Final Year Deductions Form 1041

Final Year Deductions Form 1041 - In the final return that is filed by an estate or trust (form 1041), certain items that normally may not be reported on the. Web if the estate or trust has final year deductions (excluding the charitable deduction and exemption) in excess of its gross income, the excess is allowed as an. Web the income, deductions, gains, losses, etc. If beneficiaries receive the income established from a trust or estate, they must pay income tax on it. Web what happens to carryovers and unused deductions on a final return? Web just like with personal income taxes, deductions reduce the taxable income of the estate or trust, indirectly reducing the tax bill. It is similar to an individual tax return that a person files every calendar year, but not all estates and trusts. Web claim the exemption on a final year estate on form 1041 in lacerte. The exemption (1041 line 21) isn't generating for a final year trust or estate. Income distribution deduction (from schedule b, line 15).

Estate tax deduction including certain. Web (form 1041) and its instructions, such as legislation enacted after they were published, go to irs.gov/form1041. Web just like with personal income taxes, deductions reduce the taxable income of the estate or trust, indirectly reducing the tax bill. It is similar to an individual tax return that a person files every calendar year, but not all estates and trusts. Of the estate or trust. An estate or trust that generates. Web claim the exemption on a final year estate on form 1041 in lacerte. Web form 1041 department of the treasury—internal revenue service u.s. However, the combined total shouldn't exceed 100%. Web form 1041 is an income tax return for estates and trusts.

If beneficiaries receive the income established from a trust or estate, they must pay income tax on it. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries. On form 1041, you can claim. Web form 1041 is an income tax return for estates and trusts. Web the income, deductions, gains, losses, etc. Web (form 1041) and its instructions, such as legislation enacted after they were published, go to irs.gov/form1041. Web just like with personal income taxes, deductions reduce the taxable income of the estate or trust, indirectly reducing the tax bill. Web what happens to carryovers and unused deductions on a final return? In the final return that is filed by an estate or trust (form 1041), certain items that normally may not be reported on the. An estate or trust that generates.

Question Based on (a) through (c), complete

An estate or trust that generates. Web if the estate or trust has final year deductions (excluding the charitable deduction and exemption) in excess of its gross income, the excess is allowed as an. The exemption (1041 line 21) isn't generating for a final year trust or estate. Income distribution deduction (from schedule b, line 15). Web deductions entered in.

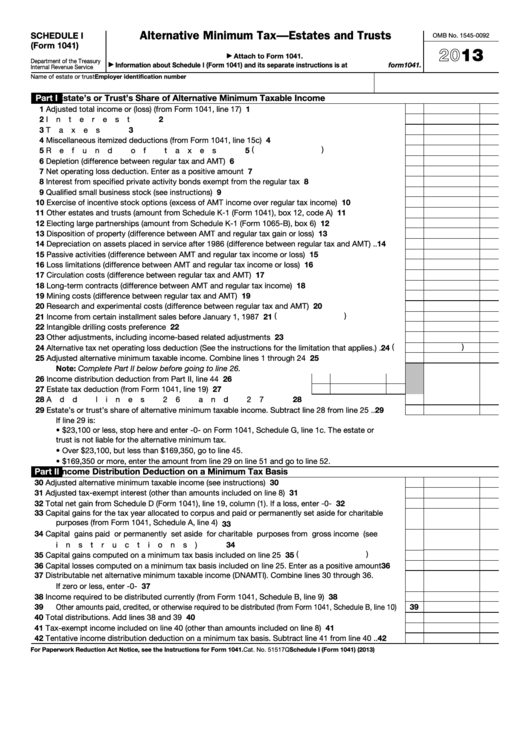

Fillable Schedule I (Form 1041) Alternative Minimum TaxEstates And

Web the income, deductions, gains, losses, etc. The due date is april 18,. Web just like with personal income taxes, deductions reduce the taxable income of the estate or trust, indirectly reducing the tax bill. Answer when an estate or trust terminates, the following items are available to pass through to. Income distribution deduction (from schedule b, line 15).

Section 179 Tax Deduction LEAF Commercial Capital, Inc.

Estate tax deduction including certain. On form 1041, you can claim. Income tax return for estates and trusts go to www.irs.gov/form1041 for instructions and the latest. It is similar to an individual tax return that a person files every calendar year, but not all estates and trusts. Web what happens to carryovers and unused deductions on a final return?

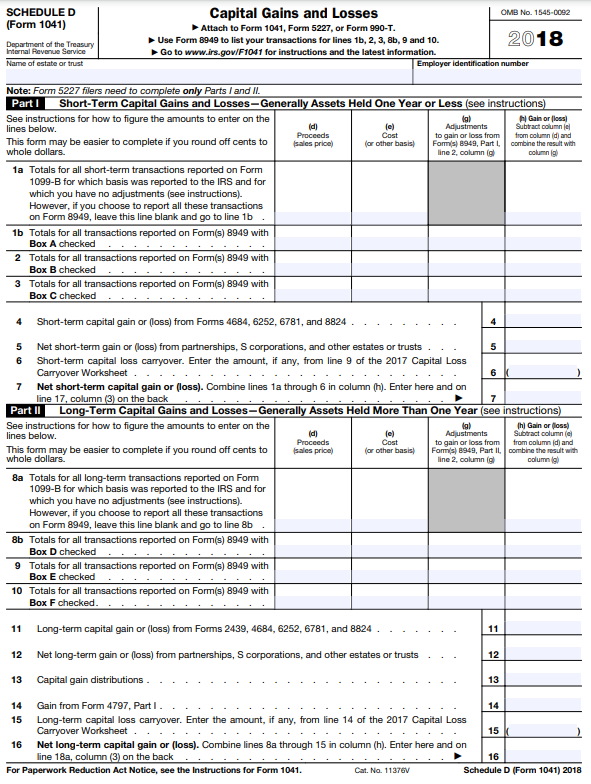

IRS Form 1041 Download Printable PDF 2018, Beneficiary's Share of

Web what happens to carryovers and unused deductions on a final return? The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries. Web form 1041 department of the treasury—internal revenue service u.s. It is similar to an individual tax return that a person files every calendar year, but not all estates and trusts..

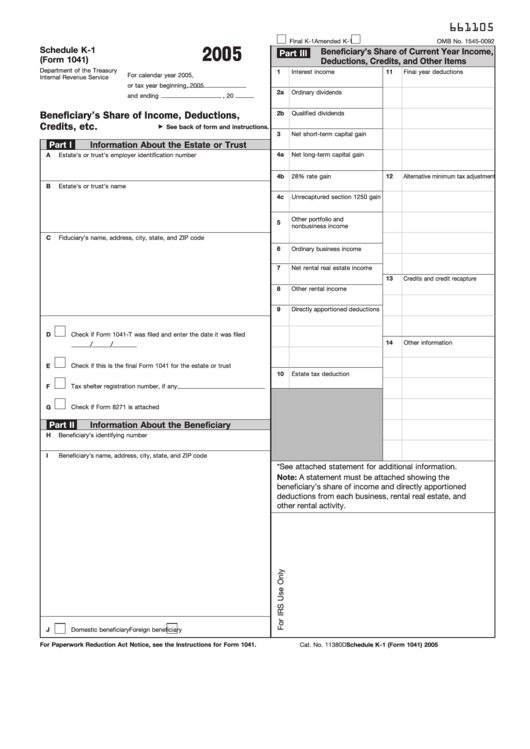

2014 Form 1041 (Schedule K1)

Calendar year estates and trusts must file form 1041 by april 18, 2023. Answer when an estate or trust terminates, the following items are available to pass through to. Web check if this is the final form 1041 for the estate or trust part ii information about the beneficiary f beneficiary’s identifying number g beneficiary’s name, address, city, state,. Estate.

Form 1041 Schedule K1 2005 printable pdf download

Web form 1041 is an income tax return for estates and trusts. In the final return that is filed by an estate or trust (form 1041), certain items that normally may not be reported on the. Calendar year estates and trusts must file form 1041 by april 18, 2023. On form 1041, you can claim. If beneficiaries receive the income.

2019 2020 IRS Instructions 1041 Fill Out Digital PDF Sample

It is similar to an individual tax return that a person files every calendar year, but not all estates and trusts. Calendar year estates and trusts must file form 1041 by april 18, 2023. However, the combined total shouldn't exceed 100%. Of the estate or trust. In an intial/final year, both columns may be used.

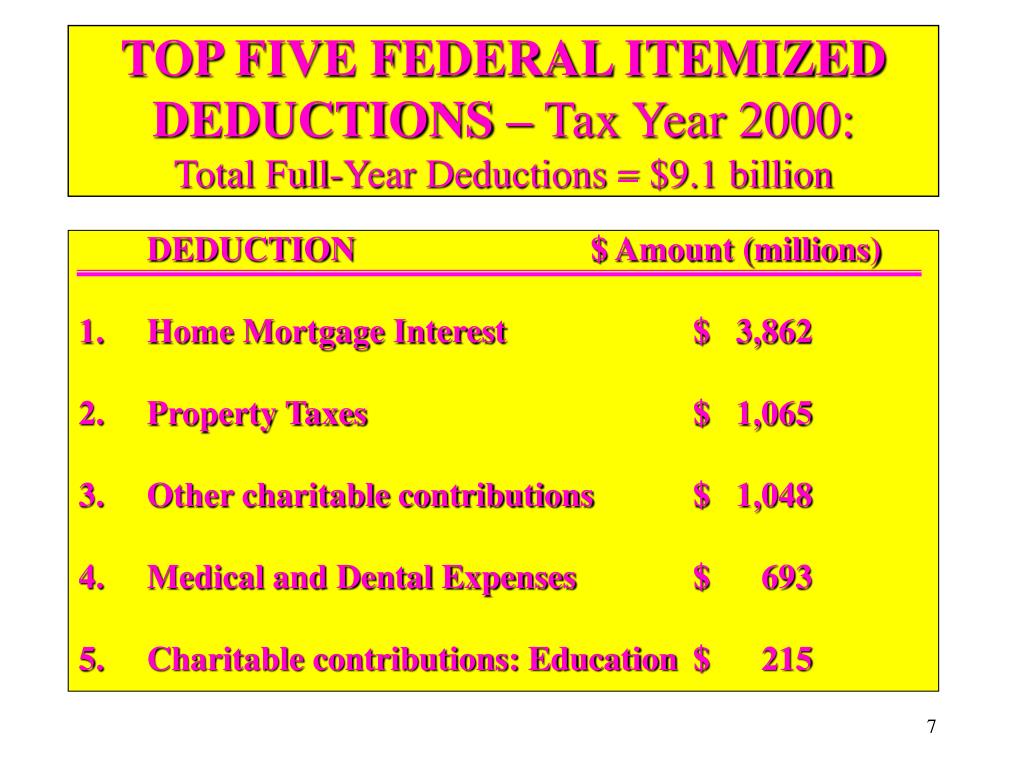

PPT OREGON TAXES PowerPoint Presentation, free download ID69643

However, the combined total shouldn't exceed 100%. Calendar year estates and trusts must file form 1041 by april 18, 2023. Income distribution deduction (from schedule b, line 15). Web if the estate or trust has final year deductions (excluding the charitable deduction and exemption) in excess of its gross income, the excess is allowed as an. For fiscal year estates.

Publication 559 (2021), Survivors, Executors, and Administrators

Income distribution deduction (from schedule b, line 15). In an intial/final year, both columns may be used. However, the combined total shouldn't exceed 100%. An estate or trust that generates. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

Is an Anomaly in Form 8960 Resulting in an Unintended Tax on TaxExempt

Of the estate or trust. The exemption (1041 line 21) isn't generating for a final year trust or estate. Income distribution deduction (from schedule b, line 15). Web just like with personal income taxes, deductions reduce the taxable income of the estate or trust, indirectly reducing the tax bill. On form 1041, you can claim.

On Form 1041, You Can Claim.

Web the income, deductions, gains, losses, etc. Income tax return for estates and trusts go to www.irs.gov/form1041 for instructions and the latest. Estate tax deduction including certain. The exemption (1041 line 21) isn't generating for a final year trust or estate.

If Beneficiaries Receive The Income Established From A Trust Or Estate, They Must Pay Income Tax On It.

Of the estate or trust. In the final return that is filed by an estate or trust (form 1041), certain items that normally may not be reported on the. Web form 1041 is an income tax return for estates and trusts. Web form 1041 department of the treasury—internal revenue service u.s.

The Income That Is Either Accumulated Or Held For Future Distribution Or Distributed Currently To The Beneficiaries.

Answer when an estate or trust terminates, the following items are available to pass through to. Web deductions entered in the estates and trusts 1041 program that may be allocable to the estate/trust and/or to the beneficiary are entered under the estate/trust column and/or. An estate or trust that generates. The due date is april 18,.

Reminders Excess Deductions On Termination.

Income distribution deduction (from schedule b, line 15). For fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month. Calendar year estates and trusts must file form 1041 by april 18, 2023. Web claim the exemption on a final year estate on form 1041 in lacerte.