Connecticut Conveyance Tax Form

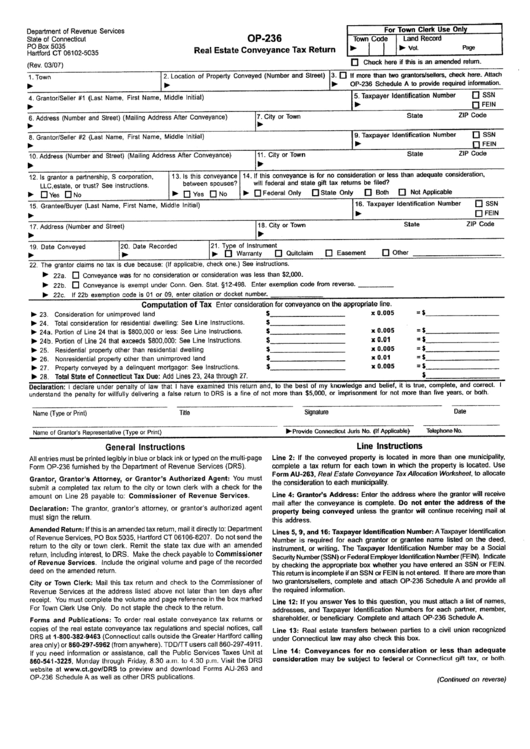

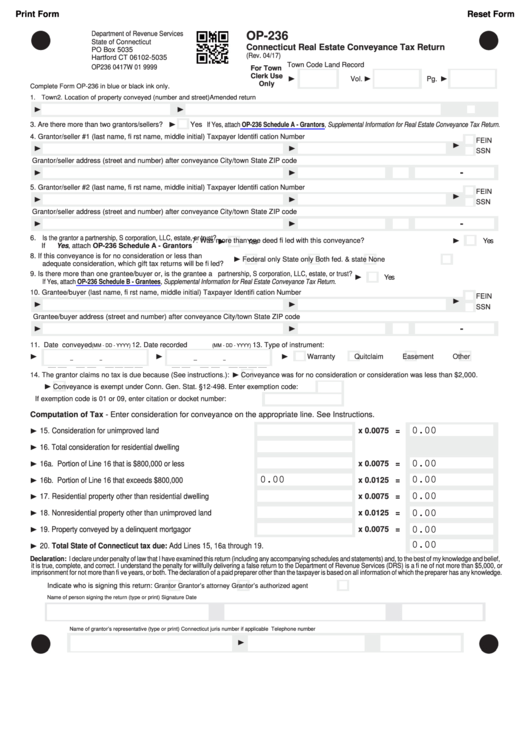

Connecticut Conveyance Tax Form - If the grantee is a partnership, Beginning july 1, 2020, a 2.25% rate applies to any portion of a residential dwelling’s sales price that exceeds $2.5 million. Web line instructions line 2: The marginal tax brackets for residential real property are as follows: Web connecticut real estate conveyance tax return (rev. If the conveyed property is located in more than one municipality, complete a tax return for each town in which the property is located. Web ct open data portal. Up to and including $800,000: Forms for state of connecticut/department of administrative services Grantor/seller #1 (last name, fi rst name, middle initial) taxpayer identifi cation number grantor/seller address (street and number) after conveyance city/town state zip code fein ssn 10.

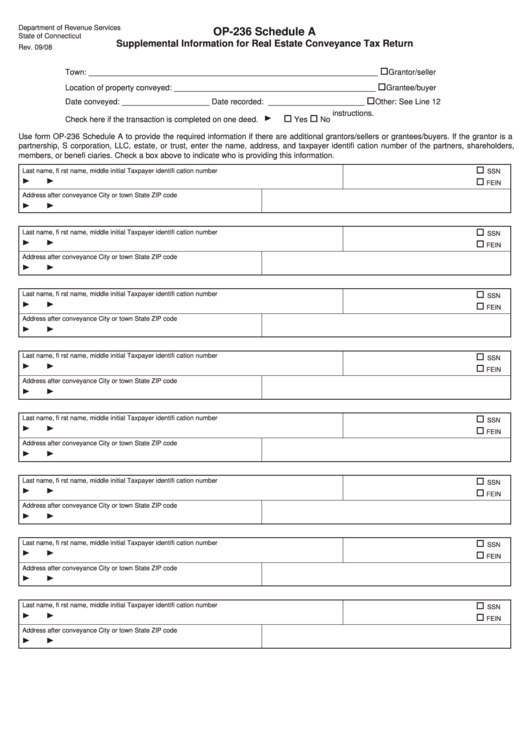

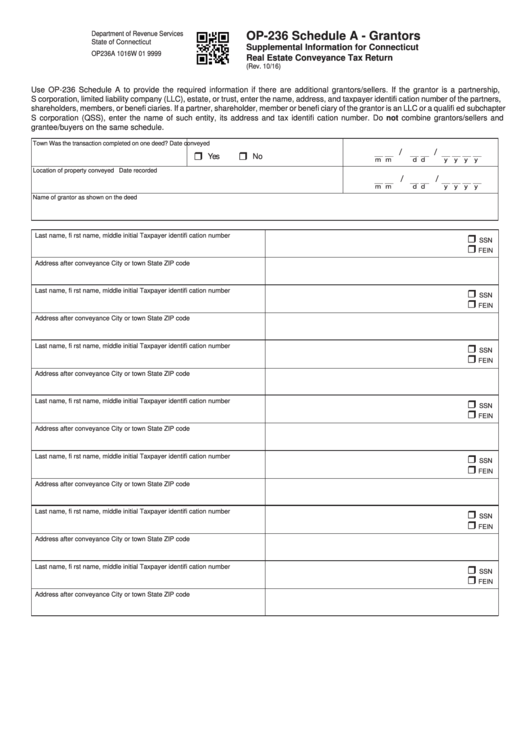

Web connecticut real estate conveyance tax return (rev. Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code Forms for state of connecticut/department of administrative services Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code fein ssn The marginal tax brackets for residential real property are as follows: Web supplemental information for connecticut real estate conveyance tax return (rev. Web line instructions line 2: Web 1.25% rate applies to (1) sales of nonresidential property other than unimproved land and (2) any portion of the sales price of a residential dwelling that exceeds $800,000 and is less than or equal to $2.5 million. Web connecticut real estate conveyance tax return (rev. Web connecticut real estate conveyance tax return (rev.

Web supplemental information for connecticut real estate conveyance tax return (rev. Web connecticut real estate conveyance tax return (rev. Grantor/seller #1 (last name, fi rst name, middle initial) taxpayer identifi cation number grantor/seller address (street and number) after conveyance city/town state zip code fein ssn 10. Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code fein ssn Web 1.25% rate applies to (1) sales of nonresidential property other than unimproved land and (2) any portion of the sales price of a residential dwelling that exceeds $800,000 and is less than or equal to $2.5 million. Download this form and complete using adobe acrobat. Up to and including $800,000: Web beginning july 1, 2020 (cite: If the grantee is a partnership, The marginal tax brackets for residential real property are as follows:

Fill Free fillable forms State of Connecticut/Department of

The marginal tax brackets for residential real property are as follows: Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code fein ssn Web connecticut real estate conveyance tax return (rev. Web supplemental information for connecticut real estate conveyance tax return (rev. If the grantee is a partnership,

Schedule A (Form Op236) Supplemental Information For Real Estate

Beginning july 1, 2020, a 2.25% rate applies to any portion of a residential dwelling’s sales price that exceeds $2.5 million. Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code Web connecticut real estate conveyance tax return (rev. Web line instructions line 2: Web beginning july 1,.

Form Op236 Real Estate Conveyance Tax Return printable pdf download

Up to and including $800,000: Forms for state of connecticut/department of administrative services Web line instructions line 2: Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code fein ssn Web ct open data portal.

Form Op236 Schedule A Grantors Supplemental Information For

Download this form and complete using adobe acrobat. Up to and including $800,000: Web line instructions line 2: Grantor/seller #1 (last name, fi rst name, middle initial) taxpayer identifi cation number grantor/seller address (street and number) after conveyance city/town state zip code fein ssn 10. Web beginning july 1, 2020 (cite:

Connecticut conveyance Fill out & sign online DocHub

If the conveyed property is located in more than one municipality, complete a tax return for each town in which the property is located. Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code Web beginning july 1, 2020 (cite: Web ct open data portal. Web 1.25% rate.

Fillable Form Op236 Connecticut Real Estate Conveyance Tax Return

Forms for state of connecticut/department of administrative services If the conveyed property is located in more than one municipality, complete a tax return for each town in which the property is located. Web supplemental information for connecticut real estate conveyance tax return (rev. Web 1.25% rate applies to (1) sales of nonresidential property other than unimproved land and (2) any.

Medina County Auditor Forms

If the grantee is a partnership, Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code fein ssn If the conveyed property is located in more than one municipality, complete a tax return for each town in which the property is located. The marginal tax brackets for residential.

Fill Free fillable OP236 Connecticut Real Estate Conveyance Tax

Web beginning july 1, 2020 (cite: Beginning july 1, 2020, a 2.25% rate applies to any portion of a residential dwelling’s sales price that exceeds $2.5 million. Grantor/seller #1 (last name, fi rst name, middle initial) taxpayer identifi cation number grantor/seller address (street and number) after conveyance city/town state zip code fein ssn 10. Forms for state of connecticut/department of.

Connecticut's Tax System Staff Briefing

Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code fein ssn Beginning july 1, 2020, a 2.25% rate applies to any portion of a residential dwelling’s sales price that exceeds $2.5 million. Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and.

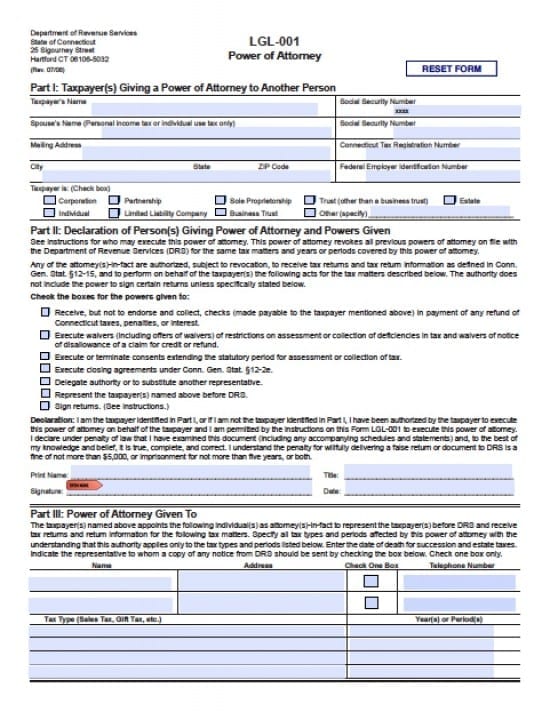

Connecticut Tax Power of Attorney Form Power of Attorney Power of

Web supplemental information for connecticut real estate conveyance tax return (rev. The marginal tax brackets for residential real property are as follows: Forms for state of connecticut/department of administrative services Up to and including $800,000: Web 1.25% rate applies to (1) sales of nonresidential property other than unimproved land and (2) any portion of the sales price of a residential.

If The Grantee Is A Partnership,

Beginning july 1, 2020, a 2.25% rate applies to any portion of a residential dwelling’s sales price that exceeds $2.5 million. Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code fein ssn Web connecticut real estate conveyance tax return (rev. Web connecticut real estate conveyance tax return (rev.

Forms For State Of Connecticut/Department Of Administrative Services

Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code Up to and including $800,000: Web ct open data portal. Web supplemental information for connecticut real estate conveyance tax return (rev.

Grantor/Seller #1 (Last Name, Fi Rst Name, Middle Initial) Taxpayer Identifi Cation Number Grantor/Seller Address (Street And Number) After Conveyance City/Town State Zip Code Fein Ssn 10.

The marginal tax brackets for residential real property are as follows: Web beginning july 1, 2020 (cite: Web line instructions line 2: Download this form and complete using adobe acrobat.

Web Connecticut Real Estate Conveyance Tax Return (Rev.

If the conveyed property is located in more than one municipality, complete a tax return for each town in which the property is located. Web 1.25% rate applies to (1) sales of nonresidential property other than unimproved land and (2) any portion of the sales price of a residential dwelling that exceeds $800,000 and is less than or equal to $2.5 million.