File Form 2848 Online

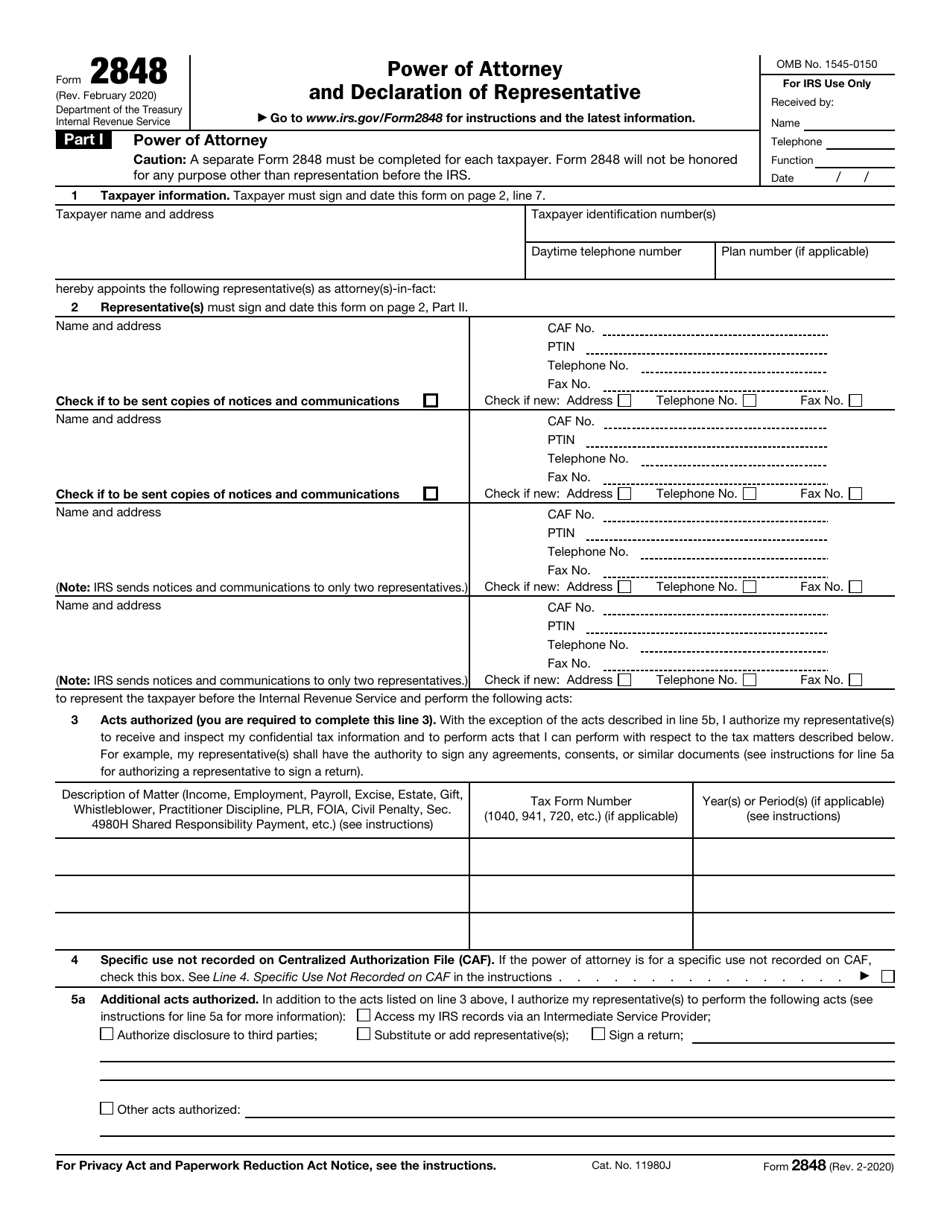

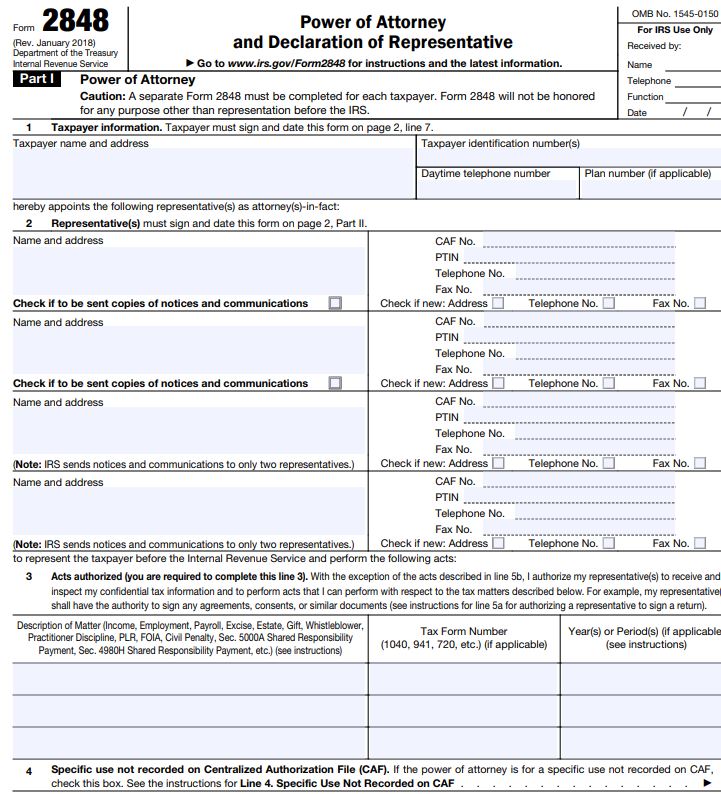

File Form 2848 Online - Web information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on how to file. Ad get ready for tax season deadlines by completing any required tax forms today. Web a form 2848 is also known as a power of attorney and declaration of representative form. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form 8821, tax information. Web a separate form 2848 must be completed for each taxpayer. This form will be used in various situations related to tax filing or tax audits. All forms individual forms information returns fiduciary. Web you can download a form 2848 from irs.gov or access the file in the image below. For more information on secure access, go to irs.gov/secureaccess. Web submit forms online.

Ad get ready for tax season deadlines by completing any required tax forms today. Web the submit forms 2848 and 8821 online tool is available from the irs.gov/taxpros page. Form 2428 allows tax professionals, such as an attorney, cpa or enrolled agent, to represent clients before the irs as if they were the taxpayer. Web submit forms online. Web the two forms — form 2848, “power of attorney and declaration of representatives,” and form 8821, “tax information authorization” — can be submitted. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form 8821, tax information. Web you can upload the irs form 2848 online on the official site, you won’t need to send it anywhere. Form 2848 will not be honored for any purpose other than representation before the irs. Web you will need to have a secure access account to submit your form 2848 online. Ad download or email irs 2848 & more fillable forms, register and subscribe now!

Web file the 2848 form fillable electronically, following the provided guidelines for a seamless submission process. It’s just two pages but can be confusing if you’re filling it out for the first time. Form 2848 will not be honored for any purpose other than representation before the irs. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form 8821, tax information. Web tax professionals can find the new submit forms 2848 and 8821 online on the irs.gov/taxpros page. All forms individual forms information returns fiduciary. Web irs form 2848 is the power of attorney and declaration of representative form. For more information on secure access, go to irs.gov/secureaccess. This form will be used in various situations related to tax filing or tax audits. Web the submit forms 2848 and 8821 online tool is available from the irs.gov/taxpros page.

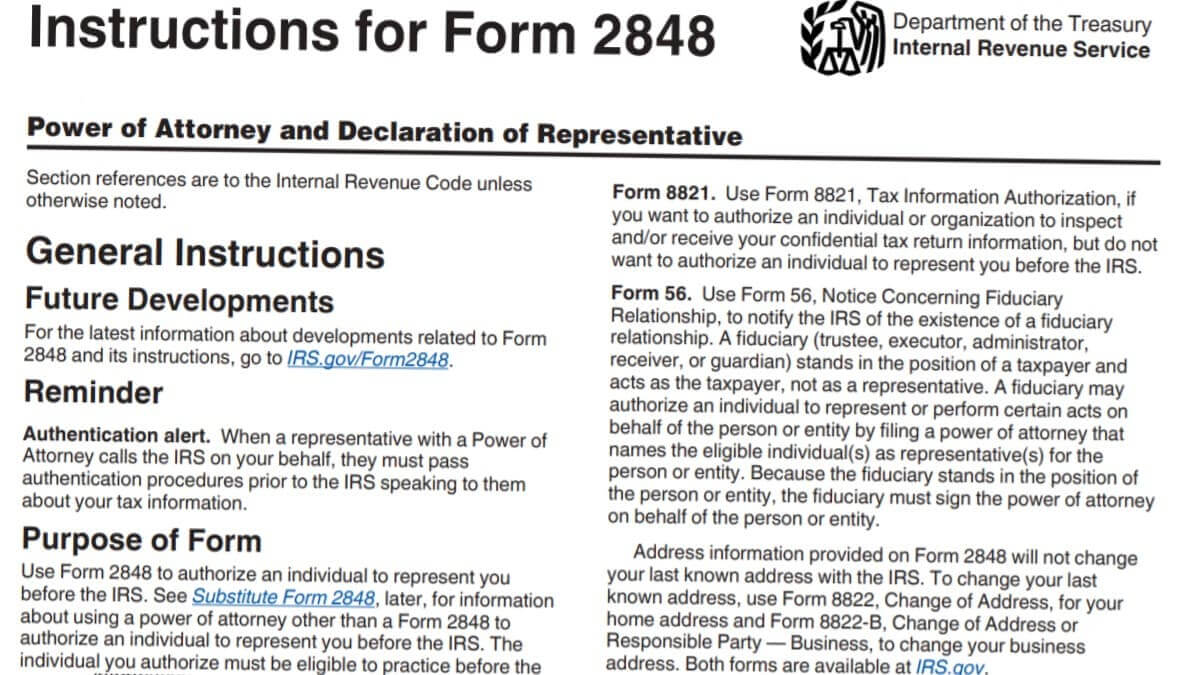

Form 2848 Instructions

Web a form 2848 is also known as a power of attorney and declaration of representative form. Web you can upload the irs form 2848 online on the official site, you won’t need to send it anywhere. Web up to $40 cash back 2017 2848 form. Ad download or email irs 2848 & more fillable forms, register and subscribe now!.

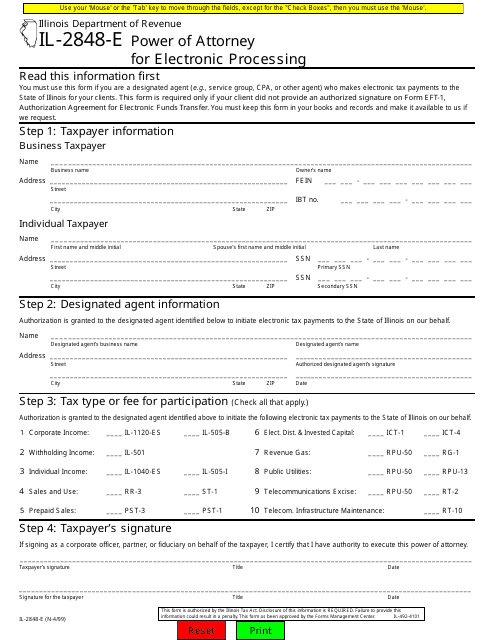

Form IL2848E Download Fillable PDF or Fill Online Power of Attorney

It’s just two pages but can be confusing if you’re filling it out for the first time. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form 8821, tax information. The tax relief center talks about the advantages and disadvantages of filling out and filing federal.

Form 2848 YouTube

Web you can download a form 2848 from irs.gov or access the file in the image below. Web the two forms — form 2848, “power of attorney and declaration of representatives,” and form 8821, “tax information authorization” — can be submitted. It also has friendly web addresses that can be bookmarked: Tax professionals must have a secure access account,. Web.

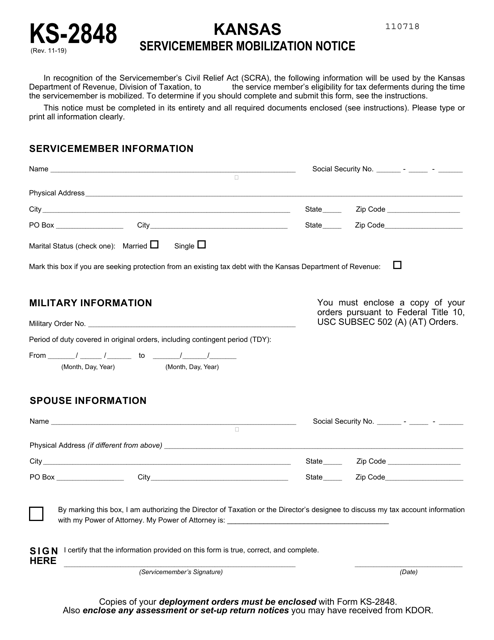

Form KS2848 Download Fillable PDF or Fill Online Servicemember

Web information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on how to file. Ad get ready for tax season deadlines by completing any required tax forms today. You may also upload the. Web the two forms — form 2848, “power of attorney and declaration of representatives,” and form 8821, “tax.

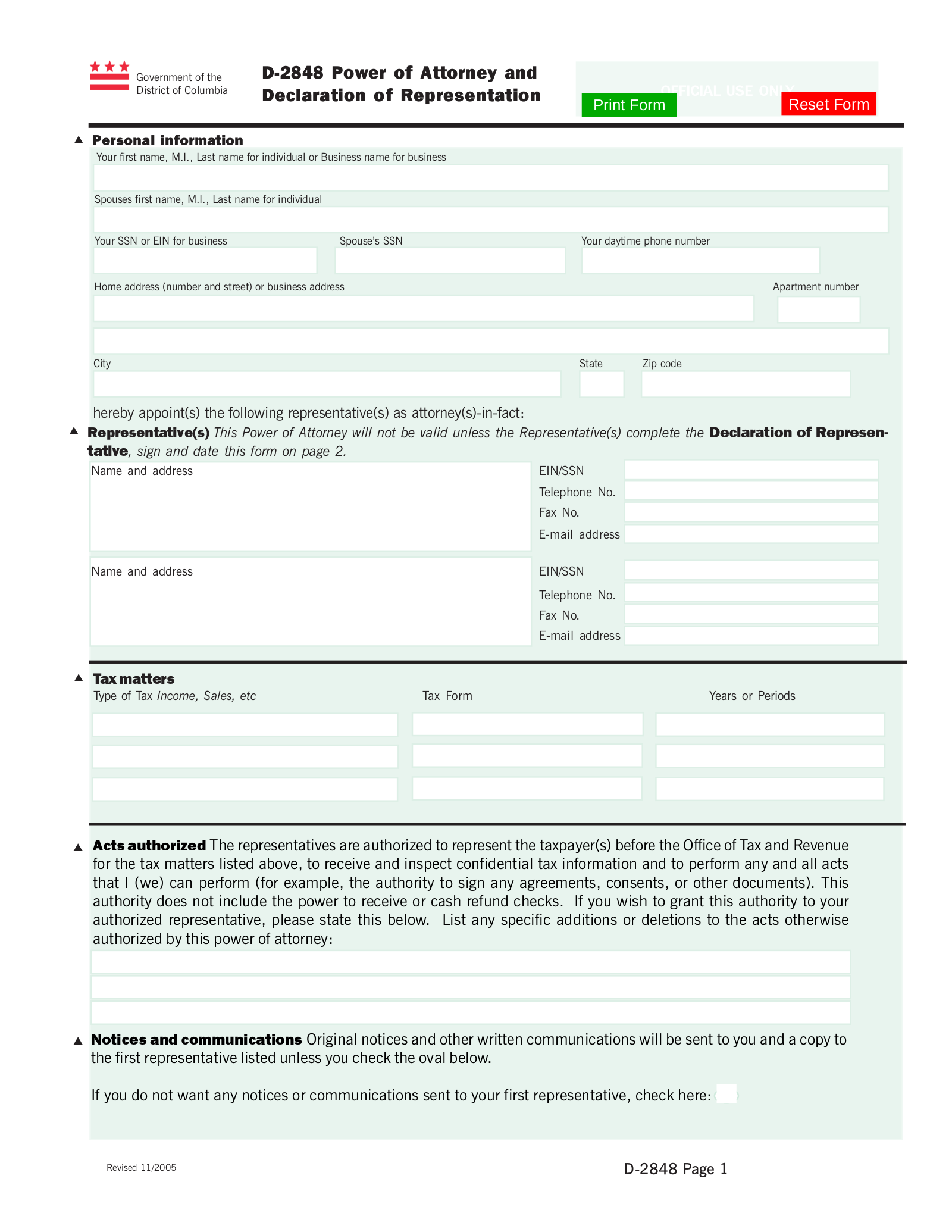

Washington D.C. Tax Power of Attorney (Form D2848) eForms

If you need someone to represent you and discuss your tax problems with the irs,. Web tax professionals can find the new submit forms 2848 and 8821 online on the irs.gov/taxpros page. Web up to $40 cash back 2017 2848 form. Web you will need to have a secure access account to submit your form 2848 online. Get ready for.

IRS Form 2848 Download Fillable PDF or Fill Online Power of Attorney

Web the submit forms 2848 and 8821 online tool is available from the irs.gov/taxpros page. Web file the 2848 form fillable electronically, following the provided guidelines for a seamless submission process. Ad download or email irs 2848 & more fillable forms, register and subscribe now! Ad get ready for tax season deadlines by completing any required tax forms today. Ad.

6 Reasons To File Form 2848 AKA Power Of Attorney Silver Tax Group

Web a form 2848 is also known as a power of attorney and declaration of representative form. Web file the 2848 form fillable electronically, following the provided guidelines for a seamless submission process. All forms individual forms information returns fiduciary. Web irs form 2848 is the power of attorney and declaration of representative form. Here you can submit federal form.

Il 2848 Instructions Fill Online, Printable, Fillable, Blank pdfFiller

You may also upload the. Tax professionals must have a secure access account,. The tax relief center talks about the advantages and disadvantages of filling out and filing federal form 2848 and how you can go through this process. Web a form 2848 is also known as a power of attorney and declaration of representative form. Form 2848 will not.

Purpose of IRS Form 2848 How to fill & Instructions Accounts Confidant

Web a form 2848 is also known as a power of attorney and declaration of representative form. Submit forms 2848 and 8821 online to the irs. It’s just two pages but can be confusing if you’re filling it out for the first time. Remember always to consult trustworthy guidelines or seek. This form will be used in various situations related.

Form 2848 Instructions for IRS Power of Attorney Community Tax

Web tax professionals can find the new submit forms 2848 and 8821 online on the irs.gov/taxpros page. Ad download or email irs 2848 & more fillable forms, register and subscribe now! Remember always to consult trustworthy guidelines or seek. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of.

Web You Can Upload The Irs Form 2848 Online On The Official Site, You Won’t Need To Send It Anywhere.

You may also upload the. Web a form 2848 is also known as a power of attorney and declaration of representative form. Web the two forms — form 2848, “power of attorney and declaration of representatives,” and form 8821, “tax information authorization” — can be submitted. Web you will need to have a secure access account to submit your form 2848 online.

This Form Will Be Used In Various Situations Related To Tax Filing Or Tax Audits.

Here you can submit federal form 2848 as well as all other documents. If you need someone to represent you and discuss your tax problems with the irs,. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form 8821, tax information. Complete, edit or print tax forms instantly.

The Tax Relief Center Talks About The Advantages And Disadvantages Of Filling Out And Filing Federal Form 2848 And How You Can Go Through This Process.

Form 2848 will not be honored for any purpose other than representation before the irs. Remember always to consult trustworthy guidelines or seek. Web tax professionals can find the new submit forms 2848 and 8821 online on the irs.gov/taxpros page. All forms individual forms information returns fiduciary.

Web A Separate Form 2848 Must Be Completed For Each Taxpayer.

Web you can download a form 2848 from irs.gov or access the file in the image below. Web file the 2848 form fillable electronically, following the provided guidelines for a seamless submission process. Get ready for tax season deadlines by completing any required tax forms today. Web up to $40 cash back 2017 2848 form.