File Form 8809 Online

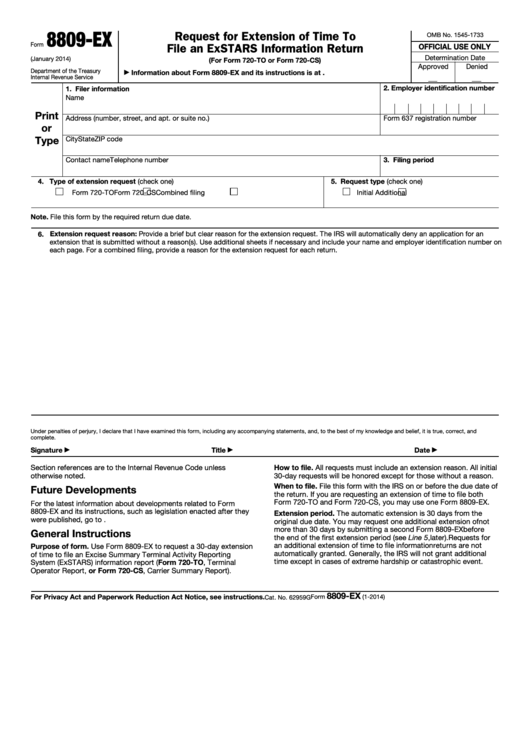

File Form 8809 Online - Web create fire system account (continued) please complete the form below. Web you can usually file form 8809 online or by filling out a paper form and mailing it to the address listed on the form. Ad 1) get access to 500+ legal templates 2) print & download, start free! Irs approved tax1099.com allows you to efile your 8809 with security and ease, all online. Prepare & file prior year taxes fast. After submitting form 8809, an. Web fire production system user options log on create new account learn the basics forgot password you will need a user id and password to begin using this application. But if you are requesting an extension for forms. Web form 8809 application for extension of timeto file information returns (rev. Transmit your form to the irs get started today.

Ad uslegalforms allows users to edit, sign, fill & share all type of documents online. Web is it possible to file form 8809 online? Choose the information tax forms for which you need an extension step 3: You will need to supply the name you intend to use as your user id, and a password. Create, edit, and print your business and legal documents quickly and easily! Irs approved tax1099.com allows you to efile your 8809 with security and ease, all online. If you already requested the automatic extension and you now need an. Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. Don't miss this 50% discount. But if you are requesting an extension for forms.

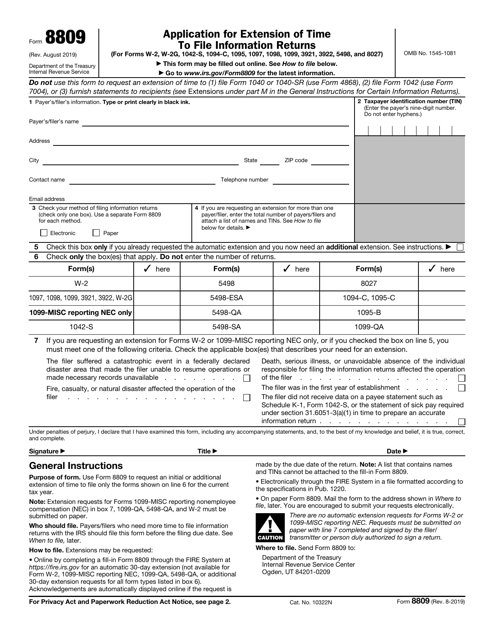

Form 8809 is an extension form that may be filed with the irs for an automatic 30 day extension of a. Web in most cases, you can file form 8809 either online or by filling out a paper form and mailing it to the address on the form. Web form 8809 application for extension of timeto file information returns (rev. Ad always free, always simple, always right. Irs form 8809 is used to apply for. Enter tax payer details step 2: Ad always free, always simple, always right. Web fire production system user options log on create new account learn the basics forgot password you will need a user id and password to begin using this application. September 2017) department of the treasury internal revenue service. Create, edit, and print your business and legal documents quickly and easily!

Form 8809 Edit, Fill, Sign Online Handypdf

Web you can usually file form 8809 online or by filling out a paper form and mailing it to the address listed on the form. Web fire production system user options log on create new account learn the basics forgot password you will need a user id and password to begin using this application. Ad efile form 2290 tax with.

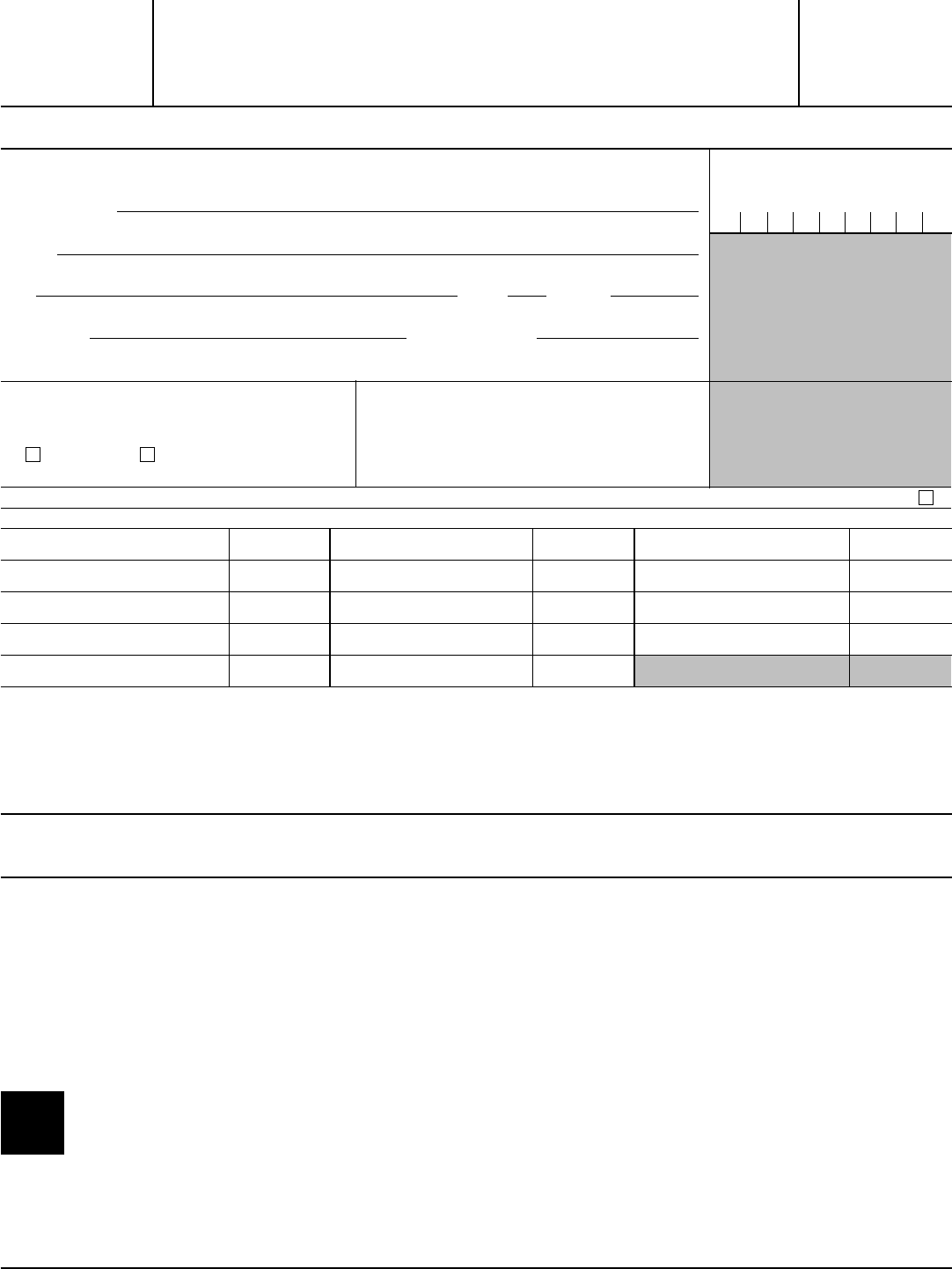

Form 8809 2022 Printable and Fillable PDF Application

Ad always free, always simple, always right. You will need to supply the name you intend to use as your user id, and a password. September 2017) department of the treasury internal revenue service. File your 2290 tax now and receive schedule 1 in minutes. Irs form 8809 is used to apply for.

EFile IRS Form 8809 Extension Form 8809 Online

Web form 8809 is a document that allows taxpayers to request additional time for filing specific information returns such as 1099, w2, or aca forms. Ad always free, always simple, always right. Ad always free, always simple, always right. Complete, edit or print tax forms instantly. Choose the information tax forms for which you need an extension step 3:

EFile 8809 1099/W2/1095 Extension Form 8809 Online

File your 2290 tax now and receive schedule 1 in minutes. Transmit your form to the irs get started today. You will need to supply the name you intend to use as your user id, and a password. Irs approved tax1099.com allows you to efile your 8809 with security and ease, all online. Who should file filers who need more.

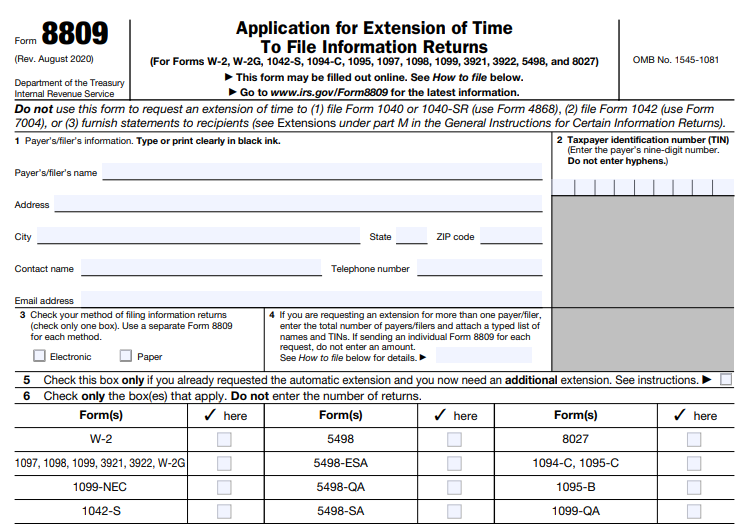

Fillable Form 8809Ex Request For Extension Of Time To File An

Web form 8809 application for extension of timeto file information returns (rev. Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. September 2017) department of the treasury internal revenue service. After submitting form 8809, an. File your 2290 tax now and receive schedule 1 in minutes.

Need a Filing Extension for W2s and 1099s? File Form 8809

Totally free federal filing, 4.8 star rating, user friendly. Ad always free, always simple, always right. Totally free federal filing, 4.8 star rating, user friendly. Web form 8809 is a document that allows taxpayers to request additional time for filing specific information returns such as 1099, w2, or aca forms. Web fire production system user options log on create new.

IRS Form 8809 Download Fillable PDF or Fill Online Application for

Transmit your form to the irs get started today. Choose the information tax forms for which you need an extension step 3: Web in most cases, you can file form 8809 either online or by filling out a paper form and mailing it to the address on the form. Ad efile form 2290 tax with ez2290 & get schedule 1.

Efile IRS Form 8809 Extension for 2020 Form 8809 Online

Important dates efile info pricing fee calculator Ad always free, always simple, always right. You will need to supply the name you intend to use as your user id, and a password. Totally free federal filing, 4.8 star rating, user friendly. Web form 8809 is a document that allows taxpayers to request additional time for filing specific information returns such.

Need a Filing Extension for W2s and 1099s? File Form 8809

Totally free federal filing, 4.8 star rating, user friendly. Web form 8809 is a document that allows taxpayers to request additional time for filing specific information returns such as 1099, w2, or aca forms. Don't miss this 50% discount. File your 2290 tax now and receive schedule 1 in minutes. Complete, edit or print tax forms instantly.

Form 8809 Application for Extension of Time to File Information

Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. Web form 8809 is a document that allows taxpayers to request additional time for filing specific information returns such as 1099, w2, or aca forms. Web form 8809 application for extension of timeto file information returns (rev. Form 8809 is an extension form that may be filed.

Choose The Information Tax Forms For Which You Need An Extension Step 3:

Totally free federal filing, 4.8 star rating, user friendly. Don't miss this 50% discount. File your 2290 tax now and receive schedule 1 in minutes. After submitting form 8809, an.

You Will Need To Supply The Name You Intend To Use As Your User Id, And A Password.

Web are you looking for where to file 8809 online? Important dates efile info pricing fee calculator Prepare & file prior year taxes fast. Ad 1) get access to 500+ legal templates 2) print & download, start free!

Create, Edit, And Print Your Business And Legal Documents Quickly And Easily!

Web you can usually file form 8809 online or by filling out a paper form and mailing it to the address listed on the form. Web form 8809 application for extension of timeto file information returns (rev. Web check your method of filing form 8966. Enter tax payer details step 2:

Who Should File Filers Who Need More Time To File.

Web form 8809 is a document that allows taxpayers to request additional time for filing specific information returns such as 1099, w2, or aca forms. Irs form 8809 is used to apply for. Transmit your form to the irs get started today. Ad always free, always simple, always right.