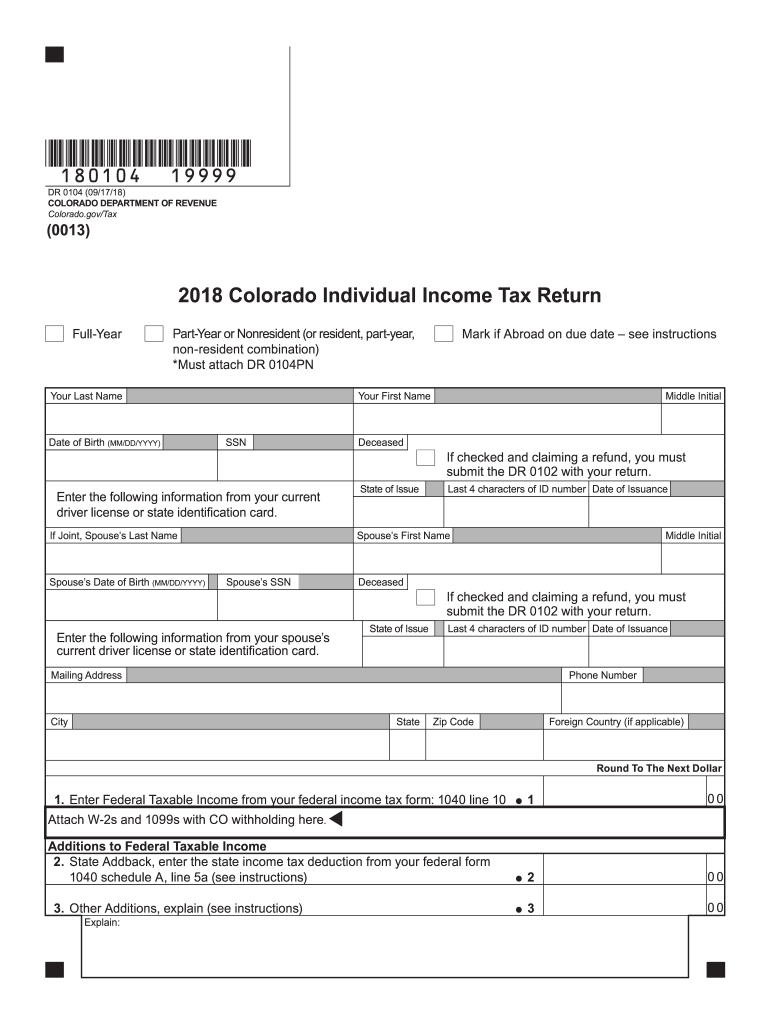

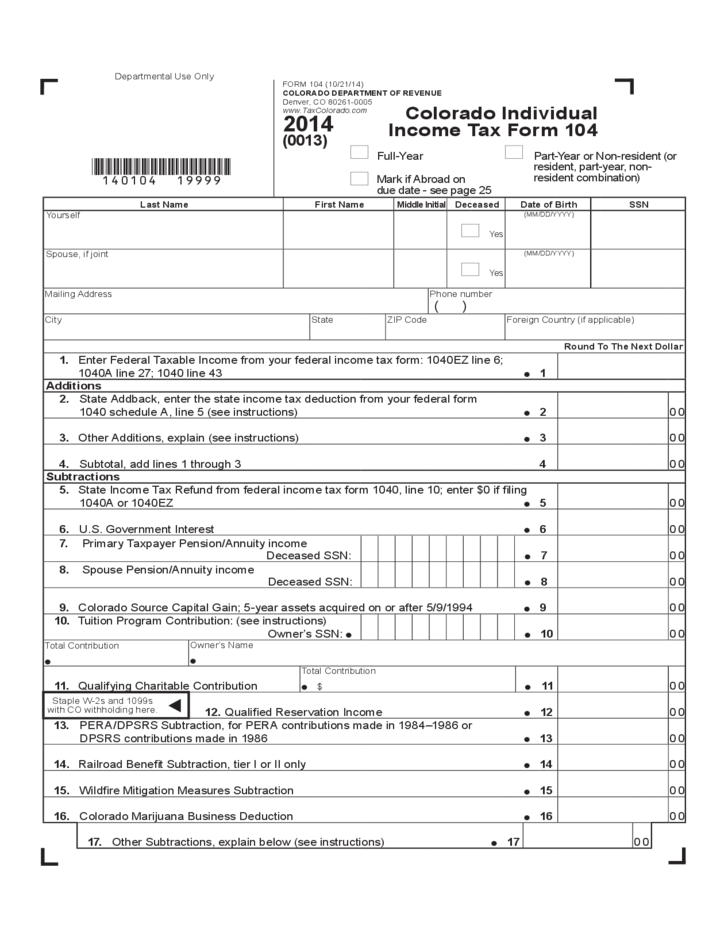

Colorado Form 104 Instructions

Colorado Form 104 Instructions - Complete, edit or print tax forms instantly. This form is for income earned in tax year 2022, with. Colorado usually releases forms for the current tax year between january and april. Edit your colorado dr 0104ad online. Web select a different state: You can download or print. Web follow these quick steps to modify the pdf printable colorado income tax form 104 online for free: Web form 104 is the general, and simplest, income tax return for individual residents of colorado. Don’t assume that — because a credit has been taken before or. And you must fill out the form even if.

You can also download it, export it or print it out. You may file by mail with paper forms or efile online. Web updated may 12, 2022 ••• colorado’s form 104 is the personal individual tax form for those who earn an income in the state. Web this form must be submitted with the dr 0104 form when filing your return. We last updated the tax credits for individuals in january 2023, so this is the latest version of. Register and log in to your account. Web file now with turbotax we last updated colorado form 104 in february 2023 from the colorado department of revenue. Complete, edit or print tax forms instantly. Web follow these quick steps to modify the pdf printable colorado income tax form 104 online for free: Colorado usually releases forms for the current tax year between january and april.

Web file now with turbotax we last updated colorado form 104 in february 2023 from the colorado department of revenue. Check the proper box at the top of form 104 to indicate whether you are filing as a full. Web updated may 12, 2022 ••• colorado’s form 104 is the personal individual tax form for those who earn an income in the state. Type text, add images, blackout confidential. Web 4 rows find colorado form 104 instructions at esmart tax today. Web select a different state: Web printable colorado income tax form 104. Complete, edit or print tax forms instantly. Web this form must be submitted with the dr 0104 form when filing your return. Web how to fill out and sign colorado income tax online?

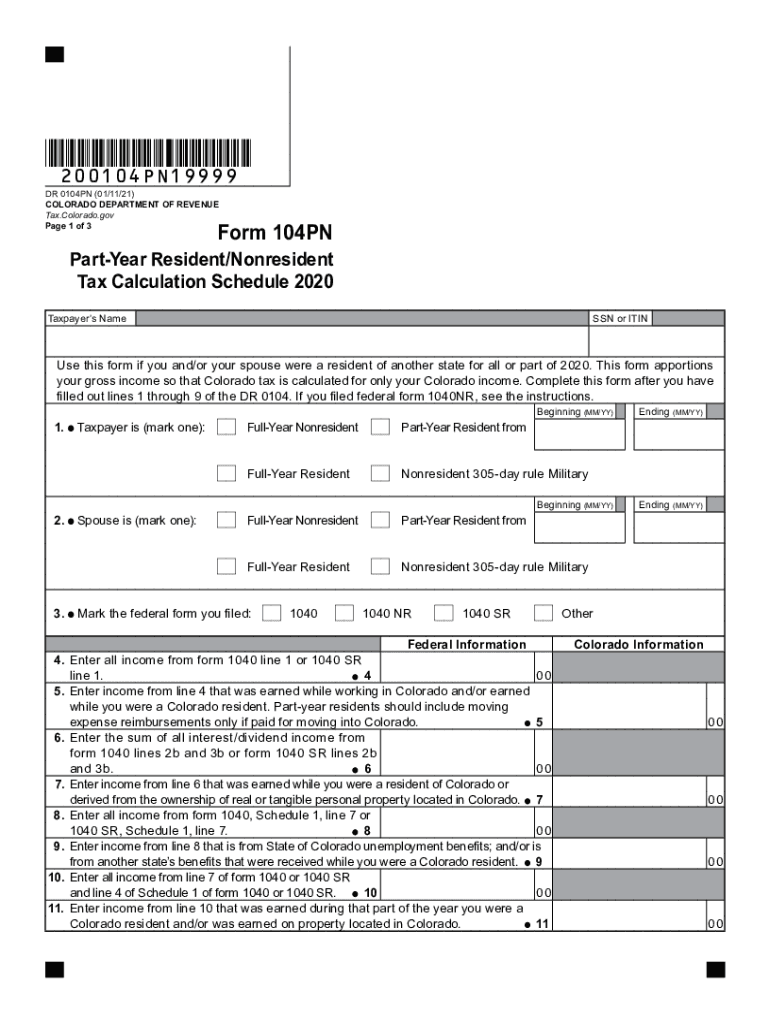

2020 Form CO DoR 104PN Fill Online, Printable, Fillable, Blank pdfFiller

Web form 104 is the general, and simplest, income tax return for individual residents of colorado. Web we last updated the alternative minimum tax schedule in january 2023, so this is the latest version of form 104amt, fully updated for tax year 2022. Web printable colorado income tax form 104. Try it for free now! Form 104 is the general,.

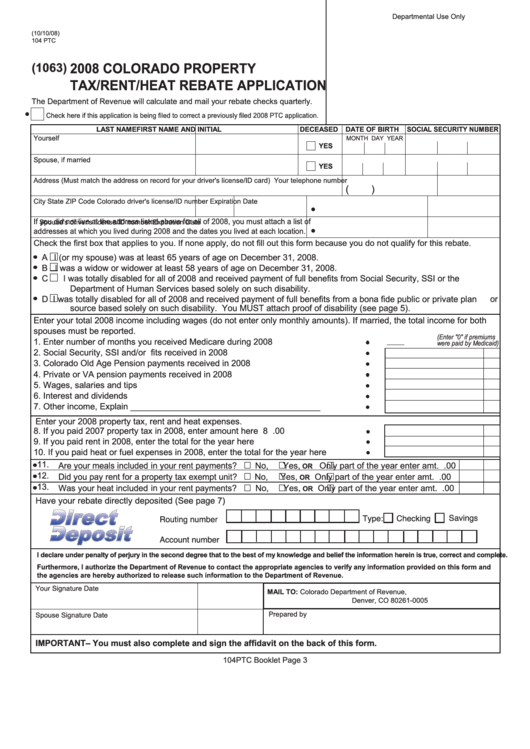

Fillable Form 104 Ptc Colorado Property Tax/rent/heat Rebate

Web we last updated the alternative minimum tax schedule in january 2023, so this is the latest version of form 104amt, fully updated for tax year 2022. Web printable colorado income tax form 104. We last updated colorado form 104 from the department of revenue in. Type text, add images, blackout confidential. Colorado usually releases forms for the current tax.

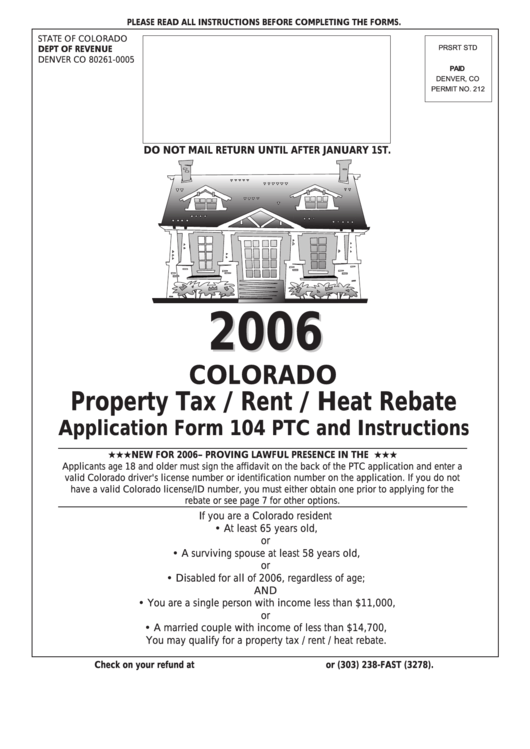

Instructions For Form 104 Ptc Colorado Property Tax / Rent / Heat

Web instructions for form 104cr introduction when taking a tax credit, always send documentation. Web select a different state: Complete, edit or print tax forms instantly. Web printable colorado income tax form 104. Web 4 rows find colorado form 104 instructions at esmart tax today.

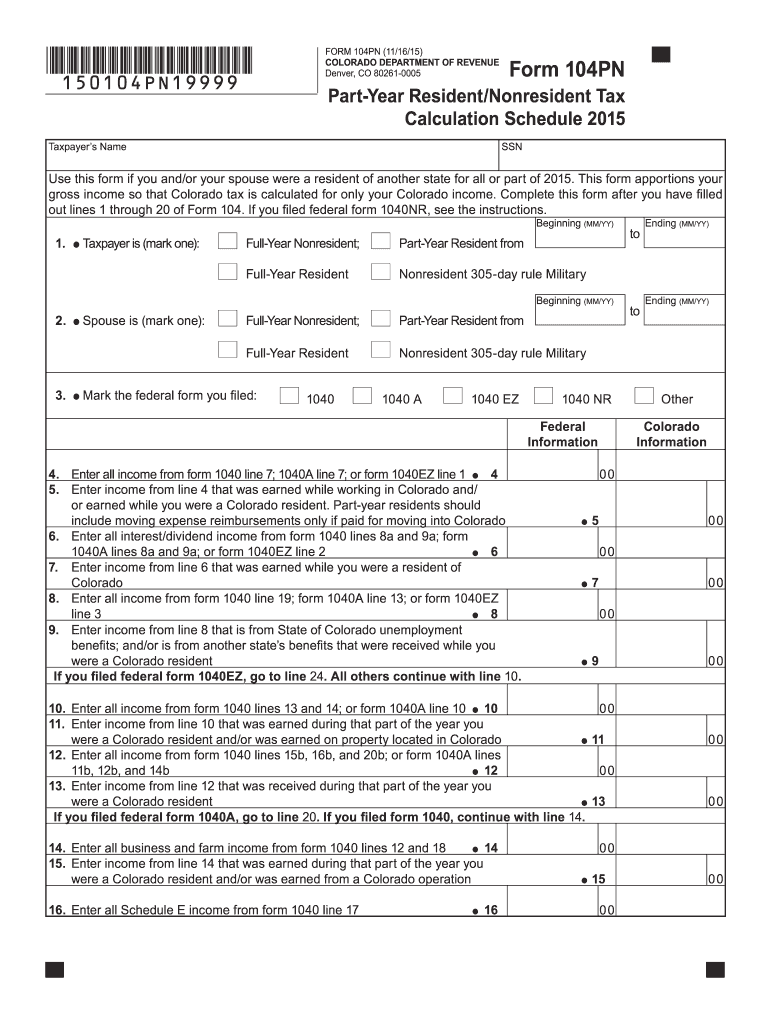

2015 Form CO DoR 104PN Fill Online, Printable, Fillable, Blank pdfFiller

Web file now with turbotax we last updated colorado form 104 in february 2023 from the colorado department of revenue. Web this form must be submitted with the dr 0104 form when filing your return. Get your online template and fill it in using progressive features. Web how to fill out and sign colorado income tax online? Don’t assume that.

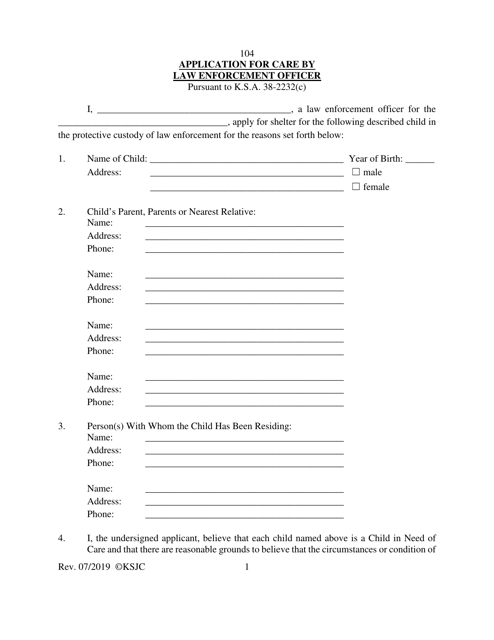

Form 104 Download Fillable PDF or Fill Online Application for Care by

We last updated the tax credits for individuals in january 2023, so this is the latest version of. Web select a different state: Edit your colorado dr 0104ad online. Type text, add images, blackout confidential. Enjoy smart fillable fields and interactivity.

Top 5 Colorado Form 104 Templates free to download in PDF format

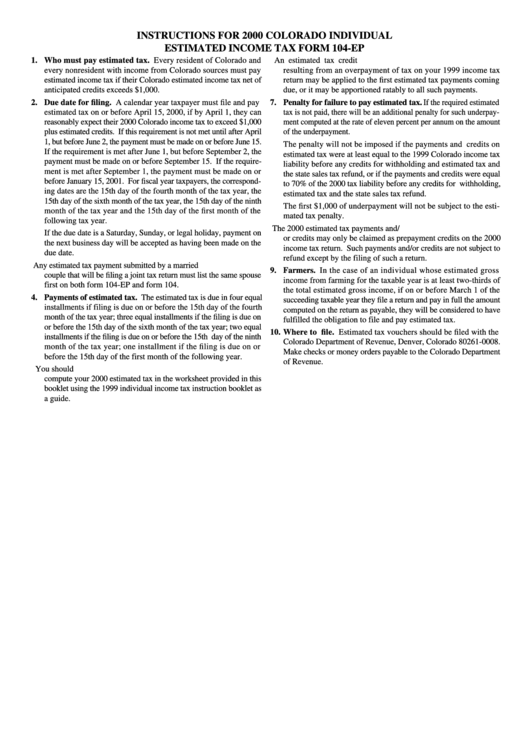

Web how to fill out and sign colorado income tax online? Web instructions for form 104cr introduction when taking a tax credit, always send documentation. Web file now with turbotax we last updated colorado form 104 in february 2023 from the colorado department of revenue. Web line 1 state income tax refund refer to your federal income tax return to.

Colorado Form 104 Fill Out and Sign Printable PDF Template signNow

Web select a different state: Don’t assume that — because a credit has been taken before or. Enjoy smart fillable fields and interactivity. And you must fill out the form even if. Try it for free now!

Printable Colorado Tax Form 104 Printable Form 2022

You may file by mail with paper forms or efile online. Type text, add images, blackout confidential. Complete, edit or print tax forms instantly. Enjoy smart fillable fields and interactivity. Web 4 rows find colorado form 104 instructions at esmart tax today.

Top 5 Colorado Form 104 Templates free to download in PDF format

Enjoy smart fillable fields and interactivity. Edit your colorado dr 0104ad online. Colorado usually releases forms for the current tax year between january and april. Web this form must be submitted with the dr 0104 form when filing your return. Web updated may 12, 2022 ••• colorado’s form 104 is the personal individual tax form for those who earn an.

Minnesota Individual Estimated Tax Vouchers newteam 2022

Web line by line instructions for preparing form 104 residency status. Try it for free now! Colorado usually releases forms for the current tax year between january and april. Form 104 is the general, and simplest, income tax return for individual residents of colorado. Web instructions for form 104cr introduction when taking a tax credit, always send documentation.

Try It For Free Now!

Colorado usually releases forms for the current tax year between january and april. We last updated the tax credits for individuals in january 2023, so this is the latest version of. Type text, add images, blackout confidential. Web select a different state:

Web Line 1 State Income Tax Refund Refer To Your Federal Income Tax Return To Complete This Line.

Web how to fill out and sign colorado income tax online? Web this form must be submitted with the dr 0104 form when filing your return. If you did not complete federal schedule 1, form 1040 or 1040sr, enter $0. Form 104 is the general, and simplest, income tax return for individual residents of colorado.

Web Form 104 Is The General, And Simplest, Income Tax Return For Individual Residents Of Colorado.

Web printable colorado income tax form 104. This form is for income earned in tax year 2022, with. Don’t assume that — because a credit has been taken before or. Check the proper box at the top of form 104 to indicate whether you are filing as a full.

You Can Download Or Print.

Web line by line instructions for preparing form 104 residency status. Web send form 104ad via email, link, or fax. Web 4 rows find colorado form 104 instructions at esmart tax today. You can also download it, export it or print it out.