Diversify Your Investments Chapter 12 Lesson 4

Diversify Your Investments Chapter 12 Lesson 4 - • benchmark 5, grade 12: To truly diversify, you need to invest in assets that are not vulnerable to one or more kinds of risk. Mitigating investment risk chapter 3: Earning by saving and more. Web diversification definition and examples. Diversification reduces risk by spreading assets among several types of investments and industry sectors. Investing in different asset classes reduces your. For example, you may want to diversify between cyclical and countercyclical investments… Web study with quizlet and memorize flashcards containing terms like what is the main purpose of savings?, what is the main purpose of investments?, 12.3: The practice of dividing the money a person invests among different types of investments in order to lower risk.

Protect the principal as much as possible. Web use these rules as the basis of your investment strategy and then select the specific investment opportunities that work best for you. Web diversification is simply the strategy of spreading out your money into different types of investments, which reduces risk while still allowing your money to grow. Web study with quizlet and memorize flashcards containing terms like what is the main purpose of savings?, what is the main purpose of investments?, 12.3: Web to lessen risk, you must expect less return, but another way to lessen risk is to diversify—to spread out your investments among a number of different asset classes. Diversification reduces risk by spreading assets among several types of investments and industry sectors. Web page 1 of 5datedirectionsto help you answer the questions below.namediversify your investmentschapter 12,lesson 4diversifying investmentsgrowth stock mutual fund1.what is the name of the fund?2.name three companies held in this fund.3.4… Investing in different asset classes reduces your. For example, you may want to diversify between cyclical and countercyclical investments… Web diversify your investments diversification can be neatly summed up as, “don’t put all your eggs in one basket.” the idea is that if one investment loses money, the other investments will make up for those losses.

Learn what every college student needs to know about money. Web use these rules as the basis of your investment strategy and then select the specific investment opportunities that work best for you. You’ve probably heard that old saying, “don’t put all your. Small, mid and large capital 4. Diversification is a common investment strategy that entails buying different types of investments to reduce the risk of market volatility. Web diversification is simply the strategy of spreading out your money into different types of investments, which reduces risk while still allowing your money to grow. Save for emergencies, large purchases and wealth building. List three different sectors represented in this fund. Before you make any investment, take a deep look at your. To truly diversify, you need to invest in assets that are not vulnerable to one or more kinds of risk.

Why It’s Important to Diversify Your Investments Well Planned

Web use these rules as the basis of your investment strategy and then select the specific investment opportunities that work best for you. Web page 1 of 5datedirectionsto help you answer the questions below.namediversify your investmentschapter 12,lesson 4diversifying investmentsgrowth stock mutual fund1.what is the name of the fund?2.name three companies held in this fund.3.4… Diversification is a common investment strategy.

Reduce Your Risk and Protect Your Assets How to Diversify Investments

Name three companies held in this fund. Explore each fund’s portfolio to help you answer the questions below. Web forward by occupy wisdom preface chapter 1: Web diversify your investments chapter 12, lesson 4 name akilah ross date 01/19/23 diversifying investments growth stock mutual fund 1. Mitigating investment risk chapter 3:

Should You Diversify Your Investments? Absolutely. Here's Why

To truly diversify, you need to invest in assets that are not vulnerable to one or more kinds of risk. Web page 1 of 5datedirectionsto help you answer the questions below.namediversify your investmentschapter 12,lesson 4diversifying investmentsgrowth stock mutual fund1.what is the name of the fund?2.name three companies held in this fund.3.4… Web diversification definition and examples. Web imagine that you.

Portfolio diversification what are the benefits?

Save for emergencies, large purchases and wealth building. To truly diversify, you need to invest in assets that are not vulnerable to one or more kinds of risk. Diversification can’t guarantee that your investments. Diversification is a common investment strategy that entails buying different types of investments to reduce the risk of market volatility. Web to lessen risk, you must.

Why Diversify Your Investments?

Web diversification definition and examples. Web imagine that you were to choose the four funds you researched to add to your investment portfolio. Web one of the most important ways to lessen the risks of investing is to diversify your investments. Diversification can’t guarantee that your investments. • benchmark 7, grade 12…

Diversify, Diversify, Diversify! Millcreek Commercial Discover Freedom

• benchmark 7, grade 12… The key to intelligent investing is diversification. Page 4 of 5diversify your investments chapter 12,lesson 4. Web • benchmark 2, grade 12: Learn what every college student needs to know about money.

SOLUTION Chapter 12 lesson 4 diversify your investments Studypool

Web one of the most important ways to lessen the risks of investing is to diversify your investments. • benchmark 5, grade 12: Web diversify your investments diversification can be neatly summed up as, “don’t put all your eggs in one basket.” the idea is that if one investment loses money, the other investments will make up for those losses..

8+ Foundations In Personal Finance Chapter 6 Answer Key Pdf

Web study with quizlet and memorize flashcards containing terms like what is the main purpose of savings?, what is the main purpose of investments?, 12.3: Before you make any investment, take a deep look at your. Learn what every college student needs to know about money. Vanguard, fidelity and goldman 3. Protect the principal as much as possible.

SOLUTION Chapter 12 lesson 4 diversify your investments Studypool

Web one of the most important ways to lessen the risks of investing is to diversify your investments. It’s one of the most basic principles of investing. Web if you want to find the right investment options to include in your portfolio, consider the following tips. What is the name of the fund? For example, you may want to diversify.

Best Areas to Diversify Your Investments

• benchmark 7, grade 12… Protect the principal as much as possible. If you buy a mix of different types of stocks, bonds, or mutual funds, your overall holdings will not be wiped out if one investment. Generally, the more uncertain the future value of an asset, the greater the return. Web forward by occupy wisdom preface chapter 1:

Learn What Every College Student Needs To Know About Money.

The key to intelligent investing is diversification. Web forward by occupy wisdom preface chapter 1: Assess the impact of money. Explore each fund’s portfolio to help you answer the questions below.

Web To Lessen Risk, You Must Expect Less Return, But Another Way To Lessen Risk Is To Diversify—To Spread Out Your Investments Among A Number Of Different Asset Classes.

Name three companies held in this fund. Web if that's the case, here are a few options to consider. The practice of dividing the money a person invests among different types of investments in order to lower risk. Web one of the most important ways to lessen the risks of investing is to diversify your investments.

Web Imagine That You Were To Choose The Four Funds You Researched To Add To Your Investment Portfolio.

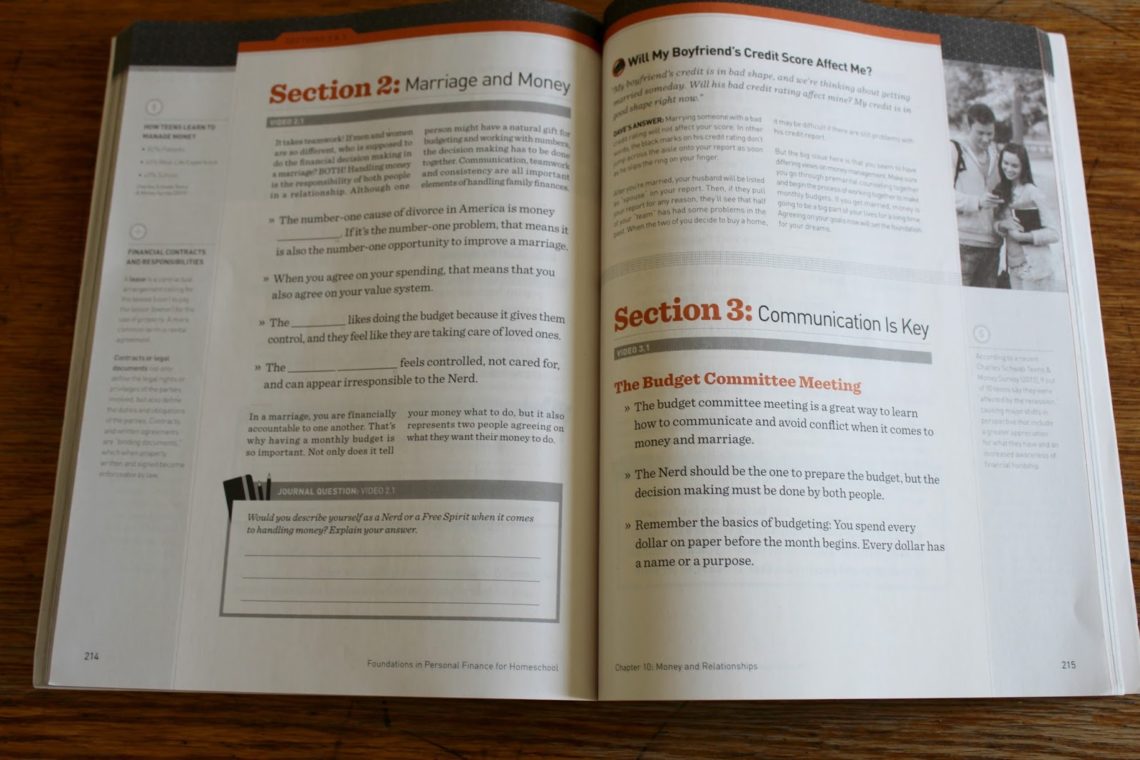

Diversification is a common investment strategy that entails buying different types of investments to reduce the risk of market volatility. Web diversify your investments chapter 12, lesson 4 name date directions research examples of the four different types of mutual funds covered in lesson 4. Web smart, disciplined, and regular investment from an early age is the best way to allow your money to mature. Discuss how these funds could help diversify your investments and lower your risk.

What Is The Name Of The Fund?

Cash & equivalents chapter 7: Web page 1 of 5datedirectionsto help you answer the questions below.namediversify your investmentschapter 12,lesson 4diversifying investmentsgrowth stock mutual fund1.what is the name of the fund?2.name three companies held in this fund.3.4… Protect the principal as much as possible. Diversification can’t guarantee that your investments.