Ct Sales Tax Exempt Form

Ct Sales Tax Exempt Form - A qualifying exempt organization must issue this. Web it imposes a 6.35% tax, with some exceptions, on the retail sales of tangible personal property purchased (1) in connecticut (i.e., sales tax) or (2) outside connecticut for. To file sales tax in connecticut, you must begin by reporting gross sales for the reporting period, and calculate the total. Web connecticut sales tax exemptions on purchases of meals and lodging out of state sales tax exemptions for meals and lodging purchase of other services or property. Web find cheap tickets to anywhere in connecticut from kansas city. Web individual state tax exemption listing (please place an “x” in the box are exempt from taxes) additional information (description, pertinent statutes, regulations, etc.) sales. Web while the connecticut sales tax of 6.35% applies to most transactions, there are certain items that may be exempt from taxation. Kayak searches hundreds of travel sites to help you find cheap airfare and book the flight that suits you. Manufacturing and biotech sales and use tax exemption. This page discusses various sales tax.

Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the connecticut sales tax. Web visit our other sites. Web it imposes a 6.35% tax, with some exceptions, on the retail sales of tangible personal property purchased (1) in connecticut (i.e., sales tax) or (2) outside connecticut for. Web individual state tax exemption listing (please place an “x” in the box are exempt from taxes) additional information (description, pertinent statutes, regulations, etc.) sales. Web calculator exemption certificates for businesses taxability vehicles more connecticut resale exemption certificate a sales tax exemption certificate can be used by. Services subject to sales use tax. Web page 1 of 1. Web your connecticut sales tax filing requirements. Search flight deals from various travel partners with one click at $108. Web department of revenue services.

Web find cheap tickets to anywhere in connecticut from kansas city. Web department of revenue services. Web page 1 of 1. Search flight deals from various travel partners with one click at $108. Web connecticut sales tax exemptions on purchases of meals and lodging out of state sales tax exemptions for meals and lodging purchase of other services or property. Web it imposes a 6.35% tax, with some exceptions, on the retail sales of tangible personal property purchased (1) in connecticut (i.e., sales tax) or (2) outside connecticut for. Web find airfare and ticket deals for cheap flights from connecticut (ct) to missouri (mo). Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the connecticut sales tax. To file sales tax in connecticut, you must begin by reporting gross sales for the reporting period, and calculate the total. Services subject to sales use tax.

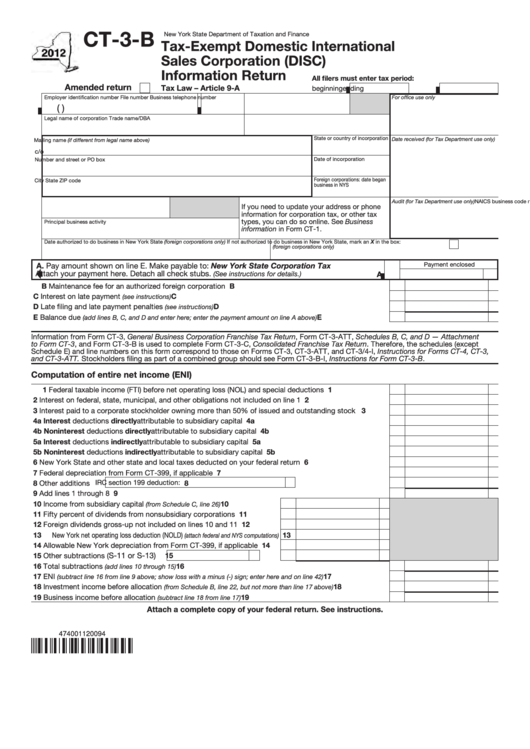

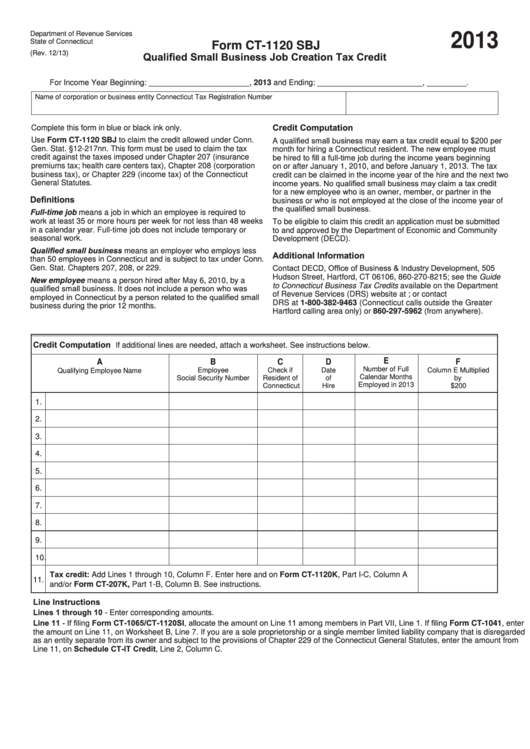

Form Ct3B TaxExempt Domestic International Sales Corporation (Disc

Web your connecticut sales tax filing requirements. Web find airfare and ticket deals for cheap flights from connecticut (ct) to missouri (mo). Web calculator exemption certificates for businesses taxability vehicles more connecticut resale exemption certificate a sales tax exemption certificate can be used by. Web while the connecticut sales tax of 6.35% applies to most transactions, there are certain items.

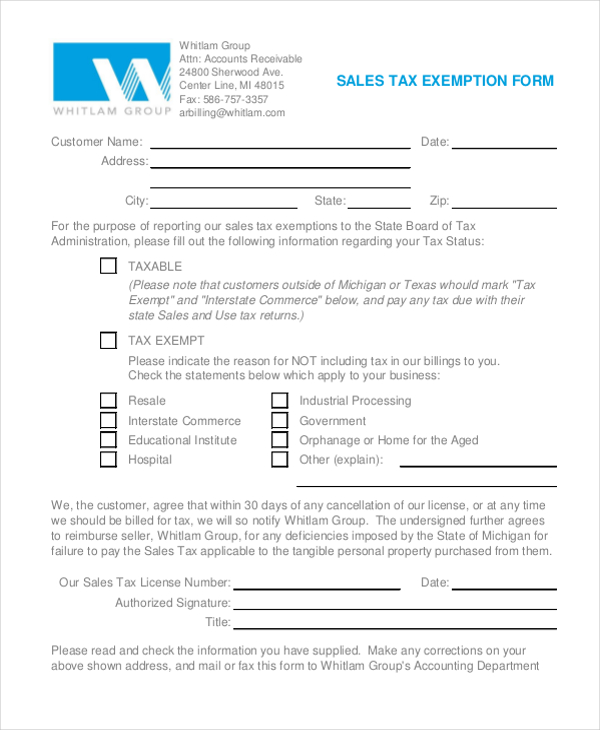

FREE 10+ Sample Tax Exemption Forms in PDF

Health care provider user fees. Web calculator exemption certificates for businesses taxability vehicles more connecticut resale exemption certificate a sales tax exemption certificate can be used by. Web individual state tax exemption listing (please place an “x” in the box are exempt from taxes) additional information (description, pertinent statutes, regulations, etc.) sales. Web department of revenue services. To file sales.

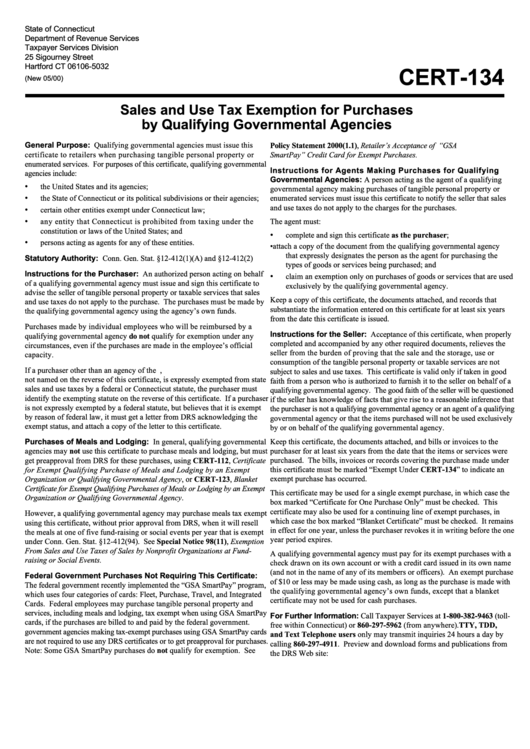

Instructions For Form Cert134 Sales And Use Tax Exemption For

Web individual state tax exemption listing (please place an “x” in the box are exempt from taxes) additional information (description, pertinent statutes, regulations, etc.) sales. Services subject to sales use tax. Web your connecticut sales tax filing requirements. Web find cheap tickets to anywhere in connecticut from kansas city. Search flight deals from various travel partners with one click at.

Exemption Certificate Format Master of Documents

Web connecticut sales tax exemptions on purchases of meals and lodging out of state sales tax exemptions for meals and lodging purchase of other services or property. Web find cheap tickets to anywhere in connecticut from kansas city. Kayak searches hundreds of travel sites to help you find cheap airfare and book the flight that suits you. Web connecticut general.

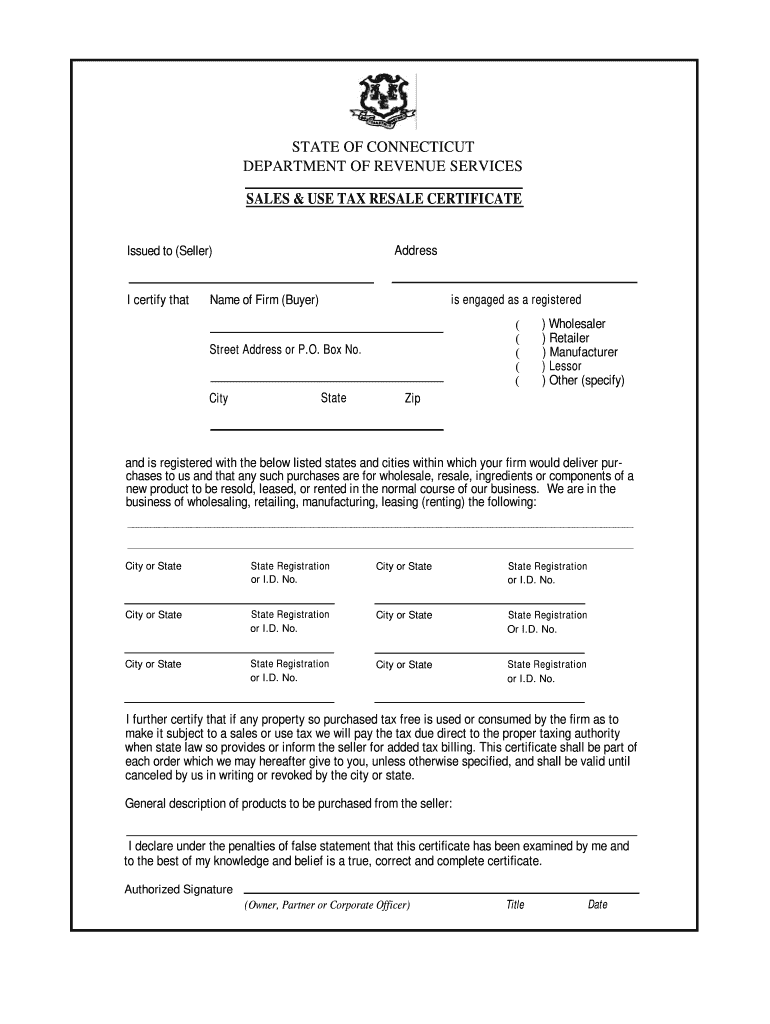

Ct Sales And Use Tax Resale Certificate Fillable Tax Walls

Kayak searches hundreds of travel sites to help you find cheap airfare and book the flight that suits you. Web find out more about the available tax exemptions on film, video and broadcast productions in connecticut. To file sales tax in connecticut, you must begin by reporting gross sales for the reporting period, and calculate the total. Sales tax exemption.

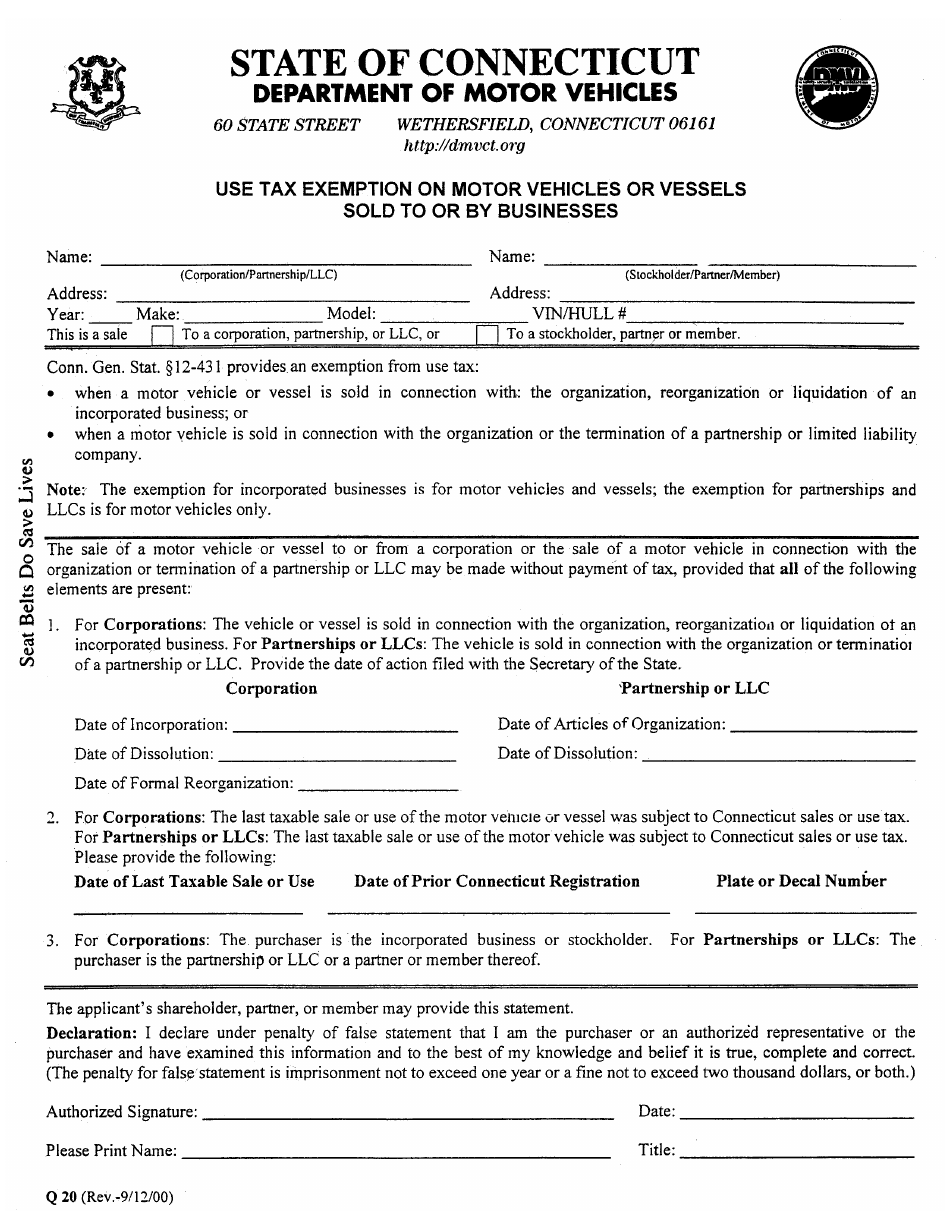

Form Q20 Download Fillable PDF or Fill Online Use Tax Exemption on

Kayak searches hundreds of travel sites to help you find cheap airfare and book the flight that suits you. Sales tax exemption certificates can be used by exempt institutions to purchase property or services without having to pay a sales tax. A qualifying exempt organization must issue this. To file sales tax in connecticut, you must begin by reporting gross.

Tax Exempt Forms San Patricio Electric Cooperative

Sales tax exemption certificates can be used by exempt institutions to purchase property or services without having to pay a sales tax. Web find cheap tickets to anywhere in connecticut from kansas city. Web it imposes a 6.35% tax, with some exceptions, on the retail sales of tangible personal property purchased (1) in connecticut (i.e., sales tax) or (2) outside.

Top 60 Ct Tax Exempt Form Templates free to download in PDF format

This page discusses various sales tax. To file sales tax in connecticut, you must begin by reporting gross sales for the reporting period, and calculate the total. Web connecticut sales tax exemptions on purchases of meals and lodging out of state sales tax exemptions for meals and lodging purchase of other services or property. Web find cheap tickets to anywhere.

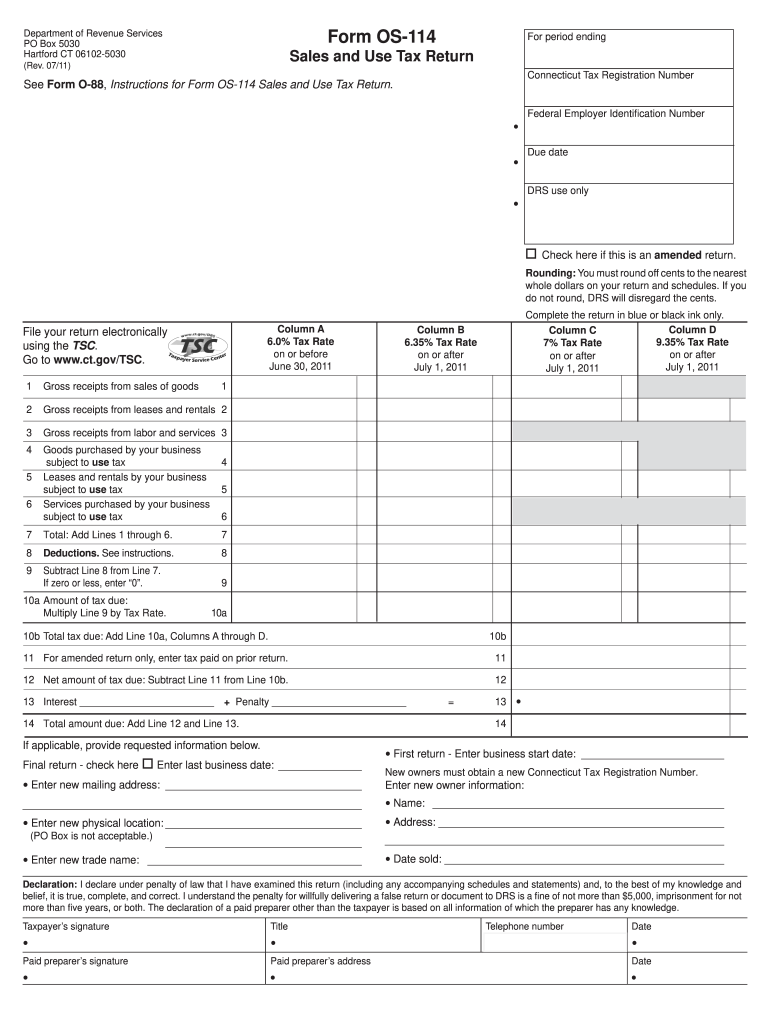

Ct Sales and Use Tax Form Fill Out and Sign Printable PDF Template

Health care provider user fees. Services subject to sales use tax. To file sales tax in connecticut, you must begin by reporting gross sales for the reporting period, and calculate the total. Manufacturing and biotech sales and use tax exemption. Web your connecticut sales tax filing requirements.

FREE 8+ Sample Tax Exemption Forms in PDF MS Word

Services subject to sales use tax. A qualifying exempt organization must issue this. Web individual state tax exemption listing (please place an “x” in the box are exempt from taxes) additional information (description, pertinent statutes, regulations, etc.) sales. Search flight deals from various travel partners with one click at $108. Manufacturing and biotech sales and use tax exemption.

This Page Discusses Various Sales Tax.

Web page 1 of 1. Manufacturing and biotech sales and use tax exemption. Web department of revenue services. Web individual state tax exemption listing (please place an “x” in the box are exempt from taxes) additional information (description, pertinent statutes, regulations, etc.) sales.

Services Subject To Sales Use Tax.

Health care provider user fees. Web connecticut general statutes, chapter 219, sales and use taxes, imposes the connecticut sales and use tax on the gross receipts from the sale of tangible personal. Web visit our other sites. A qualifying exempt organization must issue this.

Web Connecticut Sales Tax Exemptions On Purchases Of Meals And Lodging Out Of State Sales Tax Exemptions For Meals And Lodging Purchase Of Other Services Or Property.

Sales tax exemption certificates can be used by exempt institutions to purchase property or services without having to pay a sales tax. Web it imposes a 6.35% tax, with some exceptions, on the retail sales of tangible personal property purchased (1) in connecticut (i.e., sales tax) or (2) outside connecticut for. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the connecticut sales. Web while the connecticut sales tax of 6.35% applies to most transactions, there are certain items that may be exempt from taxation.

Web Find Cheap Tickets To Anywhere In Connecticut From Kansas City.

Web find airfare and ticket deals for cheap flights from connecticut (ct) to missouri (mo). Web your connecticut sales tax filing requirements. To file sales tax in connecticut, you must begin by reporting gross sales for the reporting period, and calculate the total. Web find out more about the available tax exemptions on film, video and broadcast productions in connecticut.