Federal Form 1310

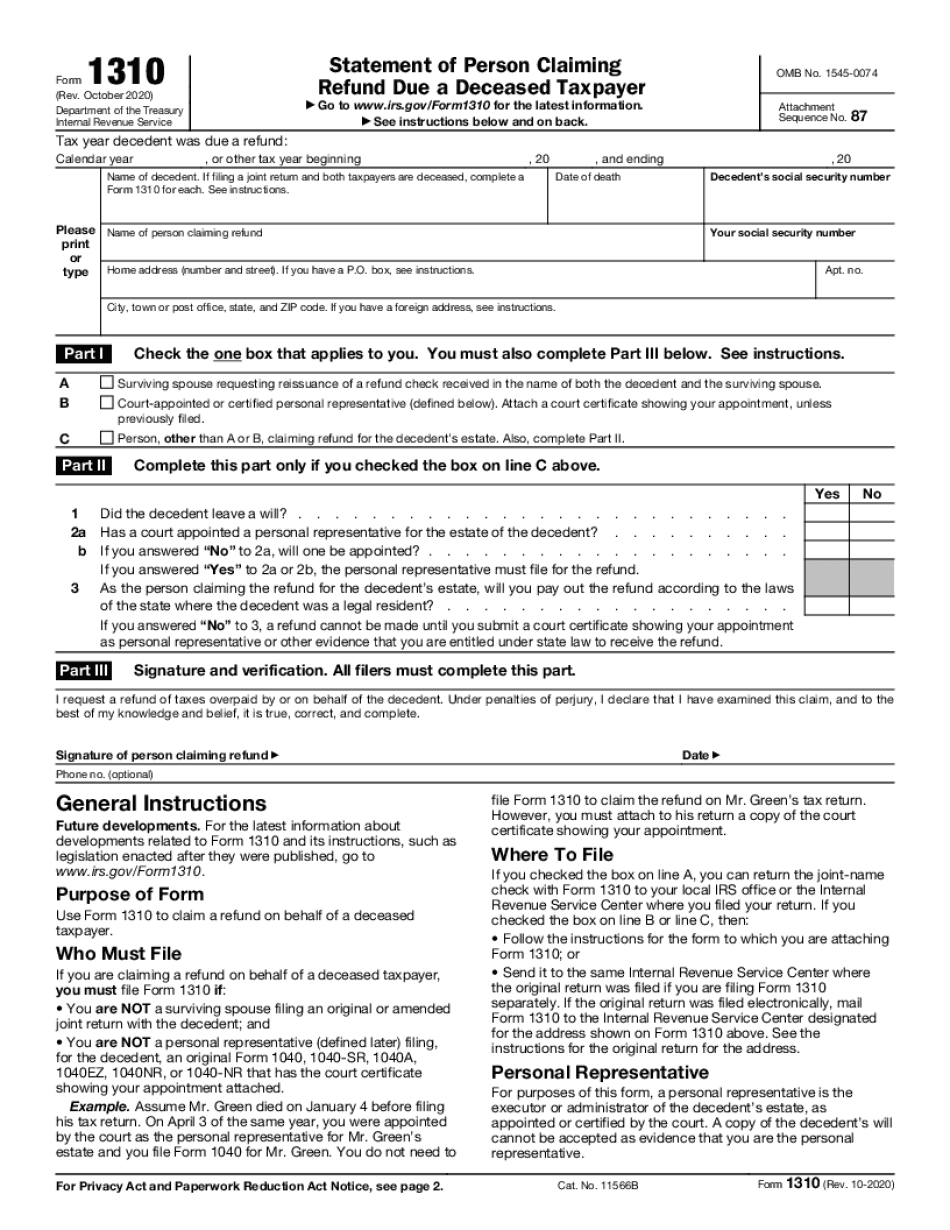

Federal Form 1310 - Anyone who expects to receive an income tax refund on behalf of a decedent should file irs form 1310 if he or she is: If money is owed, who is responsible for paying? If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: You must have written proof to file as the personal representative. Web who should file irs form 1310? Use form 1310 to claim a refund on behalf of a deceased taxpayer. You are the personal representative (executor) filing the return on behalf of the estate. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual is a surviving spouse filing a joint return or a court appointed personal representative. You are not a surviving spouse filing an original or amended joint return with the decedent; Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file.

Statement of person claiming refund due a deceased taxpayer (form 1310) unless: The irs doesn't need a copy of the death certificate or other proof of death. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual is a surviving spouse filing a joint return or a court appointed personal representative. If money is owed, who is responsible for paying? Use form 1310 to claim a refund on behalf of a deceased taxpayer. Green died on january 4 before filing his tax return. Anyone who expects to receive an income tax refund on behalf of a decedent should file irs form 1310 if he or she is: You are the surviving spouse filing a joint return, or. Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. Web who should file irs form 1310?

Green died on january 4 before filing his tax return. Web form 1310 informs the internal revenue service (irs) that a taxpayer has died and that a refund is being claimed by their beneficiaries and/or estate. If money is owed, who is responsible for paying? Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Web who should file irs form 1310? Who must file if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 if: Statement of person claiming refund due a deceased taxpayer (form 1310) unless: On april 3 of the same year, you were appointed You must have written proof to file as the personal representative.

Fillable Form IRS 8888 Savings bonds, Irs, Financial institutions

The form is filed as part of a complete. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. If money is owed, who is responsible for paying? Web form 1310 informs the internal revenue service (irs) that a taxpayer has died and that a refund is being claimed by their beneficiaries and/or estate. If you.

Estimated Tax Payments 2022 Form Latest News Update

The form is filed as part of a complete. If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: On april 3 of the same year, you were appointed Web use form 1310 to claim a refund on behalf of a deceased taxpayer. You are the surviving.

Manage Documents Using Our Document Editor For IRS Form 1310

You are the surviving spouse filing a joint return, or. Web form 1310 federal — statement of person claiming refund due a deceased taxpayer download this form print this form it appears you don't have a pdf plugin for this browser. Use form 1310 to claim a refund on behalf of a deceased taxpayer. If money is owed, who is.

2018 Form IL DoR IL1040X Fill Online, Printable, Fillable, Blank

Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual is a surviving spouse filing a joint return or a court appointed personal representative. Green died on january 4 before filing his tax return. If money is owed, who is responsible.

Fill Free fillable Form 1310 Claiming Refund Due a Deceased Taxpayer

On april 3 of the same year, you were appointed Web form 1310 informs the internal revenue service (irs) that a taxpayer has died and that a refund is being claimed by their beneficiaries and/or estate. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. You are the surviving spouse filing a joint return, or..

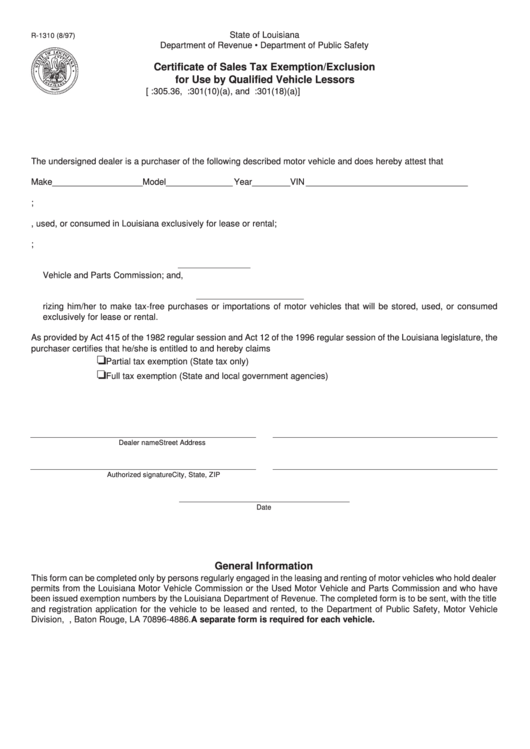

Fillable Form R1310 Certificate Of Sales Tax Exemption/exclusion For

If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: You must have written proof to file as the personal representative. Anyone who expects to receive an income tax refund on behalf of a decedent should file irs form 1310 if he or she is: If money.

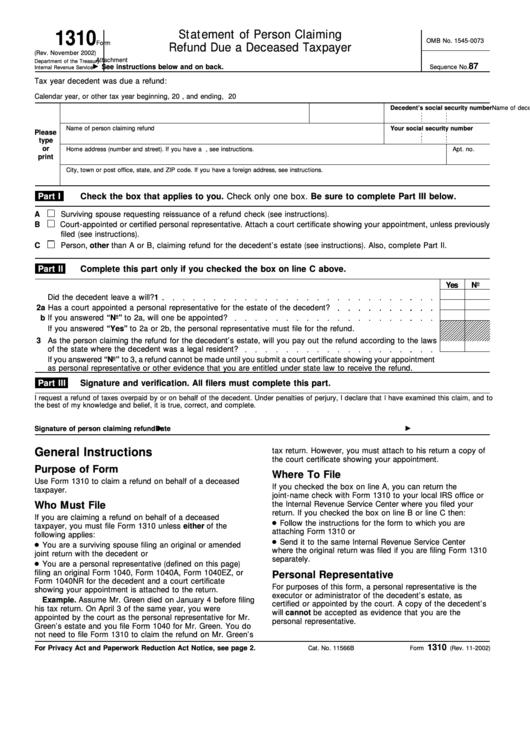

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased

Web form 1310 federal — statement of person claiming refund due a deceased taxpayer download this form print this form it appears you don't have a pdf plugin for this browser. Use form 1310 to claim a refund on behalf of a deceased taxpayer. You are the surviving spouse filing a joint return, or. Web use form 1310 to claim.

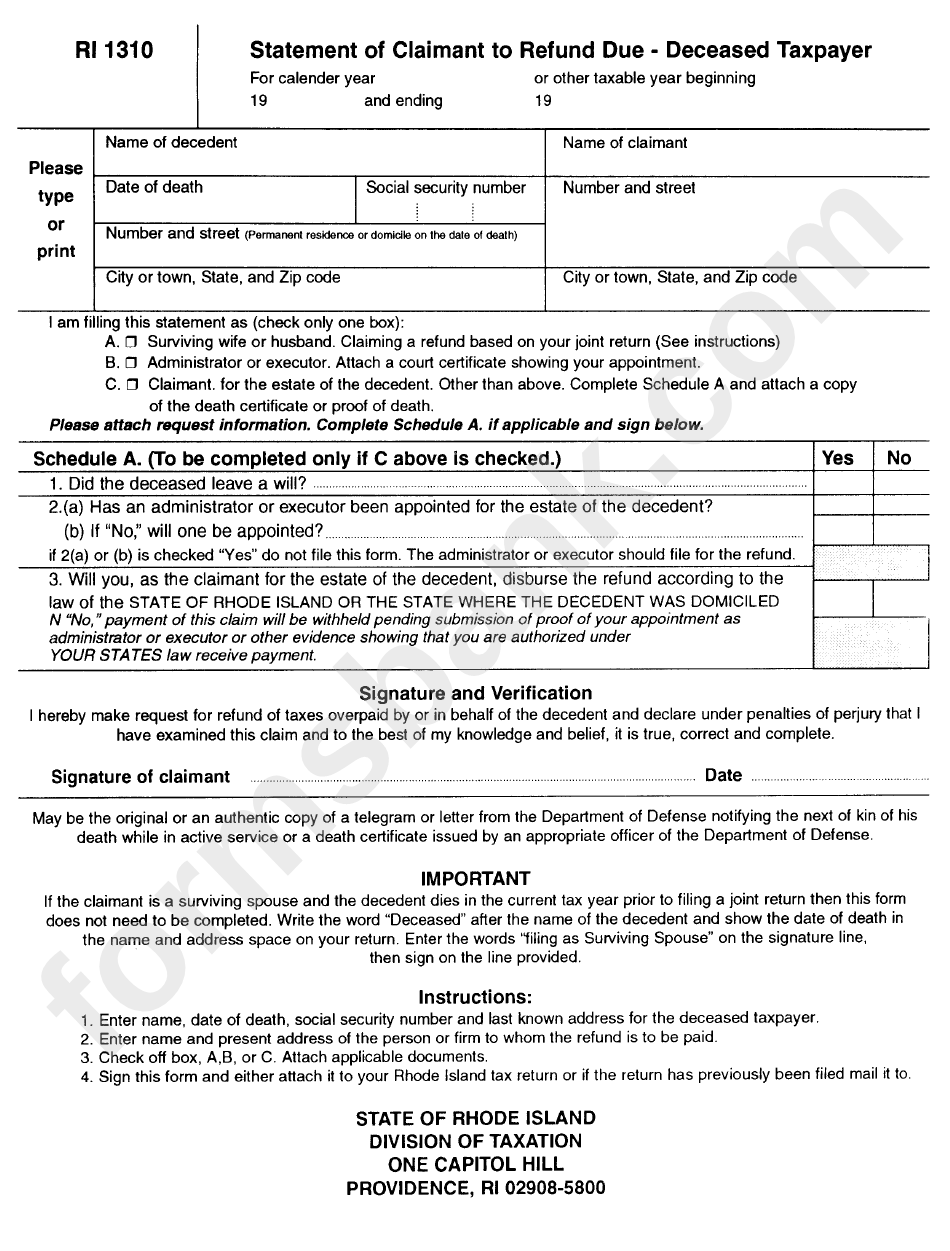

Fillable Form Ri 1310 Statement Of Claimant To Refund Due Deceased

On april 3 of the same year, you were appointed Use form 1310 to claim a refund on behalf of a deceased taxpayer. Web form 1310 informs the internal revenue service (irs) that a taxpayer has died and that a refund is being claimed by their beneficiaries and/or estate. You are the personal representative (executor) filing the return on behalf.

Form 1310 Statement of Person Claiming Refund Due a Deceased Taxpayer

You are the personal representative (executor) filing the return on behalf of the estate. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual is a surviving spouse filing a joint return or a court appointed personal representative. You are not.

Form 1310 Statement of Person Claiming Refund Due a Deceased Taxpayer

Who must file if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 if: If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Statement of person claiming refund due a deceased taxpayer (form 1310) unless: If money is owed,.

Use Form 1310 To Claim A Refund On Behalf Of A Deceased Taxpayer.

If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Statement of person claiming refund due a deceased taxpayer (form 1310) unless: Web form 1310 informs the internal revenue service (irs) that a taxpayer has died and that a refund is being claimed by their beneficiaries and/or estate. Web who should file irs form 1310?

Web Form 1310 Federal — Statement Of Person Claiming Refund Due A Deceased Taxpayer Download This Form Print This Form It Appears You Don't Have A Pdf Plugin For This Browser.

Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. You are not a surviving spouse filing an original or amended joint return with the decedent; More about the federal form 1310

If Money Is Owed, Who Is Responsible For Paying?

Green died on january 4 before filing his tax return. You must have written proof to file as the personal representative. You are the surviving spouse filing a joint return, or. The irs doesn't need a copy of the death certificate or other proof of death.

You Are The Personal Representative (Executor) Filing The Return On Behalf Of The Estate.

Who must file if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 if: On april 3 of the same year, you were appointed Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Anyone who expects to receive an income tax refund on behalf of a decedent should file irs form 1310 if he or she is: