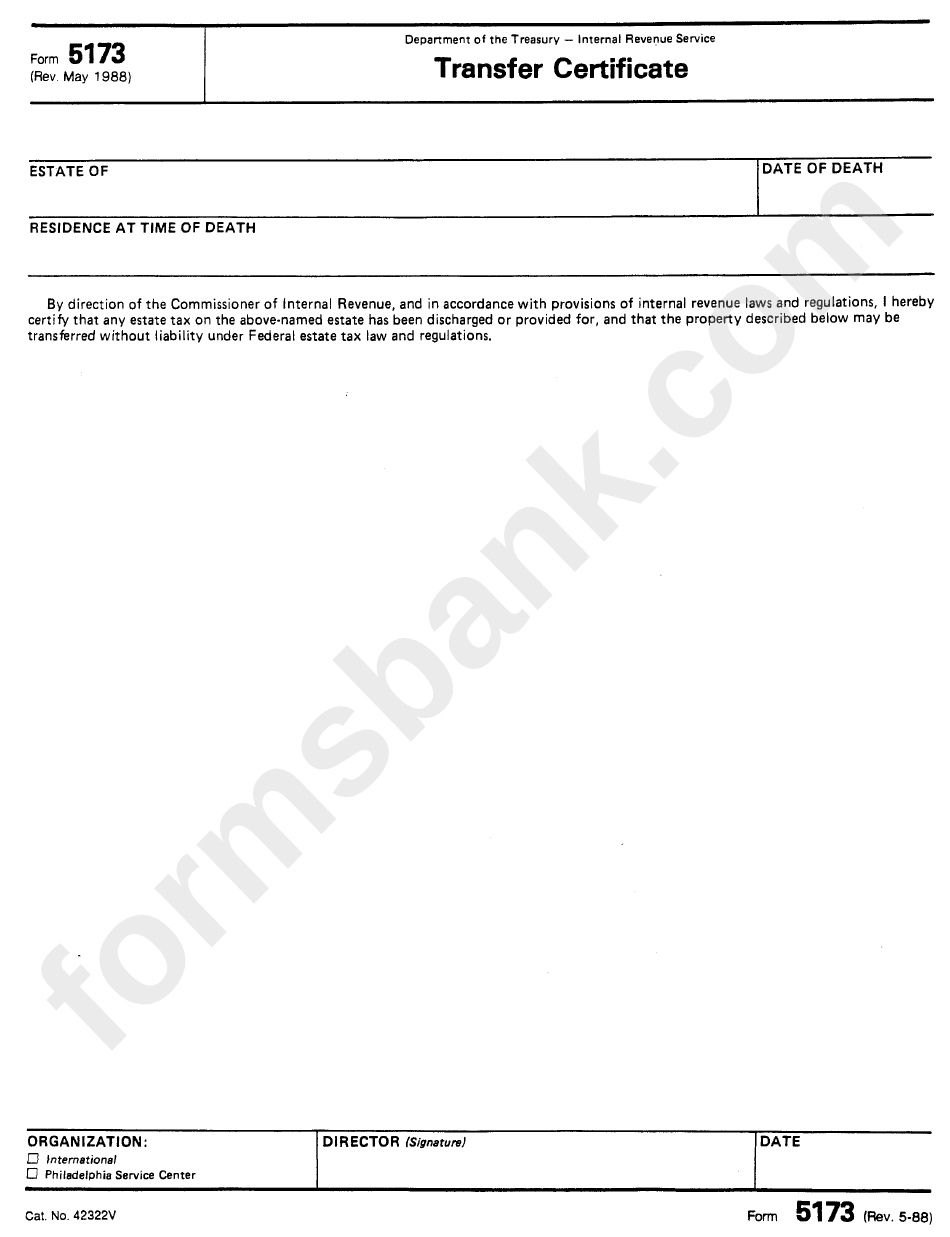

Federal Transfer Certificate Irs Form 5173

Federal Transfer Certificate Irs Form 5173 - The assets are only u.s. Web this remains certainly this case using irs form 5173 (often called an irs transfer certificate). What is the requirement for a federal transfer certificate? Web a federal transfer certificate is used to authorize the transfer of property located in the us and is required before most institutions will begin to distribute any assets, therefore if you are the executor of an estate outside of the united states which holds us assets with a value of over $60,000 at the date of death, applying for irs clearanc. Web federal transfer certificates, also sometimes referred to as form 5173, prove that inheritance tax clearance has already been obtained in the uk and therefore the assets held in the estate are exempt from inheritance tax in the usa. Web in this article, we’ll explore obtaining the irs transfer certificate and explain how form 706na and form 5173 apply to these cases. Web what is a form 5173? Int is post, we discuss the mechanicians of form 5173. (form 706na and form 5173)for more details, please check this article: The executor of the person's estate must provide form 5173 to a u.s.

Web how do i get an irs transfer certificate? Web a transfer certificate is not required for property administered by an executor or administrator appointed, qualified and acting within the united states. This can be a lengthy process. Web federal transfer certificates, also sometimes referred to as form 5173, prove that inheritance tax clearance has already been obtained in the uk and therefore the assets held in the estate are exempt from inheritance tax in the usa. The assets are only u.s. Web in this article, we’ll explore obtaining the irs transfer certificate and explain how form 706na and form 5173 apply to these cases. We be give you instructions and plus show you some tips also tricks as you can receive the form as quickly as possible. Web form 5173 is required when a deceased nonresident has u.s. The tax will be considered fully discharged for purposes of the issuance of a transfer certificate when investigation has been completed and payment of the tax, including any deficiency. What is the requirement for a federal transfer certificate?

Web a transfer certificate will be issued by the service when satisfied that the tax imposed upon the estate, if any, has been fully discharged or provided for. Web a transfer certificate is not required for property administered by an executor or administrator appointed, qualified and acting within the united states. The executor of the person's estate must provide form 5173 to a u.s. The assets are only u.s. Web form 5173 is required when a deceased nonresident has u.s. The tax will be considered fully discharged for purposes of the issuance of a transfer certificate when investigation has been completed and payment of the tax, including any deficiency. Web how do i get an irs transfer certificate? Int is post, we discuss the mechanicians of form 5173. Custodian in order for them to release the. Web a federal transfer certificate is used to authorize the transfer of property located in the us and is required before most institutions will begin to distribute any assets, therefore if you are the executor of an estate outside of the united states which holds us assets with a value of over $60,000 at the date of death, applying for irs clearanc.

IRS Publication 936 2010 Fill and Sign Printable Template Online US

Web federal transfer certificates, also sometimes referred to as form 5173, prove that inheritance tax clearance has already been obtained in the uk and therefore the assets held in the estate are exempt from inheritance tax in the usa. Web what is a form 5173? Real estate, tangible property, and u.s. Web a transfer certificate is not required for property.

form 5173 Fill Online, Printable, Fillable Blank form706

Web this remains certainly this case using irs form 5173 (often called an irs transfer certificate). Web a transfer certificate will be issued by the service when satisfied that the tax imposed upon the estate, if any, has been fully discharged or provided for. Int is post, we discuss the mechanicians of form 5173. Web a transfer certificate is not.

Form 5173 Transfer Certificate printable pdf download

Int is post, we discuss the mechanicians of form 5173. Transfer certificate filing requirements for the estates of nonresident citizens of the united states | internal revenue service Web a federal transfer certificate is used to authorize the transfer of property located in the us and is required before most institutions will begin to distribute any assets, therefore if you.

EDGAR Filing Documents for 000119312516456864

What is the requirement for a federal transfer certificate? Transfer certificate filing requirements for the estates of nonresident citizens of the united states | internal revenue service The assets are only u.s. Web in this article, we’ll explore obtaining the irs transfer certificate and explain how form 706na and form 5173 apply to these cases. Web federal transfer certificate requirements.

11Transfer certificate front page

Web this remains certainly this case using irs form 5173 (often called an irs transfer certificate). The tax will be considered fully discharged for purposes of the issuance of a transfer certificate when investigation has been completed and payment of the tax, including any deficiency. Web federal transfer certificates, also sometimes referred to as form 5173, prove that inheritance tax.

What is the IRS Form 5173 Tax Clearance Certificate

Transfer certificate filing requirements for the estates of nonresident citizens of the united states | internal revenue service Web this remains certainly this case using irs form 5173 (often called an irs transfer certificate). Real estate, tangible property, and u.s. Int is post, we discuss the mechanicians of form 5173. Custodian in order for them to release the.

What is the IRS Form 5173 Tax Clearance Certificate YouTube

Custodian in order for them to release the. What is the requirement for a federal transfer certificate? Web in this article, we’ll explore obtaining the irs transfer certificate and explain how form 706na and form 5173 apply to these cases. Web what is a form 5173? Web this remains certainly this case using irs form 5173 (often called an irs.

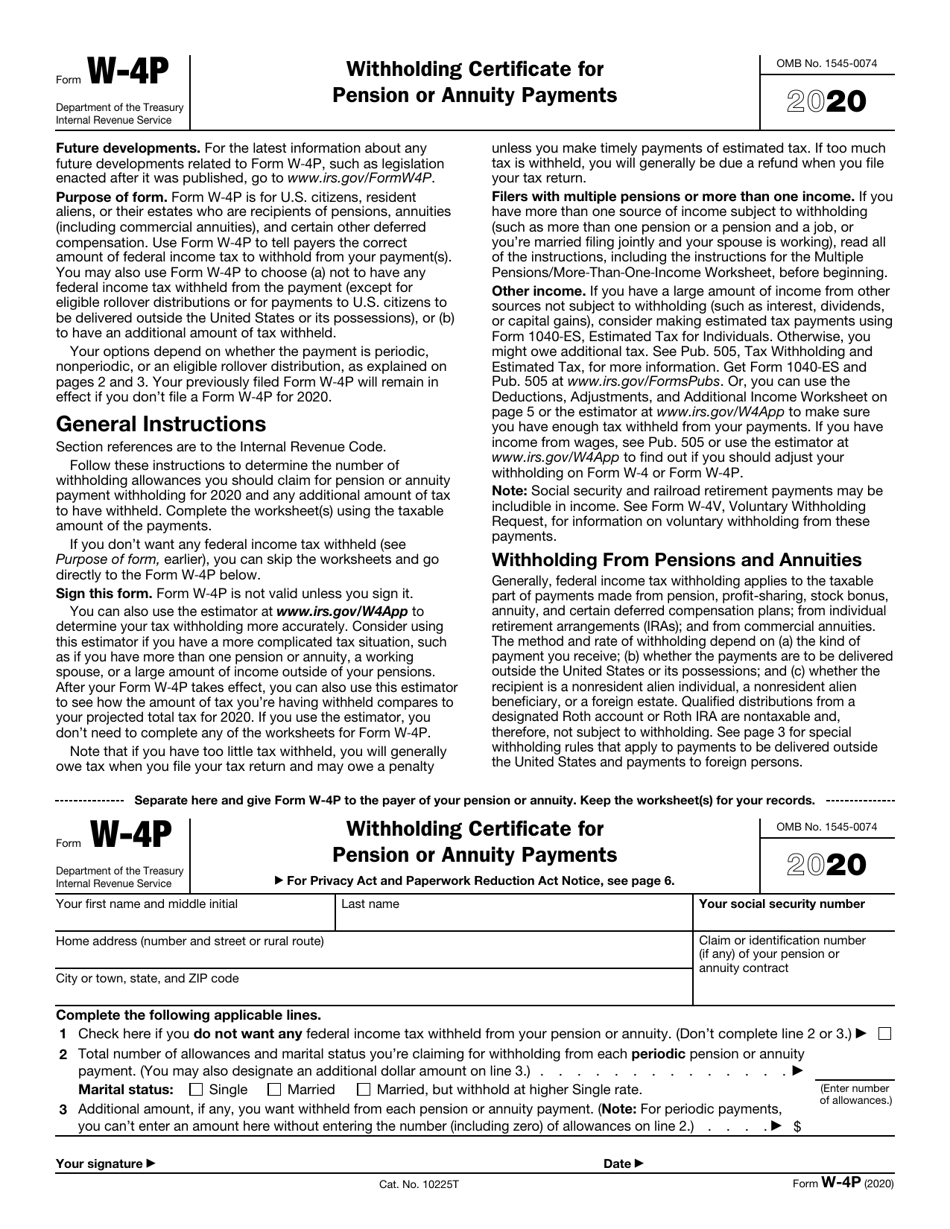

IRS Form W4P Download Fillable PDF or Fill Online Withholding

The assets are only u.s. Web a transfer certificate is not required for property administered by an executor or administrator appointed, qualified and acting within the united states. Web a transfer certificate will be issued by the service when satisfied that the tax imposed upon the estate, if any, has been fully discharged or provided for. This can be a.

IRS Form 8038GC Download Fillable PDF or Fill Online Information

Web this remains certainly this case using irs form 5173 (often called an irs transfer certificate). Real estate, tangible property, and u.s. The executor of the person's estate must provide form 5173 to a u.s. Transfer certificate filing requirements for the estates of nonresident citizens of the united states | internal revenue service We be give you instructions and plus.

IRS Letter of Tax Exempt Status

We be give you instructions and plus show you some tips also tricks as you can receive the form as quickly as possible. The assets are only u.s. Web in this article, we’ll explore obtaining the irs transfer certificate and explain how form 706na and form 5173 apply to these cases. Custodian in order for them to release the. The.

The Tax Will Be Considered Fully Discharged For Purposes Of The Issuance Of A Transfer Certificate When Investigation Has Been Completed And Payment Of The Tax, Including Any Deficiency.

What is the requirement for a federal transfer certificate? This can be a lengthy process. Int is post, we discuss the mechanicians of form 5173. The assets are only u.s.

Web In This Article, We’ll Explore Obtaining The Irs Transfer Certificate And Explain How Form 706Na And Form 5173 Apply To These Cases.

Web what is a form 5173? Web this remains certainly this case using irs form 5173 (often called an irs transfer certificate). Web a transfer certificate is not required for property administered by an executor or administrator appointed, qualified and acting within the united states. Web how do i get an irs transfer certificate?

The Executor Of The Person's Estate Must Provide Form 5173 To A U.s.

Web form 5173 is required when a deceased nonresident has u.s. Web a transfer certificate will be issued by the service when satisfied that the tax imposed upon the estate, if any, has been fully discharged or provided for. Web a federal transfer certificate is used to authorize the transfer of property located in the us and is required before most institutions will begin to distribute any assets, therefore if you are the executor of an estate outside of the united states which holds us assets with a value of over $60,000 at the date of death, applying for irs clearanc. Transfer certificate filing requirements for the estates of nonresident citizens of the united states | internal revenue service

Custodian In Order For Them To Release The.

Web federal transfer certificate requirements. (form 706na and form 5173)for more details, please check this article: Web federal transfer certificates, also sometimes referred to as form 5173, prove that inheritance tax clearance has already been obtained in the uk and therefore the assets held in the estate are exempt from inheritance tax in the usa. Real estate, tangible property, and u.s.