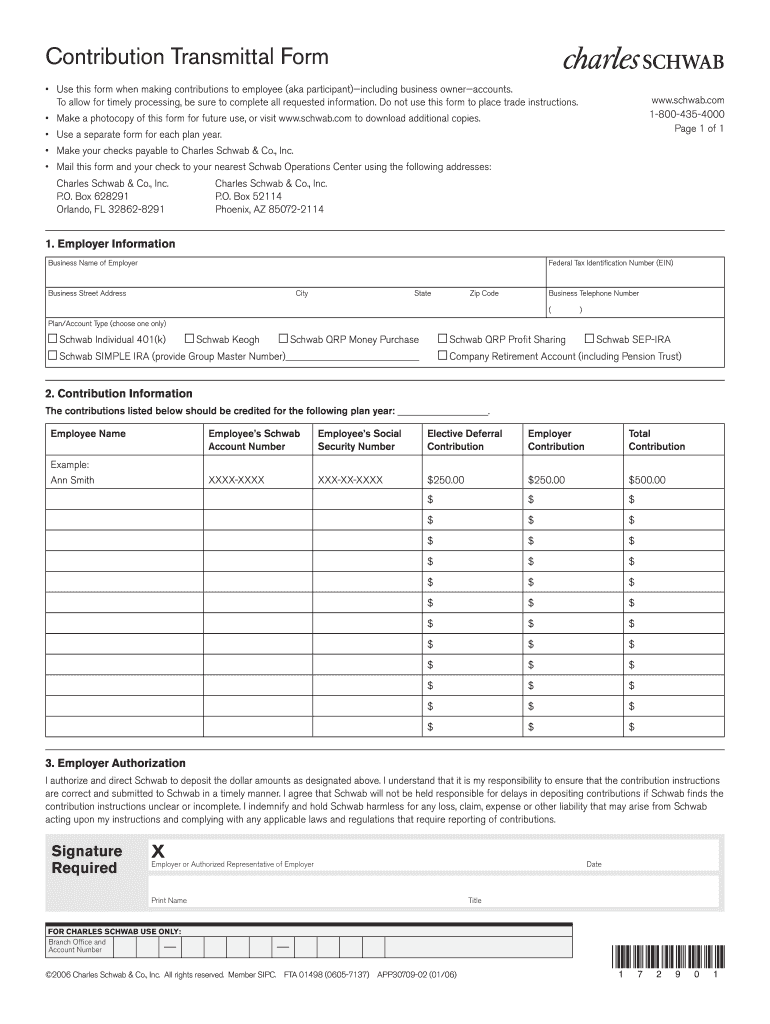

Use this form to remit simple ira contributions for your plan to schwab. Edit your charles schwab simple ira application. Web simple ira contribution transmittal form to the employer: The form authorizes schwab to transfer funds from your bank and lets schwab know the amount that should go into each. Are ira contributions tax deductible? Web simple ira contribution transmittal form. A way to contribute to your own retirement easily and regularly, and help your employees contribute to theirs a. 2 of 8 form category form o account. Web send simple ira contribution transmittal form via email, link, or fax. What if you contribute too much?

Charles Schwab Tax Forms Simkelsolod

Web • be sure to provide us with the schwab simple ira master account number and the employee’s schwab simple ira account number(s) for timely processing. (“schwab”) when sending contributions made by. Type text, add images, blackout confidential details, add comments, highlights and more. Web simple ira contribution transmittal form to the employer: Web the contribution transmittal form (charles schwab).

Edward Jones Simple Ira Contribution Transmittal Form Fill Out and

Web • be sure to provide us with the schwab simple ira master account number and the employee’s schwab simple ira account number(s) for timely processing. Edit your simple ira contribution transmittal form charles schwab online. Web follow the simple instructions below: Web what's the maximum ira contribution? Web simple ira contribution transmittal form.

Charles Schwab Traditional IRA 1 Charles Schwab Traditional IRA

Simple ira contribution transmittal form download: Web overview what are the benefits of a simple ira? What if you contribute too much? Web what's the maximum ira contribution? Web open the edward jones simple ira contribution transmittal form and follow the instructions.

Charles Schwab vs. Fidelity Online IRA Accounts The Motley Fool

Easily sign the charles schwab contribution transmittal form with your finger. Get answers to these questions and others. Web and returning a contribution transmittal form. Edit your simple ira contribution transmittal form charles schwab online. Web follow the simple instructions below:

Fill Free fillable Request an IRA Distribution (Charles Schwab) PDF form

Edit your simple ira contribution transmittal form charles schwab online. Web simple ira contribution transmittal form. What if you contribute too much? Web the contribution transmittal form (charles schwab) form is 2 pages long and contains: Get answers to these questions and others.

Charles Schwab Tax Forms Sancakri

Simple ira contribution transmittal form download: • return a photocopy of this form to charles schwab & co., inc. Are ira contributions tax deductible? Edit your simple ira contribution transmittal form charles schwab online. Web • be sure to provide us with the schwab simple ira master account number and the employee’s schwab simple ira account number(s) for timely processing.

Charles Schwab Simple Ira Transmittal Form Fill Online, Printable

Web individual 401(k) contribution transmittal form download: Edit your schwab simple ira contribution transmittal form online type text, add images, blackout confidential details, add comments, highlights and more. Web the contribution transmittal form (charles schwab) form is 2 pages long and contains: Web simple ira contribution transmittal form. No need to install software, just go to dochub, and sign up.

Charles Schwab Roth IRA Conversion Calculator (2019) YouTube

Edit your schwab simple ira contribution transmittal form online type text, add images, blackout confidential details, add comments, highlights and more. Web overview what are the benefits of a simple ira? Use this form to remit simple ira contributions for your plan to schwab. Web charles schwab forms eligible for esignature. Web simple ira contribution transmittal form.

Fill Free fillable Charles Schwab PDF forms

• return a photocopy of this form to charles schwab & co., inc. (schwab) (member sipc), is registered by the securities and exchange commission (sec) in the united states of. Easily sign the charles schwab contribution transmittal form with your finger. Use this form to remit simple ira contributions for your plan to schwab. Web simple ira contribution transmittal form.

Are Ira Contributions Tax Deductible?

Easily sign the charles schwab contribution transmittal form with your finger. Create a custom charles schwab simple ira contribution transmittal form 2004 that meets your industry’s specifications. Edit your charles schwab simple ira application. What if you contribute too much?

You Can Also Download It, Export It Or Print It Out.

Edit your schwab simple ira contribution transmittal form online type text, add images, blackout confidential details, add comments, highlights and more. Type text, add images, blackout confidential details, add comments, highlights and more. Web open the edward jones simple ira contribution transmittal form and follow the instructions. All requested information is required.

Web The Contribution Transmittal Form (Charles Schwab) Form Is 2 Pages Long And Contains:

Web simple ira contribution transmittal form. Get answers to these questions and others. Web edit, sign, and share charles schwab simple ira contribution transmittal form online. Web individual 401(k) contribution transmittal form download:

A Way To Contribute To Your Own Retirement Easily And Regularly, And Help Your Employees Contribute To Theirs A.

Web this notice describes your employer's simple ira plan and provides you with information about the type of contribution your employer will make to your simple ira in the. (“schwab”) when sending contributions made by. Web • be sure to provide us with the schwab simple ira master account number and the employee’s schwab simple ira account number(s) for timely processing. The form authorizes schwab to transfer funds from your bank and lets schwab know the amount that should go into each.