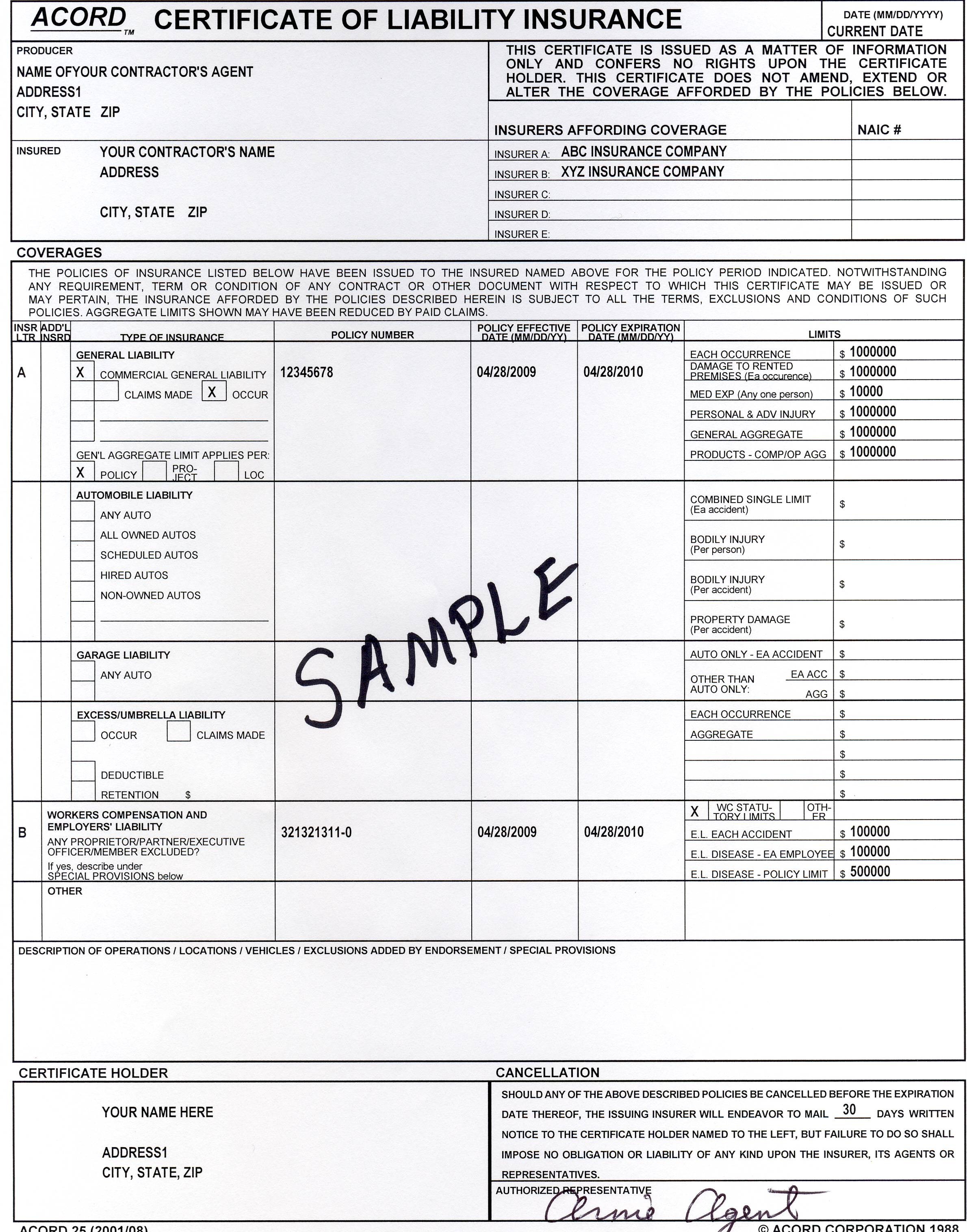

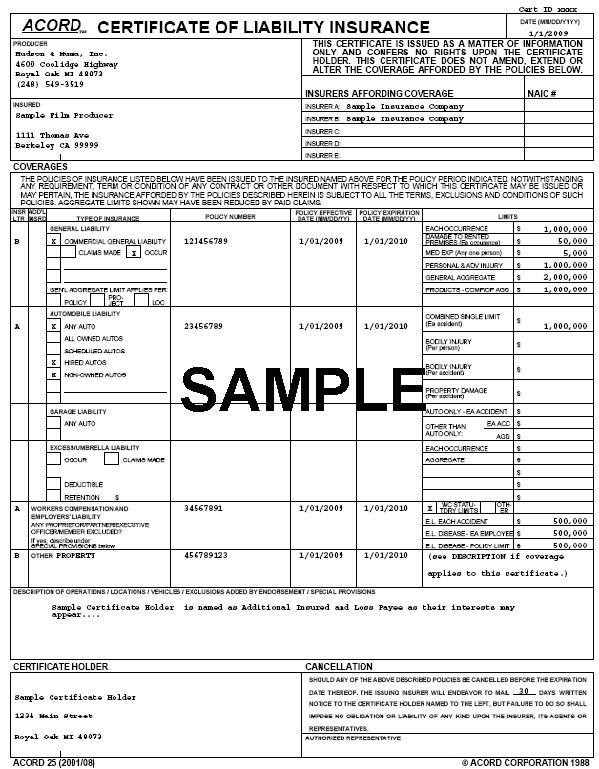

Coi Insurance Form

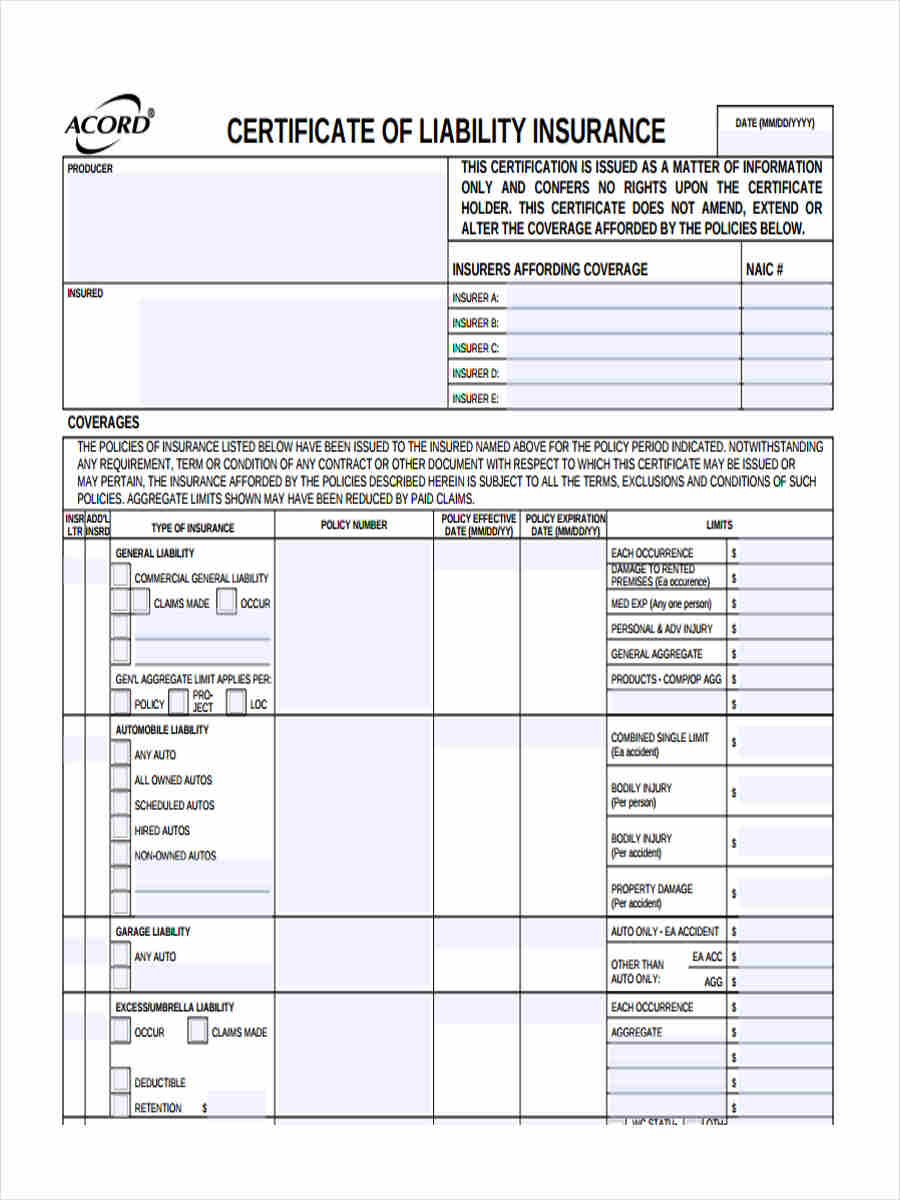

Coi Insurance Form - Limits shown may have been reduced by paid claims. Web a certificate of insurance (coi) form provides proof of insurance coverage. Web a certificate of insurance (coi) is issued by an insurance company or broker and verifies the existence of an insurance policy. With a coi, your clients can make sure you have the right insurance before they start working with you. If the certificate holder is an additional insured, the policy(ies) must be endorsed. It includes policy details like your specific coverage, limits, and effective dates, but it isn’t an insurance contract. It is also known as an acord 25 certificate of insurance, certificate of insurance (coi) or a. They’re also known as certificates of liability insurance or proof of insurance. This certificate of insurance does not constitute a contract between the issuing insurer(s), authorized representative or producer, and the certificate holder. Small business owners and contractors typically require a coi.

They’re also known as certificates of liability insurance or proof of insurance. It summarizes the benefits and limits of your general liability insurance policy. A coi for most insurance policies is no longer than one page. Small business owners and contractors typically require a coi. If the certificate holder is an additional insured, the policy(ies) must be endorsed. After the policy has been issued, most certificates of insurance are available online. Web a certificate of insurance (coi), also known as a certificate of liability insurance, is proof of an active, valid insurance policy and serves as verification to your vendors, customers, or landlords that your business is indeed insured. Web a certificate of insurance (coi) is issued by an insurance company or broker and verifies the existence of an insurance policy. Limits shown may have been reduced by paid claims. It includes policy details like your specific coverage, limits, and effective dates, but it isn’t an insurance contract.

Learn more from the hartford. Small business owners and contractors typically require a coi. Web a certificate of insurance (coi) form provides proof of insurance coverage. It is also known as an acord 25 certificate of insurance, certificate of insurance (coi) or a. After the policy has been issued, most certificates of insurance are available online. It summarizes the benefits and limits of your general liability insurance policy. Web a certificate of insurance (coi), also known as a certificate of liability insurance, is proof of an active, valid insurance policy and serves as verification to your vendors, customers, or landlords that your business is indeed insured. With a coi, your clients can make sure you have the right insurance before they start working with you. Limits shown may have been reduced by paid claims. If the certificate holder is an additional insured, the policy(ies) must be endorsed.

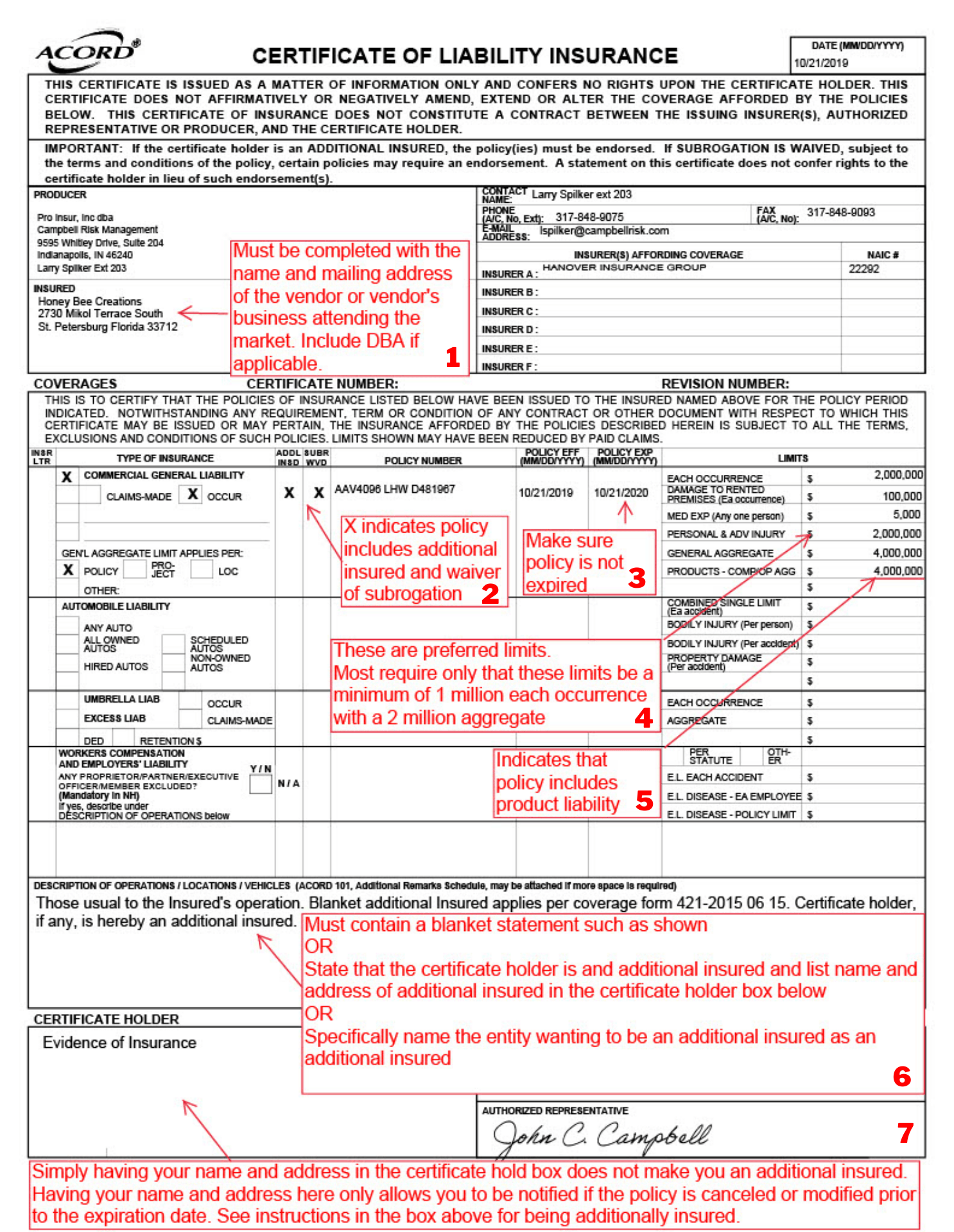

How to Read Your Certificate of Liability Insurance Campbell Risk

Web certificate may be issued or may pertain, the insurance afforded by the policies described herein is subject to all the terms, exclusions and conditions of such policies. To acquire a coi, you must first buy a small business liability insurance policy. It is also known as an acord 25 certificate of insurance, certificate of insurance (coi) or a. They’re.

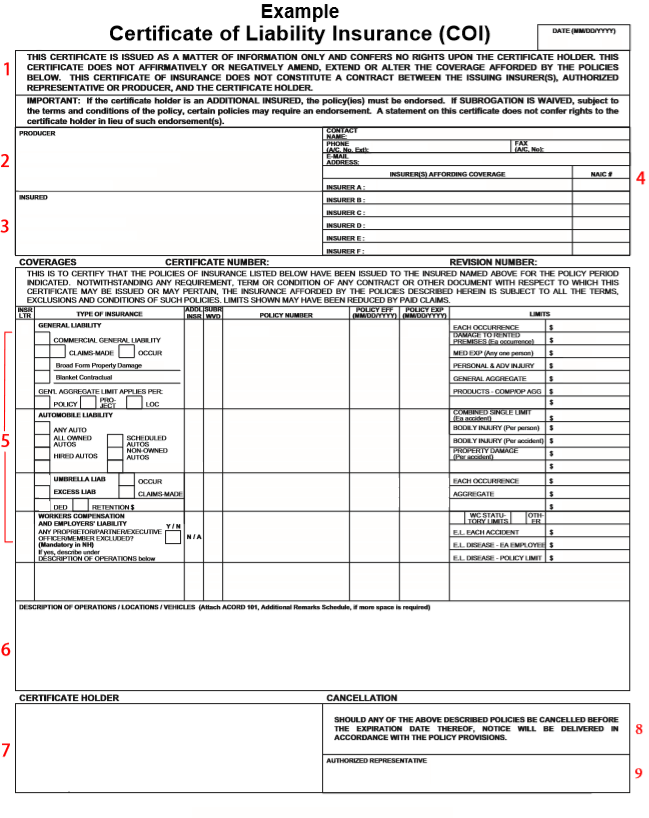

HOW TO INSPECT AN EXHIBITOR'S COI EVENT HUB

Small business owners and contractors typically require a coi. To acquire a coi, you must first buy a small business liability insurance policy. Web a certificate of insurance (coi), also known as a certificate of liability insurance, is proof of an active, valid insurance policy and serves as verification to your vendors, customers, or landlords that your business is indeed.

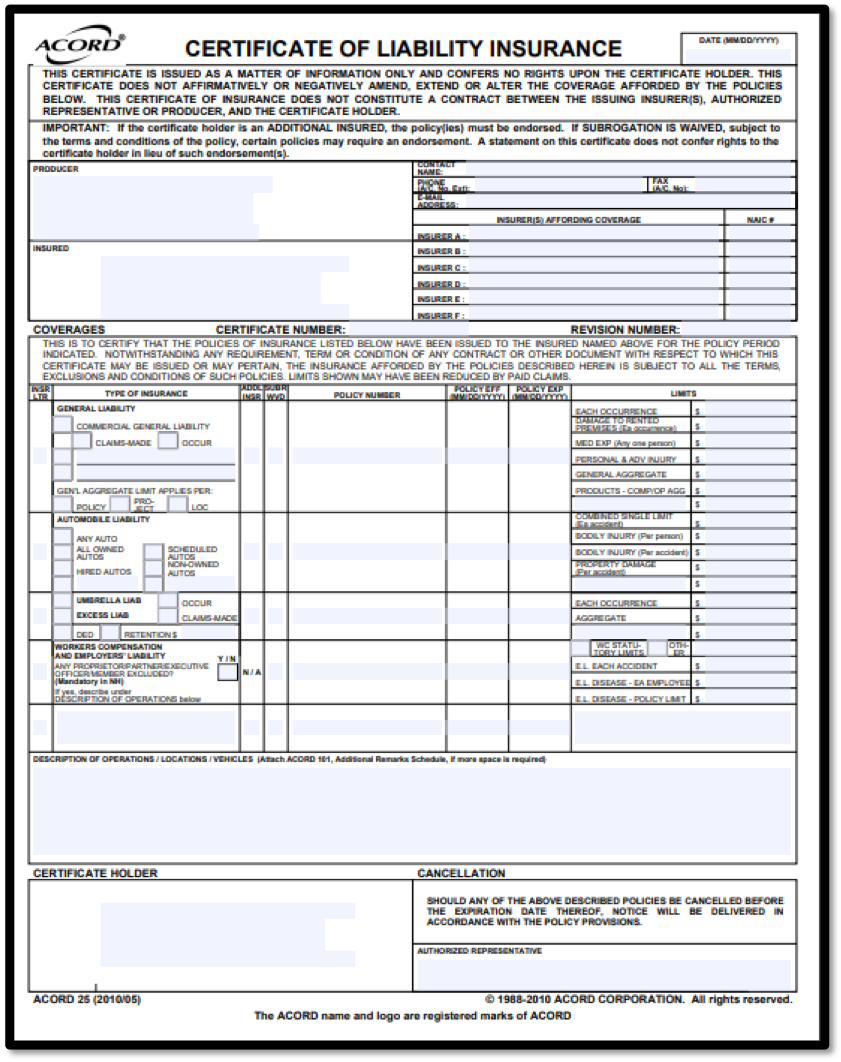

Certificate of Insurance Form Fill Out and Sign Printable PDF

Web a certificate of insurance (coi) is a document from an insurer to show you have business insurance. In some cases you may need to fill out an online form or send an email to your insurance company to get a copy of your coi. If the certificate holder is an additional insured, the policy(ies) must be endorsed. This certificate.

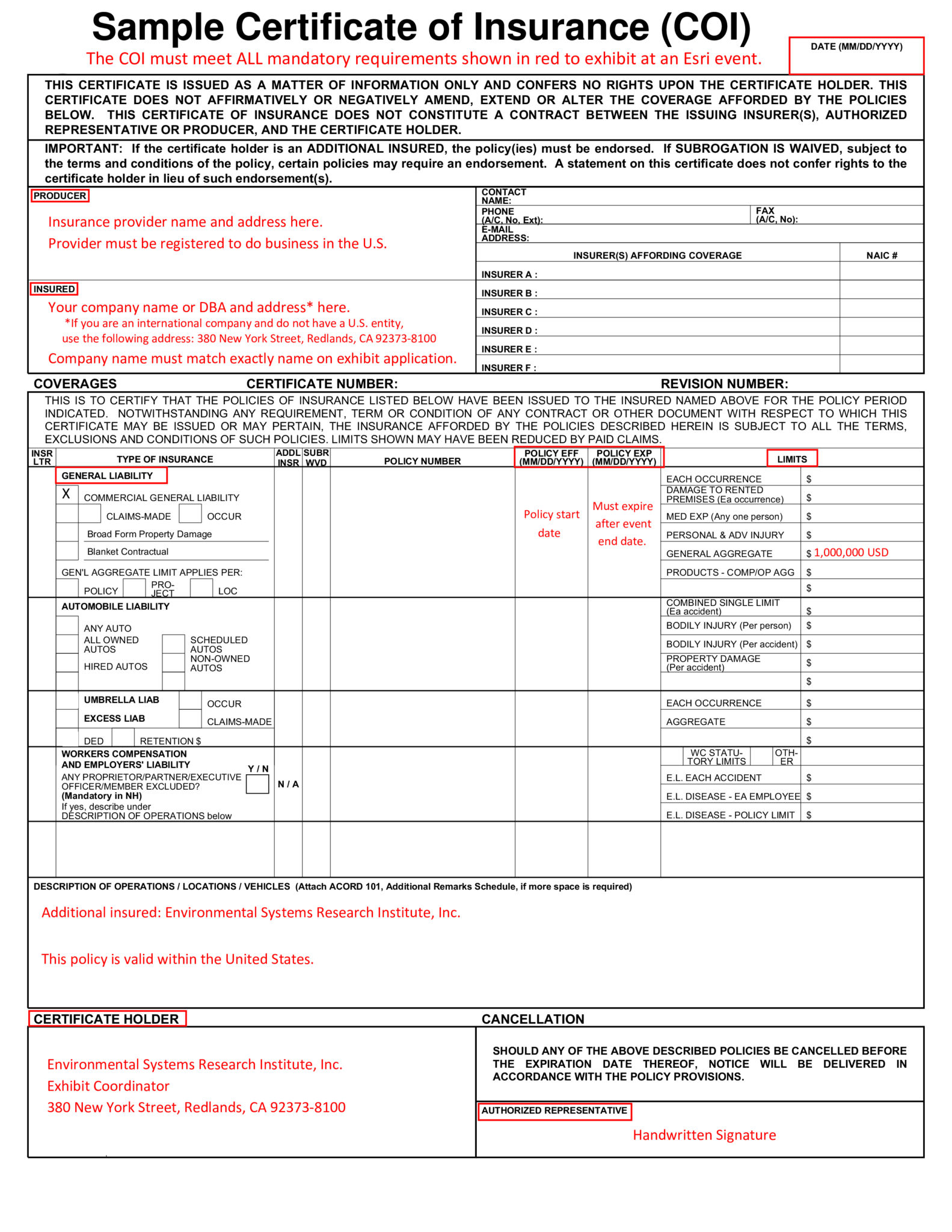

Certificate of Liability Insurance How to Request + Sample

It is also known as an acord 25 certificate of insurance, certificate of insurance (coi) or a. Limits shown may have been reduced by paid claims. Web request a copy of your coi through your insurer if necessary. This certificate of insurance does not constitute a contract between the issuing insurer(s), authorized representative or producer, and the certificate holder. Web.

How to Read a Certificate of Insurance — Centurion Insurance

In some cases you may need to fill out an online form or send an email to your insurance company to get a copy of your coi. Web a certificate of liability insurance (coi) is a form that provides proof of professional liability insurance for your business. This certificate of insurance does not constitute a contract between the issuing insurer(s),.

Sample Certificate Of Insurance (Coi) Templates At throughout

Web a certificate of insurance (coi) form provides proof of insurance coverage. Web request a copy of your coi through your insurer if necessary. Small business owners and contractors typically require a coi. Web a certificate of insurance (coi), also known as a certificate of liability insurance, is proof of an active, valid insurance policy and serves as verification to.

Apply for a Booth

It summarizes the benefits and limits of your general liability insurance policy. Web a certificate of insurance (coi) is issued by an insurance company or broker and verifies the existence of an insurance policy. If the certificate holder is an additional insured, the policy(ies) must be endorsed. Web a certificate of insurance (coi) form provides proof of insurance coverage. A.

Workers Compensation Insurance Workers Compensation Insurance Certificate

After the policy has been issued, most certificates of insurance are available online. Limits shown may have been reduced by paid claims. Web a certificate of insurance (coi) form provides proof of insurance coverage. $ $ $ property damage $ bodily injury (per accident) bodily injury (per person) combined single limit autos only autos only. Small business owners and contractors.

Certificate of Insurance Bounce About

Web request a copy of your coi through your insurer if necessary. Small business owners and contractors typically require a coi. Web a certificate of insurance (coi) is issued by an insurance company or broker and verifies the existence of an insurance policy. Learn more from the hartford. A coi for most insurance policies is no longer than one page.

FREE 9+ Liability Insurance Forms in PDF MS Word

This certificate of insurance does not constitute a contract between the issuing insurer(s), authorized representative or producer, and the certificate holder. It summarizes the benefits and limits of your general liability insurance policy. Web a certificate of liability insurance (coi) is a form that provides proof of professional liability insurance for your business. Limits shown may have been reduced by.

They’re Also Known As Certificates Of Liability Insurance Or Proof Of Insurance.

Web certificate may be issued or may pertain, the insurance afforded by the policies described herein is subject to all the terms, exclusions and conditions of such policies. $ $ $ property damage $ bodily injury (per accident) bodily injury (per person) combined single limit autos only autos only. This certificate of insurance does not constitute a contract between the issuing insurer(s), authorized representative or producer, and the certificate holder. With a coi, your clients can make sure you have the right insurance before they start working with you.

If The Certificate Holder Is An Additional Insured, The Policy(Ies) Must Be Endorsed.

To acquire a coi, you must first buy a small business liability insurance policy. In some cases you may need to fill out an online form or send an email to your insurance company to get a copy of your coi. After the policy has been issued, most certificates of insurance are available online. It summarizes the benefits and limits of your general liability insurance policy.

It Is Also Known As An Acord 25 Certificate Of Insurance, Certificate Of Insurance (Coi) Or A.

Web a certificate of liability insurance (coi) is a form that provides proof of professional liability insurance for your business. Learn more from the hartford. A coi for most insurance policies is no longer than one page. It includes policy details like your specific coverage, limits, and effective dates, but it isn’t an insurance contract.

Web A Certificate Of Insurance (Coi) Is Issued By An Insurance Company Or Broker And Verifies The Existence Of An Insurance Policy.

Limits shown may have been reduced by paid claims. Web request a copy of your coi through your insurer if necessary. Web a certificate of insurance (coi) is a document from an insurer to show you have business insurance. Web a certificate of insurance (coi) form provides proof of insurance coverage.