Form 1041 Extension Due Date 2021

Form 1041 Extension Due Date 2021 - Web how to file for a tax extension in 2022. The 15th day of the 4th month after the end of the tax year. 15 or the next business day. A 1041 extension must be filed no later than midnight on the normal due date of the return: Web december 22, 2020 mark your calendars! Web the original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041. Web 7 rows 1041 irs filing deadlines & electronic filing information this topic provides. Complete, edit or print tax forms instantly. Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s. Supports irs and state extensions.

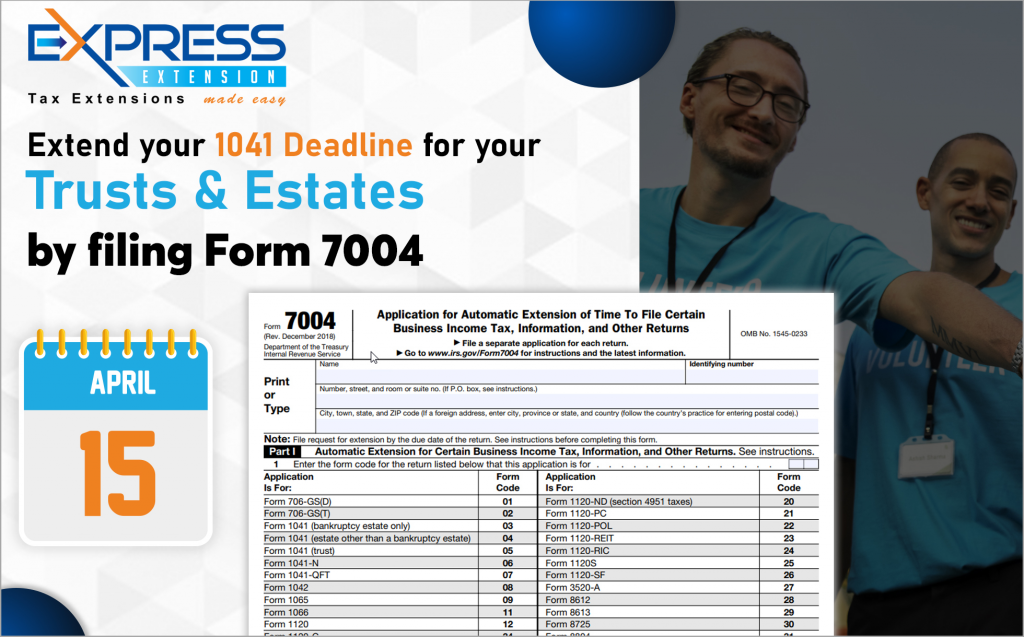

Expresstaxexempt | april 14, 2021. The 15th day of the 4th month after the end of the tax year. Web tax deadlines at a glance. Web beneficiaries, including charitable organizations, can extend their irs form 1041 deadline by filing form 7004 by april 15, 2021. The calendar year 2021 due dates for tax year 2020 tax returns is now available. Web even though the original federal tax return filing deadline for most people was on april 18 this year, the due date for filing an extended return for the 2021 tax year is. Web how to file for a tax extension in 2022. Supports irs and state extensions. Web the original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041. Whenever a regular tax filing date falls on.

Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s. Web for fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the close of the tax year. Web 7 rows 1041 irs filing deadlines & electronic filing information this topic provides. Complete, edit or print tax forms instantly. The calendar year 2021 due dates for tax year 2020 tax returns is now available. Expresstaxexempt | april 14, 2021. A 1041 extension must be filed no later than midnight on the normal due date of the return: For example, an estate that has a tax year that. As a general rule by the irs, the deadline for filing form 1041 falls on the 15th day of the fourth month following the close. Web the original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041.

filing form 1041 Blog ExpressExtension Extensions Made Easy

Web when is form 1041 due to the irs? Web beneficiaries, including charitable organizations, can extend their irs form 1041 deadline by filing form 7004 by april 15, 2021. Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s. Web 7 rows 1041 irs filing deadlines &.

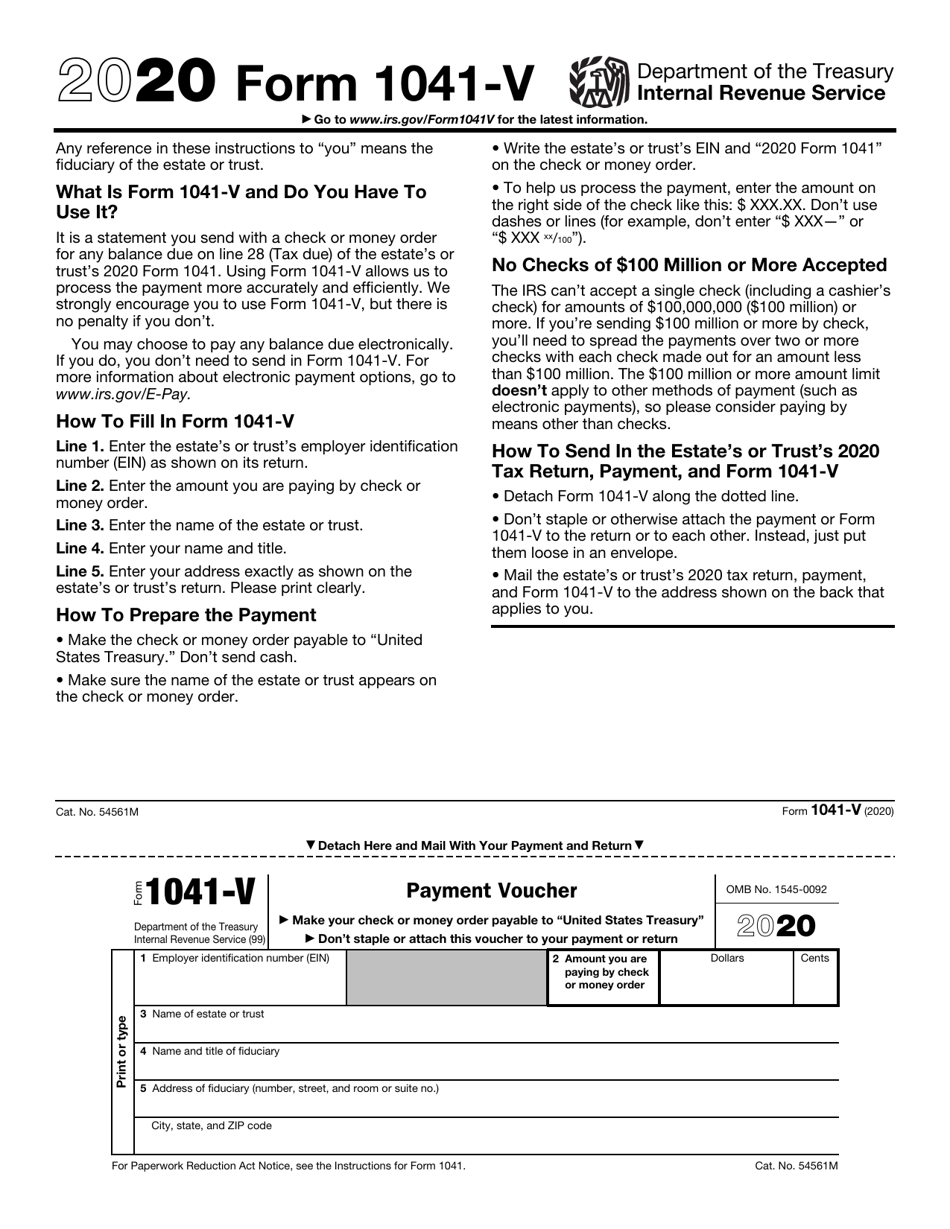

IRS Form 1041V Download Fillable PDF or Fill Online Payment Voucher

Web 2021 federal tax filing deadlines | 2022 irs tax deadlines | 1041 due date free download: You can file for a tax extension in 2022 by submitting form 4868 to the irs on or before the april 18, 2022 tax deadline. Web when is form 1041 due to the irs? Web for fiscal year estates and trusts, file form.

Form 1041 and Other Tax Forms Still Due April 15, 2021 YouTube

Web 7 rows 1041 irs filing deadlines & electronic filing information this topic provides. Web tax deadlines at a glance. Federal tax filing deadlines for tax year 2021 april 21, 2020 |. A 1041 extension must be filed no later than midnight on the normal due date of the return: Web even though the original federal tax return filing deadline.

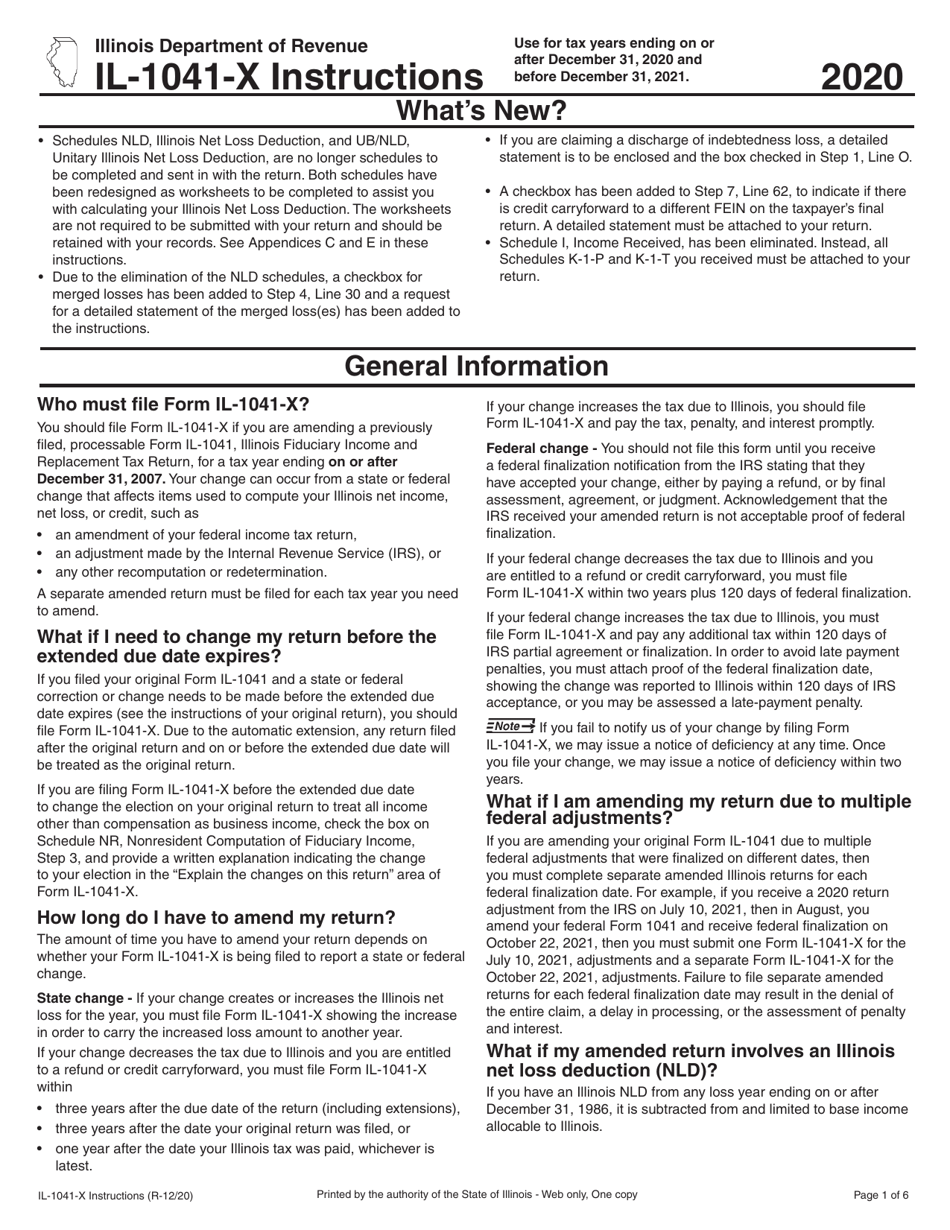

Download Instructions for Form IL1041X Amended Fiduciary and

The extension request will allow a 5 1/2 month. Web 7 rows 1041 irs filing deadlines & electronic filing information this topic provides. Web if the decedent passed away june 1, the fy would run until may 31 of the following year, with form 1041 due sept. Federal tax filing deadlines for tax year 2021 april 21, 2020 |. Web.

Tax Extension Due Date for Corporations and Partnerships is September

Complete, edit or print tax forms instantly. Web the original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041. Web when is form 1041 due to the irs? Web general instructions section references are to the internal revenue code unless otherwise noted. The 15th day of the 4th month after the.

form 1041 Blog ExpressExtension Extensions Made Easy

Web the original due date of april 15, 2021 was only extended for individuals, not estates or trusts filing form 1041. Supports irs and state extensions. Web for fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month following the close of the tax year. Ad access irs tax forms. Federal tax filing deadlines.

form1041extension

Web tax deadlines at a glance. Web even though the original federal tax return filing deadline for most people was on april 18 this year, the due date for filing an extended return for the 2021 tax year is. As a general rule by the irs, the deadline for filing form 1041 falls on the 15th day of the fourth.

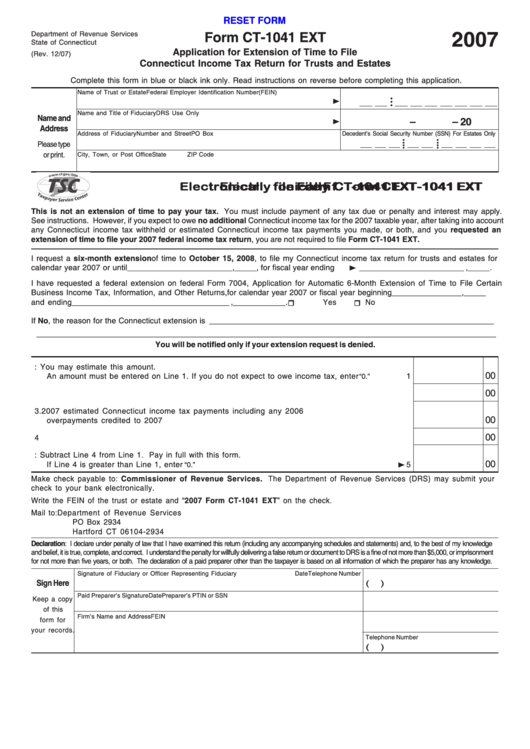

Fillable Form Ct1041 Ext Application For Extension Of Time To File

Web december 22, 2020 mark your calendars! Web when is form 1041 due to the irs? The 15th day of the 4th month after the end of the tax year. As a general rule by the irs, the deadline for filing form 1041 falls on the 15th day of the fourth month following the close. Get ready for tax season.

form 1041t extension Fill Online, Printable, Fillable Blank form

Web 2021 federal tax filing deadlines | 2022 irs tax deadlines | 1041 due date free download: Complete, edit or print tax forms instantly. Web when is form 1041 due to the irs? Web beneficiaries, including charitable organizations, can extend their irs form 1041 deadline by filing form 7004 by april 15, 2021. Web for fiscal year estates and trusts,.

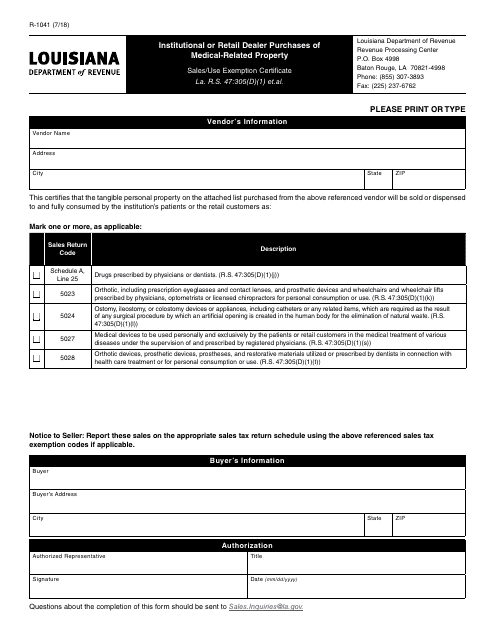

Form R1041 Download Fillable PDF or Fill Online Institutional or

As a general rule by the irs, the deadline for filing form 1041 falls on the 15th day of the fourth month following the close. Ad access irs tax forms. Supports irs and state extensions. Whenever a regular tax filing date falls on. The extension request will allow a 5 1/2 month.

Web 7 Rows 1041 Irs Filing Deadlines & Electronic Filing Information This Topic Provides.

Complete, edit or print tax forms instantly. Supports irs and state extensions. 15 or the next business day. Ad access irs tax forms.

Web When Is Form 1041 Due To The Irs?

Estates or trusts must file form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate’s. Web december 22, 2020 mark your calendars! A 1041 extension must be filed no later than midnight on the normal due date of the return: The extension request will allow a 5 1/2 month.

Web The Original Due Date Of April 15, 2021 Was Only Extended For Individuals, Not Estates Or Trusts Filing Form 1041.

The calendar year 2021 due dates for tax year 2020 tax returns is now available. Web beneficiaries, including charitable organizations, can extend their irs form 1041 deadline by filing form 7004 by april 15, 2021. Web how to file for a tax extension in 2022. Web if the decedent passed away june 1, the fy would run until may 31 of the following year, with form 1041 due sept.

For Example, An Estate That Has A Tax Year That.

As a general rule by the irs, the deadline for filing form 1041 falls on the 15th day of the fourth month following the close. Get ready for tax season deadlines by completing any required tax forms today. Whenever a regular tax filing date falls on. Web general instructions section references are to the internal revenue code unless otherwise noted.