Edward Jones Contribution Transmittal Form

Edward Jones Contribution Transmittal Form - Simply sign in, select documents and go to the tax forms section. Web find and fill out the correct edward jones simple ira contribution transmittal form 2022. Log in to the editor using your credentials or click create free account to test the tool’s capabilities. Web contribution transmittal (optional for contribution deposits) salary reduction agreement (retained by client’s payroll area) summary plan description and employer contribution notice Participants may contribute on a pretax basis, up to the annual limit of $14,000 for 2022. Edward jones may accept contributions from my employer for any taxable year in amounts and at such time as may be permitted by the code and regulations. Disclosure statement (pdf) salary reduction agreement form (pdf) disclosure statement appendix (pdf) schedule of fees (pdf) Web follow these fast steps to modify the pdf edward jones simple ira contribution transmittal form online for free: Add the edward jones simple ira contribution transmittal form for redacting. Web sep iras what is a sep ira retirement plan?

Web follow these fast steps to modify the pdf edward jones simple ira contribution transmittal form online for free: Choose the correct version of the editable pdf form from the list and get started filling it out. Web the maximum contribution amount an employee may defer is limited to the lesser of 100% of earned income up to the contribution limit for each calendar year: Employees who defer salary into other employer retirement plans (such as 401(k) or 403(b)) during the same calendar year are subject to a maximum deferral limit of: Sign up and log in to your account. Web contribution transmittal (optional for contribution deposits). Web with online access, you have a secure and convenient way to view, print and download your edward jones tax forms electronically. Web sep iras what is a sep ira retirement plan? Edward jones is also required to provide information to help with completing article vi of the form. Simply sign in, select documents and go to the tax forms section.

Web sep iras what is a sep ira retirement plan? Edward jones is also required to provide information to help with completing article vi of the form. Edward jones may accept contributions from my employer for any taxable year in amounts and at such time as may be permitted by the code and regulations. Sign up and log in to your account. You must be signed up for online access to use the features described below. Disclosure statement (pdf) salary reduction agreement form (pdf) disclosure statement appendix (pdf) schedule of fees (pdf) Web follow these fast steps to modify the pdf edward jones simple ira contribution transmittal form online for free: Web the maximum contribution amount an employee may defer is limited to the lesser of 100% of earned income up to the contribution limit for each calendar year: Log in to the editor using your credentials or click create free account to test the tool’s capabilities. Employees who defer salary into other employer retirement plans (such as 401(k) or 403(b)) during the same calendar year are subject to a maximum deferral limit of:

Elegant Edward Jones Contribution Transmittal form

Employees who defer salary into other employer retirement plans (such as 401(k) or 403(b)) during the same calendar year are subject to a maximum deferral limit of: Simple ira agreement & disclosures (pdf) related disclosures provided at account opening: You must be signed up for online access to use the features described below. Web contribution transmittal (optional for contribution deposits)..

Unique Alabama Department Of Revenue

Employees who defer salary into other employer retirement plans (such as 401(k) or 403(b)) during the same calendar year are subject to a maximum deferral limit of: Log in to the editor using your credentials or click create free account to test the tool’s capabilities. All contributions are 100% vested to the employee. Simply sign in, select documents and go.

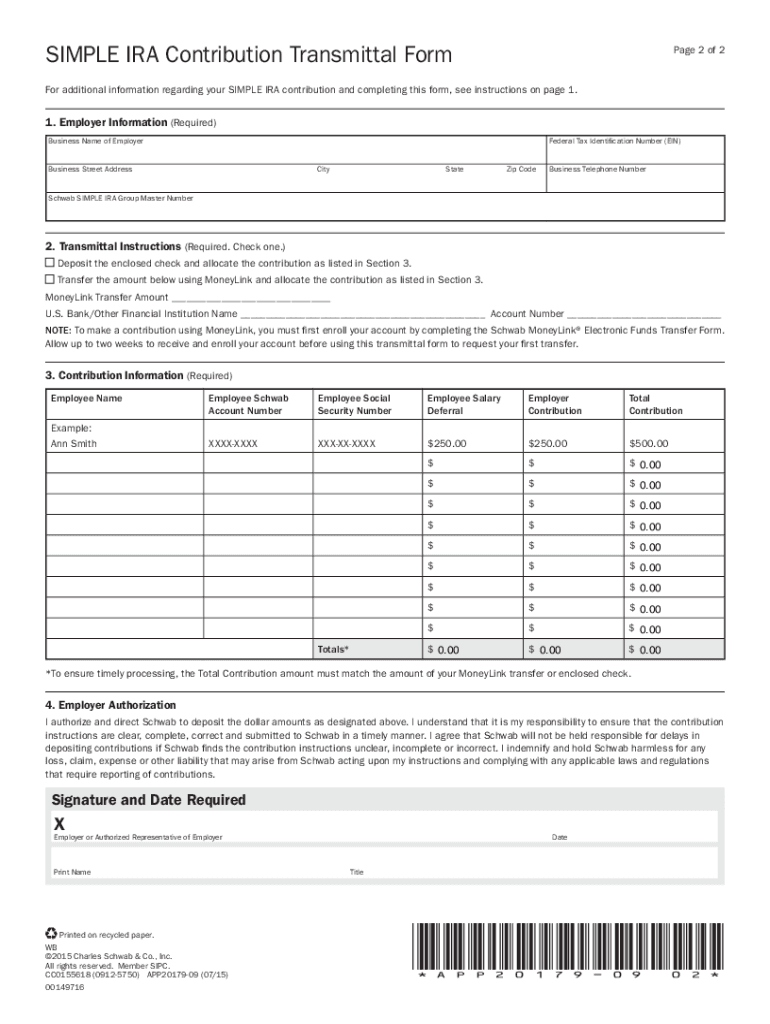

Simple IRA Contribution Transmittal Form 20152022 Fill and Sign

Simple ira agreement & disclosures (pdf) related disclosures provided at account opening: Sign up and log in to your account. Web the maximum contribution amount an employee may defer is limited to the lesser of 100% of earned income up to the contribution limit for each calendar year: You must be signed up for online access to use the features.

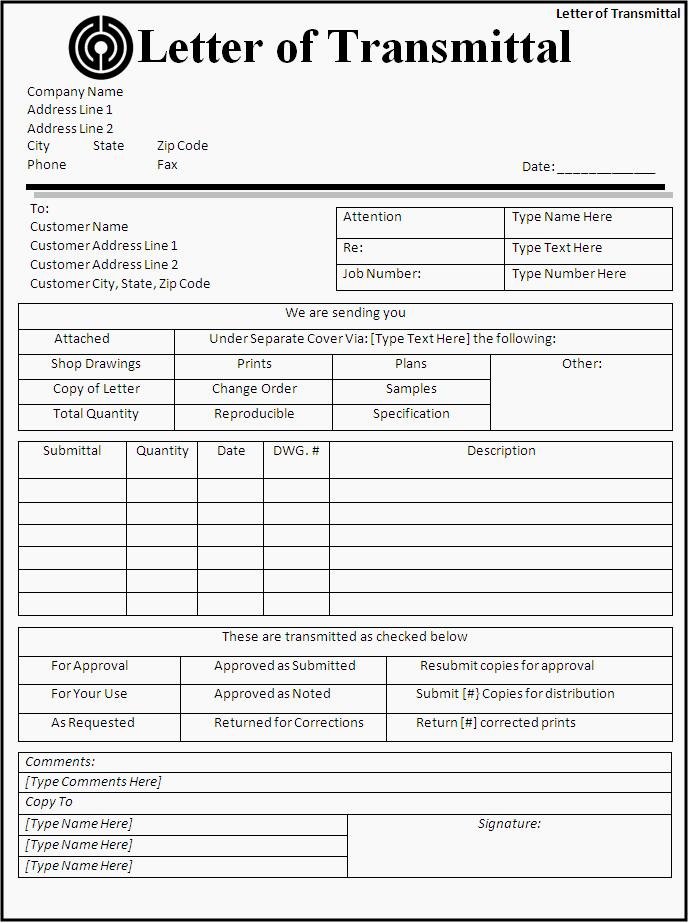

FREE 9+ Sample Transmittal Forms in PDF

Web with online access, you have a secure and convenient way to view, print and download your edward jones tax forms electronically. Edward jones is also required to provide information to help with completing article vi of the form. Web find and fill out the correct edward jones simple ira contribution transmittal form 2022. Web the maximum contribution amount an.

Schwab Contribution Transmittal PDF Form FormsPal

Web sep iras what is a sep ira retirement plan? You must be signed up for online access to use the features described below. Sign up and log in to your account. Web find and fill out the correct edward jones simple ira contribution transmittal form 2022. Log in to the editor using your credentials or click create free account.

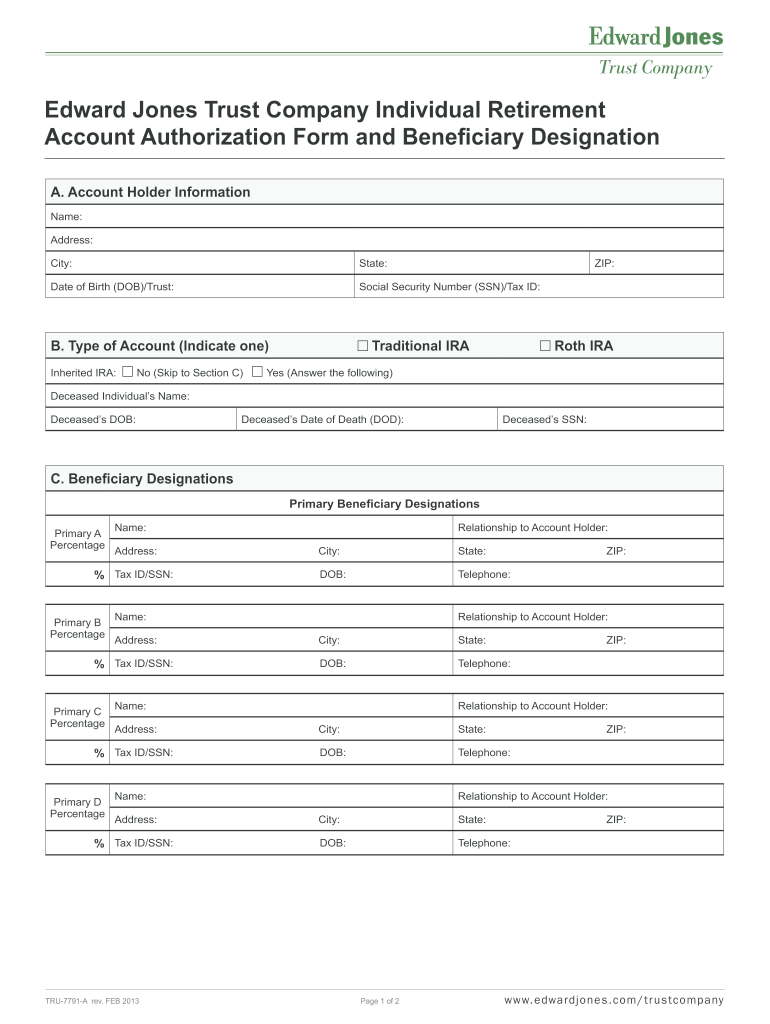

Edward Jones Transfer On Death Agreement Form Fill Out and Sign

Add the edward jones simple ira contribution transmittal form for redacting. Edward jones may accept contributions from my employer for any taxable year in amounts and at such time as may be permitted by the code and regulations. Edward jones is also required to provide information to help with completing article vi of the form. Log in to the editor.

Construction Transmittal form Peterainsworth

Simple ira agreement & disclosures (pdf) related disclosures provided at account opening: Web contribution transmittal (optional for contribution deposits). Web contribution transmittal (optional for contribution deposits) salary reduction agreement (retained by client’s payroll area) summary plan description and employer contribution notice Web sep iras what is a sep ira retirement plan? Web find and fill out the correct edward jones.

Fill Free fillable Contribution Transmittal Form (Charles Schwab) PDF

Web contribution transmittal (optional for contribution deposits). Simply sign in, select documents and go to the tax forms section. Log in to the editor using your credentials or click create free account to test the tool’s capabilities. Disclosure statement (pdf) salary reduction agreement form (pdf) disclosure statement appendix (pdf) schedule of fees (pdf) All contributions are 100% vested to the.

Best Of Ohio Sales Tax Exemption form 2018

Web the maximum contribution amount an employee may defer is limited to the lesser of 100% of earned income up to the contribution limit for each calendar year: Employees who defer salary into other employer retirement plans (such as 401(k) or 403(b)) during the same calendar year are subject to a maximum deferral limit of: All contributions are 100% vested.

Inspirational Texas 130u form Download

Add the edward jones simple ira contribution transmittal form for redacting. Sign up and log in to your account. Choose the correct version of the editable pdf form from the list and get started filling it out. Log in to the editor using your credentials or click create free account to test the tool’s capabilities. Simply sign in, select documents.

Web With Online Access, You Have A Secure And Convenient Way To View, Print And Download Your Edward Jones Tax Forms Electronically.

Choose the correct version of the editable pdf form from the list and get started filling it out. You must be signed up for online access to use the features described below. Edward jones may accept contributions from my employer for any taxable year in amounts and at such time as may be permitted by the code and regulations. Edward jones is also required to provide information to help with completing article vi of the form.

Web Sep Iras What Is A Sep Ira Retirement Plan?

Participants may contribute on a pretax basis, up to the annual limit of $14,000 for 2022. Web contribution transmittal (optional for contribution deposits) salary reduction agreement (retained by client’s payroll area) summary plan description and employer contribution notice Simply sign in, select documents and go to the tax forms section. Web contribution transmittal (optional for contribution deposits).

Log In To The Editor Using Your Credentials Or Click Create Free Account To Test The Tool’s Capabilities.

Web follow these fast steps to modify the pdf edward jones simple ira contribution transmittal form online for free: Web find and fill out the correct edward jones simple ira contribution transmittal form 2022. Web the maximum contribution amount an employee may defer is limited to the lesser of 100% of earned income up to the contribution limit for each calendar year: Add the edward jones simple ira contribution transmittal form for redacting.

Simple Ira Agreement & Disclosures (Pdf) Related Disclosures Provided At Account Opening:

Employees who defer salary into other employer retirement plans (such as 401(k) or 403(b)) during the same calendar year are subject to a maximum deferral limit of: All contributions are 100% vested to the employee. Disclosure statement (pdf) salary reduction agreement form (pdf) disclosure statement appendix (pdf) schedule of fees (pdf) Sign up and log in to your account.