Fillable Form 2553

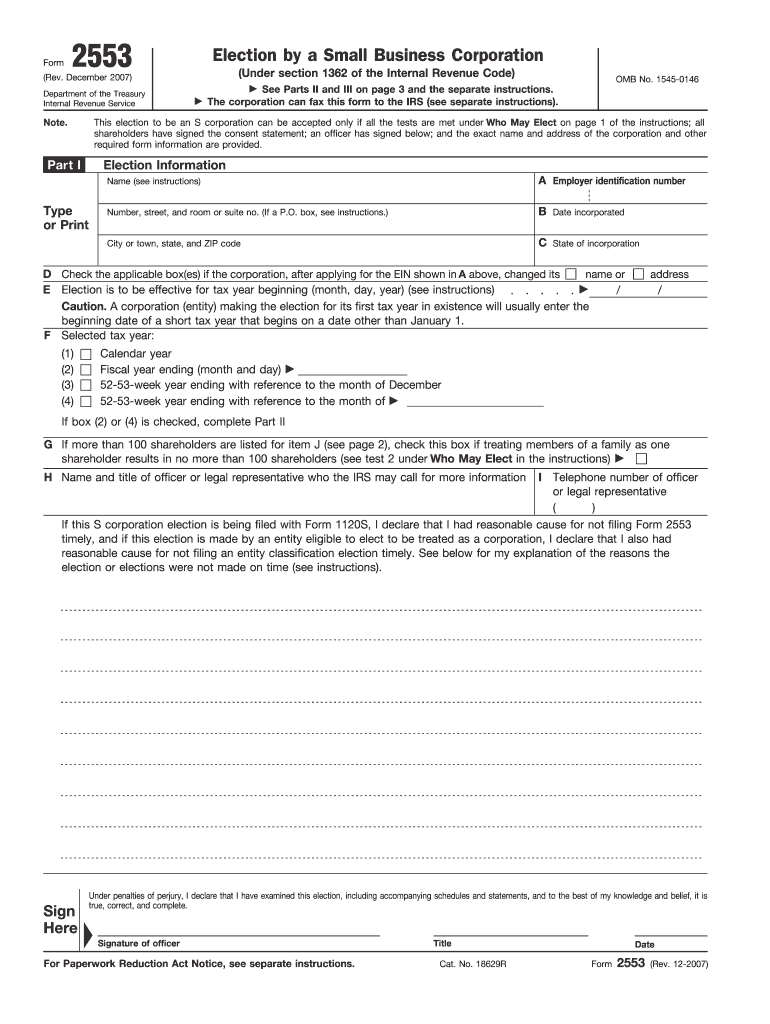

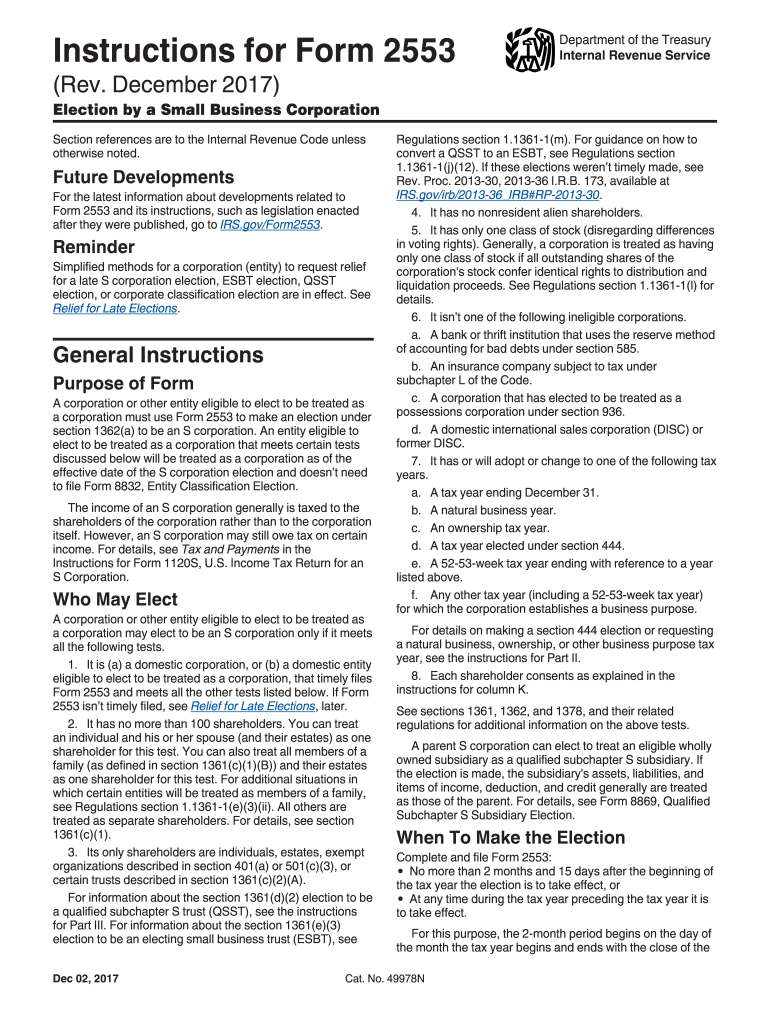

Fillable Form 2553 - Ad form 2553, get ready for tax deadlines by filling online any tax form for free. Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Download or email irs 2553 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Ad access irs tax forms. Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests listed. Selection of fiscal tax year;. Web like most irs forms, the first fillable page of form 2553 is meant to identify and learn more about your organization. It must be filed when an entity wishes to elect “s” corporation status under the internal revenue code.

Form 2553 must be filed before the 16th day of the third month of the corporation's tax year, or before the 15th day of the second. December 2017) department of the treasury internal revenue service. Web a corporation can file form 2553 to elect “s” corporation (also known as an “s corp” or “subchapter s corporation”) federal tax classification with the irs. Election information and employer identification number; Ad access irs tax forms. Web so if you want your business to be taxed as an s corportion (s corp), you’ll have to fill out the internal revenue service’s (irs) form 2553 you can make this. The form consists of several parts requiring the following information: Download, print or email irs 2553 tax form on pdffiller for free. There is no filing fee associated with this. Election by a small business corporation (under section 1362 of the internal revenue.

Web form 2553 is an irs form. Ad form 2553, get ready for tax deadlines by filling online any tax form for free. Download, print or email irs 2553 tax form on pdffiller for free. Web by filing form 2553 with the irs (instructions below) you are simply changing the default tax classification of the llc (from either sole proprietorship or. Selection of fiscal tax year;. Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests listed. Form 2553 must be filed before the 16th day of the third month of the corporation's tax year, or before the 15th day of the second. Election by a small business corporation (under section 1362 of the internal revenue. To complete this form, you’ll need the following. It must be filed when an entity wishes to elect “s” corporation status under the internal revenue code.

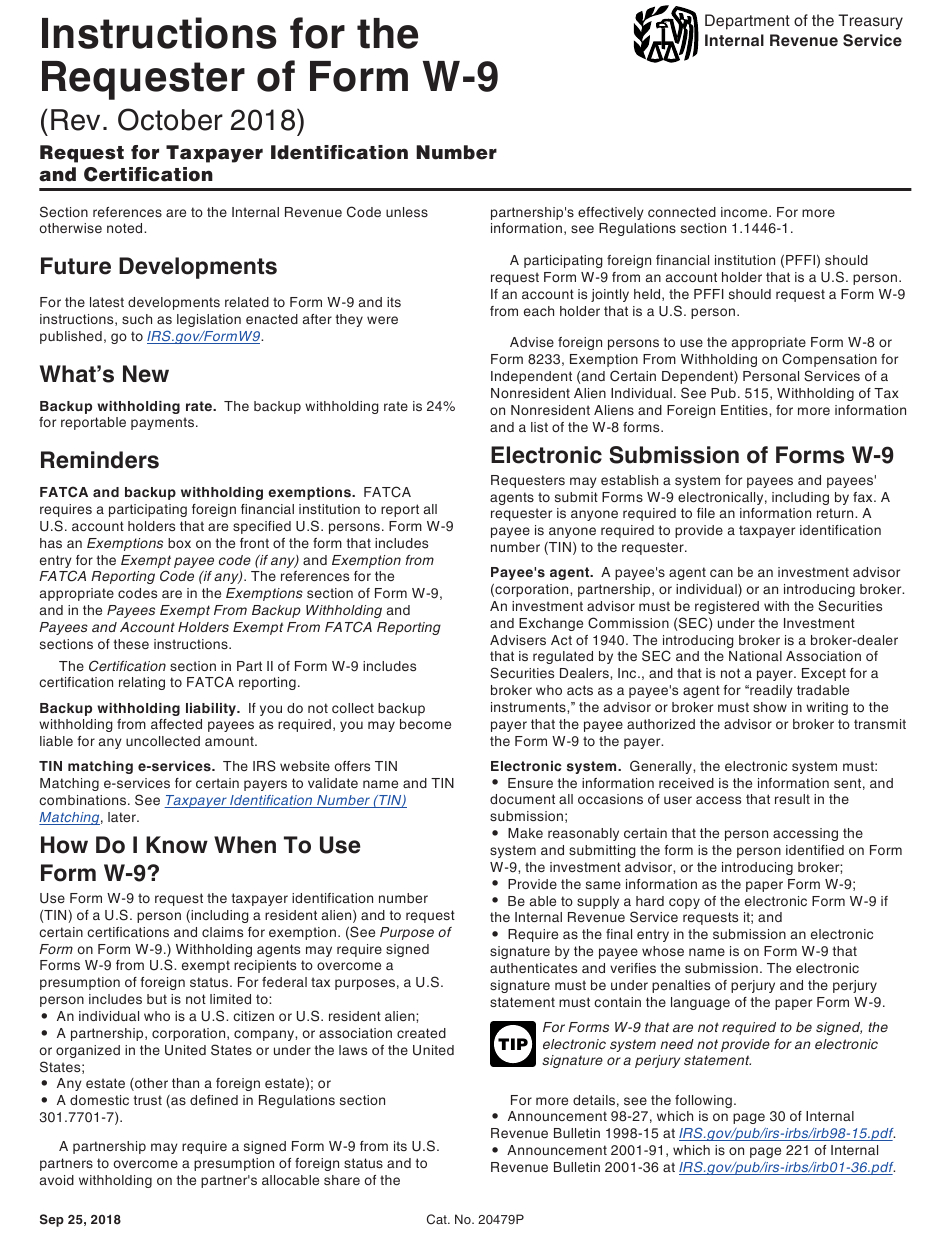

Free W 9 Form 2021 Printable Pdf Example Calendar Printable

Web requirements for filing form 2553. Ad fill, sign, email irs 2553 & more fillable forms, try for free now! Web filling out irs 2553. Download or email irs 2553 & more fillable forms, register and subscribe now! Web form 2553 is an irs form.

IRS Form 2553 Instructions How to Fill Out Form 2553 Excel Capital

The form consists of several parts requiring the following information: Download or email irs 2553 & more fillable forms, register and subscribe now! Web filling out irs 2553. There is no filing fee associated with this. Web like most irs forms, the first fillable page of form 2553 is meant to identify and learn more about your organization.

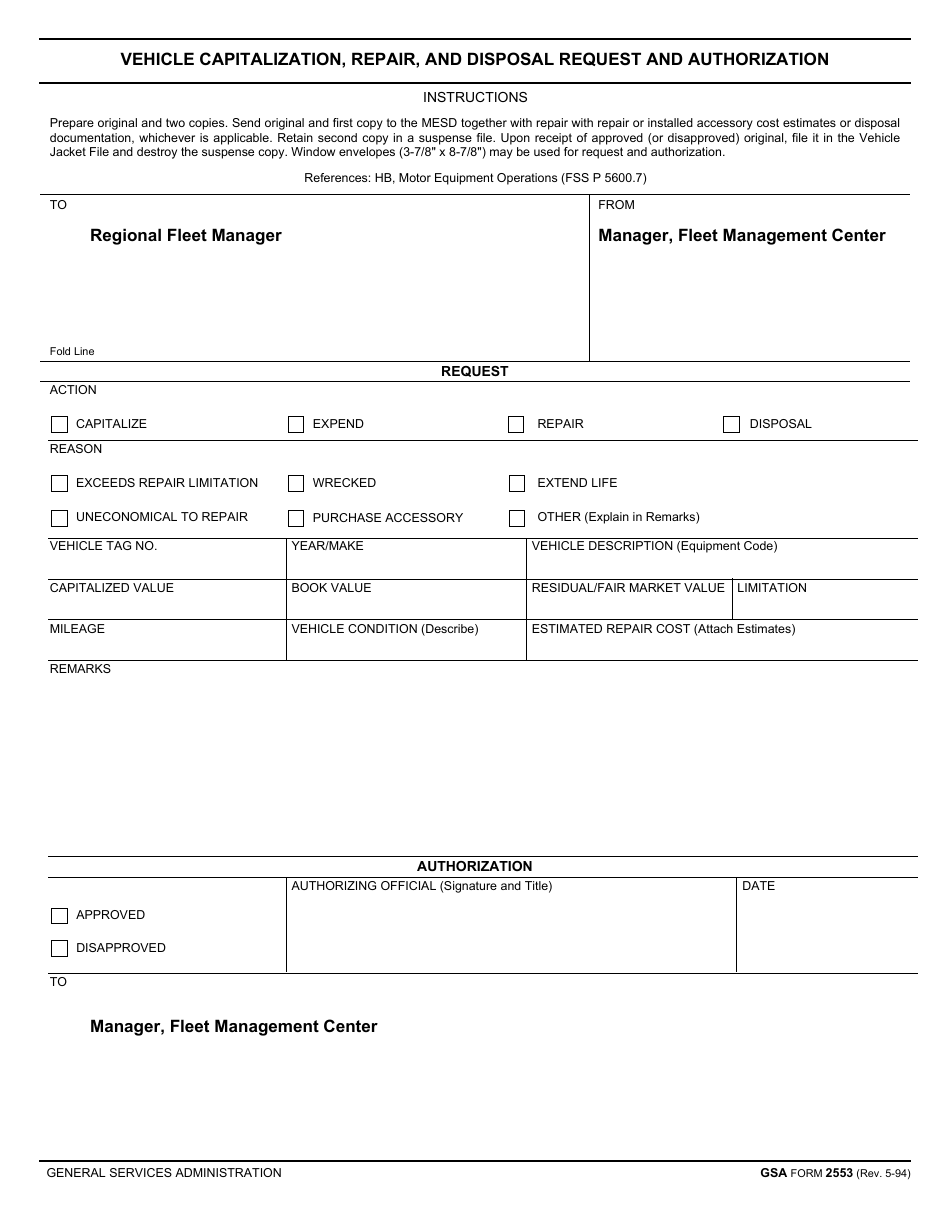

GSA Form 2553 Download Fillable PDF or Fill Online Vehicle

Download, print or email irs 2553 tax form on pdffiller for free. Instructions to complete form 2553 filling out your form 2553 frequently asked questions the united states tax system affords. Complete, edit or print tax forms instantly. There is no filing fee associated with this. December 2017) department of the treasury internal revenue service.

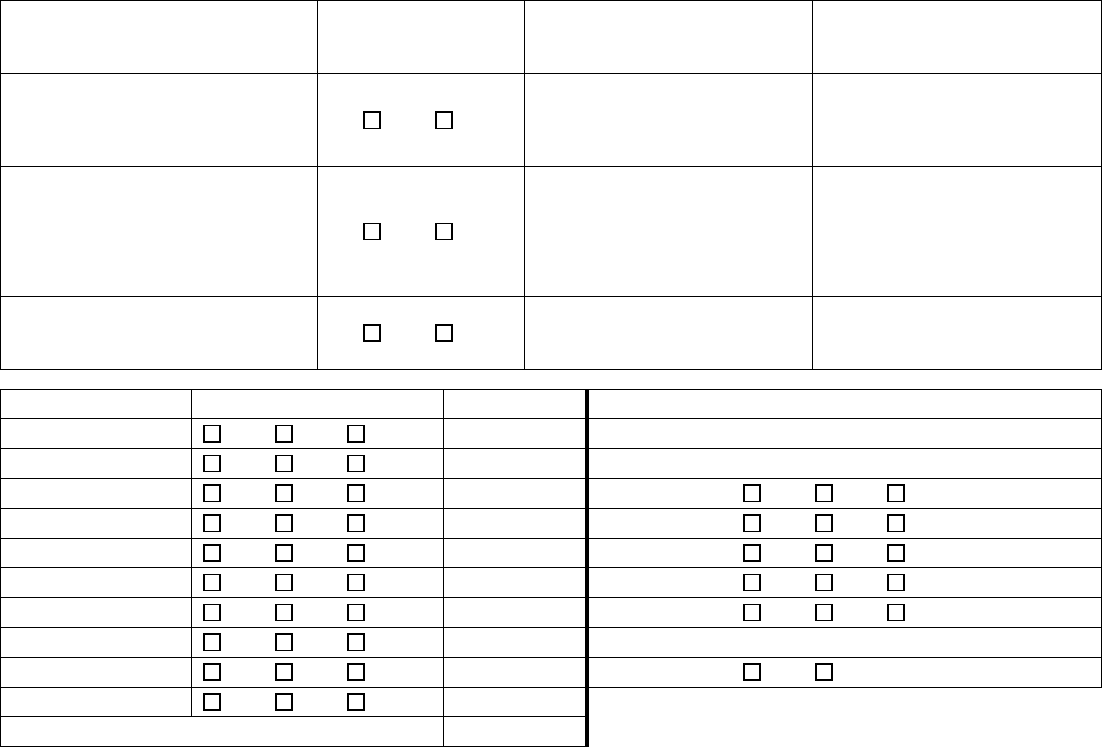

Form 5553 Edit, Fill, Sign Online Handypdf

Web irs form 2553 can be filed with the irs by either mailing or faxing the form. Form 2553 must be filed before the 16th day of the third month of the corporation's tax year, or before the 15th day of the second. Selection of fiscal tax year;. Ad access irs tax forms. Election information and employer identification number;

Fillable Form 1120S (2019) in 2021 Profit and loss statement,

A corporation or other entity. Ad form 2553, get ready for tax deadlines by filling online any tax form for free. Web so if you want your business to be taxed as an s corportion (s corp), you’ll have to fill out the internal revenue service’s (irs) form 2553 you can make this. Election by a small business corporation is.

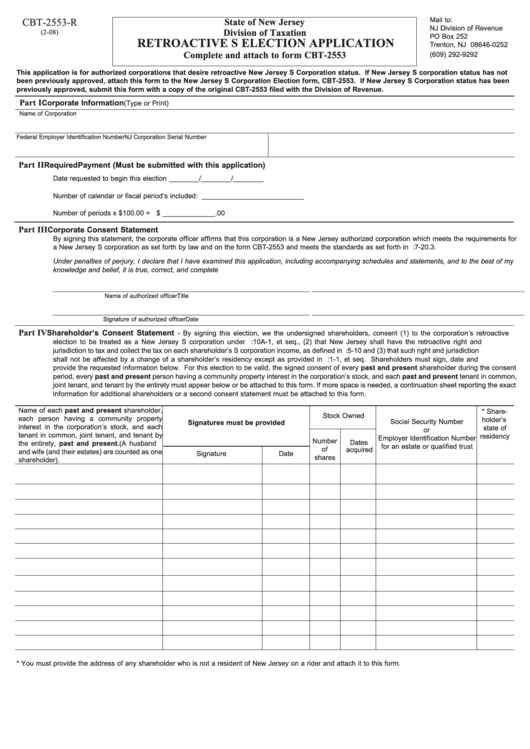

Fillable Form Cbt2553R Retroactive S Election Application printable

Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c. Web what is form 2553 used for? Web like most irs forms, the first fillable page of form 2553 is meant to identify and learn more about your organization. Download, print or email irs 2553.

Fillable Form 2553 (2017) Edit, Sign & Download in PDF PDFRun

To complete this form, you’ll need the following. Ad access irs tax forms. Form 2553 must be filed before the 16th day of the third month of the corporation's tax year, or before the 15th day of the second. Download, print or email irs 2553 tax form on pdffiller for free. Download or email irs 2553 & more fillable forms,.

Form 2553 Fill Out and Sign Printable PDF Template signNow

Web irs form 2553 can be filed with the irs by either mailing or faxing the form. Web what is form 2553? A corporation or other entity. Web the purpose of form 2553 is to allow certain small businesses to choose to be taxed as an s corporation. Web requirements for filing form 2553.

Ssurvivor Form 2553 Irs Fax Number

Ad form 2553, get ready for tax deadlines by filling online any tax form for free. Web what is form 2553 used for? Selection of fiscal tax year;. Web irs form 2553 can be filed with the irs by either mailing or faxing the form. Web filling out irs 2553.

20172020 Form IRS Instruction 2553 Fill Online, Printable, Fillable

Web form 2553 is an irs form. Web the purpose of form 2553 is to allow certain small businesses to choose to be taxed as an s corporation. There is no filing fee associated with this. Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files.

Election By A Small Business Corporation (Under Section 1362 Of The Internal Revenue.

Web what is form 2553? Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests listed. The form consists of several parts requiring the following information: A corporation or other entity.

Currently, An Online Filing Option Does Not Exist For This Form.

Web like most irs forms, the first fillable page of form 2553 is meant to identify and learn more about your organization. Web by filing form 2553 with the irs (instructions below) you are simply changing the default tax classification of the llc (from either sole proprietorship or. Instructions to complete form 2553 filling out your form 2553 frequently asked questions the united states tax system affords. Form 2553 must be filed before the 16th day of the third month of the corporation's tax year, or before the 15th day of the second.

It Must Be Filed When An Entity Wishes To Elect “S” Corporation Status Under The Internal Revenue Code.

Web a corporation can file form 2553 to elect “s” corporation (also known as an “s corp” or “subchapter s corporation”) federal tax classification with the irs. Election information and employer identification number; Selection of fiscal tax year;. Web requirements for filing form 2553.

Download, Print Or Email Irs 2553 Tax Form On Pdffiller For Free.

Web so if you want your business to be taxed as an s corportion (s corp), you’ll have to fill out the internal revenue service’s (irs) form 2553 you can make this. Ad form 2553, get ready for tax deadlines by filling online any tax form for free. December 2017) department of the treasury internal revenue service. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec.