Form 1041-A

Form 1041-A - Use this form to report the charitable information required by section 6034 and the related regulations. Information return trust accumulation of charitable amounts. Web form 1041 is a tax return filed by estates or trusts that generated income after the decedent passed away and before the designated assets were transferred to beneficiaries. Source income of foreign persons; For calendar year 2022 or fiscal year beginning , 2022, and ending , 20. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. Form 1042, annual withholding tax return for u.s. Income tax return for estates and trusts. Web information about form 1041, u.s. For example, for a trust or estate with a tax year ending december 31, the due date is april 15 of the following year.

Create custom documents by adding smart fillable fields. Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s tax year. For calendar year 2022 or fiscal year beginning , 2022, and ending , 20. Income tax return for estates and trusts. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. Form 1041 is used by a fiduciary to file an income tax return for every domestic estate or. Name of estate or trust (if a grantor type trust, see the. For instructions and the latest information. Source income of foreign persons; For example, for a trust or estate with a tax year ending december 31, the due date is april 15 of the following year.

Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. Form 1041 is used by a fiduciary to file an income tax return for every domestic estate or. For calendar year 2022 or fiscal year beginning , 2022, and ending , 20. Income tax return for estates and trusts. Use this form to report the charitable information required by section 6034 and the related regulations. For instructions and the latest information. Information return trust accumulation of charitable amounts. Source income of foreign persons; Web form 1041 department of the treasury—internal revenue service. Source income subject to withholding.

Form 1041A U.S. Information Return Trust Accumulation of Charitable

Web information about form 1041, u.s. Source income subject to withholding. Create custom documents by adding smart fillable fields. Form 1042, annual withholding tax return for u.s. Income tax return for estates and trusts.

Form 1041A U.S. Information Return Trust Accumulation of Charitable

Income tax return for estates and trusts. Web form 1041 is a tax return filed by estates or trusts that generated income after the decedent passed away and before the designated assets were transferred to beneficiaries. Web information about form 1041, u.s. Source income subject to withholding. Income tax return for estates and trusts, including recent updates, related forms and.

form 1041 sch b instructions Fill Online, Printable, Fillable Blank

Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. For instructions and the latest information. Web form 1041 is a tax return filed by estates or trusts that generated income after the decedent passed away and before the designated assets were transferred to beneficiaries. Use this form to report the charitable.

1041 A Printable PDF Sample

Web information about form 1041, u.s. For instructions and the latest information. Source income of foreign persons; Form 1042, annual withholding tax return for u.s. Web form 1041 is a tax return filed by estates or trusts that generated income after the decedent passed away and before the designated assets were transferred to beneficiaries.

form 1041 withholding Fill Online, Printable, Fillable Blank form

For instructions and the latest information. Source income subject to withholding. Income tax return for estates and trusts. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. Name of estate or trust (if a grantor type trust, see the.

Form 1041A U.S. Information Return Trust Accumulation of Charitable

Web information about form 1041, u.s. Web form 1041 department of the treasury—internal revenue service. Create custom documents by adding smart fillable fields. Information return trust accumulation of charitable amounts. Form 1042, annual withholding tax return for u.s.

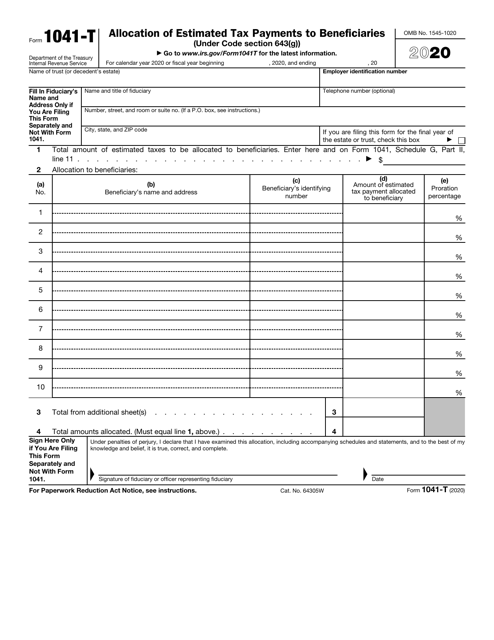

IRS Form 1041T Download Fillable PDF or Fill Online Allocation of

Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. For instructions and the latest information. Information return trust accumulation of charitable amounts. Source income of foreign persons; For calendar year 2022 or fiscal year beginning , 2022, and ending , 20.

Form 1041A U.S. Information Return Trust Accumulation of Charitable

Name of estate or trust (if a grantor type trust, see the. For instructions and the latest information. Income tax return for estates and trusts. Use this form to report the charitable information required by section 6034 and the related regulations. Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of.

Form 1041 filing instructions

Form 1042, annual withholding tax return for u.s. Name of estate or trust (if a grantor type trust, see the. Source income of foreign persons; Web information about form 1041, u.s. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file.

Form 1041T Allocation of Estimated Tax Payments to Beneficiaries

Web form 1041 is a tax return filed by estates or trusts that generated income after the decedent passed away and before the designated assets were transferred to beneficiaries. Form 1041 is used by a fiduciary to file an income tax return for every domestic estate or. Source income of foreign persons; Source income subject to withholding. Income tax return.

Source Income Subject To Withholding.

Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s tax year. Information return trust accumulation of charitable amounts. Form 1042, annual withholding tax return for u.s. For instructions and the latest information.

Use This Form To Report The Charitable Information Required By Section 6034 And The Related Regulations.

Web information about form 1041, u.s. Income tax return for estates and trusts. Create custom documents by adding smart fillable fields. For calendar year 2022 or fiscal year beginning , 2022, and ending , 20.

Web Form 1041 Department Of The Treasury—Internal Revenue Service.

For example, for a trust or estate with a tax year ending december 31, the due date is april 15 of the following year. Web form 1041 is a tax return filed by estates or trusts that generated income after the decedent passed away and before the designated assets were transferred to beneficiaries. Name of estate or trust (if a grantor type trust, see the. Form 1041 is used by a fiduciary to file an income tax return for every domestic estate or.

Income Tax Return For Estates And Trusts, Including Recent Updates, Related Forms And Instructions On How To File.

Source income of foreign persons;