Filing Chapter 13 After 7

Filing Chapter 13 After 7 - Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Web a chapter 13 bankruptcy case is a debt reorganization. A chapter 7 case will end your obligation to pay a chapter 13 plan. Compare top 5 consolidation options. Web yes, converting chapter 13 to a chapter 7 is something debtors need to do on occasion. See if you qualify to save monthly on your debt. Ad don't file for bankruptcy. When you file under chapter 13, you propose a repayment plan. Web read on to learn about filing a chapter 13 after receiving a chapter 7 discharge—the order that eliminates qualifying debt—and. Web pros of switching to chapter 7.

Web typically, you can file a chapter 7 bankruptcy six years after the filing date of your chapter 13. Web after initially filing for bankruptcy under chapter 13, a debtor might decide that they need to file under chapter 7 instead. Web a chapter 13 bankruptcy case is a debt reorganization. Ad don't file for bankruptcy. After the conversion of a case, your date of filing remains the. When you file under chapter 13, you propose a repayment plan. Ad don't file for bankruptcy. Web partnerships and corporations file bankruptcy under chapter 7 or chapter 11 of the bankruptcy code. Compare top 5 consolidation options. See if you qualify to save monthly on your debt.

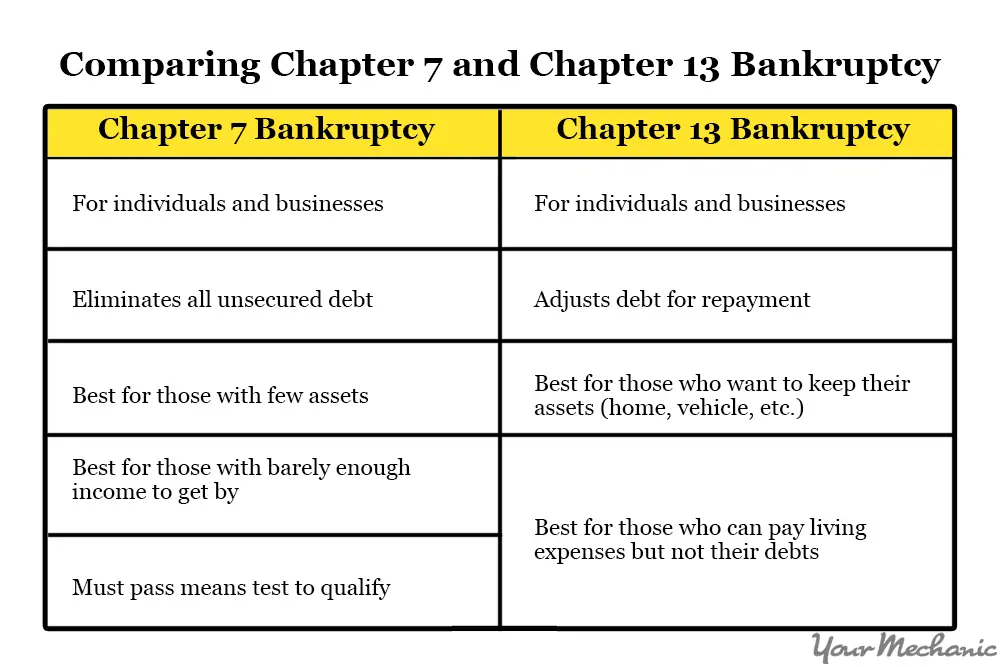

Web the biggest differences between chapter 7 and chapter 13 bankruptcy are what happens to your property and who qualifies. Compare top 5 consolidation options. Ad don't file for bankruptcy. Consolidate your debt to save with one lower monthly payment. Perhaps most significantly, chapter 13. See if you qualify to save monthly on your debt. After the conversion of a case, your date of filing remains the. Web partnerships and corporations file bankruptcy under chapter 7 or chapter 11 of the bankruptcy code. But you might not qualify, or it might not. 14, 2023 5:47 pm et | wsj pro.

Can I Keep My Tax Refund After Filing Chapter 7? Cibik Law

Compare top 5 consolidation options. Web after initially filing for bankruptcy under chapter 13, a debtor might decide that they need to file under chapter 7 instead. Web a list of some new chapter 11 bankruptcy filings made during the last week. Web yes, converting chapter 13 to a chapter 7 is something debtors need to do on occasion. See.

Can You Sell Your House After Filing Chapter 7 Bankruptcy In Virginia?

Consolidate your debt to save with one lower monthly payment. Consolidate your debt to save with one lower monthly payment. Web the biggest differences between chapter 7 and chapter 13 bankruptcy are what happens to your property and who qualifies. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13..

6 Things That Happen After Filing Chapter 7 Bankruptcy Sasser Law Firm

Web after you file a chapter 7 bankruptcy, you are cannot file another chapter 7 bankruptcy for 8 years however, you can always still. Ad don't file for bankruptcy. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Ad don't file for bankruptcy. When you file under chapter 13,.

How To File Bankruptcy Chapter 13

Consolidate your debt to save with one lower monthly payment. Compare top 5 consolidation options. Web can i file a chapter 7 after chapter 13? Web question how long after filing for chapter 7 bankruptcy can you file for chapter 13? Web under section 1307 (a) of the bankruptcy code, debtors may generally convert to chapter 7 from chapter 13.

Pros And Cons Of Filing Chapter 13 Bankruptcy Chris Mudd & Associates

Web partnerships and corporations file bankruptcy under chapter 7 or chapter 11 of the bankruptcy code. But you might not qualify, or it might not. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Compare top 5 consolidation options. 14, 2023 5:47 pm et | wsj pro.

designshrew How To File Chapter 7 In Missouri

Compare top 5 consolidation options. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Web the biggest differences between chapter 7 and chapter 13 bankruptcy are what happens to your property and who qualifies. See if you qualify to save monthly on your debt. Compare top 5 consolidation options.

Chapter 13 Bankruptcy Explained Step By Step

When you file under chapter 13, you propose a repayment plan. Web partnerships and corporations file bankruptcy under chapter 7 or chapter 11 of the bankruptcy code. Web the biggest differences between chapter 7 and chapter 13 bankruptcy are what happens to your property and who qualifies. Consolidate your debt to save with one lower monthly payment. Web chapter 13.

Breaking a Lease After Filing For Chapter 7 Bankruptcy

Web a list of some new chapter 11 bankruptcy filings made during the last week. Web yes, converting chapter 13 to a chapter 7 is something debtors need to do on occasion. Compare top 5 consolidation options. Web after you file a chapter 7 bankruptcy, you are cannot file another chapter 7 bankruptcy for 8 years however, you can always.

Filing for Chapter 7 and Chapter 13 Bankruptcy in Alabama Bouloukos

But you might not qualify, or it might not. Web a chapter 13 bankruptcy case is a debt reorganization. Answer if you receive a discharge in a. After the conversion of a case, your date of filing remains the. Compare top 5 consolidation options.

What Happens When You File For Bankruptcy In Pa

Web a chapter 7 bankruptcy will remain on your credit report for up to 10 years, while a chapter 13 will remain for. Web what happens after a case is converted to chapter 7? Consolidate your debt to save with one lower monthly payment. Web can i file a chapter 7 after chapter 13? Web read on to learn about.

Web A Chapter 13 Bankruptcy Case Is A Debt Reorganization.

Web yes, you can file chapter 7 or chapter 13 bankruptcy if your previous chapter 13 was in january of 2003. Web partnerships and corporations file bankruptcy under chapter 7 or chapter 11 of the bankruptcy code. Web the biggest differences between chapter 7 and chapter 13 bankruptcy are what happens to your property and who qualifies. See if you qualify to save monthly on your debt.

Web What Happens After A Case Is Converted To Chapter 7?

Web can i file a chapter 7 after chapter 13? Web read on to learn about filing a chapter 13 after receiving a chapter 7 discharge—the order that eliminates qualifying debt—and. Web typically, you can file a chapter 7 bankruptcy six years after the filing date of your chapter 13. That time frame can be.

Consolidate Your Debt To Save With One Lower Monthly Payment.

Web a chapter 7 bankruptcy will remain on your credit report for up to 10 years, while a chapter 13 will remain for. When you file under chapter 13, you propose a repayment plan. But you might not qualify, or it might not. Web pros of switching to chapter 7.

See If You Qualify To Save Monthly On Your Debt.

Web a list of some new chapter 11 bankruptcy filings made during the last week. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Web under section 1307 (a) of the bankruptcy code, debtors may generally convert to chapter 7 from chapter 13 at. After the conversion of a case, your date of filing remains the.