Deadline For Filing Form 5500

Deadline For Filing Form 5500 - Web standard filing deadline. Web those on the march 15 th /september 15 th tax filing schedule can still achieve the october due date for their 5500 as long as they submit the form 5558 by the original july 31 st. Web file any applicable final form 5500 series return; Filings for plan years prior to 2009 are not. Web form 5500 must be filed annually by the last day of the seventh calendar month after the end of the plan year (july 31 for calendar year plans) unless an extension. And if desired, ask the irs to make a determination about the plan's qualification status at termination by filing a. Web missing the final deadline for filing your form 5500 is a common pitfall for plan administrators. Form 5500 must be filed by the last day of the seventh month following the end of the plan year. Web the form 5500 annual return/report is filed by employee benefit plans and certain other entities and serves as the principal source of information and data. On december 8, 2022 dol, irs, and pbgc.

Web the form 5500 annual return/report is filed by employee benefit plans and certain other entities and serves as the principal source of information and data. Accordingly, the automatic extension does not apply to. Web secure act section 202 directed dol and irs to establish a consolidated form 5500 filing option f or groups of defined contribution plans that satisfy certain criteria. Web file any applicable final form 5500 series return; Web the due date for 2019 form 5500 filings for calendar year plans is july 31, 2020—outside the relief window. Web standard filing deadline. Filings for plan years prior to 2009 are not. And if desired, ask the irs to make a determination about the plan's qualification status at termination by filing a. The filing due date for a form 5500 is seven months after the end of the. On december 8, 2022 dol, irs, and pbgc.

On december 8, 2022 dol, irs, and pbgc. The filing due date for a form 5500 is seven months after the end of the. Accordingly, the automatic extension does not apply to. Filings for plan years prior to 2009 are not. Web form 5500 must be filed annually by the last day of the seventh calendar month after the end of the plan year (july 31 for calendar year plans) unless an extension. Web the form 5500 annual return/report is filed by employee benefit plans and certain other entities and serves as the principal source of information and data. Web file any applicable final form 5500 series return; Form 5500 must be filed by the last day of the seventh month following the end of the plan year. Web missing the final deadline for filing your form 5500 is a common pitfall for plan administrators. And if desired, ask the irs to make a determination about the plan's qualification status at termination by filing a.

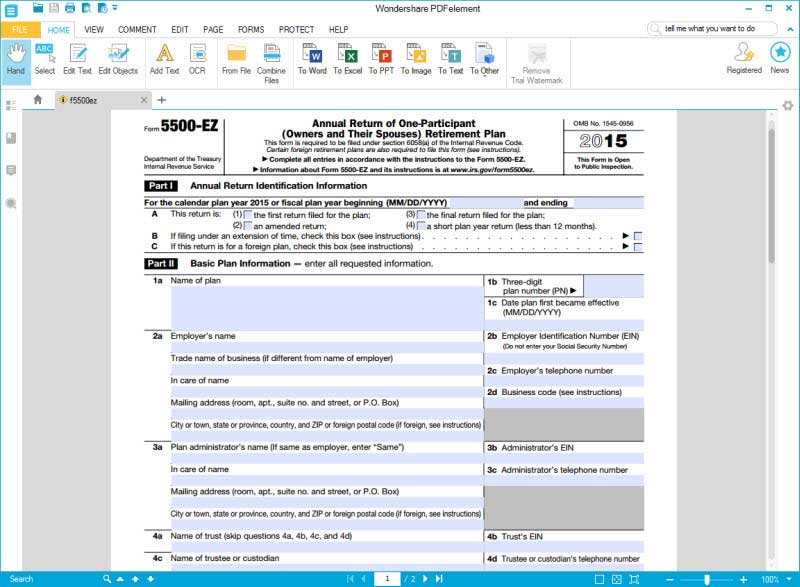

Form 5500 Instructions 5 Steps to Filing Correctly (2023)

Web the form 5500 annual return/report is filed by employee benefit plans and certain other entities and serves as the principal source of information and data. Form 5500 must be filed by the last day of the seventh month following the end of the plan year. Accordingly, the automatic extension does not apply to. Web the due date for 2019.

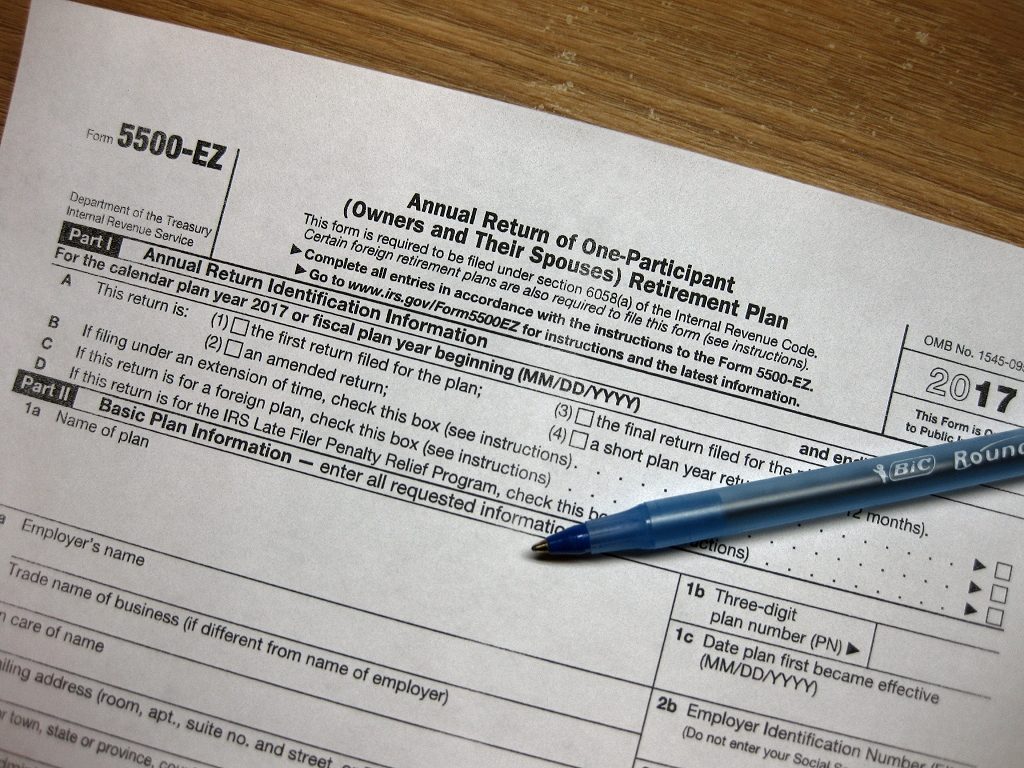

How To File The Form 5500EZ For Your Solo 401k in 2022 Good Money Sense

Web file any applicable final form 5500 series return; Accordingly, the automatic extension does not apply to. Web secure act section 202 directed dol and irs to establish a consolidated form 5500 filing option f or groups of defined contribution plans that satisfy certain criteria. Web standard filing deadline. On december 8, 2022 dol, irs, and pbgc.

Form 5500 Deadline Is it Extended Due to COVID19? Mitchell Wiggins

Web missing the final deadline for filing your form 5500 is a common pitfall for plan administrators. Accordingly, the automatic extension does not apply to. Filings for plan years prior to 2009 are not. Web those on the march 15 th /september 15 th tax filing schedule can still achieve the october due date for their 5500 as long as.

Form 5500 Deadline Coming Up In August! MyHRConcierge

Web file any applicable final form 5500 series return; And if desired, ask the irs to make a determination about the plan's qualification status at termination by filing a. Accordingly, the automatic extension does not apply to. Form 5500 must be filed by the last day of the seventh month following the end of the plan year. On december 8,.

IRS Form 5500EZ Use the Most Efficient Tool to Fill it

Web file any applicable final form 5500 series return; And if desired, ask the irs to make a determination about the plan's qualification status at termination by filing a. On december 8, 2022 dol, irs, and pbgc. Web those on the march 15 th /september 15 th tax filing schedule can still achieve the october due date for their 5500.

Form 5500 Is Due by July 31 for Calendar Year Plans

And if desired, ask the irs to make a determination about the plan's qualification status at termination by filing a. Web secure act section 202 directed dol and irs to establish a consolidated form 5500 filing option f or groups of defined contribution plans that satisfy certain criteria. Web file any applicable final form 5500 series return; On december 8,.

10 Common Errors in Form 5500 Preparation Outsourcing Services

Accordingly, the automatic extension does not apply to. Web standard filing deadline. Web the due date for 2019 form 5500 filings for calendar year plans is july 31, 2020—outside the relief window. The filing due date for a form 5500 is seven months after the end of the. Form 5500 must be filed by the last day of the seventh.

Certain Form 5500 Filing Deadline Extensions Granted by IRS BASIC

And if desired, ask the irs to make a determination about the plan's qualification status at termination by filing a. Web file any applicable final form 5500 series return; Web standard filing deadline. Web those on the march 15 th /september 15 th tax filing schedule can still achieve the october due date for their 5500 as long as they.

Solo 401k Reporting Requirements Solo 401k

Web form 5500 must be filed annually by the last day of the seventh calendar month after the end of the plan year (july 31 for calendar year plans) unless an extension. The filing due date for a form 5500 is seven months after the end of the. Web standard filing deadline. Filings for plan years prior to 2009 are.

What is Form 5500 & What Plan Sponsors Need to Know About It? NESA

Web those on the march 15 th /september 15 th tax filing schedule can still achieve the october due date for their 5500 as long as they submit the form 5558 by the original july 31 st. Web form 5500 must be filed annually by the last day of the seventh calendar month after the end of the plan year.

Web File Any Applicable Final Form 5500 Series Return;

Web secure act section 202 directed dol and irs to establish a consolidated form 5500 filing option f or groups of defined contribution plans that satisfy certain criteria. Web the form 5500 annual return/report is filed by employee benefit plans and certain other entities and serves as the principal source of information and data. Web those on the march 15 th /september 15 th tax filing schedule can still achieve the october due date for their 5500 as long as they submit the form 5558 by the original july 31 st. Filings for plan years prior to 2009 are not.

On December 8, 2022 Dol, Irs, And Pbgc.

Web missing the final deadline for filing your form 5500 is a common pitfall for plan administrators. Web form 5500 must be filed annually by the last day of the seventh calendar month after the end of the plan year (july 31 for calendar year plans) unless an extension. Web the due date for 2019 form 5500 filings for calendar year plans is july 31, 2020—outside the relief window. Web standard filing deadline.

The Filing Due Date For A Form 5500 Is Seven Months After The End Of The.

And if desired, ask the irs to make a determination about the plan's qualification status at termination by filing a. Form 5500 must be filed by the last day of the seventh month following the end of the plan year. Accordingly, the automatic extension does not apply to.