Filing Form 1310

Filing Form 1310 - Web we last updated the statement of person claiming refund due a deceased taxpayer in january 2023, so this is the latest version of form 1310, fully updated for tax year 2022. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Web this information includes name, address, and the social security number of the person who is filing the tax return. Ad access irs tax forms. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. The person claiming the refund must equal. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web file form 1310 to claim the refund on mr. However, you must attach to his return a copy of the court certificate showing your appointment.

Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Web generally, a person who is filing a return for a decedent and claiming a refund must file form 1310 statement of person claiming refund due a deceased taxpayer with the. For form 1310 to be generated, the date of death field on screen 1 must be entered to indicate the. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Web we last updated the statement of person claiming refund due a deceased taxpayer in january 2023, so this is the latest version of form 1310, fully updated for tax year 2022. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web file form 1310 to claim the refund on mr. Web overview you must file a tax return for an individual who died during the tax year if:

However, you must attach to his return a copy of the court certificate showing your appointment. Who must file if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless. Web irs form 1310, statement of person claiming refund due a deceased taxpayer, is used to inform the irs that a taxpayer has passed away and a trust or beneficiary will be. Ad access irs tax forms. Then you have to provide all other required information in the. Complete, edit or print tax forms instantly. Ad access irs tax forms. Web generally, a person who is filing a return for a decedent and claiming a refund must file form 1310 statement of person claiming refund due a deceased taxpayer with the. If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of. Download or email irs 1310 & more fillable forms, register and subscribe now!

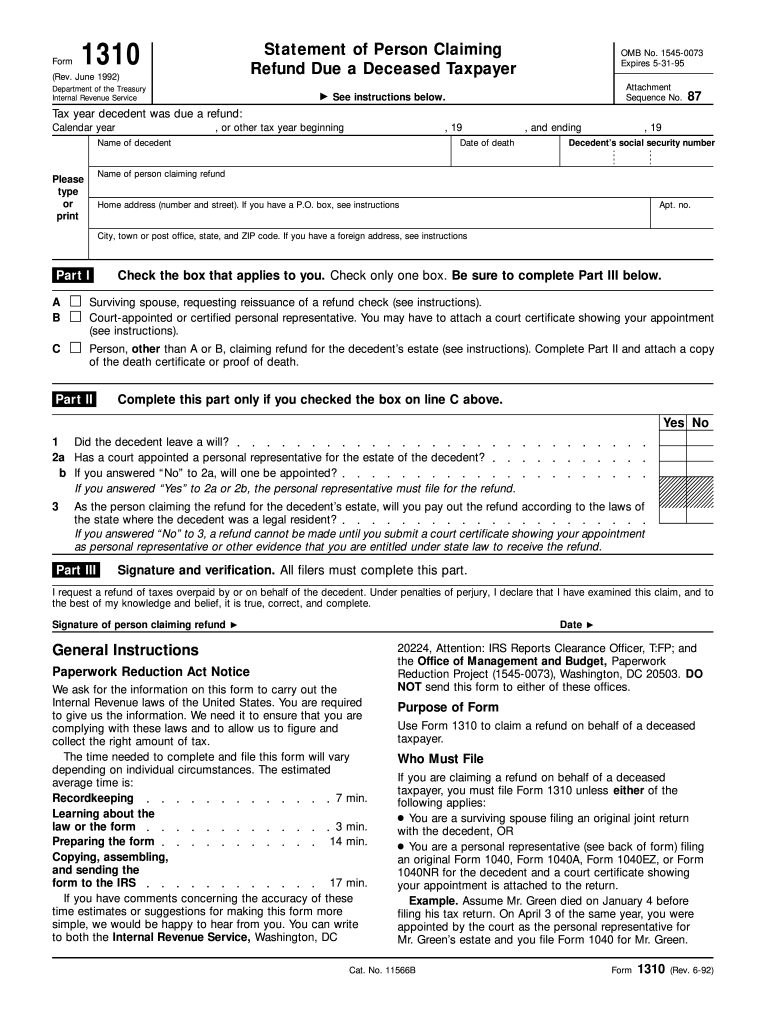

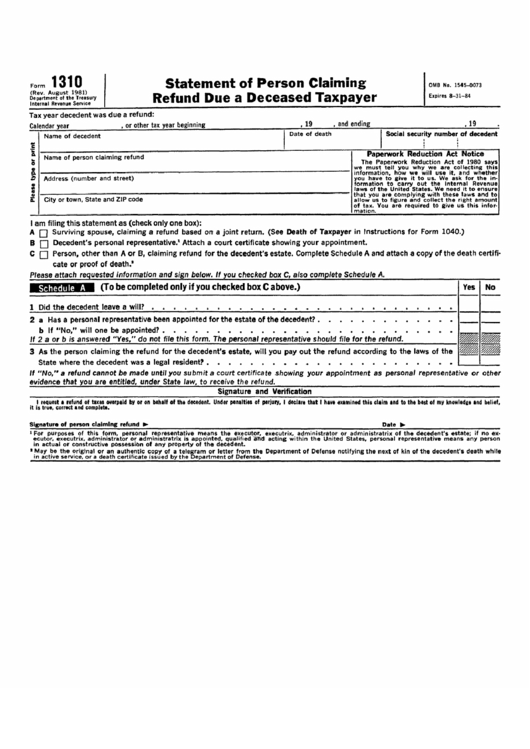

1992 Form IRS 1310 Fill Online, Printable, Fillable, Blank pdfFiller

Get ready for tax season deadlines by completing any required tax forms today. For form 1310 to be generated, the date of death field on screen 1 must be entered to indicate the. Web this information includes name, address, and the social security number of the person who is filing the tax return. Web use form 1310 to claim a.

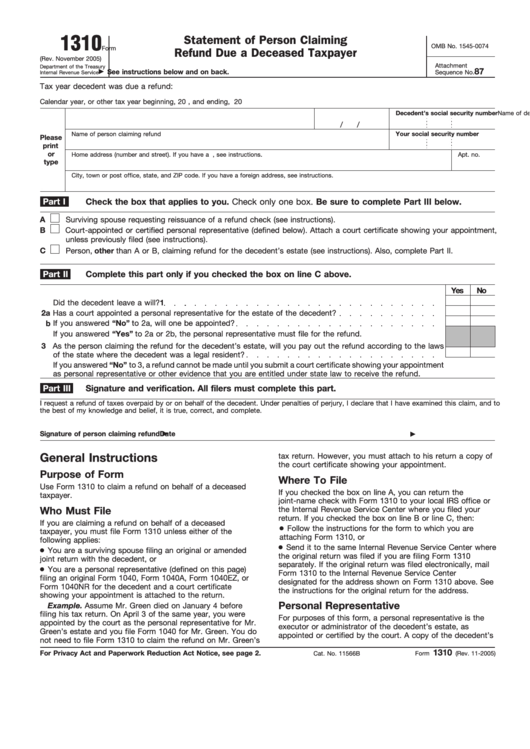

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased

Web this information includes name, address, and the social security number of the person who is filing the tax return. Complete, edit or print tax forms instantly. In today’s post, i’ll answer some common questions about requesting a tax refund. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge.

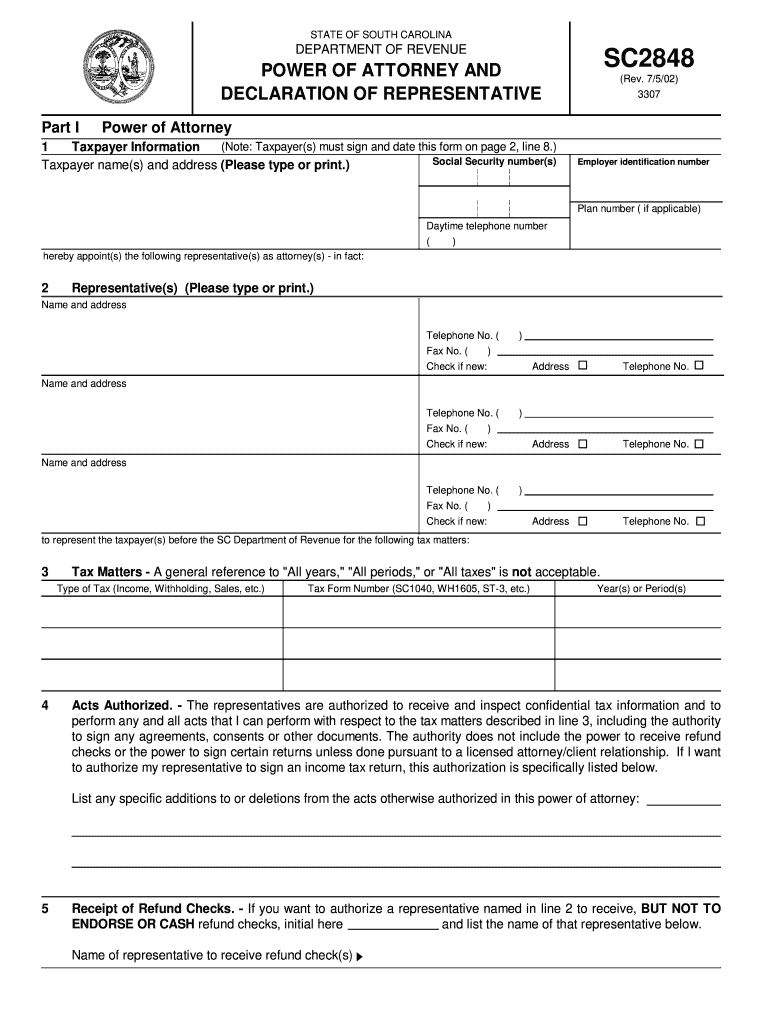

SC DoR SC2848 2002 Fill out Tax Template Online US Legal Forms

Web in order to claim a federal tax refund for a deceased person, you may need to file form 1310. Web we last updated the statement of person claiming refund due a deceased taxpayer in january 2023, so this is the latest version of form 1310, fully updated for tax year 2022. Web this information includes name, address, and the.

Form 990 N E Filing Receipt Irs Status Accepted Forms NjkxMQ

Who must file if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless. You are a surviving spouse filing an original or. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Ad access irs tax forms. Web in order to claim a federal tax refund for a.

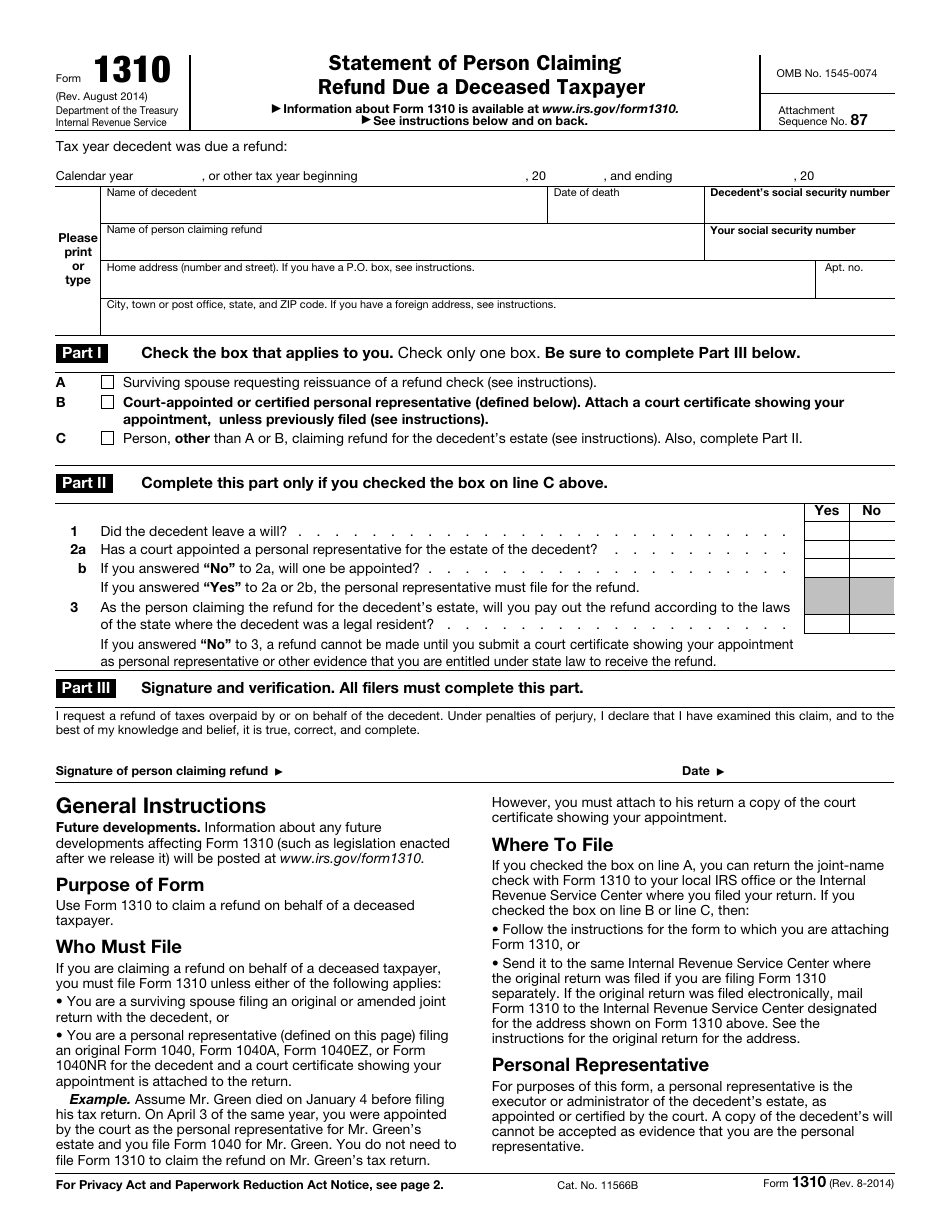

IRS Form 1310 Download Fillable PDF or Fill Online Statement of Person

You are a surviving spouse filing an original or. Web this information includes name, address, and the social security number of the person who is filing the tax return. Web use this screen to complete form 1310 and claim a refund on behalf of a deceased taxpayer. However, you must attach to his return a copy of the court certificate.

Filing A 1099 Form Form Resume Examples q78Qn291g9

Web irs form 1310, statement of person claiming refund due a deceased taxpayer, is used to inform the irs that a taxpayer has passed away and a trust or beneficiary will be. In addition to completing this screen, the return must have the following in. The person claiming the refund must equal. Web overview you must file a tax return.

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer

Web we last updated the statement of person claiming refund due a deceased taxpayer in january 2023, so this is the latest version of form 1310, fully updated for tax year 2022. However, you must attach to his return a copy of the court certificate showing your appointment. Complete, edit or print tax forms instantly. Web use form 1310 to.

Form 1310 Major Errors Intuit Accountants Community

You are a surviving spouse filing an original or. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to. Ad access irs tax forms. Ad access irs tax forms.

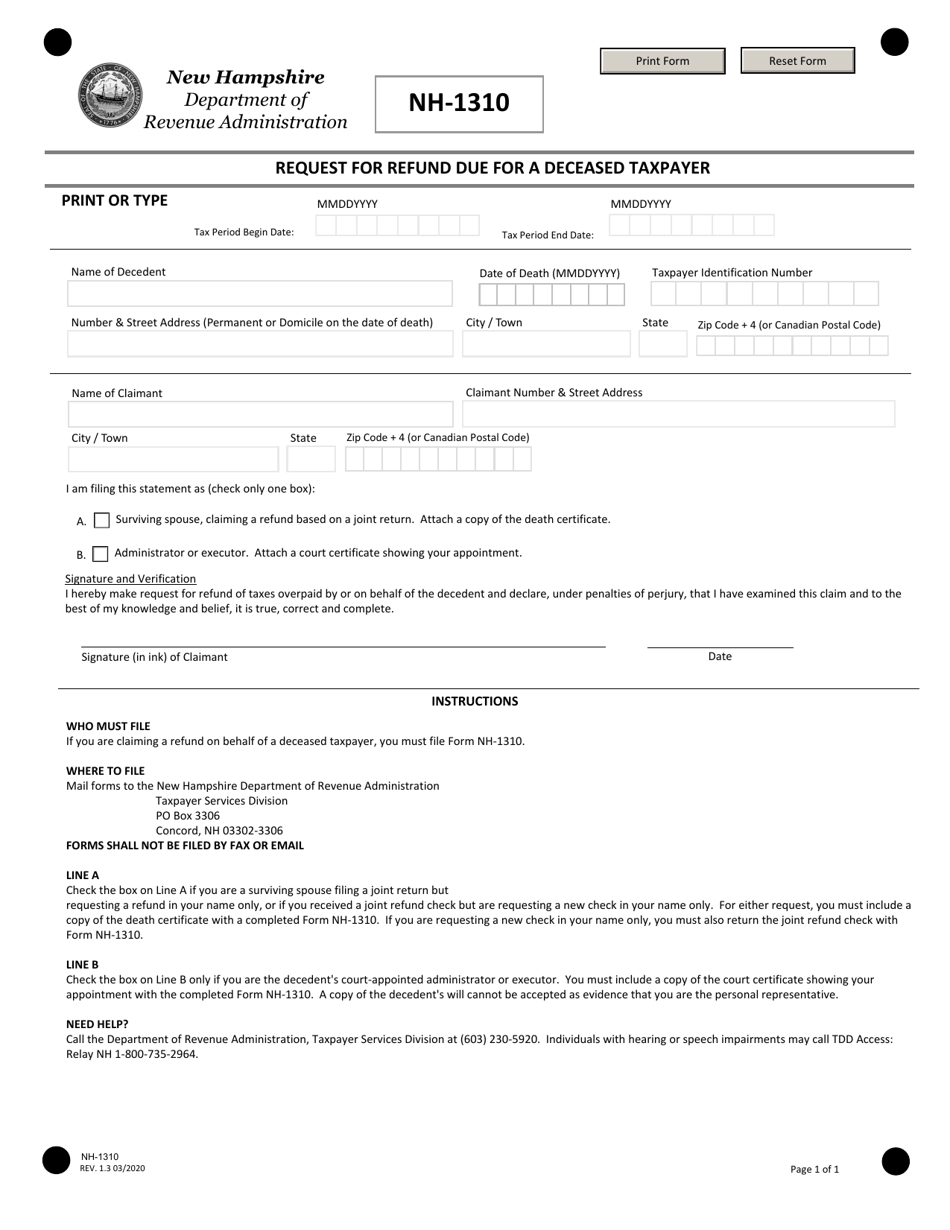

Form NH1310 Download Fillable PDF or Fill Online Request for Refund

Web use this screen to complete form 1310 and claim a refund on behalf of a deceased taxpayer. Web we last updated the statement of person claiming refund due a deceased taxpayer in january 2023, so this is the latest version of form 1310, fully updated for tax year 2022. Web this information includes name, address, and the social security.

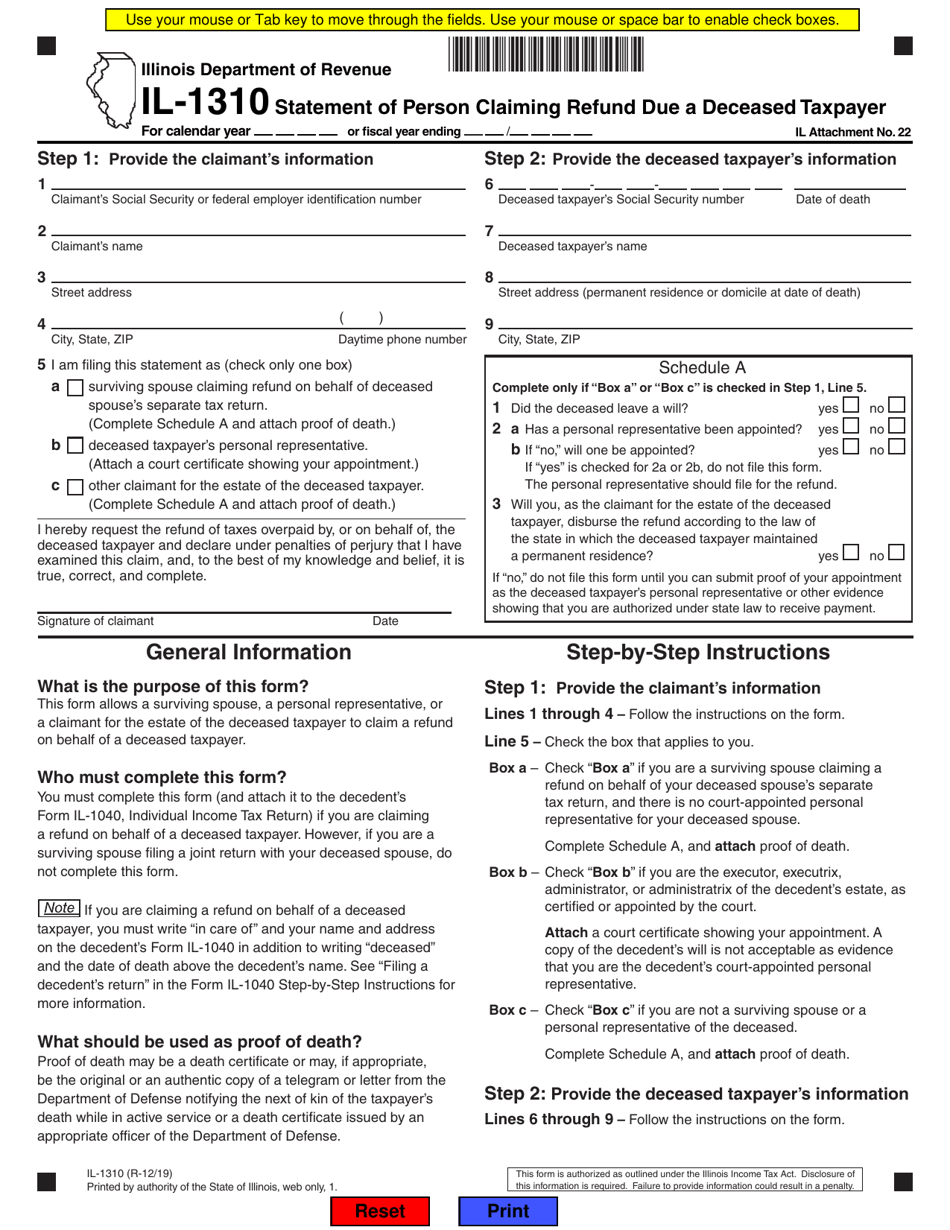

Form IL1310 Download Fillable PDF or Fill Online Statement of Person

Ad access irs tax forms. If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of. In addition to completing this screen, the return must have the following in. Web generally, a person who is filing a return for a decedent and claiming a refund must file form 1310 statement of.

Complete, Edit Or Print Tax Forms Instantly.

Then you have to provide all other required information in the. Complete, edit or print tax forms instantly. Web file form 1310 to claim the refund on mr. Web overview you must file a tax return for an individual who died during the tax year if:

Download Or Email Irs 1310 & More Fillable Forms, Register And Subscribe Now!

Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Web generally, a person who is filing a return for a decedent and claiming a refund must file form 1310 statement of person claiming refund due a deceased taxpayer with the. Complete, edit or print tax forms instantly.

Who Must File If You Are Claiming A Refund On Behalf Of A Deceased Taxpayer, You Must File Form 1310 Unless.

The person claiming the refund must equal. You are a surviving spouse filing an original or. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Web if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies:

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

However, you must attach to his return a copy of the court certificate showing your appointment. Web use this screen to complete form 1310 and claim a refund on behalf of a deceased taxpayer. Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to. Ad access irs tax forms.