Espp Form 3922

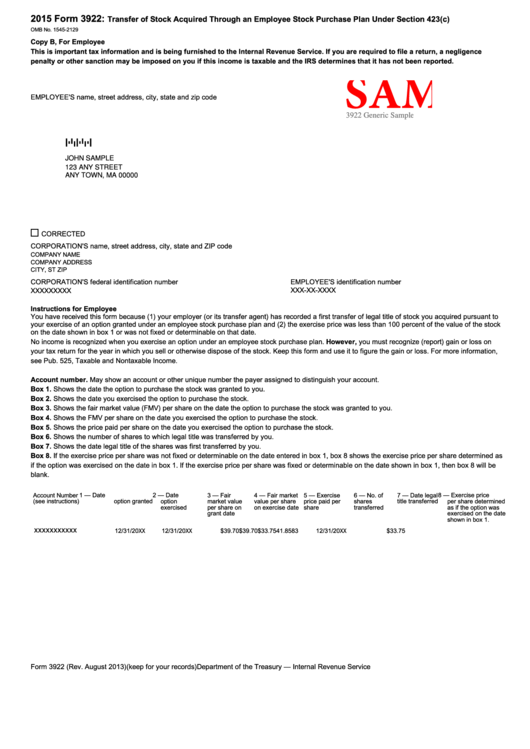

Espp Form 3922 - Web only if you sold stock that was purchased through an espp (employee stock purchase plan). Web stock purchases made through an espp during a calendar year must be reported by the company to you and the irs on form 3922 by january 31 of the following year. Web please find enclosed a form 3922, which provides certain information regarding your 2021 purchase of shares under the company’s employee stock purchase plan (espp). Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your. Nathan curtis cpa • october 20, 2010. Some of our standard services. Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2020, corporations must file completed forms 3921 and forms 3922 with.

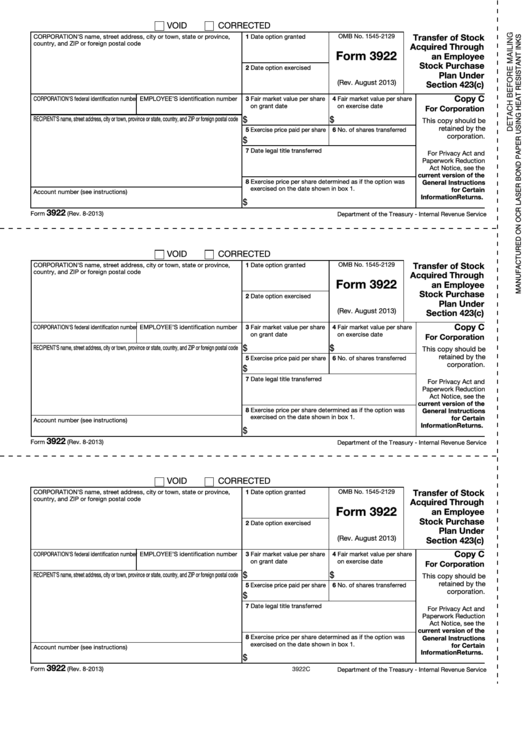

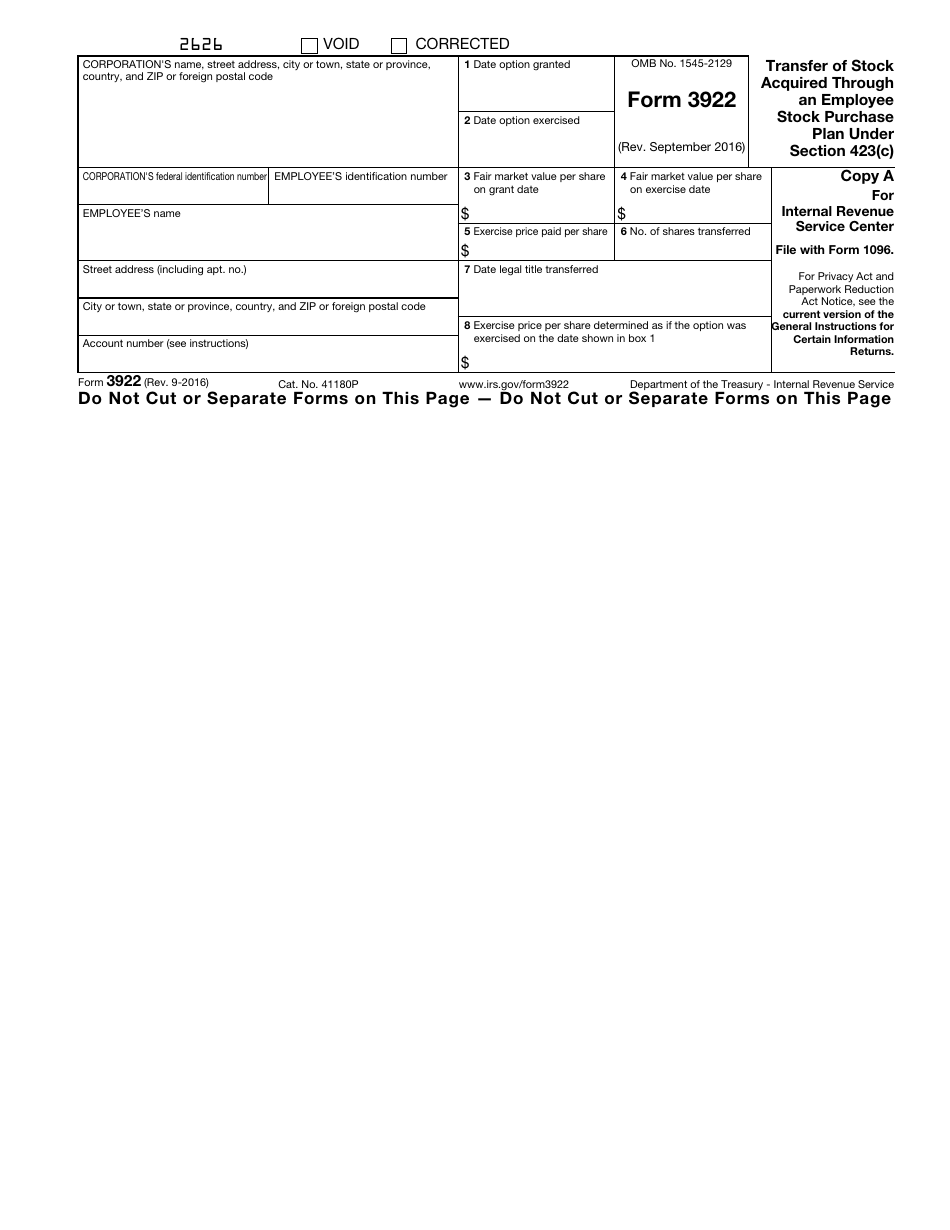

Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. Web what is irs form 3922? We tailor our solutions to fit your unique needs. Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 • updated july 14, 2022. I work with employee stock ownership plans, not employee stock purchase plans, but from my limited understanding. Web only if you sold stock that was purchased through an espp (employee stock purchase plan). Web service highlights everything we do is with you and your company's plan participants in mind. Get answers to these five common questions about reporting espp. Some of our standard services.

Web service highlights everything we do is with you and your company's plan participants in mind. Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), is a form a taxpayer receives if they have. Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 • updated july 14, 2022. Web please find enclosed a form 3922, which provides certain information regarding your 2021 purchase of shares under the company’s employee stock purchase plan (espp). Web the espp, known as employee stock purchase plan, is a program that is run by the company that employees can purchase the shares of the company at a set price. Web certain information must be included in forms 3921 and/or 3922 (or substitute forms), including for espp transactions, the price per share of espp stock. Web what is irs form 3922? We tailor our solutions to fit your unique needs. Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan.

3922, Tax Reporting Instructions & Filing Requirements for Form 3922

Web the espp, known as employee stock purchase plan, is a program that is run by the company that employees can purchase the shares of the company at a set price. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Irs form.

IRS Form 3922 Instructions 2022 How to Fill out Form 3922

Some of our standard services. Nathan curtis cpa • october 20, 2010. Get answers to these five common questions about reporting espp. Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2020, corporations must file completed forms 3921 and forms 3922 with. Web if you purchased espp shares, your employer will send you form 3922,.

3922 2020 Public Documents 1099 Pro Wiki

Web certain information must be included in forms 3921 and/or 3922 (or substitute forms), including for espp transactions, the price per share of espp stock. Web service highlights everything we do is with you and your company's plan participants in mind. I work with employee stock ownership plans, not employee stock purchase plans, but from my limited understanding. Web your.

A Quick Guide to Form 3922 YouTube

Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2020, corporations must file completed forms 3921 and forms 3922 with. Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web what is irs form 3922? Web form 3922 transfer of stock.

Form 3922 Transfer Of Stock Acquired Through An Employee Stock

Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2020, corporations must file completed forms 3921 and forms 3922 with. Get answers to these five common questions about reporting espp. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 • updated.

IRS Form 3922 Download Fillable PDF or Fill Online Transfer of Stock

Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. Web what is irs form 3922? Hi, i purchased shares through espp and sold the shares as soon as they were available in 2022. Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), is a form a.

Form 3922 Sample Transfer Of Stock Acquired Through An Employee Stock

I work with employee stock ownership plans, not employee stock purchase plans, but from my limited understanding. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2020, corporations.

IRS Form 3922

Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2020, corporations must file completed forms 3921 and forms 3922 with. Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), is a form a taxpayer receives if they have. Web service highlights everything we do is with you.

File IRS Form 3922 Online EFile Form 3922 for 2022

Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your. Web the espp, known as employee stock purchase plan, is a program that is run by the company that employees can purchase the shares of the company at a set price. Hi,.

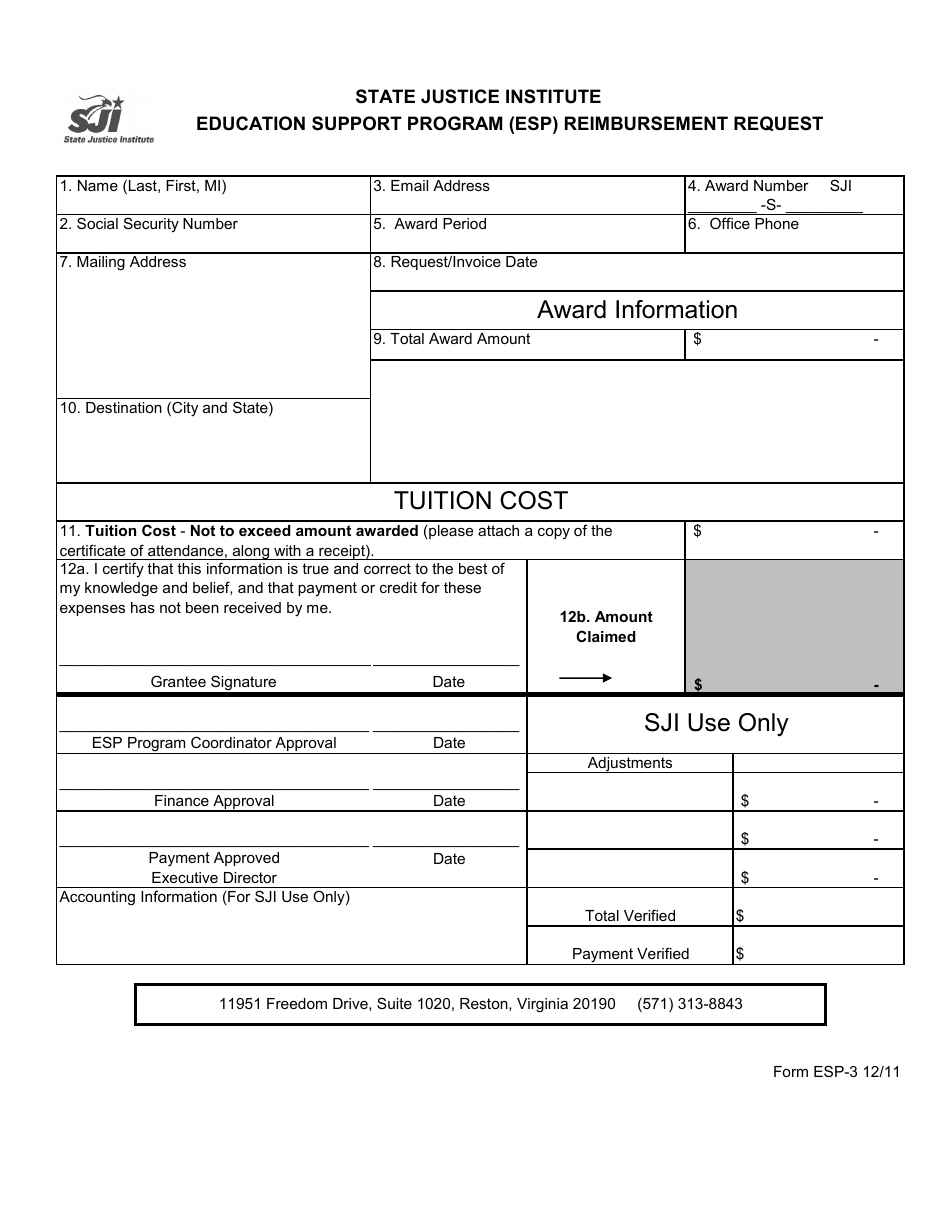

Form ESP3 Download Fillable PDF or Fill Online Education Support

Nathan curtis cpa • october 20, 2010. Get answers to these five common questions about reporting espp. Web please find enclosed a form 3922, which provides certain information regarding your 2021 purchase of shares under the company’s employee stock purchase plan (espp). Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved.

Web Please Find Enclosed A Form 3922, Which Provides Certain Information Regarding Your 2021 Purchase Of Shares Under The Company’s Employee Stock Purchase Plan (Espp).

Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), is a form a taxpayer receives if they have. Some of our standard services. We tailor our solutions to fit your unique needs. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your.

Irs Form 3922, Transfer Of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423(C), Reports Specific.

I work with employee stock ownership plans, not employee stock purchase plans, but from my limited understanding. Web what is irs form 3922? Get answers to these five common questions about reporting espp. Web stock purchases made through an espp during a calendar year must be reported by the company to you and the irs on form 3922 by january 31 of the following year.

Nathan Curtis Cpa • October 20, 2010.

Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Web the espp, known as employee stock purchase plan, is a program that is run by the company that employees can purchase the shares of the company at a set price. Web only if you sold stock that was purchased through an espp (employee stock purchase plan). Web service highlights everything we do is with you and your company's plan participants in mind.

Web Certain Information Must Be Included In Forms 3921 And/Or 3922 (Or Substitute Forms), Including For Espp Transactions, The Price Per Share Of Espp Stock.

Hi, i purchased shares through espp and sold the shares as soon as they were available in 2022. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 • updated july 14, 2022. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2020, corporations must file completed forms 3921 and forms 3922 with.