Extension For Form 5500

Extension For Form 5500 - Get ready for tax season deadlines by completing any required tax forms today. Avoid errors when requesting an extension. Web if you received a cp notice about filing your form 5500 series return or form 5558, application for extension of time to file certain employee plan returns, the following information will help you understand why you received the notice and how to respond. Web the form 5500 series is part of erisa's overall reporting and disclosure framework, which is intended to assure that employee benefit plans are operated and managed in accordance with certain prescribed standards and that participants and beneficiaries, as well as regulators, are provided or have access to sufficient information to protect the r. A copy of the application for extension of time to file the federal income tax return is maintained with the filer’s records. See also the “troubleshooters guide to filing the erisa annual reports” available on www.dol.gov/ebsa, which is intended to help filers comply with the form 5500 and. Web the employer has been granted an extension of time to file its federal income tax return to a date later than the normal due date for filing the form 5500; Web an extension of time to file form 5500 series (form 5500, annual return/report of employee benefit plan; An extension for filing form 5500 (annual return/report of employee benefit plan) is obtained by filing form 5558 (application for extension of time to file certain employee plan returns) on or before the regular form 5500 due date, which is seven months after the end of the plan year. Unless specified otherwise, reference to form 5500 series return includes:

Web the employer has been granted an extension of time to file its federal income tax return to a date later than the normal due date for filing the form 5500; An extension for filing form 5500 (annual return/report of employee benefit plan) is obtained by filing form 5558 (application for extension of time to file certain employee plan returns) on or before the regular form 5500 due date, which is seven months after the end of the plan year. Get ready for tax season deadlines by completing any required tax forms today. Thus, filing of the 2023 forms generally will not begin until july 2024. Avoid errors when requesting an extension. Unless specified otherwise, reference to form 5500 series return includes: Web an extension of time to file form 5500 series (form 5500, annual return/report of employee benefit plan; Web if you received a cp notice about filing your form 5500 series return or form 5558, application for extension of time to file certain employee plan returns, the following information will help you understand why you received the notice and how to respond. Complete, edit or print tax forms instantly. See also the “troubleshooters guide to filing the erisa annual reports” available on www.dol.gov/ebsa, which is intended to help filers comply with the form 5500 and.

A copy of the application for extension of time to file the federal income tax return is maintained with the filer’s records. See also the “troubleshooters guide to filing the erisa annual reports” available on www.dol.gov/ebsa, which is intended to help filers comply with the form 5500 and. Web the form 5500 series is part of erisa's overall reporting and disclosure framework, which is intended to assure that employee benefit plans are operated and managed in accordance with certain prescribed standards and that participants and beneficiaries, as well as regulators, are provided or have access to sufficient information to protect the r. Web use a separate form 5558 for an extension of time to file form 5330 or form 5500 series. Avoid errors when requesting an extension. The quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements of the 2019 form 5500. Web an extension of time to file form 5500 series (form 5500, annual return/report of employee benefit plan; Web if you received a cp notice about filing your form 5500 series return or form 5558, application for extension of time to file certain employee plan returns, the following information will help you understand why you received the notice and how to respond. Web the employer has been granted an extension of time to file its federal income tax return to a date later than the normal due date for filing the form 5500; An extension for filing form 5500 (annual return/report of employee benefit plan) is obtained by filing form 5558 (application for extension of time to file certain employee plan returns) on or before the regular form 5500 due date, which is seven months after the end of the plan year.

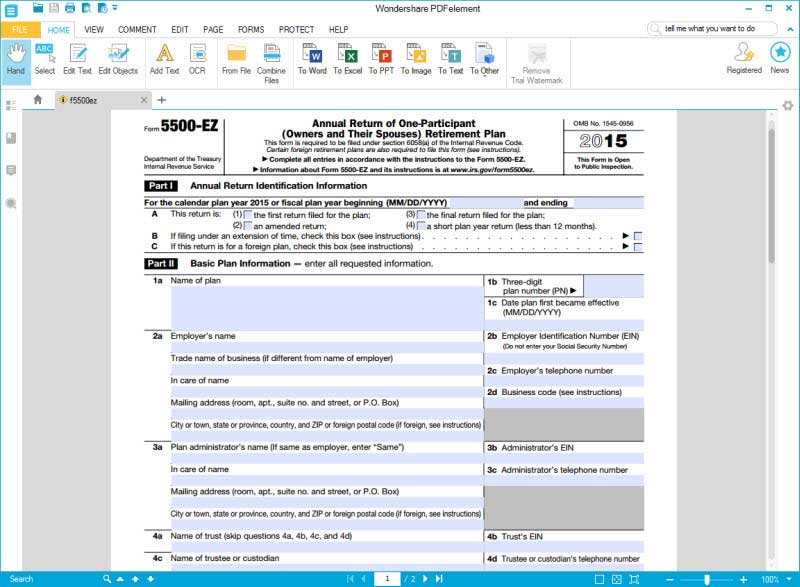

Form 5500EZ Annual Return of One Participant Retirement Plan (2014

Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Unless specified otherwise, reference to form 5500 series return includes: See also the “troubleshooters guide to filing the erisa annual reports” available on www.dol.gov/ebsa, which is intended to help filers comply with the form 5500 and. Web an extension of.

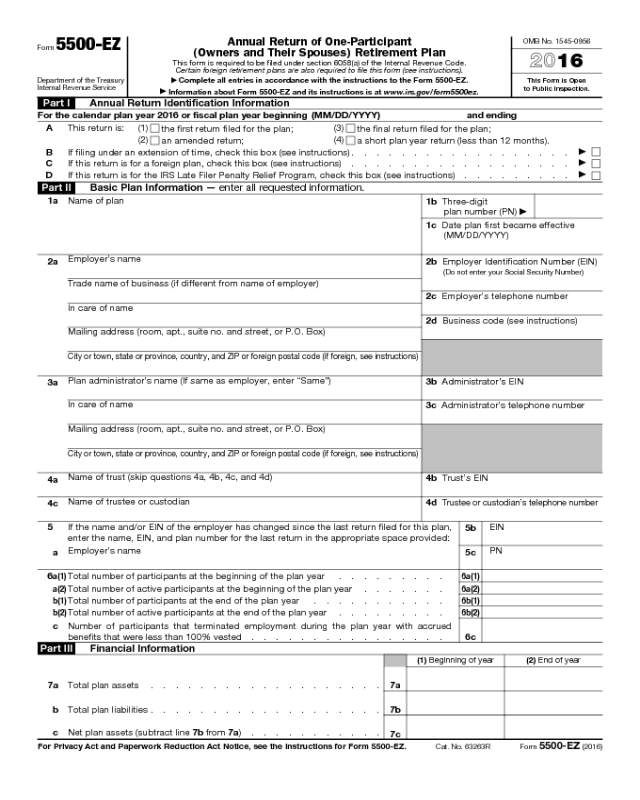

Form 5500EZ Edit, Fill, Sign Online Handypdf

Web use a separate form 5558 for an extension of time to file form 5330 or form 5500 series. See also the “troubleshooters guide to filing the erisa annual reports” available on www.dol.gov/ebsa, which is intended to help filers comply with the form 5500 and. Web if you received a cp notice about filing your form 5500 series return or.

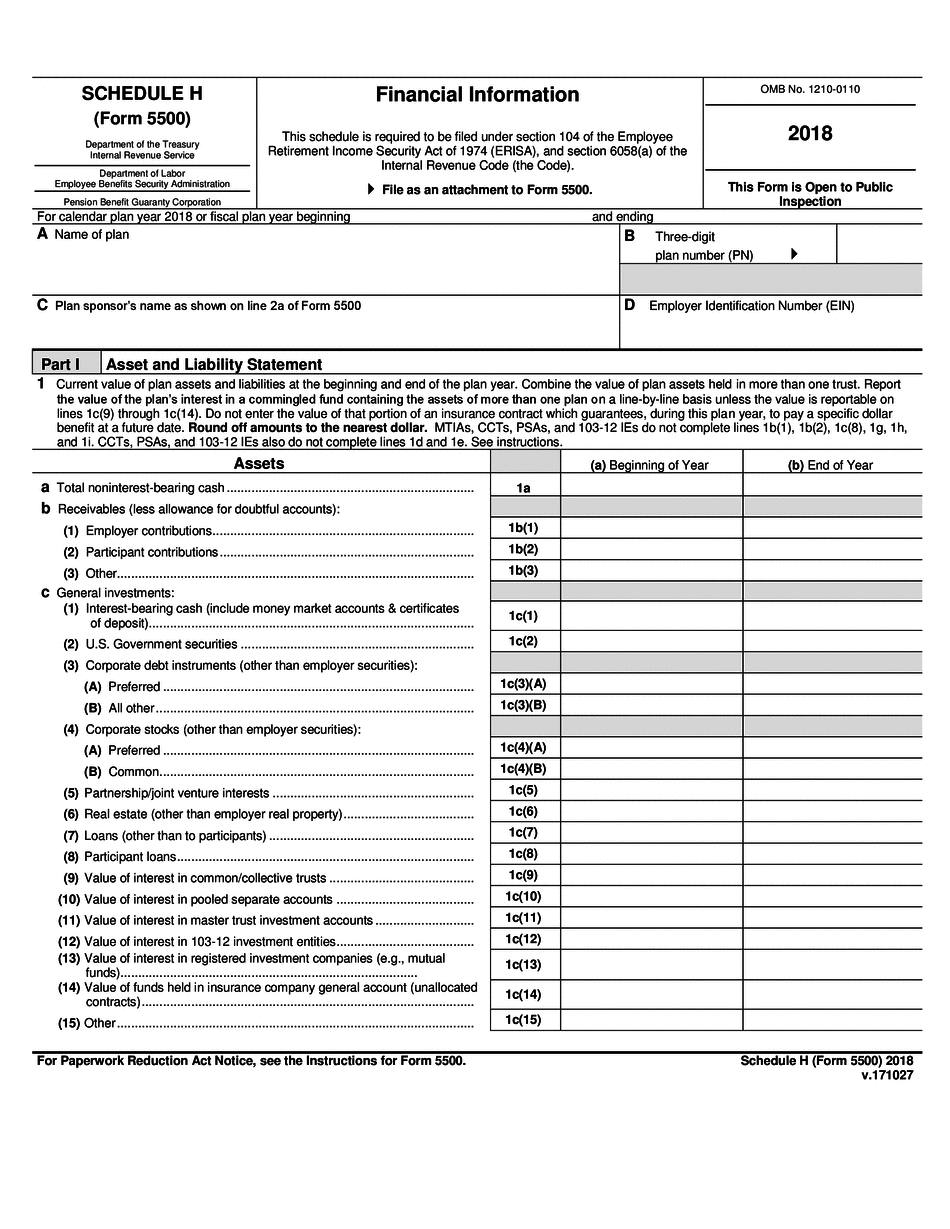

form 5500 extension due date 2022 Fill Online, Printable, Fillable

An extension for filing form 5500 (annual return/report of employee benefit plan) is obtained by filing form 5558 (application for extension of time to file certain employee plan returns) on or before the regular form 5500 due date, which is seven months after the end of the plan year. See also the “troubleshooters guide to filing the erisa annual reports”.

Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]

Web if you received a cp notice about filing your form 5500 series return or form 5558, application for extension of time to file certain employee plan returns, the following information will help you understand why you received the notice and how to respond. Complete, edit or print tax forms instantly. Avoid errors when requesting an extension. A copy of.

Certain Form 5500 Filing Deadline Extensions Granted by IRS BASIC

Complete, edit or print tax forms instantly. Web use a separate form 5558 for an extension of time to file form 5330 or form 5500 series. An extension for filing form 5500 (annual return/report of employee benefit plan) is obtained by filing form 5558 (application for extension of time to file certain employee plan returns) on or before the regular.

How to File Form 5500EZ Solo 401k

Web an extension of time to file form 5500 series (form 5500, annual return/report of employee benefit plan; Web the employer has been granted an extension of time to file its federal income tax return to a date later than the normal due date for filing the form 5500; Web the form 5500 series is part of erisa's overall reporting.

Form 5500 Search What You Need To Know Form 5500

Unless specified otherwise, reference to form 5500 series return includes: See also the “troubleshooters guide to filing the erisa annual reports” available on www.dol.gov/ebsa, which is intended to help filers comply with the form 5500 and. The quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements of the 2019 form 5500..

IRS Form 5500EZ Use the Most Efficient Tool to Fill it

An extension for filing form 5500 (annual return/report of employee benefit plan) is obtained by filing form 5558 (application for extension of time to file certain employee plan returns) on or before the regular form 5500 due date, which is seven months after the end of the plan year. Unless specified otherwise, reference to form 5500 series return includes: See.

Avoid Using the 5500 Extension Wrangle 5500 ERISA Reporting and

Web use a separate form 5558 for an extension of time to file form 5330 or form 5500 series. Web an extension of time to file form 5500 series (form 5500, annual return/report of employee benefit plan; Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web the employer.

5500 Extension due to COVID19

Complete, edit or print tax forms instantly. Web use a separate form 5558 for an extension of time to file form 5330 or form 5500 series. The quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements of the 2019 form 5500. Web the employer has been granted an extension of time.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web the employer has been granted an extension of time to file its federal income tax return to a date later than the normal due date for filing the form 5500; Complete, edit or print tax forms instantly. See also the “troubleshooters guide to filing the erisa annual reports” available on www.dol.gov/ebsa, which is intended to help filers comply with the form 5500 and. Unless specified otherwise, reference to form 5500 series return includes:

Web Use A Separate Form 5558 For An Extension Of Time To File Form 5330 Or Form 5500 Series.

Web the form 5500 series is part of erisa's overall reporting and disclosure framework, which is intended to assure that employee benefit plans are operated and managed in accordance with certain prescribed standards and that participants and beneficiaries, as well as regulators, are provided or have access to sufficient information to protect the r. Web if you received a cp notice about filing your form 5500 series return or form 5558, application for extension of time to file certain employee plan returns, the following information will help you understand why you received the notice and how to respond. The quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements of the 2019 form 5500. A copy of the application for extension of time to file the federal income tax return is maintained with the filer’s records.

An Extension For Filing Form 5500 (Annual Return/Report Of Employee Benefit Plan) Is Obtained By Filing Form 5558 (Application For Extension Of Time To File Certain Employee Plan Returns) On Or Before The Regular Form 5500 Due Date, Which Is Seven Months After The End Of The Plan Year.

Thus, filing of the 2023 forms generally will not begin until july 2024. Web an extension of time to file form 5500 series (form 5500, annual return/report of employee benefit plan; Avoid errors when requesting an extension.

![Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]](https://www.emparion.com/wp-content/uploads/2018/05/5500ez-part-2.png)