Fema Flood Policy Transfer Form

Fema Flood Policy Transfer Form - Whatever are the negatives about them? Floods can happen anywhere — just one inch of floodwater can cause up to $25,000 in damage. We’re sure that you’ll find these tools valuable as you review your clients flood insurance needs. Many other people refer to them as policy transfers. Web national flood insurance program forms underwriting forms forms to review and submit applications for insurance. Endorsement forms nfip policy documents elevation certificate Web first of all, generally a policy transfer or a policy assumption is when a national flood insurance policy is moved from one property owner to the next, fema also calls it a policy assumption. Find an insurance form | fema.gov Web the national flood insurance program (nfip) is managed by the fema and is delivered to the public by a network of more than 50 insurance companies and the nfip direct. Web endorsement forms & policy documents | national flood services endorsement forms & policy documents these templates were designed with a number of scenarios in mind.

Web if your policy is written through a private insurer, you may send the form to your company, which will then communicate with fema. We’re sure that you’ll find these tools valuable as you review your clients flood insurance needs. Find an insurance form | fema.gov Important — complete page 1 and page 2 before. Policyholder claim forms forms to assess damage submitted for insurance claims. Whatever are the negatives about them? If paying by check or money order, make payable to the national flood insurance program. Many other people refer to them as policy transfers. Endorsement forms nfip policy documents elevation certificate How can they help property owners?

Endorsement forms nfip policy documents elevation certificate Web the forms will need to be reviewed by the current flood insurance carrier for approval. If you have any questions about policy assumptions or are selling a home and would like to transfer your existing policy to the buyer,. Many other people refer to them as policy transfers. Web first of all, generally a policy transfer or a policy assumption is when a national flood insurance policy is moved from one property owner to the next, fema also calls it a policy assumption. Policyholder claim forms forms to assess damage submitted for insurance claims. Whatever are the negatives about them? Web the national flood insurance program (nfip) is managed by the fema and is delivered to the public by a network of more than 50 insurance companies and the nfip direct. Web now we are talking about tide insurance policy transfers or floods insurance policy assumptions. Find an insurance form | fema.gov

Fema Flood Application Form Form Resume Examples E4Y4D88YlB

Let's talk about some of the benefits of them. Important — complete page 1 and page 2 before. Web the forms will need to be reviewed by the current flood insurance carrier for approval. The october 2015 dwelling form is used on all claims reported with. Policyholder claim forms forms to assess damage submitted for insurance claims.

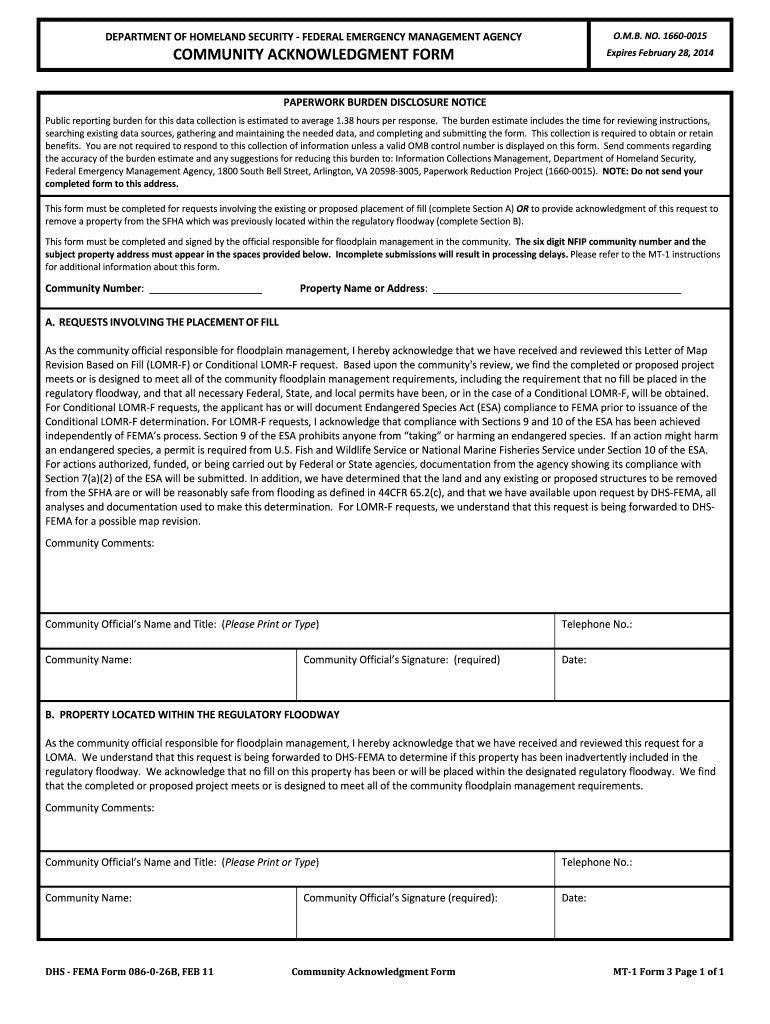

Acknowledgement Of Flood Fill Out and Sign Printable PDF Template

Whatever are the negatives about them? Web now we are talking about tide insurance policy transfers or floods insurance policy assumptions. Web skip to the main content. Endorsement forms nfip policy documents elevation certificate Web the forms will need to be reviewed by the current flood insurance carrier for approval.

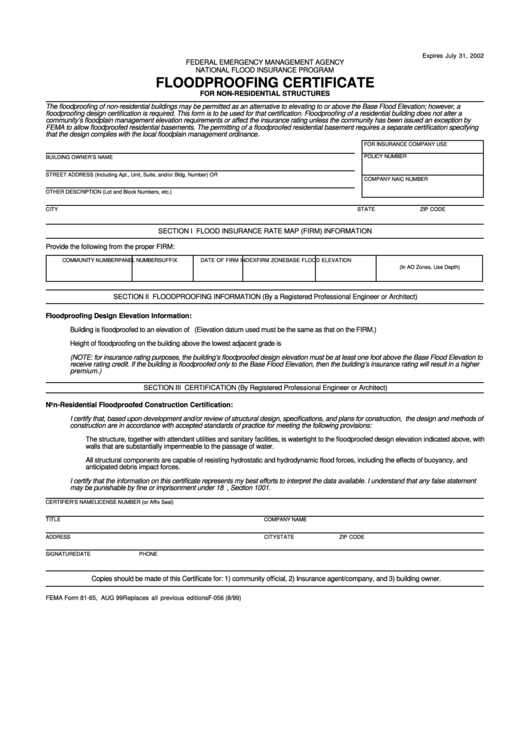

Fema Form 8165 Floodproofing Certificate For NonResidential

Many other people refer to them as policy transfers. Let's talk about some of the benefits of them. Web now we are talking about tide insurance policy transfers or floods insurance policy assumptions. Find an insurance form | fema.gov Whatever are the negatives about them?

Fema Flood Insurance Application Financial Report

For the flood insurance transfer form, you’ll need both the seller’s and purchaser’s information, as well as the info for the new lender or mortgage company. If paying by check or money order, make payable to the national flood insurance program. Web the national flood insurance program (nfip) is managed by the fema and is delivered to the public by.

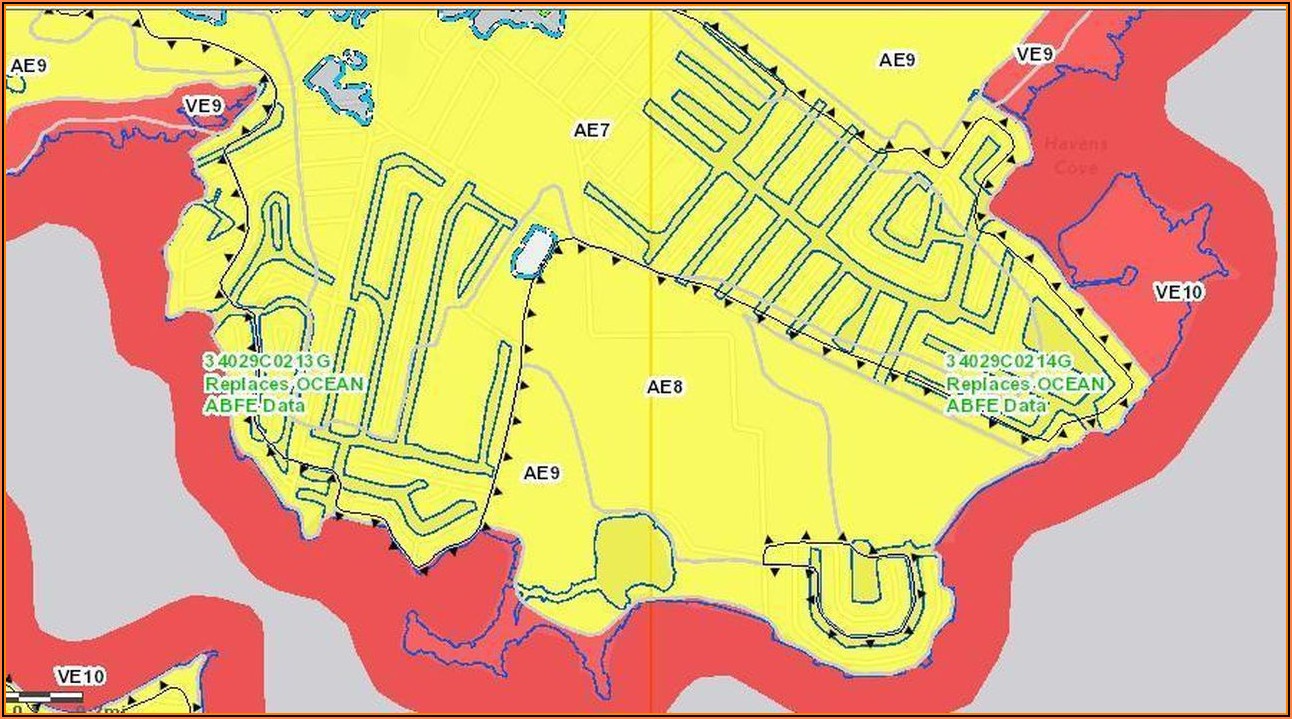

New FEMA flood map changes could cost homeowners along Lake Ontario

Important — complete page 1 and page 2 before. Instructions can they be beneficial? Web now we are talking about tide insurance policy transfers or floods insurance policy assumptions. Web the national flood insurance program (nfip) is managed by the fema and is delivered to the public by a network of more than 50 insurance companies and the nfip direct..

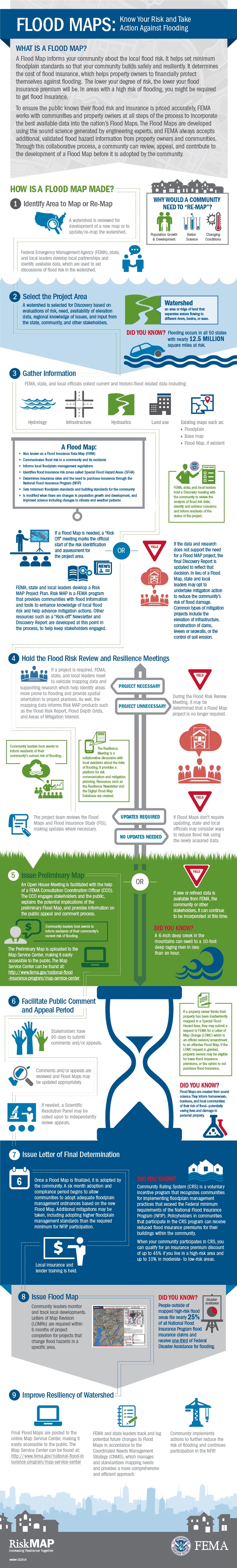

Infographic of the Month March 2014 (FEMA Flood Maps!) Public Works

How can they help property owners? Many other people refer to them as policy transfers. For the flood insurance transfer form, you’ll need both the seller’s and purchaser’s information, as well as the info for the new lender or mortgage company. Web the forms will need to be reviewed by the current flood insurance carrier for approval. Web if your.

Fema Flood Insurance Application Form Universal Network

Policyholder claim forms forms to assess damage submitted for insurance claims. Find an insurance form | fema.gov We’re sure that you’ll find these tools valuable as you review your clients flood insurance needs. Many other people refer to them as policy transfers. Whatever are the negatives about them?

Fema Flood Application Form Form Resume Examples Rg8DNyyKMq

Web if your policy is written through a private insurer, you may send the form to your company, which will then communicate with fema. Web first of all, generally a policy transfer or a policy assumption is when a national flood insurance policy is moved from one property owner to the next, fema also calls it a policy assumption. Policyholder.

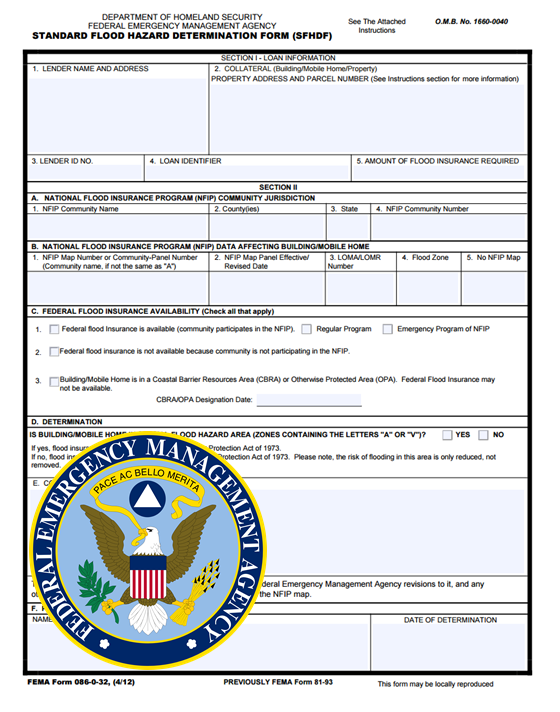

Determination Form New FEMA Flood Maps Search by County

Web national flood insurance program forms underwriting forms forms to review and submit applications for insurance. Web the national flood insurance program (nfip) is managed by the fema and is delivered to the public by a network of more than 50 insurance companies and the nfip direct. Many other people refer to them as policy transfers. The october 2015 dwelling.

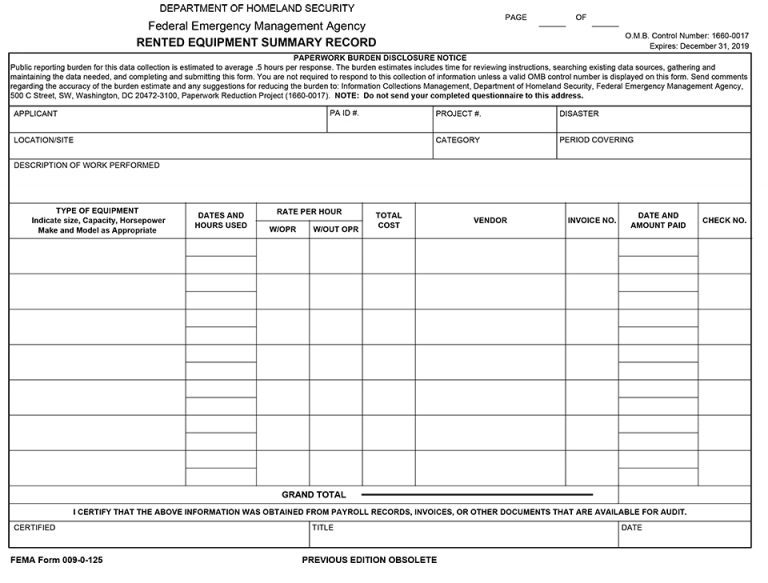

Covering your Assets a Guide to Documentation for Flood Recovery

Web if your policy is written through a private insurer, you may send the form to your company, which will then communicate with fema. Web the national flood insurance program (nfip) is managed by the fema and is delivered to the public by a network of more than 50 insurance companies and the nfip direct. For the flood insurance transfer.

We’re Sure That You’ll Find These Tools Valuable As You Review Your Clients Flood Insurance Needs.

Web if your policy is written through a private insurer, you may send the form to your company, which will then communicate with fema. Web endorsement forms & policy documents | national flood services endorsement forms & policy documents these templates were designed with a number of scenarios in mind. If you have any questions about policy assumptions or are selling a home and would like to transfer your existing policy to the buyer,. Important — complete page 1 and page 2 before.

How Can They Help Property Owners?

Web first of all, generally a policy transfer or a policy assumption is when a national flood insurance policy is moved from one property owner to the next, fema also calls it a policy assumption. Find an insurance form | fema.gov Floods can happen anywhere — just one inch of floodwater can cause up to $25,000 in damage. Web skip to the main content.

If Paying By Check Or Money Order, Make Payable To The National Flood Insurance Program.

Let's talk about some of the benefits of them. Web the forms will need to be reviewed by the current flood insurance carrier for approval. Web now we are talking about tide insurance policy transfers or floods insurance policy assumptions. The october 2015 dwelling form is used on all claims reported with.

Policyholder Claim Forms Forms To Assess Damage Submitted For Insurance Claims.

Many other people refer to them as policy transfers. Whatever are the negatives about them? Web national flood insurance program forms underwriting forms forms to review and submit applications for insurance. For the flood insurance transfer form, you’ll need both the seller’s and purchaser’s information, as well as the info for the new lender or mortgage company.