Fillable Form 1099 Nec

Fillable Form 1099 Nec - Submit up to 100 records per upload with csv templates. You can complete the form using irs free file or a tax filing software. For privacy act and paperwork reduction act notice, see the 2020 general instructions for certain information returns. Simple, and easy to use no software downloads or installation required. January 2022) miscellaneous information and nonemployee compensation section references are to the internal revenue code unless otherwise noted. Web iris is a free service that lets you: Current general instructions for certain information returns. Web $ city or town, state or province, country, and zip or foreign postal code withheld copy a for internal revenue service center file with form 1096. Web nonqualified deferred compensation ( box 15 ). Account number (see instructions) 2nd tin not.

A version of the form is downloadable and a fillable online pdf format is available on the irs website. Web iris is a free service that lets you: For privacy act and paperwork reduction act notice, see the 2020 general instructions for certain information returns. Submit up to 100 records per upload with csv templates. Web nonqualified deferred compensation ( box 15 ). For internal revenue service center. Examples of this include freelance work or driving for doordash or uber. January 2022) miscellaneous information and nonemployee compensation section references are to the internal revenue code unless otherwise noted. Simple, and easy to use no software downloads or installation required. You can complete the form using irs free file or a tax filing software.

Simple, and easy to use no software downloads or installation required. Account number (see instructions) 2nd tin not. Examples of this include freelance work or driving for doordash or uber. Web nonqualified deferred compensation ( box 15 ). Web $ city or town, state or province, country, and zip or foreign postal code withheld copy a for internal revenue service center file with form 1096. January 2022) miscellaneous information and nonemployee compensation section references are to the internal revenue code unless otherwise noted. A version of the form is downloadable and a fillable online pdf format is available on the irs website. For privacy act and paperwork reduction act notice, see the 2020 general instructions for certain information returns. You can complete the form using irs free file or a tax filing software. For internal revenue service center.

1099 Tax Form Fill Online, Printable, Fillable, Blank pdfFiller

Web iris is a free service that lets you: Submit up to 100 records per upload with csv templates. A version of the form is downloadable and a fillable online pdf format is available on the irs website. For internal revenue service center. For privacy act and paperwork reduction act notice, see the 2020 general instructions for certain information returns.

What the 1099NEC Coming Back Means for your Business Chortek

A version of the form is downloadable and a fillable online pdf format is available on the irs website. Submit up to 100 records per upload with csv templates. January 2022) miscellaneous information and nonemployee compensation section references are to the internal revenue code unless otherwise noted. Account number (see instructions) 2nd tin not. For privacy act and paperwork reduction.

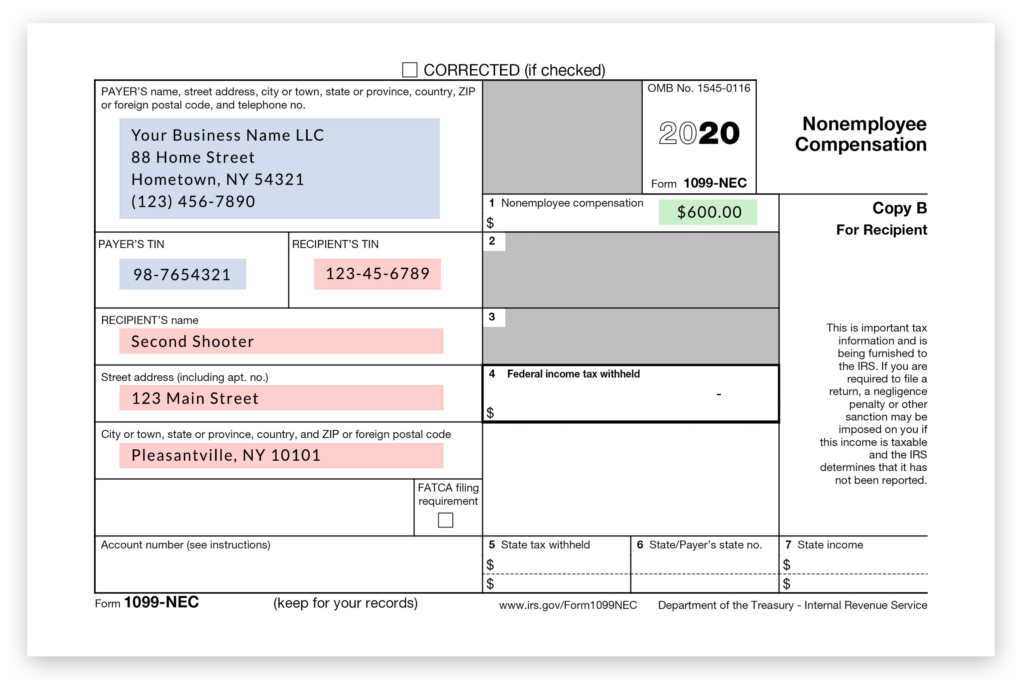

The New 1099NEC IRS Form for Second Shooters & Independent Contractors

January 2022) miscellaneous information and nonemployee compensation section references are to the internal revenue code unless otherwise noted. Examples of this include freelance work or driving for doordash or uber. Web nonqualified deferred compensation ( box 15 ). Current general instructions for certain information returns. Simple, and easy to use no software downloads or installation required.

Form1099NEC

January 2022) miscellaneous information and nonemployee compensation section references are to the internal revenue code unless otherwise noted. Current general instructions for certain information returns. For privacy act and paperwork reduction act notice, see the 2020 general instructions for certain information returns. Web iris is a free service that lets you: Web $ city or town, state or province, country,.

Form 1099NEC Requirements, Deadlines, and Penalties eFile360

Account number (see instructions) 2nd tin not. Current general instructions for certain information returns. Web iris is a free service that lets you: Examples of this include freelance work or driving for doordash or uber. For internal revenue service center.

Fillable Form 1099 Nec Form Resume Examples o7Y3LqkVBN

Current general instructions for certain information returns. You can complete the form using irs free file or a tax filing software. For privacy act and paperwork reduction act notice, see the 2020 general instructions for certain information returns. Account number (see instructions) 2nd tin not. January 2022) miscellaneous information and nonemployee compensation section references are to the internal revenue code.

1099NEC Form Print Template for Word or PDF 1096 Transmittal Etsy

Current general instructions for certain information returns. For internal revenue service center. Web iris is a free service that lets you: A version of the form is downloadable and a fillable online pdf format is available on the irs website. Examples of this include freelance work or driving for doordash or uber.

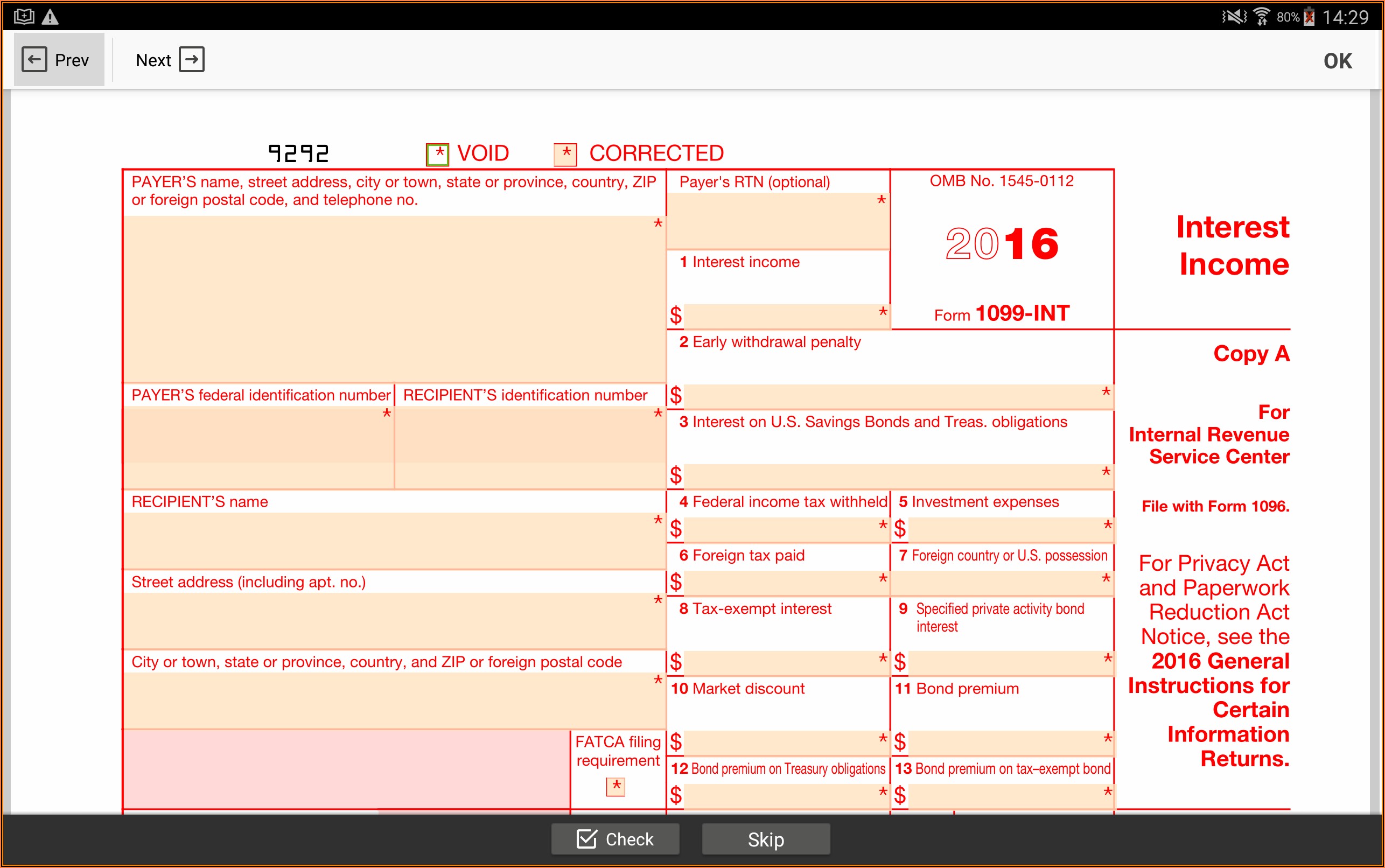

Fillable Form 1099 Int Form Resume Examples A19XKw324k

For privacy act and paperwork reduction act notice, see the 2020 general instructions for certain information returns. Web iris is a free service that lets you: Web $ city or town, state or province, country, and zip or foreign postal code withheld copy a for internal revenue service center file with form 1096. For internal revenue service center. Web nonqualified.

Fillable 1099nec 2022 Fillable Form 2022

Account number (see instructions) 2nd tin not. You can complete the form using irs free file or a tax filing software. For internal revenue service center. A version of the form is downloadable and a fillable online pdf format is available on the irs website. January 2022) miscellaneous information and nonemployee compensation section references are to the internal revenue code.

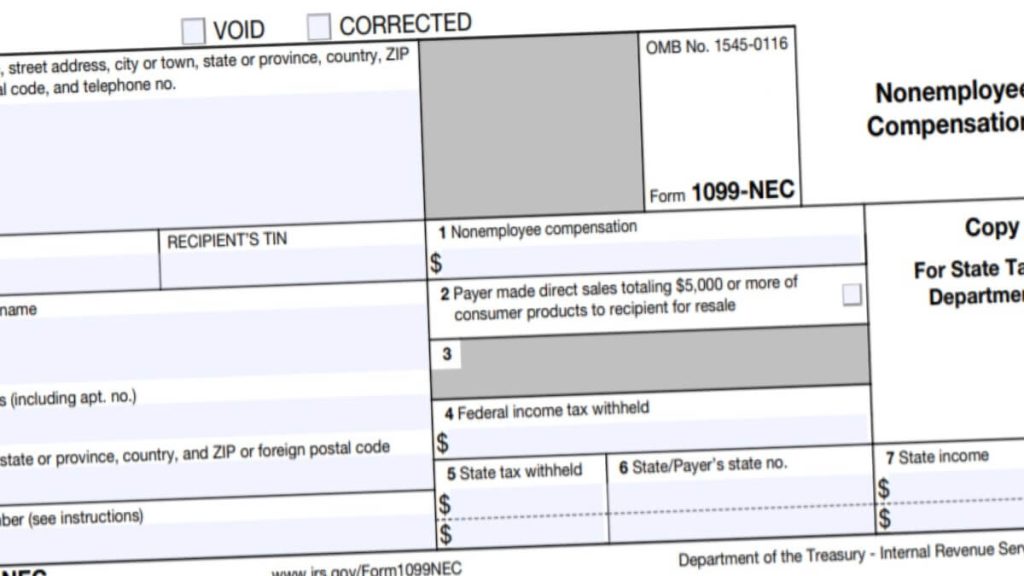

Form 1099NEC Instructions and Tax Reporting Guide

You can complete the form using irs free file or a tax filing software. Account number (see instructions) 2nd tin not. For privacy act and paperwork reduction act notice, see the 2020 general instructions for certain information returns. Web nonqualified deferred compensation ( box 15 ). Examples of this include freelance work or driving for doordash or uber.

Web Iris Is A Free Service That Lets You:

Web nonqualified deferred compensation ( box 15 ). Web $ city or town, state or province, country, and zip or foreign postal code withheld copy a for internal revenue service center file with form 1096. For privacy act and paperwork reduction act notice, see the 2020 general instructions for certain information returns. Account number (see instructions) 2nd tin not.

You Can Complete The Form Using Irs Free File Or A Tax Filing Software.

A version of the form is downloadable and a fillable online pdf format is available on the irs website. For internal revenue service center. Simple, and easy to use no software downloads or installation required. Submit up to 100 records per upload with csv templates.

January 2022) Miscellaneous Information And Nonemployee Compensation Section References Are To The Internal Revenue Code Unless Otherwise Noted.

Current general instructions for certain information returns. Examples of this include freelance work or driving for doordash or uber.