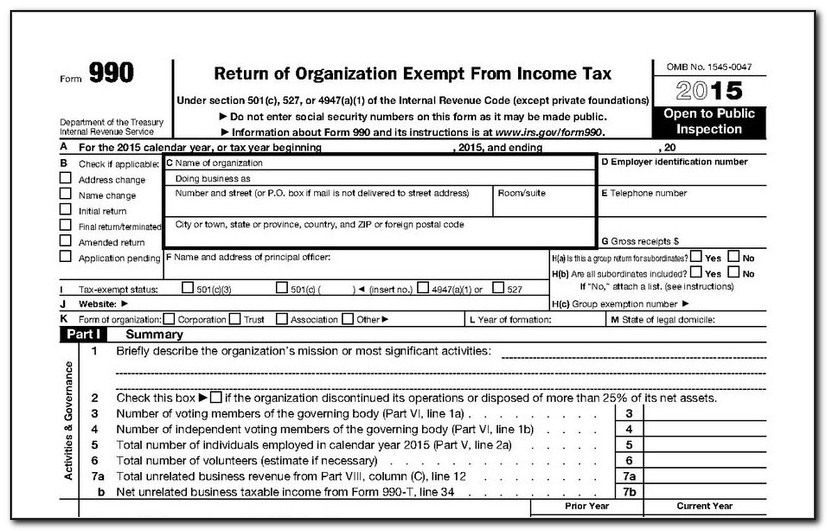

Extension Form 990

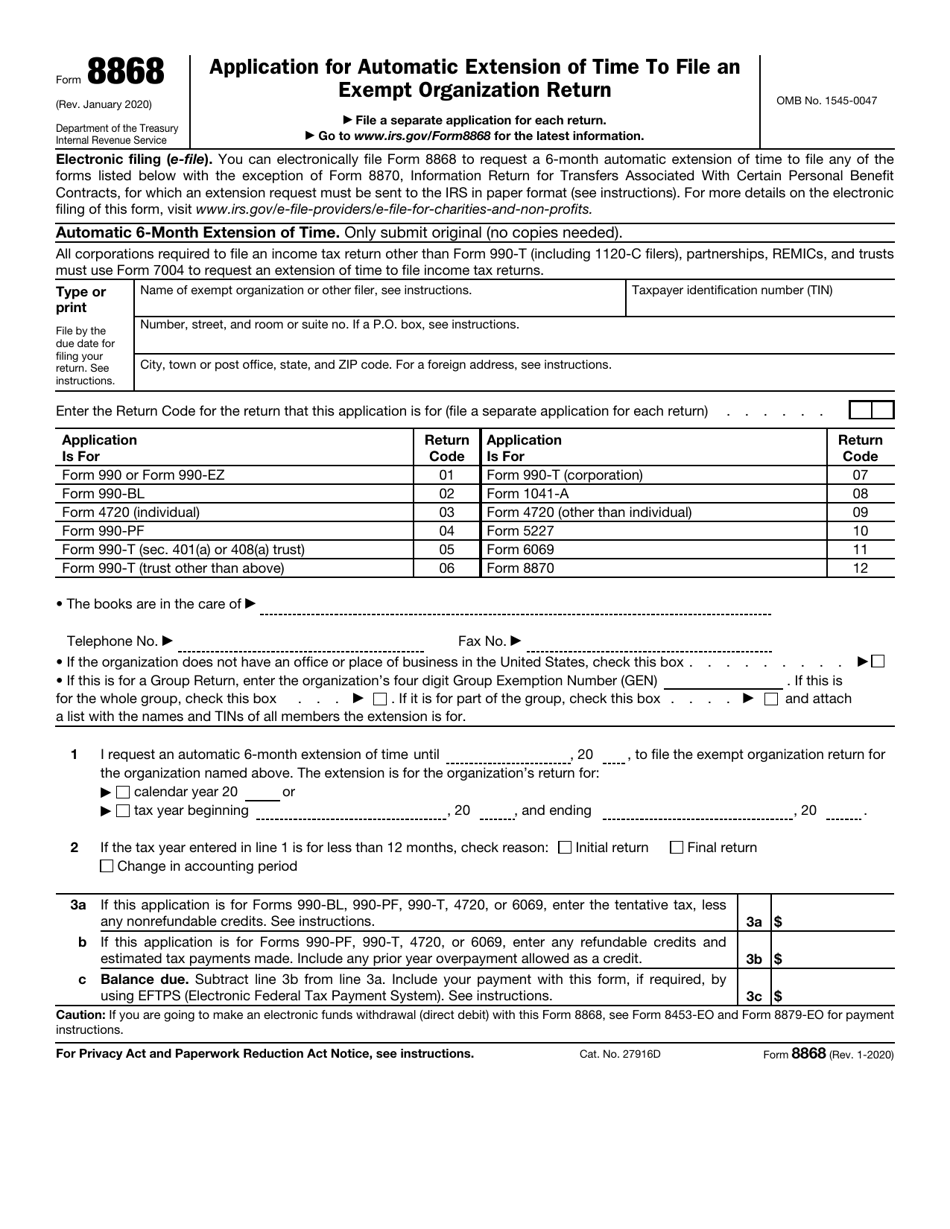

Extension Form 990 - For organizations on a calendar year, the form 990 is due. Web the extension of time to file applies to the following forms only: Form 990 has 12 pages and 12. Edit, sign and save org exempt tax retn short form. Return of organization exempt from income tax. Form 100 form 109 form 199 an extension allows you more time to file the return, not an extension of time to. Upon written request, copies available from: Filing an extension only extends the time to file your return and does not extend the time to pay any tax due. Web accordingly, nonprofits operating on a calendar year that typically involves them submitting a form 8868 to extend their may 15, 2020 form 990 filing deadline for. Form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code.

Uslegalforms allows users to edit, sign, fill & share all type of documents online. Upon written request, copies available from: For organizations on a calendar year, the form 990 is due. To use the table, you. Here is how you can file your extension form 8868 using. Web can any officer file the extension request? Form 100 form 109 form 199 an extension allows you more time to file the return, not an extension of time to. Thus, for a calendar year. Web form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on.

Web accordingly, nonprofits operating on a calendar year that typically involves them submitting a form 8868 to extend their may 15, 2020 form 990 filing deadline for. And will that extension request automatically extend to my state filing deadline? Return of organization exempt from income tax. Form 990 has 12 pages and 12. Securities and exchange commission, office of foia services, 100 f street ne, washington, dc. The filing of form 1023, application for recognition of exemption under 501(c)(3). Web the extension of time to file applies to the following forms only: Form 100 form 109 form 199 an extension allows you more time to file the return, not an extension of time to. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Upon written request, copies available from:

Form 990 Filing Extension Form Resume Examples GEOG2LE5Vr

Form 990 has 12 pages and 12. Edit, sign and save org exempt tax retn short form. Securities and exchange commission, office of foia services, 100 f street ne, washington, dc. To use the table, you. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day.

Oh [Bleep]! I Need to File a Form 990 Extension! File 990

Return of organization exempt from income tax. Edit, sign and save org exempt tax retn short form. Web accordingly, nonprofits operating on a calendar year that typically involves them submitting a form 8868 to extend their may 15, 2020 form 990 filing deadline for. To use the table, you. Web the filing of form 990 series annual returns.

Irs Fillable Extension Form Printable Forms Free Online

Web accordingly, nonprofits operating on a calendar year that typically involves them submitting a form 8868 to extend their may 15, 2020 form 990 filing deadline for. Form 100 form 109 form 199 an extension allows you more time to file the return, not an extension of time to. Web information about form 8868, application for extension of time to.

Form 990 Filing Instructions Fill Out and Sign Printable PDF Template

Web how do i file an extension for a 990 return? Here is how you can file your extension form 8868 using. For organizations on a calendar year, the form 990 is due. Web is there an extension for 990 forms? Filing an extension only extends the time to file your return and does not extend the time to pay.

990 Form For Non Profits Irs Universal Network

Upon written request, copies available from: To use the table, you. Here is how you can file your extension form 8868 using. Form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code. For organizations on a calendar year, the form 990 is due.

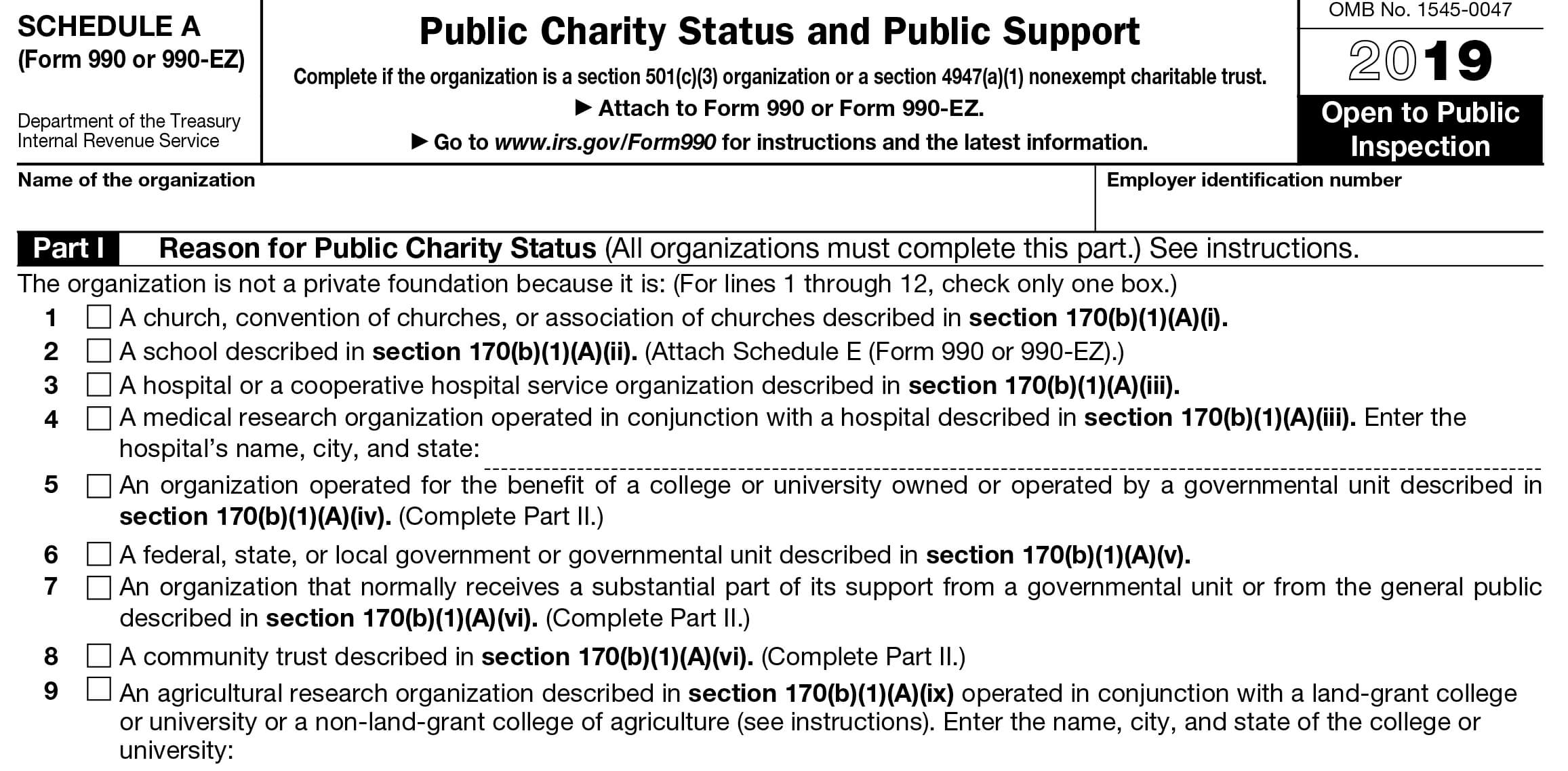

IRS Form 990 Schedules

And will that extension request automatically extend to my state filing deadline? Web there are several ways to submit form 4868. Form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code. For organizations on a calendar year, the form 990 is due. Edit, sign and save org exempt tax retn short form.

form 990 extension due date 2020 Fill Online, Printable, Fillable

Web is there an extension for 990 forms? Upon written request, copies available from: Web the extension only provided you the time to file the information return and not to pay any due taxes. Filing an extension only extends the time to file your return and does not extend the time to pay any tax due. Edit, sign and save.

How to Keep Your TaxExempt Status by Filing IRS Form 990

Web the extension only provided you the time to file the information return and not to pay any due taxes. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on. Web the extension of time to file applies to the following forms only: Upon written request,.

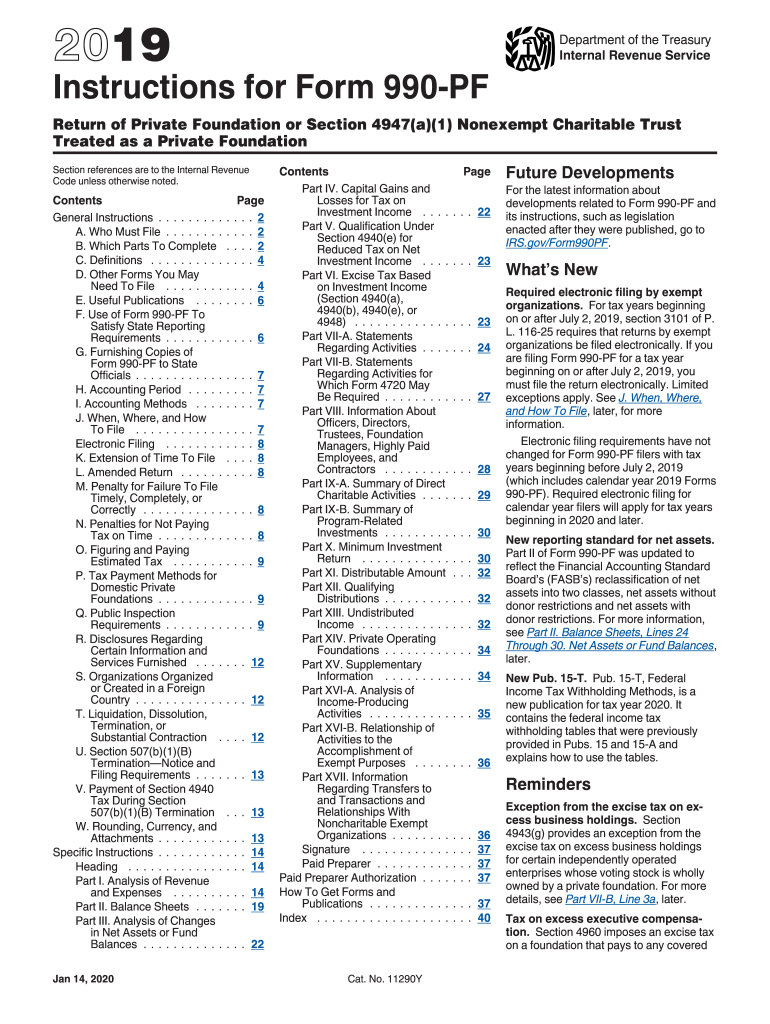

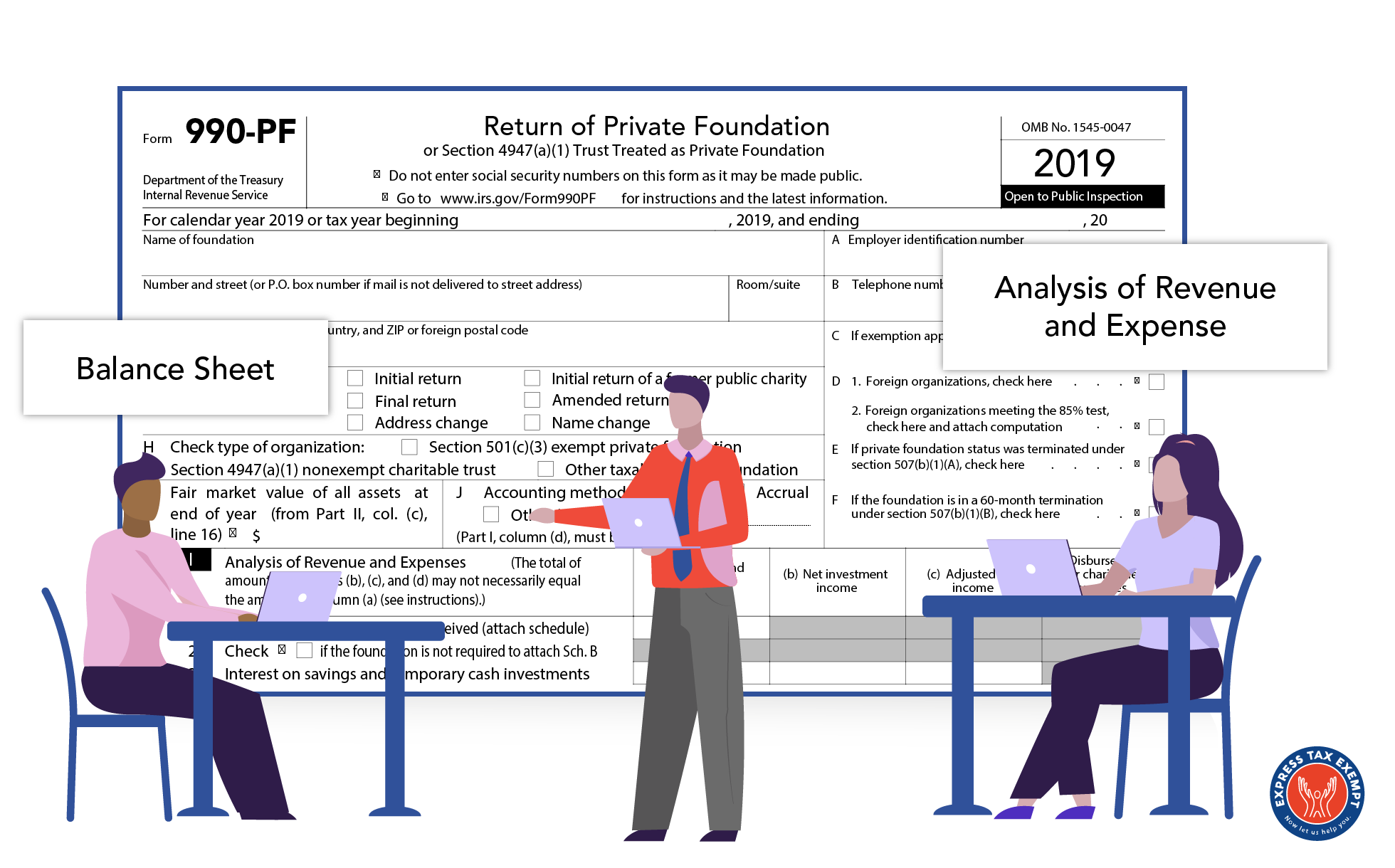

Instructions to file your Form 990PF A Complete Guide

Web can any officer file the extension request? Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. For organizations on a calendar year, the form 990 is due. Web how do i file an extension for a 990 return? Form 4720, return of certain excise taxes under chapters 41 and.

How to File A LastMinute 990 Extension With Form 8868

Uslegalforms allows users to edit, sign, fill & share all type of documents online. Return of organization exempt from income tax. Web accordingly, nonprofits operating on a calendar year that typically involves them submitting a form 8868 to extend their may 15, 2020 form 990 filing deadline for. Web is there an extension for 990 forms? Filing an extension only.

Taxpayers Can File Form 4868 By Mail, But Remember To Get Your Request In The Mail By Tax Day.

Uslegalforms allows users to edit, sign, fill & share all type of documents online. To use the table, you. Form 990 has 12 pages and 12. Web is there an extension for 990 forms?

Web Information About Form 8868, Application For Extension Of Time To File An Exempt Organization Return, Including Recent Updates, Related Forms, And Instructions On.

Form 100 form 109 form 199 an extension allows you more time to file the return, not an extension of time to. Thus, for a calendar year. Web the extension only provided you the time to file the information return and not to pay any due taxes. Web form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year.

Return Of Organization Exempt From Income Tax.

The filing of form 1023, application for recognition of exemption under 501(c)(3). For organizations on a calendar year, the form 990 is due. Form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code. Web how do i file an extension for a 990 return?

Web Can Any Officer File The Extension Request?

And will that extension request automatically extend to my state filing deadline? Web the filing of form 990 series annual returns. Web accordingly, nonprofits operating on a calendar year that typically involves them submitting a form 8868 to extend their may 15, 2020 form 990 filing deadline for. Web there are several ways to submit form 4868.

![Oh [Bleep]! I Need to File a Form 990 Extension! File 990](https://www.file990.org/hubfs/Imported_Blog_Media/I-Need-to-File-a-Form-990-Extension-1.jpg)