Conflict Of Interest Form Nonprofit

Conflict Of Interest Form Nonprofit - I have reviewed, and agree to abide by, the policy of conflict of interest of oregon society of tax consultants. Web nonprofit conflict of interest policy. It asks the officers and directors to proactively. Web a conflict of interest exists when a member of the organization has a personal interest that may influence them when making decisions. Web conflicts of interest pose risk, and they need to be assessed and managed from a risk leadership perspective. 2 there are times when charities actively seek. Web using a conflict of interest policy, information about comparable transactions between unrelated parties, and reliable methods for evaluating the transaction, are examples of. The organization is committed to observing the highest standards. Definitions “ompensation” means any direct or indirect remuneration, as. Web a conflict of interest policy is intended to help ensure that when actual or potential conflicts of interest arise, the organization has a process in place under.

Web conflict of interest policies provide written guidance for nonprofit boards on how to manage any conflict of interest. Web the irs form 990 even asks whether or not a nonprofit has a written policy on conflicts of interest, how a nonprofit manages conflicts, and how a nonprofit. Web a conflict of interest policy is intended to help ensure that when actual or potential conflicts of interest arise, the nonprofit organization has a process in place under. I have reviewed, and agree to abide by, the policy of conflict of interest of oregon society of tax consultants. Web nature of conflicting interest: Most often, they’re not intentional. Web applicable laws governing conflicts of interest in nonprofit and charitable organizations. Definitions “ompensation” means any direct or indirect remuneration, as. Web using a conflict of interest policy, information about comparable transactions between unrelated parties, and reliable methods for evaluating the transaction, are examples of. Web circumstances that you believe could contribute to a conflict of interest:

I have reviewed, and agree to abide by, the policy of conflict of interest of oregon society of tax consultants. ____ _ i have no conflict of interest to report. Most often, they’re not intentional. It asks the officers and directors to proactively. Web conflict of interest policies provide written guidance for nonprofit boards on how to manage any conflict of interest. Nonprofit boards should be aware of any. Web a conflict of interest policy is intended to help ensure that when actual or potential conflicts of interest arise, the organization has a process in place under. Web a conflict of interest policy is intended to help ensure that when actual or potential conflicts of interest arise, the nonprofit organization has a process in place under. Web the irs form 990 even asks whether or not a nonprofit has a written policy on conflicts of interest, how a nonprofit manages conflicts, and how a nonprofit. Web at its core, a board member conflict of interest policy should (a) require those with a conflict (or a potential conflict) to disclose it, and (b) prohibit any board members from.

Conflicts of Interest in a Nonprofit

Web conflicts of interest pose risk, and they need to be assessed and managed from a risk leadership perspective. Web using a conflict of interest policy, information about comparable transactions between unrelated parties, and reliable methods for evaluating the transaction, are examples of. Web a conflict of interest policy is intended to help ensure that when actual or potential conflicts.

CONFLICT OF INTEREST POLICY SA Apex

Web at its core, a board member conflict of interest policy should (a) require those with a conflict (or a potential conflict) to disclose it, and (b) prohibit any board members from. A conflicting interest may be defined as an interest, direct or indirect, with any persons or firms mentioned in section 3. Web nature of conflicting interest: Most often,.

Conflict of Interest Disclosure Form Template iSight

Most often, they’re not intentional. ____ _ i have the following conflict of interest to report. A conflicting interest may be defined as an interest, direct or indirect, with any persons or firms mentioned in section 3. Web conflicts of interest pose risk, and they need to be assessed and managed from a risk leadership perspective. Web this is a.

Conflict of Interest in Nonprofit Organizations Integrity Asia

Nepotism is the practice of playing favorites with family. Web up to 24% cash back this policy is intended to supplement, but not replace, any applicable state and federal laws governing conflicts of interest applicable to nonprofit and charitable. Web conflicts of interest can and do occur within nonprofit organizations. A conflicting interest may be defined as an interest, direct.

Conflict Of Interest Policy Gotilo

That said, it’s everyone’s responsibility to be aware of the. Nonprofit boards should be aware of any. Web a conflict of interest policy is intended to help ensure that when actual or potential conflicts of interest arise, the nonprofit organization has a process in place under. Web up to 25% cash back conflicts of interest exist when directors have personal.

7 Conflict Of Interest form Template FabTemplatez

A conflicting interest may be defined as an interest, direct or indirect, with any persons or firms mentioned in section 3. Most often, they’re not intentional. ____ _ i have the following conflict of interest to report. Nepotism is the practice of playing favorites with family. 2 there are times when charities actively seek.

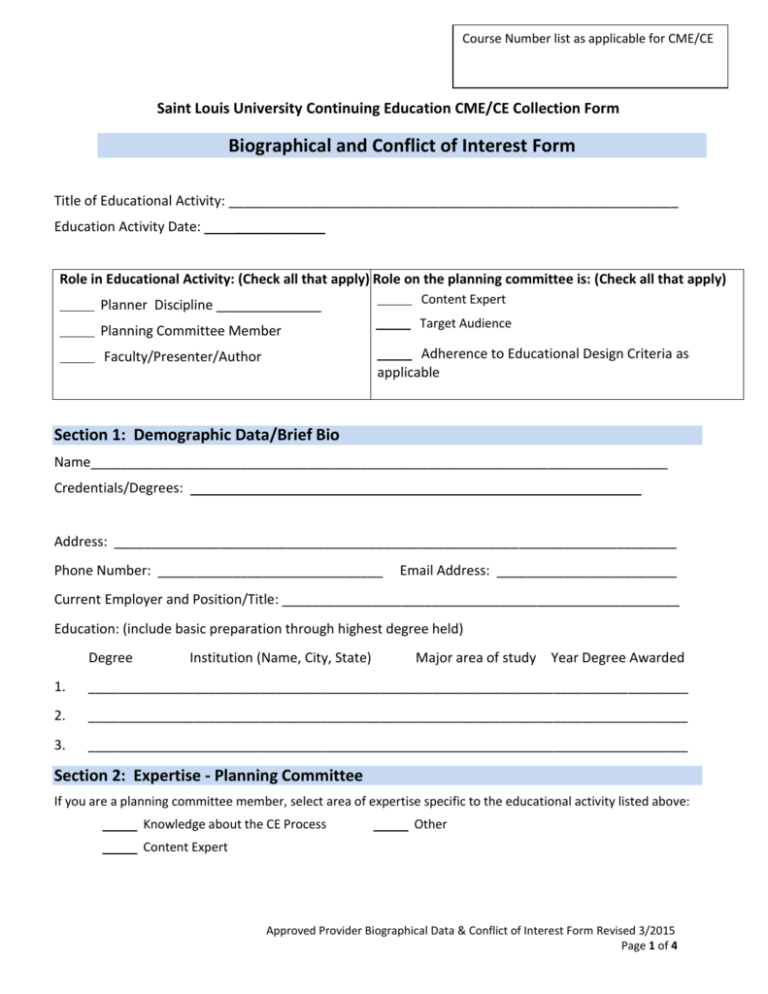

Combined Biographical and Conflict of Interest Form

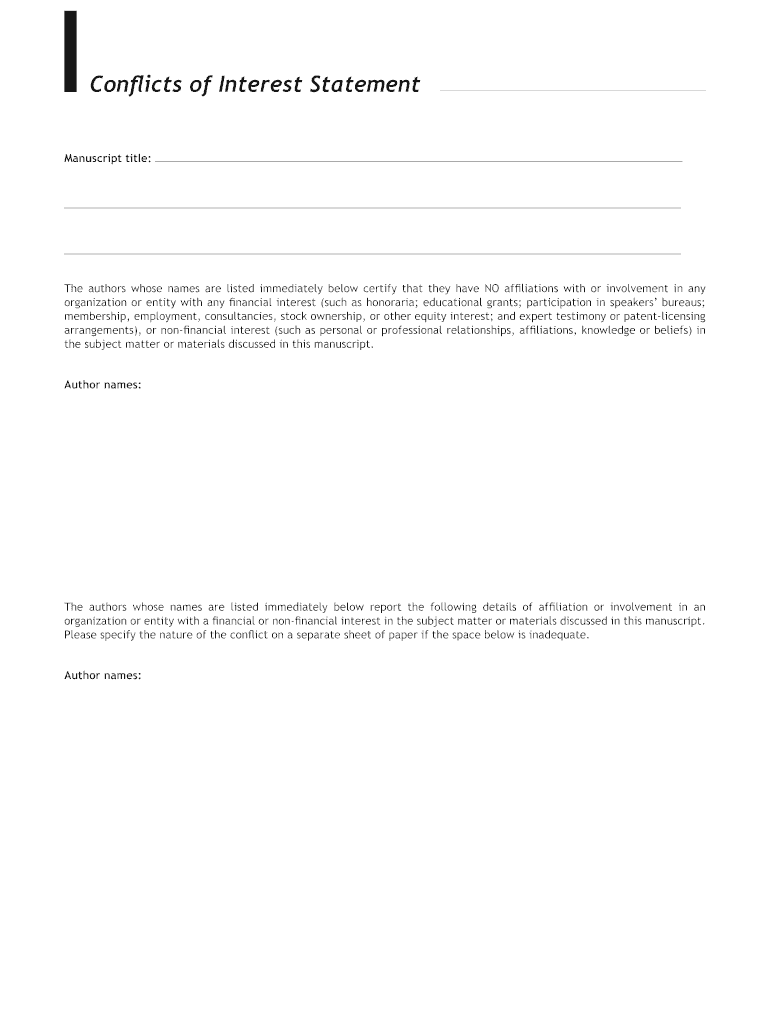

Web nature of conflicting interest: A conflicting interest may be defined as an interest, direct or indirect, with any persons or firms mentioned in section 3. Web conflicts of interest can and do occur within nonprofit organizations. Web a conflict of interest policy is intended to help ensure that when actual or potential conflicts of interest arise, the organization has.

Sample Nonprofit Conflict Of Interest Policy Template For Fill

2 there are times when charities actively seek. It asks the officers and directors to proactively. Web a conflict of interest policy is intended to help ensure that when actual or potential conflicts of interest arise, the organization has a process in place under. ____ _ i have the following conflict of interest to report. Nepotism is the practice of.

Conflict of Interest Policy Sample Free Download

Web at its core, a board member conflict of interest policy should (a) require those with a conflict (or a potential conflict) to disclose it, and (b) prohibit any board members from. Nonprofit boards should be aware of any. It asks the officers and directors to proactively. Web up to 25% cash back conflicts of interest exist when directors have.

Conflict of Interest Form Fill Out and Sign Printable PDF Template

Web nonprofit conflict of interest policy. Web using a conflict of interest policy, information about comparable transactions between unrelated parties, and reliable methods for evaluating the transaction, are examples of. 2 there are times when charities actively seek. Web up to 25% cash back conflicts of interest exist when directors have personal or financial interests that could influence their judgment.

Web Circumstances That You Believe Could Contribute To A Conflict Of Interest:

Web at its core, a board member conflict of interest policy should (a) require those with a conflict (or a potential conflict) to disclose it, and (b) prohibit any board members from. Web a conflict of interest policy is intended to help ensure that when actual or potential conflicts of interest arise, the nonprofit organization has a process in place under. The organization is committed to observing the highest standards. Web up to 25% cash back conflicts of interest exist when directors have personal or financial interests that could influence their judgment in making decisions for the nonprofit.

Web A Conflict Of Interest Policy Is Intended To Help Ensure That When Actual Or Potential Conflicts Of Interest Arise, The Organization Has A Process In Place Under.

Web a conflict of interest exists when a member of the organization has a personal interest that may influence them when making decisions. Most often, they’re not intentional. Web up to 24% cash back this policy is intended to supplement, but not replace, any applicable state and federal laws governing conflicts of interest applicable to nonprofit and charitable. Definitions “ompensation” means any direct or indirect remuneration, as.

Web Nonprofit Conflict Of Interest Policy.

Web applicable laws governing conflicts of interest in nonprofit and charitable organizations. Web conflicts of interest pose risk, and they need to be assessed and managed from a risk leadership perspective. A conflicting interest may be defined as an interest, direct or indirect, with any persons or firms mentioned in section 3. ____ _ i have no conflict of interest to report.

Web Conflicts Of Interest Can And Do Occur Within Nonprofit Organizations.

That said, it’s everyone’s responsibility to be aware of the. Web this is a model conflict of interest disclosure form for nonprofits to distribute to all officers and directors. Web the irs form 990 even asks whether or not a nonprofit has a written policy on conflicts of interest, how a nonprofit manages conflicts, and how a nonprofit. Web nature of conflicting interest: