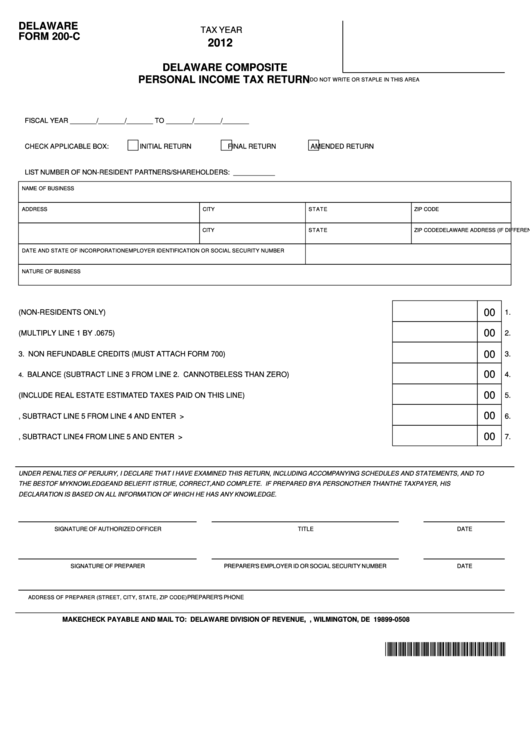

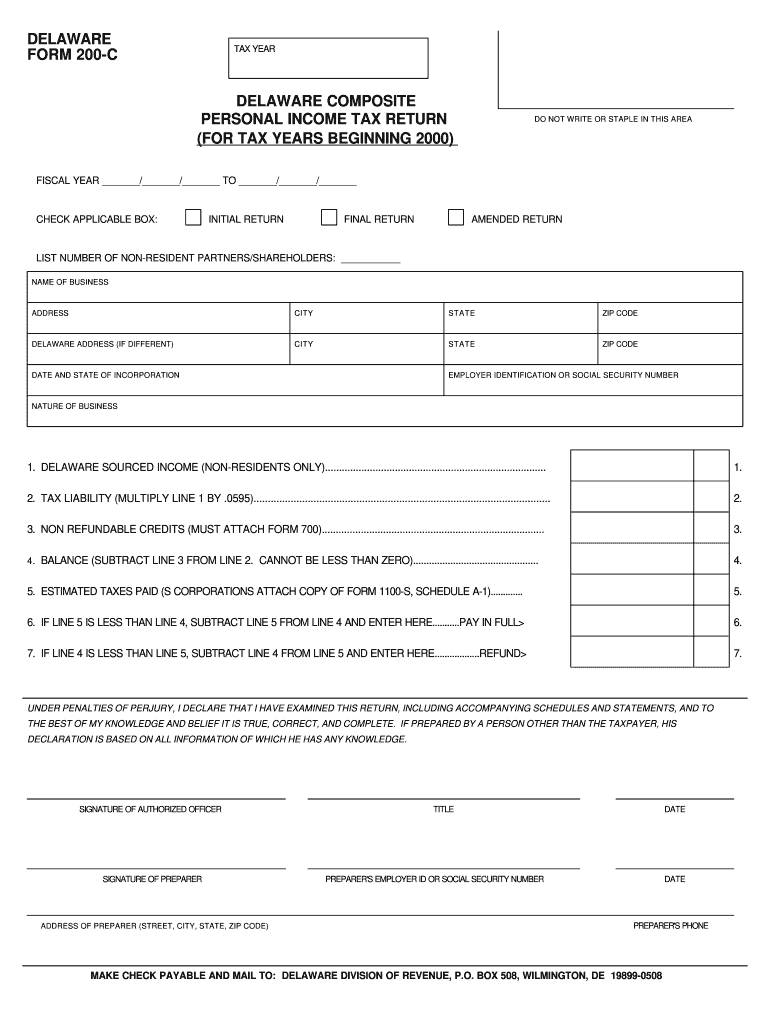

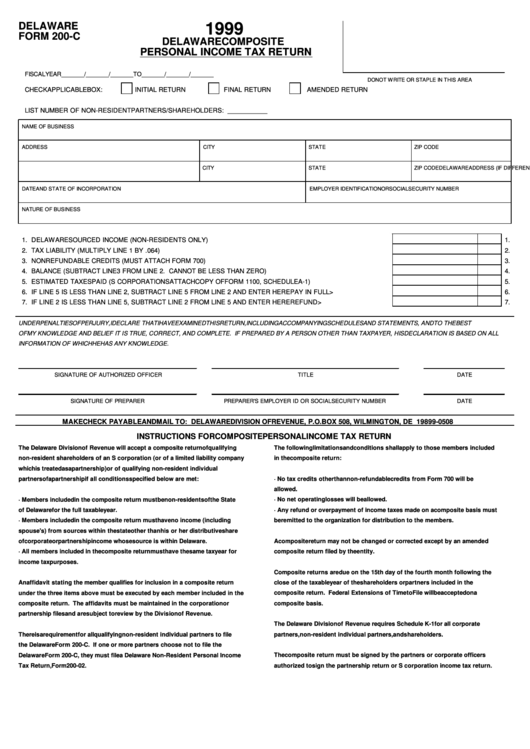

Delaware Form 200-C Instructions 2022

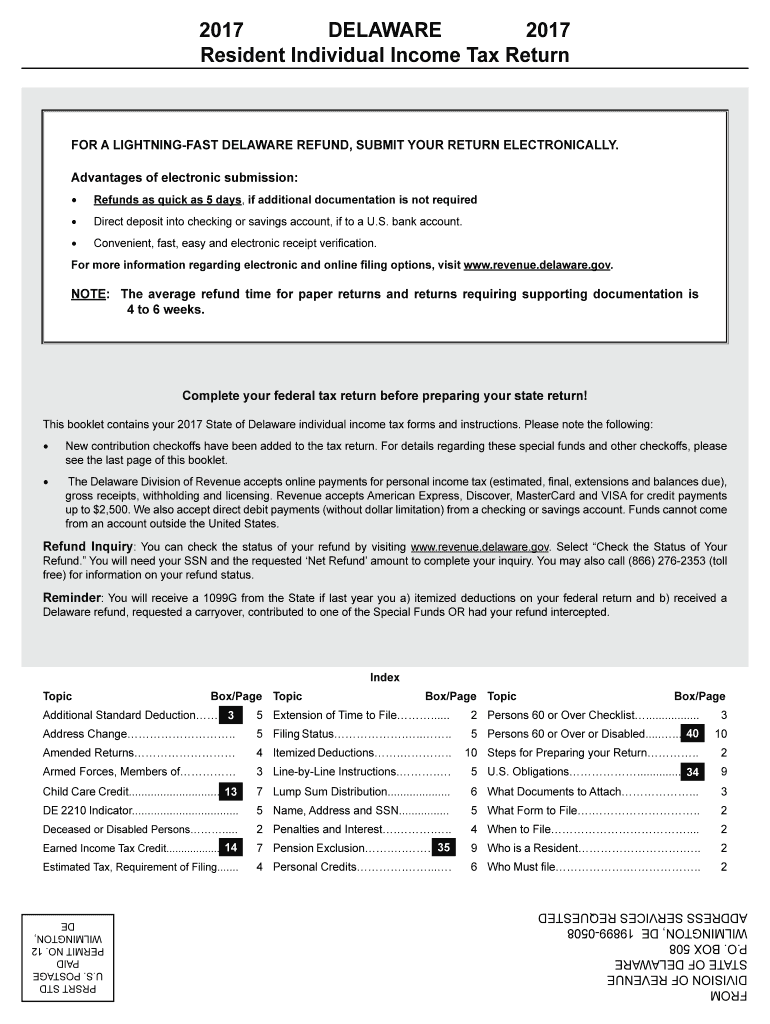

Delaware Form 200-C Instructions 2022 - Your employer has not and will not file a claim for refund of such erroneous withholdings. Electronic filing is fast, convenient,. The composite return must be signed by a partner or corporate officer authorized to sign the partnership return or s. The delaware division of revenue will accept a composite return of. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web form 200c delaware composite return. Delaware department of insurance bureau of captive & financial products 1351 west north. Form 200es req request for change. Resident individual income tax return general instructions. Web delaware has a state income tax that ranges between 2.2% and 6.6%.

Be sure to verify that the form you are downloading is for the. Get ready for tax season deadlines by completing any required tax forms today. Your employer erroneously withheld delaware income taxes, and c. Web delaware has a state income tax that ranges between 2.2% and 6.6%. Tax refund inquiry check the status of your delaware personal income tax refund online. Web form 200c delaware composite return. Form 200ci delaware composite return instructions. Form 209 claim for refund of deceased taxpayer. Complete, edit or print tax forms instantly. This form is for income earned in tax year 2022, with tax returns due in april 2023.

Web extension form must be filed by 1. Your employer erroneously withheld delaware income taxes, and c. Form 200es req request for change. The composite return must be signed by a partner or corporate officer authorized to sign the partnership return or s. Total income tax liability you expect to owe 2. Web we last updated delaware form 200c in april 2021 from the delaware division of revenue. Delaware department of insurance bureau of captive & financial products 1351 west north. Form 200ci delaware composite return instructions. Complete, edit or print tax forms instantly. Your employer has not and will not file a claim for refund of such erroneous withholdings.

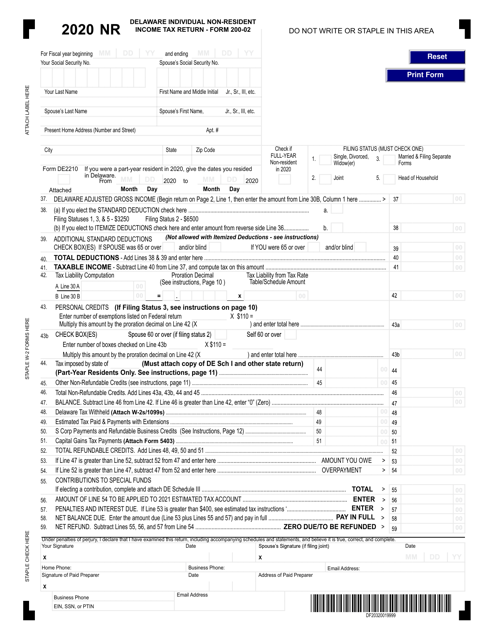

Form 20002 Download Fillable PDF or Fill Online Delaware Individual

The composite return must be signed by a partner or corporate officer authorized to sign the partnership return or s. Electronic filing is fast, convenient,. Complete, edit or print tax forms instantly. Web delaware has a state income tax that ranges between 2.2% and 6.6%. Your employer erroneously withheld delaware income taxes, and c.

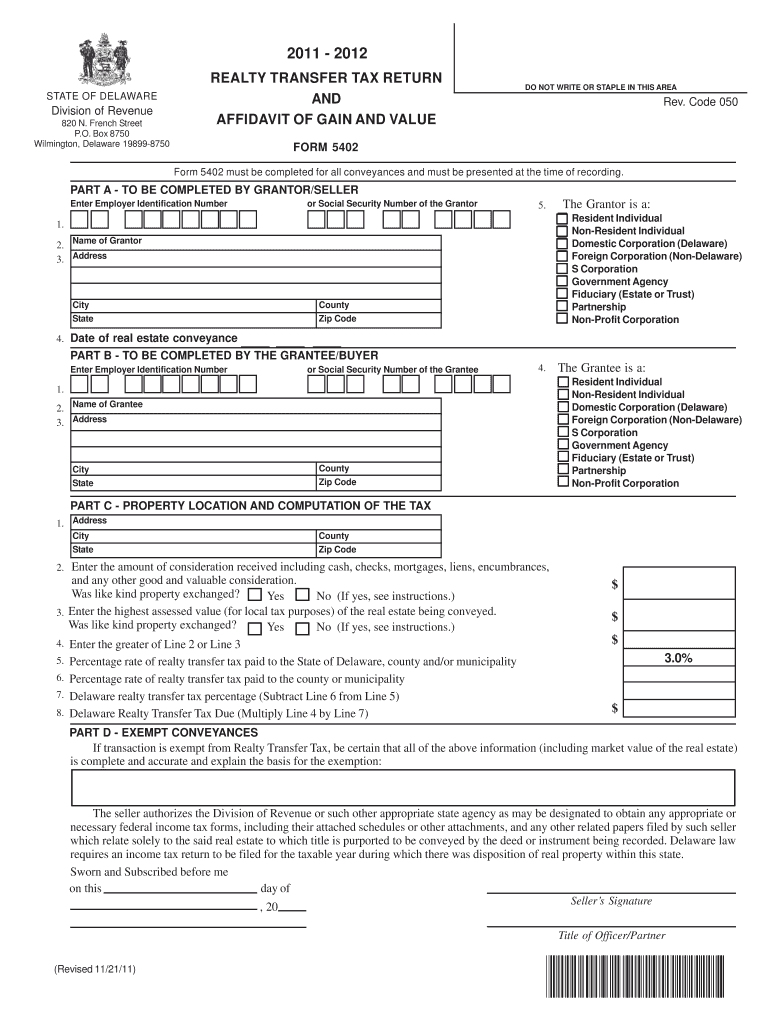

Delaware Form 5402 Instructions Fill Online, Printable, Fillable

Estimate tax payments (including prior year over payments allowed as a credit). Form 200es req request for change. Some information on this website is provided in pdf. For those filing a composite return for the 2020. The composite return must be signed by a partner or corporate officer authorized to sign the partnership return or s.

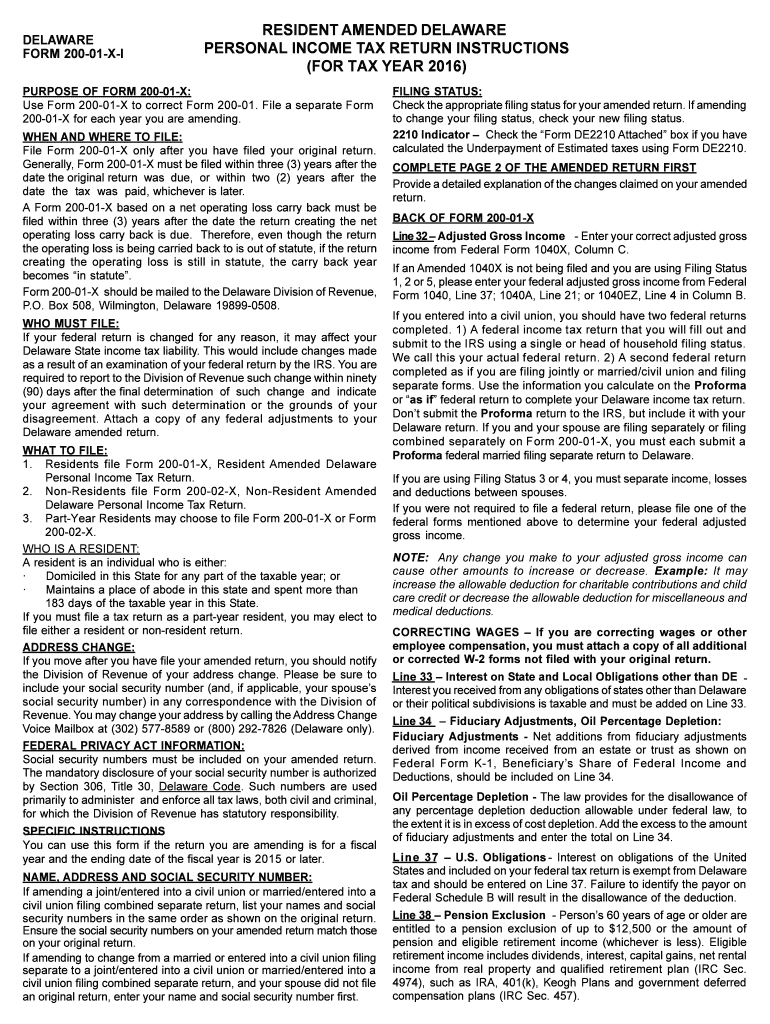

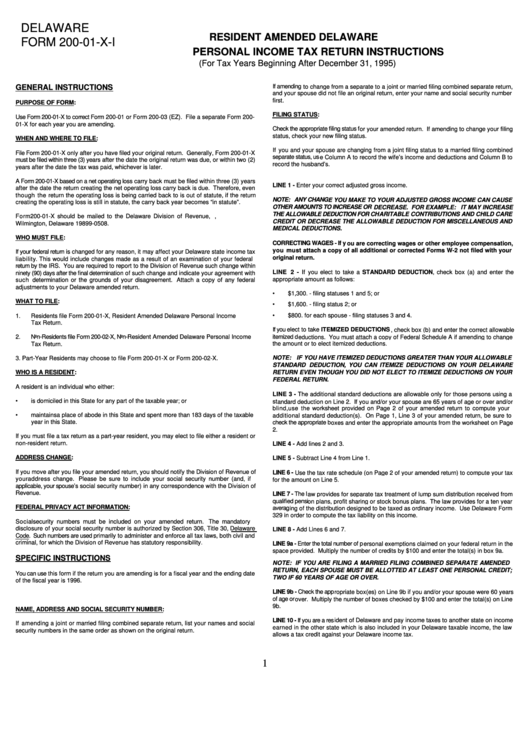

Delaware 200 01 X I Form Fill Out and Sign Printable PDF Template

Estimate tax payments (including prior year over payments allowed as a credit). Be sure to verify that the form you are downloading is for the. Some information on this website is provided in pdf. Your employer has not and will not file a claim for refund of such erroneous withholdings. Form 209 claim for refund of deceased taxpayer.

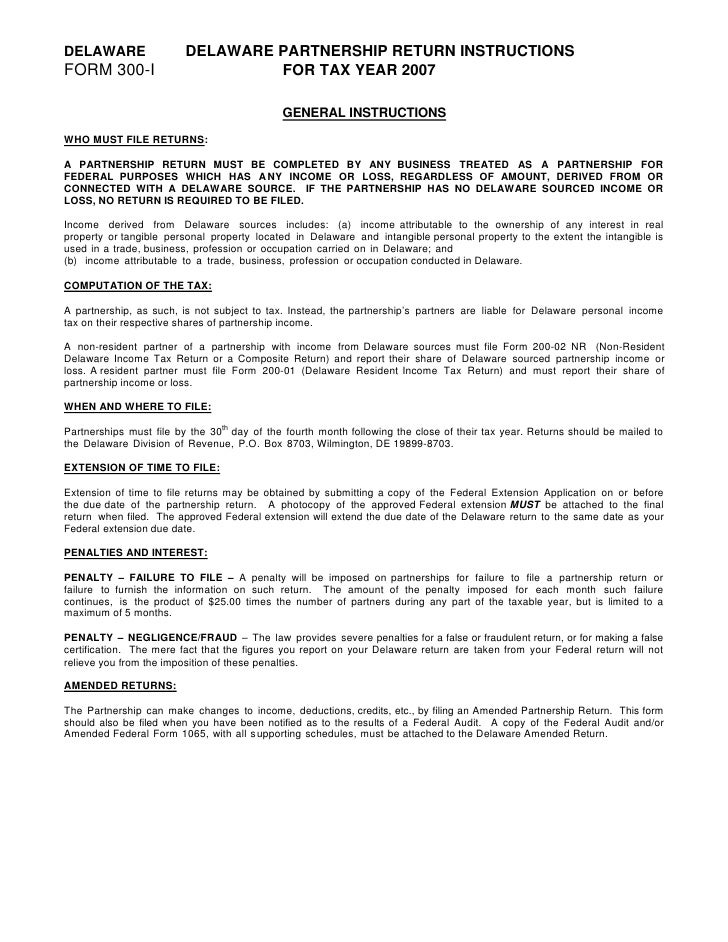

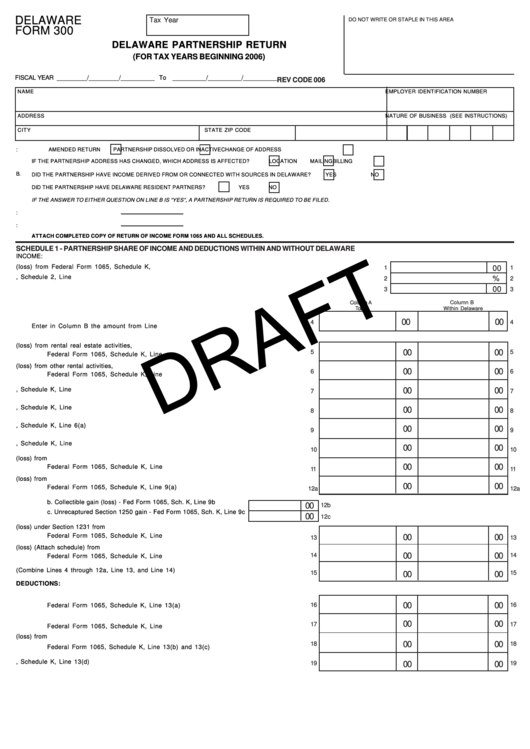

Form 300i Delaware Partnership Instructions

Delaware (department of technology and information)form is 1 pagelong and. For those filing a composite return for the 2020. The composite return must be signed by a partner or corporate officer authorized to sign the partnership return or s. Delaware department of insurance bureau of captive & financial products 1351 west north. Be sure to verify that the form you.

Fillable Delaware Form 200C Delaware Composite Personal Tax

Web make check payable and mail to: Be sure to verify that the form you are downloading is for the. Electronic filing is fast, convenient,. Your employer has not and will not file a claim for refund of such erroneous withholdings. Some information on this website is provided in pdf.

Delaware Form 200 01 Fill Out and Sign Printable PDF Template signNow

Web delaware has a state income tax that ranges between 2.2% and 6.6%. Complete, edit or print tax forms instantly. Delaware division of revenue, p.o. Electronic filing is fast, convenient, accurate and. Your employer erroneously withheld delaware income taxes, and c.

Form 20001XI Resident Amended Delaware Personal Tax Return

Web make check payable and mail to: Total income tax liability you expect to owe 2. Form 200ci delaware composite return instructions. Your employer has not and will not file a claim for refund of such erroneous withholdings. Your employer erroneously withheld delaware income taxes, and c.

Delaware Form 300 (Draft) Delaware Partnership Return 2006

The composite return must be signed by a partner or corporate officer authorized to sign the partnership return or s. Complete, edit or print tax forms instantly. Form 200ci delaware composite return instructions. Resident individual income tax return general instructions. Web extension form must be filed by 1.

Delaware form 200 c 2002 Fill out & sign online DocHub

Delaware (department of technology and information)form is 1 pagelong and. Be sure to verify that the form you are downloading is for the. Web form 200c delaware composite return. Electronic filing is fast, convenient, accurate and. Web we last updated delaware form 200c in april 2021 from the delaware division of revenue.

Delaware Form 200C Delaware Composite Personal Tax Return

Form 200ci delaware composite return instructions. Tax refund inquiry check the status of your delaware personal income tax refund online. Delaware division of revenue, p.o. Form 209 claim for refund of deceased taxpayer. Estimate tax payments (including prior year over payments allowed as a credit).

Form 209 Claim For Refund Of Deceased Taxpayer.

Delaware division of revenue, p.o. Tax refund inquiry check the status of your delaware personal income tax refund online. Electronic filing is fast, convenient, accurate and. The composite return must be signed by a partner or corporate officer authorized to sign the partnership return or s.

Complete, Edit Or Print Tax Forms Instantly.

Web delaware has a state income tax that ranges between 2.2% and 6.6%. Your employer has not and will not file a claim for refund of such erroneous withholdings. Web make check payable and mail to: Web extension form must be filed by 1.

Some Information On This Website Is Provided In Pdf.

Web form 200c delaware composite return. Delaware department of insurance bureau of captive & financial products 1351 west north. Your employer erroneously withheld delaware income taxes, and c. Electronic filing is fast, convenient,.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April 2023.

Estimate tax payments (including prior year over payments allowed as a credit). The delaware division of revenue will accept a composite return of. Total income tax liability you expect to owe 2. Web we last updated delaware form 200c in april 2021 from the delaware division of revenue.