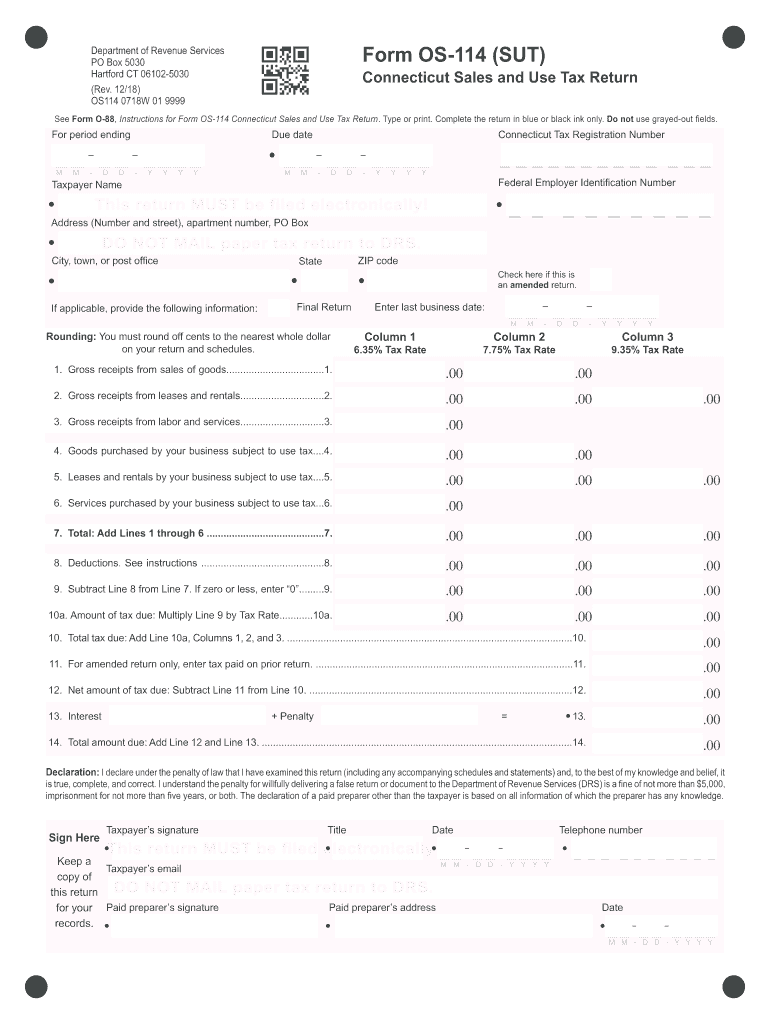

Ct Form Os 114

Ct Form Os 114 - Type text, add images, blackout confidential details, add comments, highlights and more. Get form be filed electronically address number and street apartment. Web form os‑114, connecticut sales and use tax return, must be filed and paid electronically using myconnect. Drs myconnect allows taxpayers to electronically file, pay, and. Web all connecticut businesses must regularly file a sales and use tax return even if they have no tax due. The connecticut sales and use tax return is included in new york sales tax preparer for our user's convenience. Complete the return in blue or black ink only. To request a waiver from the electronic filing requirements visit. Web send ct gov form os 114 via email, link, or fax. Complete the return in blue or black ink only.

To request a waiver from the electronic filing requirements visit. Open up the form os 114 within the editor to view the information of the template. Visit portal.ct.gov/tsc to file your return electronically using the tsc. Sign it in a few clicks. 07/11) for period ending connecticut tax registration. Web use a ct os 114 fillable form 2022 template to make your document workflow more streamlined. Web form os‑114, connecticut sales and use tax return, must be filed and paid electronically using myconnect. Edit your ct os 114 fillable form online. Get form be filed electronically address number and street apartment. You can also download it, export it or print it out.

Web send ct gov form os 114 via email, link, or fax. Complete the return in blue or black ink only. Sign it in a few clicks. The return may be fi led electronically through the department of revenue. 07/11) for period ending connecticut tax registration. Web use a ct os 114 fillable form 2022 template to make your document workflow more streamlined. Complete the return in blue or black ink only. Web all connecticut businesses must regularly file a sales and use tax return even if they have no tax due. Complete the return in blue or black ink only. To request a waiver from the electronic filing requirements visit.

Ct Sales And Use Tax Form Os 114 Instructions Form Resume Examples

Connecticut state department of revenue. Complete the return in blue or black ink only. Open up the form os 114 within the editor to view the information of the template. You can also download it, export it or print it out. Edit your os 114 online.

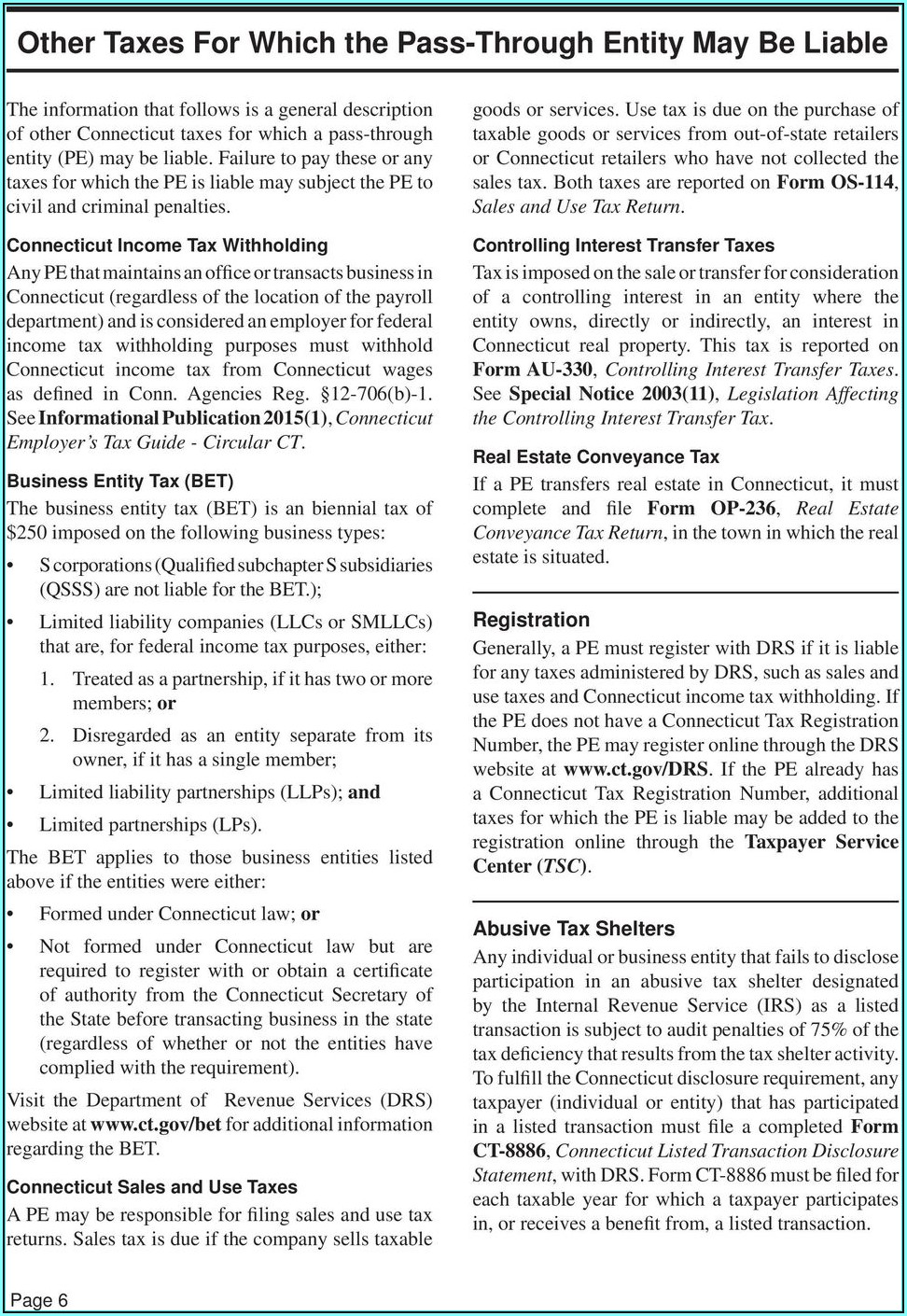

Form Os114 (But) Sales And Use Tax Return 2014 printable pdf download

Type text, add images, blackout confidential details, add. Sign it in a few clicks. 07/11) for period ending connecticut tax registration. Web search bar for ct.gov. Type text, add images, blackout confidential details, add comments, highlights and more.

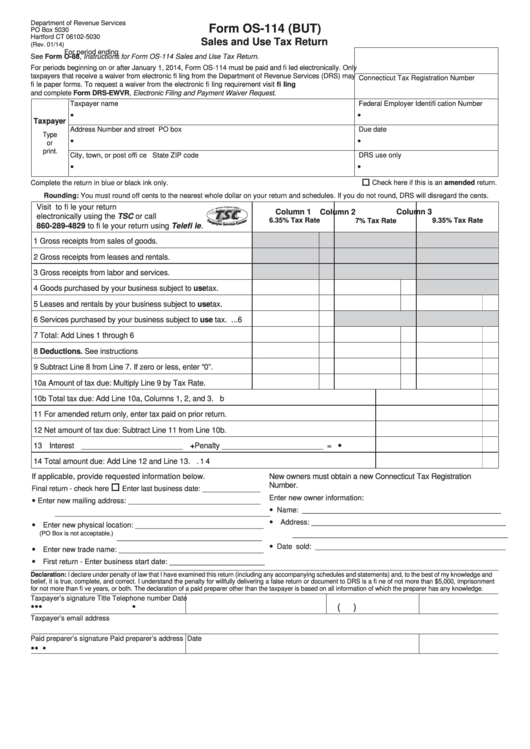

Form OS114 (SUT) Fill Out, Sign Online and Download Printable PDF

Open up the form os 114 within the editor to view the information of the template. Complete the return in blue or black ink only. Annual filers are required to electronically. Sign it in a few clicks. Type text, add images, blackout confidential details, add.

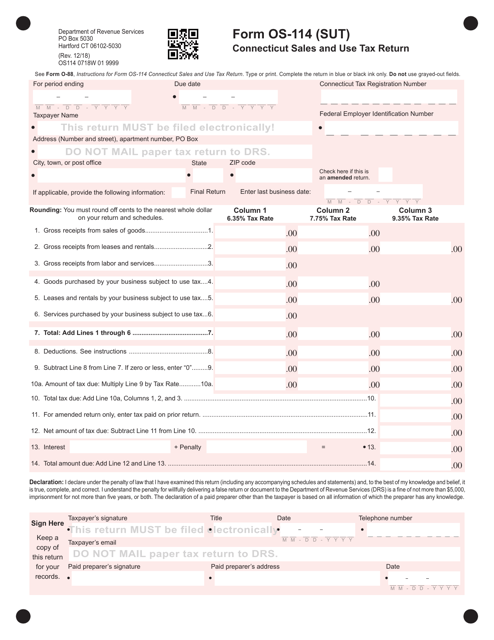

2015 Form CT DRS CT941 Fill Online, Printable, Fillable, Blank PDFfiller

Open up the form os 114 within the editor to view the information of the template. Edit your os 114 online. The connecticut sales and use tax return is included in new york sales tax preparer for our user's convenience. Web all connecticut businesses must regularly file a sales and use tax return even if they have no tax due..

Form Os 114 Fill Out and Sign Printable PDF Template signNow

Web use a ct os 114 fillable form 2022 template to make your document workflow more streamlined. The return may be fi led electronically through the department of revenue. Connecticut state department of revenue. Complete the return in blue or black ink only. Web search bar for ct.gov.

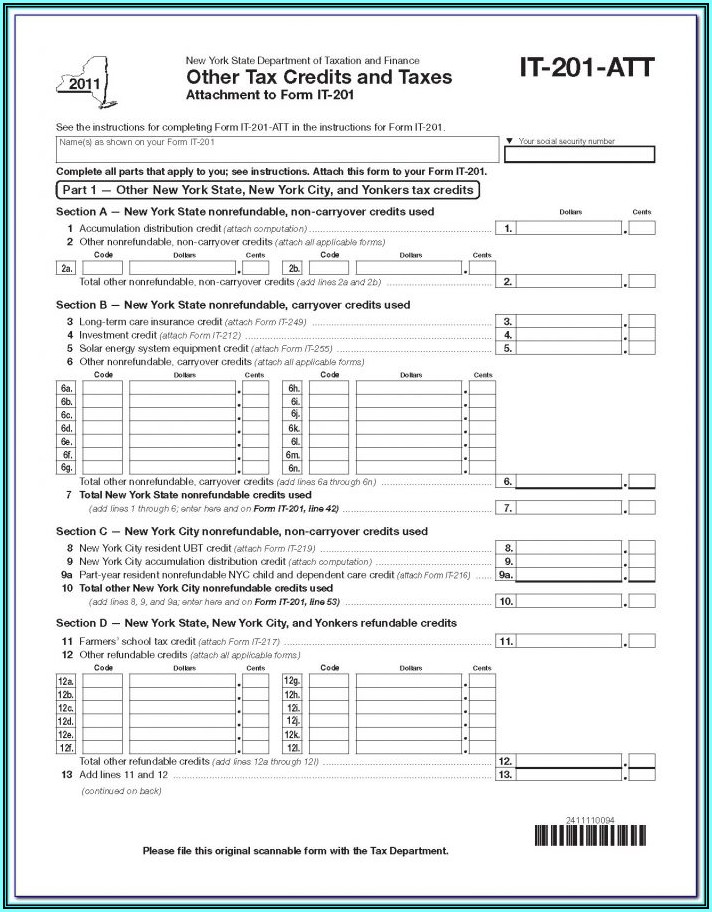

Ny State Tax Extension Form It 201 Form Resume Examples MW9pX8Z9AJ

Edit your ct os 114 fillable form online. Drs myconnect allows taxpayers to electronically file, pay, and. Complete the return in blue or black ink only. Web form os‑114, connecticut sales and use tax return, must be filed and paid electronically using myconnect. Open up the form os 114 within the editor to view the information of the template.

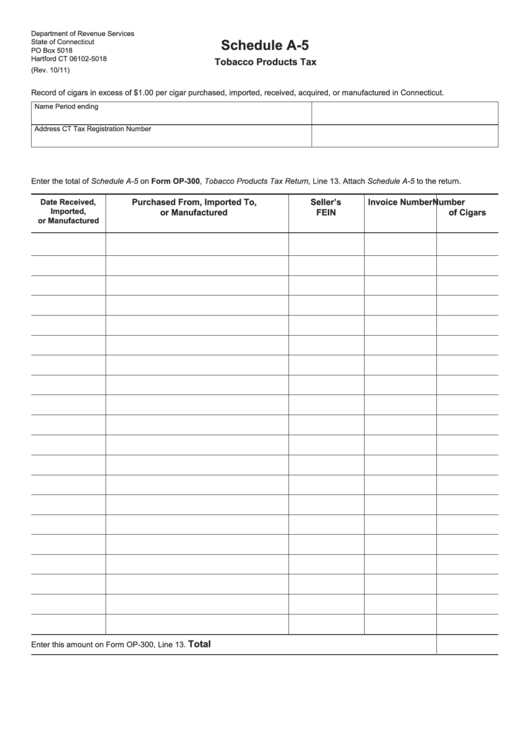

Top 23 Form Os114 Templates free to download in PDF format

Complete the return in blue or black ink only. Open up the form os 114 within the editor to view the information of the template. Visit portal.ct.gov/tsc to file your return electronically using the tsc. The connecticut sales and use tax return is included in new york sales tax preparer for our user's convenience. Web send ct gov form os.

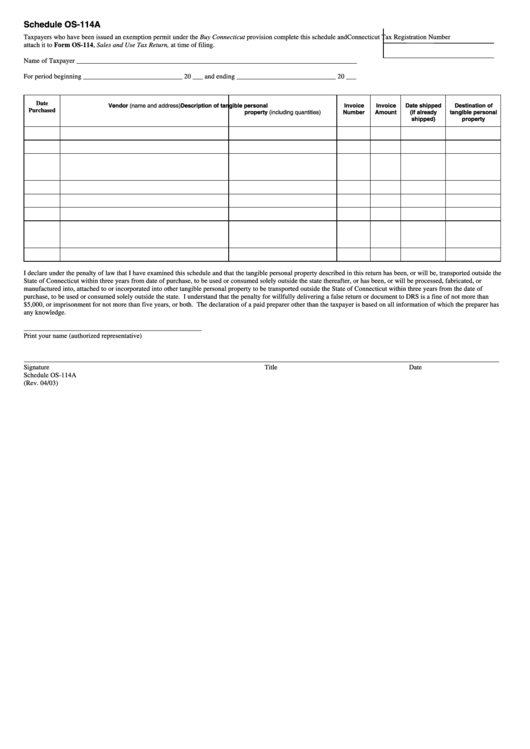

Schedule Os114a printable pdf download

Get form be filed electronically address number and street apartment. Connecticut state department of revenue. The connecticut sales and use tax return is included in new york sales tax preparer for our user's convenience. Open up the form os 114 within the editor to view the information of the template. Annual filers are required to electronically.

Ct Os 114 Mail Paper 2015 Fill Online, Printable, Fillable, Blank

Complete the return in blue or black ink only. Sign it in a few clicks. Web send ct gov form os 114 via email, link, or fax. Edit your os 114 online. Web form os‑114, connecticut sales and use tax return, must be filed and paid electronically using myconnect.

Ct Sales And Use Tax Form Os 114 Instructions Form Resume Examples

The return may be fi led electronically through the department of revenue. Type text, add images, blackout confidential details, add. Web send ct gov form os 114 via email, link, or fax. Annual filers are required to electronically. Web send ct gov form os 114 via email, link, or fax.

Edit Your Os 114 Online.

Complete the return in blue or black ink only. Edit your ct os 114 fillable form online. Type text, add images, blackout confidential details, add comments, highlights and more. Type text, add images, blackout confidential details, add.

To Request A Waiver From The Electronic Filing Requirements Visit.

The return may be fi led electronically through the department of revenue. You can also download it, export it or print it out. Sign it in a few clicks. Web form os‑114, connecticut sales and use tax return, must be filed and paid electronically using myconnect.

Drs Myconnect Allows Taxpayers To Electronically File, Pay, And.

Open up the form os 114 within the editor to view the information of the template. 07/11) for period ending connecticut tax registration. Connecticut state department of revenue. Get form be filed electronically address number and street apartment.

You Can Proceed And Download A Blank Format Or Fill In And Deliver It On.

Web use a ct os 114 fillable form 2022 template to make your document workflow more streamlined. Web all connecticut businesses must regularly file a sales and use tax return even if they have no tax due. Visit portal.ct.gov/tsc to file your return electronically using the tsc. The connecticut sales and use tax return is included in new york sales tax preparer for our user's convenience.