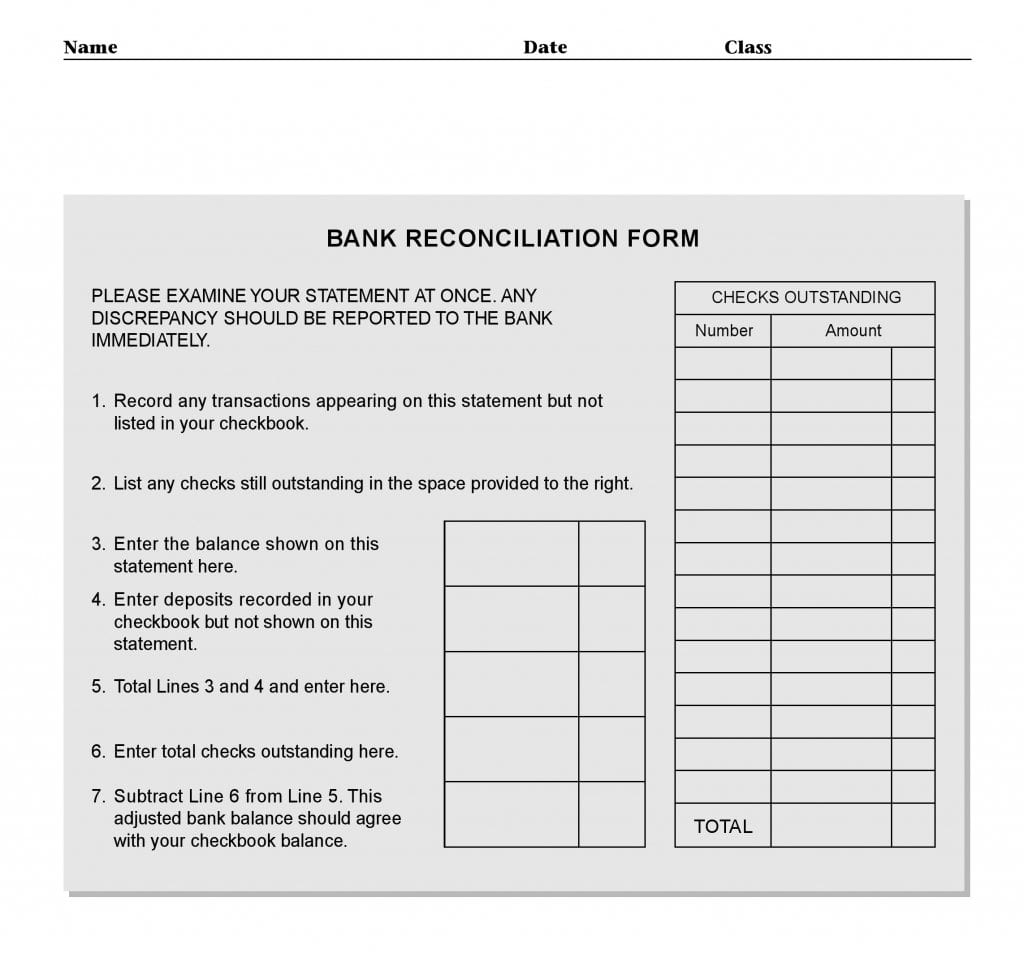

Check Reconciliation Form

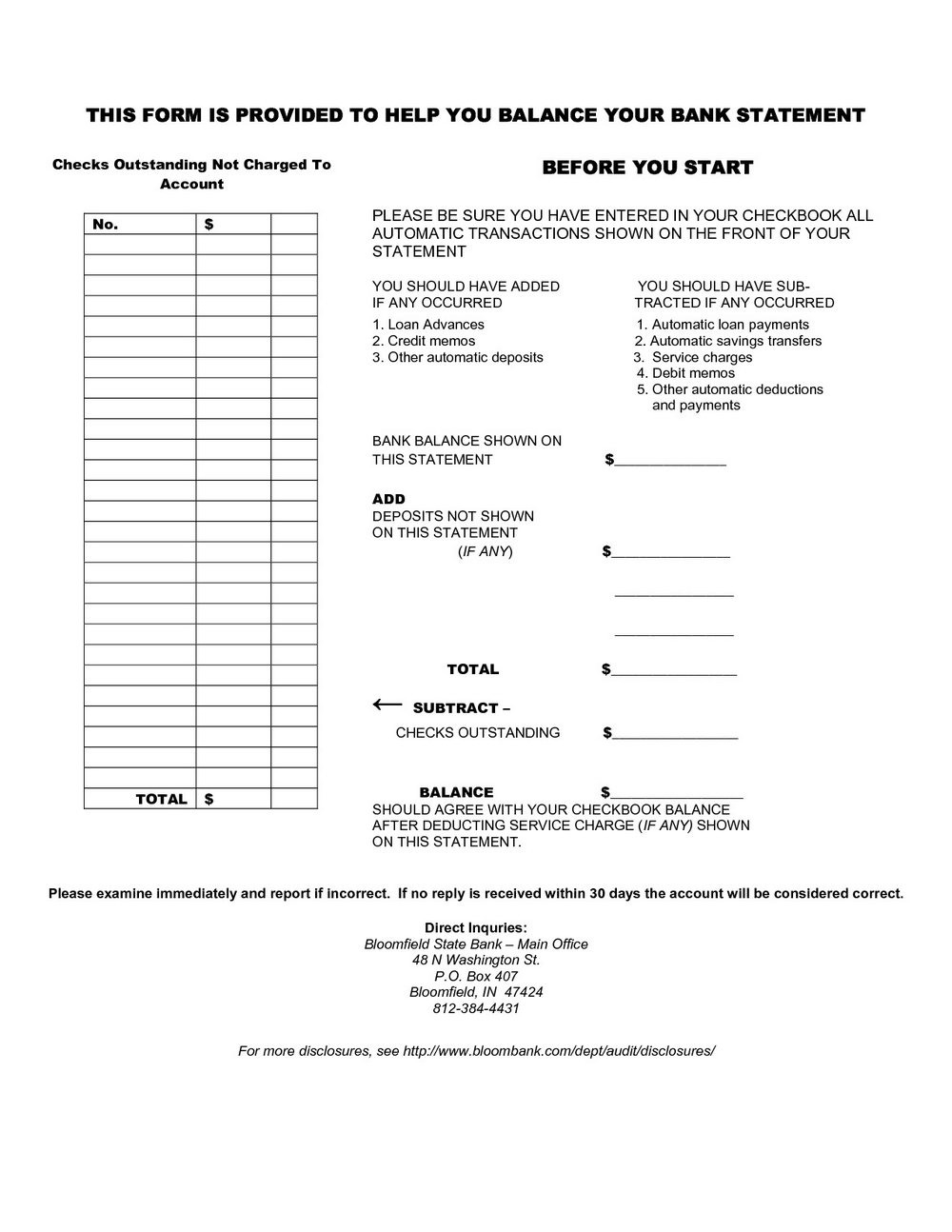

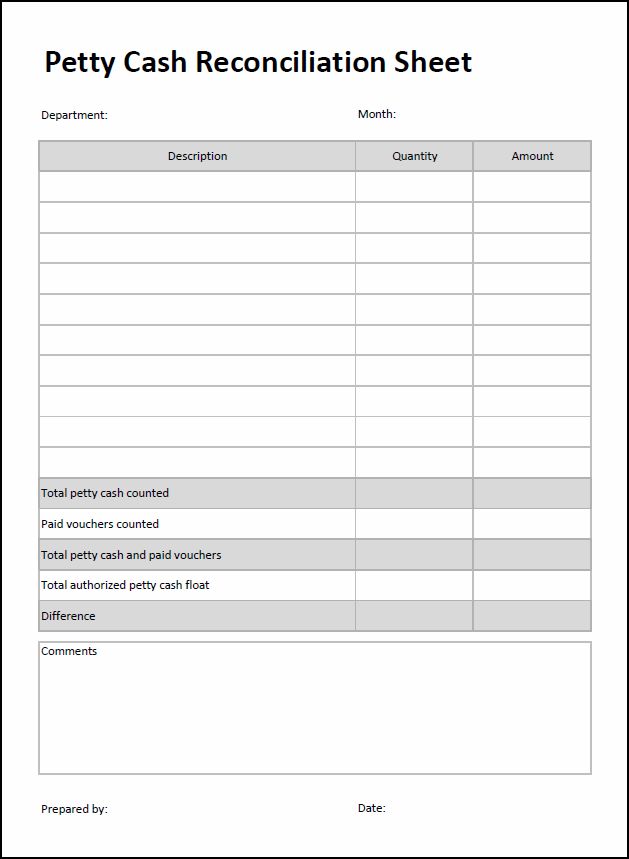

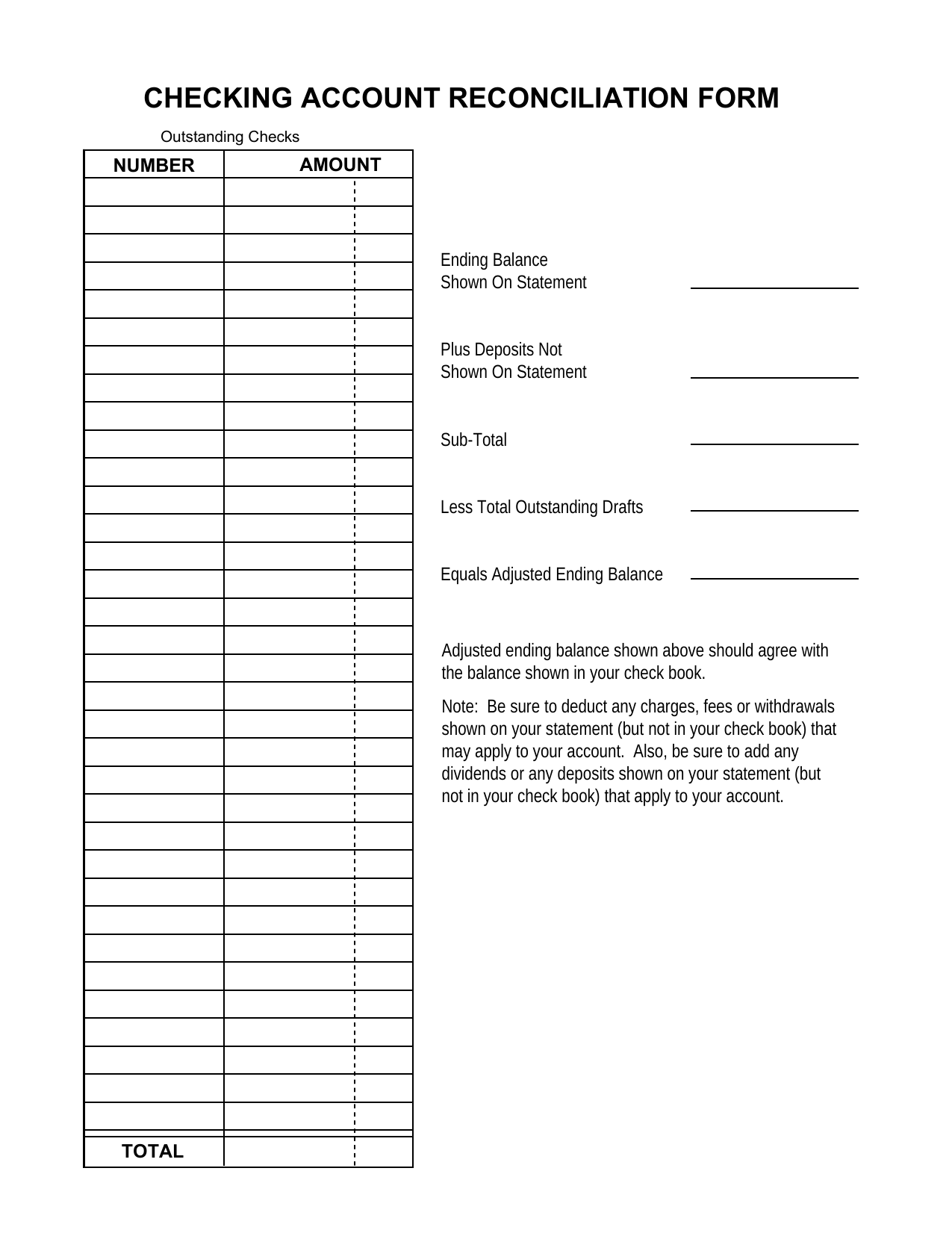

Check Reconciliation Form - Web personal checking account reconciliation checking account reconciliation here’s how to balance your checkbook. Web here are the basic steps involved and the items to track as you reconcile accounts: To stay on top of their balance sheet, businesses reconcile their bank statement by comparing the bank’s records in a checking account to the operation’s own records. Once you have adjusted your ledger for outstanding transactions as well. Be sure to deduct any charges, fees or withdrawals shown on your statement (but not in your check book) that may apply to your account. Web look for an entry in your account called ending balance, previous ending balance, or beginning balance. enter this figure on your form or spreadsheet. Add outstanding deposits next, add any missing deposits and credits to the balance above. Our tips and form help simplify this money task, so you can easily manage your accounts. Depending on the accounts you plan to reconcile, inspect and compare bank statements or. Web a checking account reconciliation form is a financial form that business owners and accountants use to organize and track transactions from a company’s checking account.

Web 26 jul 2023. Be sure to deduct any charges, fees or withdrawals shown on your statement (but not in your check book) that may apply to your account. Web personal checking account reconciliation checking account reconciliation here’s how to balance your checkbook. Dm reconciliation in respect of the dm check reconciliation. Once you have adjusted your ledger for outstanding transactions as well. Enter deposits made later than the ending date of your. Web a checking account reconciliation form is a financial form that business owners and accountants use to organize and track transactions from a company’s checking account. Web look for an entry in your account called ending balance, previous ending balance, or beginning balance. enter this figure on your form or spreadsheet. Subtract from your check register any charges listed on your statement that you have not previously deducted from your balance. The dm check reconciliation quantity for a day shall be determined as the failed daily read reconciliation volume, or (as the case may be) the dm check reconciliation volume, multiplied by the applicable calorific value for the day.

Enter your ending checking balance as shown on your statement: Dm reconciliation in respect of the dm check reconciliation. To stay on top of their balance sheet, businesses reconcile their bank statement by comparing the bank’s records in a checking account to the operation’s own records. Add outstanding deposits next, add any missing deposits and credits to the balance above. The dm check reconciliation quantity for a day shall be determined as the failed daily read reconciliation volume, or (as the case may be) the dm check reconciliation volume, multiplied by the applicable calorific value for the day. Subtract from your check register any charges listed on your statement that you have not previously deducted from your balance. Our tips and form help simplify this money task, so you can easily manage your accounts. Be sure to deduct any charges, fees or withdrawals shown on your statement (but not in your check book) that may apply to your account. Make sure your monthly checking statement matches your own records by reconciling your checking account regularly. Also, addany dividends not previously included.

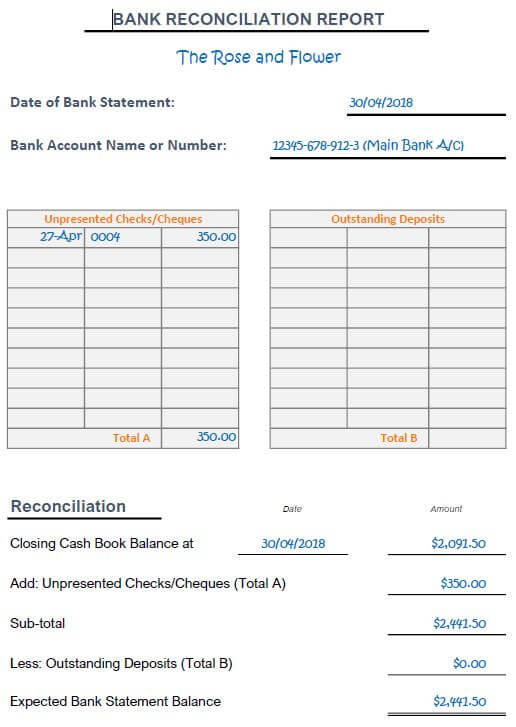

Bank Reconciliation Template Double Entry Bookkeeping

Be sure to deduct any charges, fees or withdrawals shown on your statement (but not in your check book) that may apply to your account. Also, addany dividends not previously included. Depending on the accounts you plan to reconcile, inspect and compare bank statements or. Web 26 jul 2023. Web examples of check reconciliation in a sentence.

20+ Free Bank Reconciliation Sheet Templates Printable Samples

To stay on top of their balance sheet, businesses reconcile their bank statement by comparing the bank’s records in a checking account to the operation’s own records. Web check reconcilement form instructions 1. The dm check reconciliation quantity for a day shall be determined as the failed daily read reconciliation volume, or (as the case may be) the dm check.

25+ Cash Drawer Reconciliation Sheet Sample Templates

Our tips and form help simplify this money task, so you can easily manage your accounts. Add outstanding deposits next, add any missing deposits and credits to the balance above. Depending on the accounts you plan to reconcile, inspect and compare bank statements or. Web look for an entry in your account called ending balance, previous ending balance, or beginning.

Free Bank Reconciliation Form PDF Template Form Download

Enter your ending checking balance as shown on your statement: Web a checking account reconciliation form is a financial form that business owners and accountants use to organize and track transactions from a company’s checking account. The dm check reconciliation quantity for a day shall be determined as the failed daily read reconciliation volume, or (as the case may be).

Checking Account Reconciliation Worksheet Excel Universal —

The dm check reconciliation quantity for a day shall be determined as the failed daily read reconciliation volume, or (as the case may be) the dm check reconciliation volume, multiplied by the applicable calorific value for the day. Web here are the basic steps involved and the items to track as you reconcile accounts: Subtract from your check register any.

Cash Reconciliation Forms charlotte clergy coalition

Once you have adjusted your ledger for outstanding transactions as well. Also, addany dividends not previously included. Web 26 jul 2023. Make sure your monthly checking statement matches your own records by reconciling your checking account regularly. Subtract from your check register any charges listed on your statement that you have not previously deducted from your balance.

13 [PDF] BLANK RECONCILIATION WORKSHEET PRINTABLE ZIP DOCX DOWNLOAD

Web 26 jul 2023. Dm reconciliation in respect of the dm check reconciliation. Depending on the accounts you plan to reconcile, inspect and compare bank statements or. Web here are the basic steps involved and the items to track as you reconcile accounts: To stay on top of their balance sheet, businesses reconcile their bank statement by comparing the bank’s.

Download Reconciliation Balance Sheet Template Excel PDF RTF

Enter your ending checking balance as shown on your statement: Depending on the accounts you plan to reconcile, inspect and compare bank statements or. The dm check reconciliation quantity for a day shall be determined as the failed daily read reconciliation volume, or (as the case may be) the dm check reconciliation volume, multiplied by the applicable calorific value for.

Bank Reconciliation Exercises and Answers Free Downloads

Be sure to deduct any charges, fees or withdrawals shown on your statement (but not in your check book) that may apply to your account. The dm check reconciliation quantity for a day shall be determined as the failed daily read reconciliation volume, or (as the case may be) the dm check reconciliation volume, multiplied by the applicable calorific value.

Chase Checking Account Reconciliation Form Form Resume Examples

Web personal checking account reconciliation checking account reconciliation here’s how to balance your checkbook. Web a checking account reconciliation form is a financial form that business owners and accountants use to organize and track transactions from a company’s checking account. Enter your ending checking balance as shown on your statement: Enter deposits made later than the ending date of your..

Web Personal Checking Account Reconciliation Checking Account Reconciliation Here’s How To Balance Your Checkbook.

Web look for an entry in your account called ending balance, previous ending balance, or beginning balance. enter this figure on your form or spreadsheet. Subtract from your check register any charges listed on your statement that you have not previously deducted from your balance. Our tips and form help simplify this money task, so you can easily manage your accounts. Web a checking account reconciliation form is a financial form that business owners and accountants use to organize and track transactions from a company’s checking account.

Be Sure To Deduct Any Charges, Fees Or Withdrawals Shown On Your Statement (But Not In Your Check Book) That May Apply To Your Account.

Also, addany dividends not previously included. Web here are the basic steps involved and the items to track as you reconcile accounts: Web check reconcilement form instructions 1. Enter your ending checking balance as shown on your statement:

Dm Reconciliation In Respect Of The Dm Check Reconciliation.

Add outstanding deposits next, add any missing deposits and credits to the balance above. Enter deposits made later than the ending date of your. Web examples of check reconciliation in a sentence. Make sure your monthly checking statement matches your own records by reconciling your checking account regularly.

Depending On The Accounts You Plan To Reconcile, Inspect And Compare Bank Statements Or.

Web 26 jul 2023. By using a free checking account reconciliation form template, you can streamline your accounting process by collecting your bank’s information, deleting and correcting. To stay on top of their balance sheet, businesses reconcile their bank statement by comparing the bank’s records in a checking account to the operation’s own records. Once you have adjusted your ledger for outstanding transactions as well.