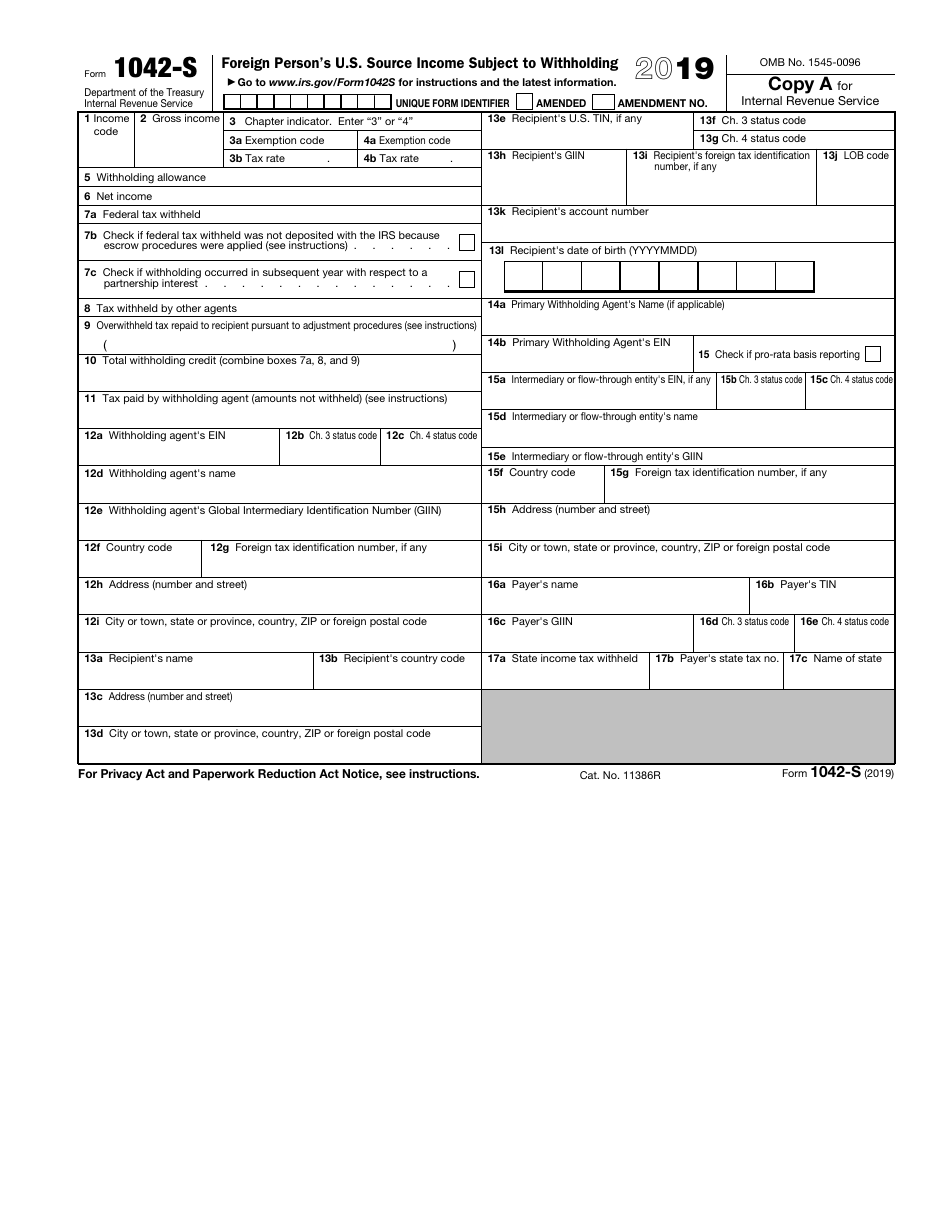

Form 1042-S Pdf

Form 1042-S Pdf - Source income subject to withholding go to www.irs.gov/form1042sfor. Complete, edit or print tax forms instantly. Source income subject to withholding, is used to report any payments made to foreign persons. Source income subject to withholding to assess penalties and to send out notices for incorrectly filed forms 1042. Source income subject to withholding 2010. Department of the treasury internal revenue service foreign person’s u.s. Web publication 515 is for withholding agents who pay income to foreign persons, including: Source income of foreign persons, including recent updates, related forms, and instructions on how to file. Ad access irs tax forms. Web 1042s explanation of codes box 1.

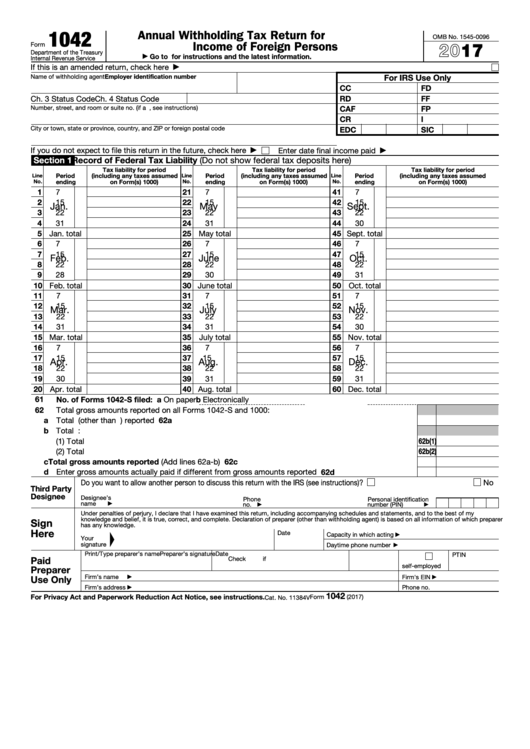

Web information about form 1042, annual withholding tax return for u.s. Source income of foreign persons, including recent updates, related forms, and instructions on how to file. Source income subject to withholding go to www.irs.gov/form1042sfor. Source income subject to withholding 2010. Source income subject to withholding multiple statements: North carolina department of revenue. Source income subject to withholding, is used to report any payments made to foreign persons. Income code code interest 01 02 03 04 05 22 29 30 31 33 51 54 dividend 06 07 08 34 40 52 other 53 09 10 11 12 13 14 15 16 17 18 19 20 23 24. Ad get ready for tax season deadlines by completing any required tax forms today. Source income subject to withholding to assess penalties and to send out notices for incorrectly filed forms 1042.

Complete, edit or print tax forms instantly. Source income subject to withholding multiple statements: North carolina department of revenue. Web information about form 1042, annual withholding tax return for u.s. Source income subject to withholding, is used to report any payments made to foreign persons. Source income subject to withholding to assess penalties and to send out notices for incorrectly filed forms 1042. Complete, edit or print tax forms instantly. Web 1042s explanation of codes box 1. Source income subject to withholding go to www.irs.gov/form1042sfor. Source income of foreign persons, including recent updates, related forms, and instructions on how to file.

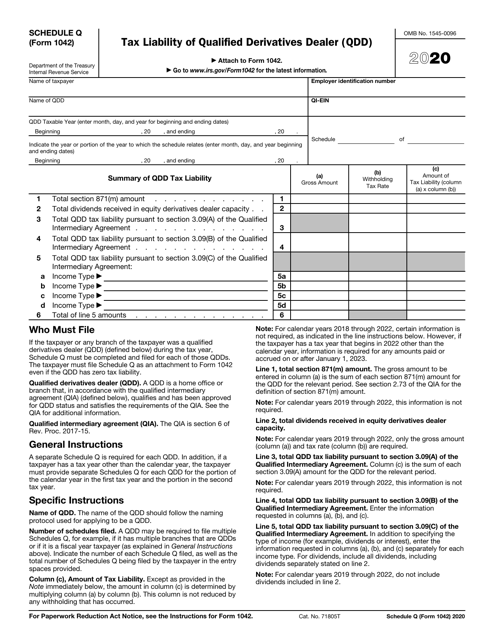

IRS Form 1042 Schedule Q Download Fillable PDF or Fill Online Tax

Source income subject to withholding electronically, both state. Complete, edit or print tax forms instantly. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

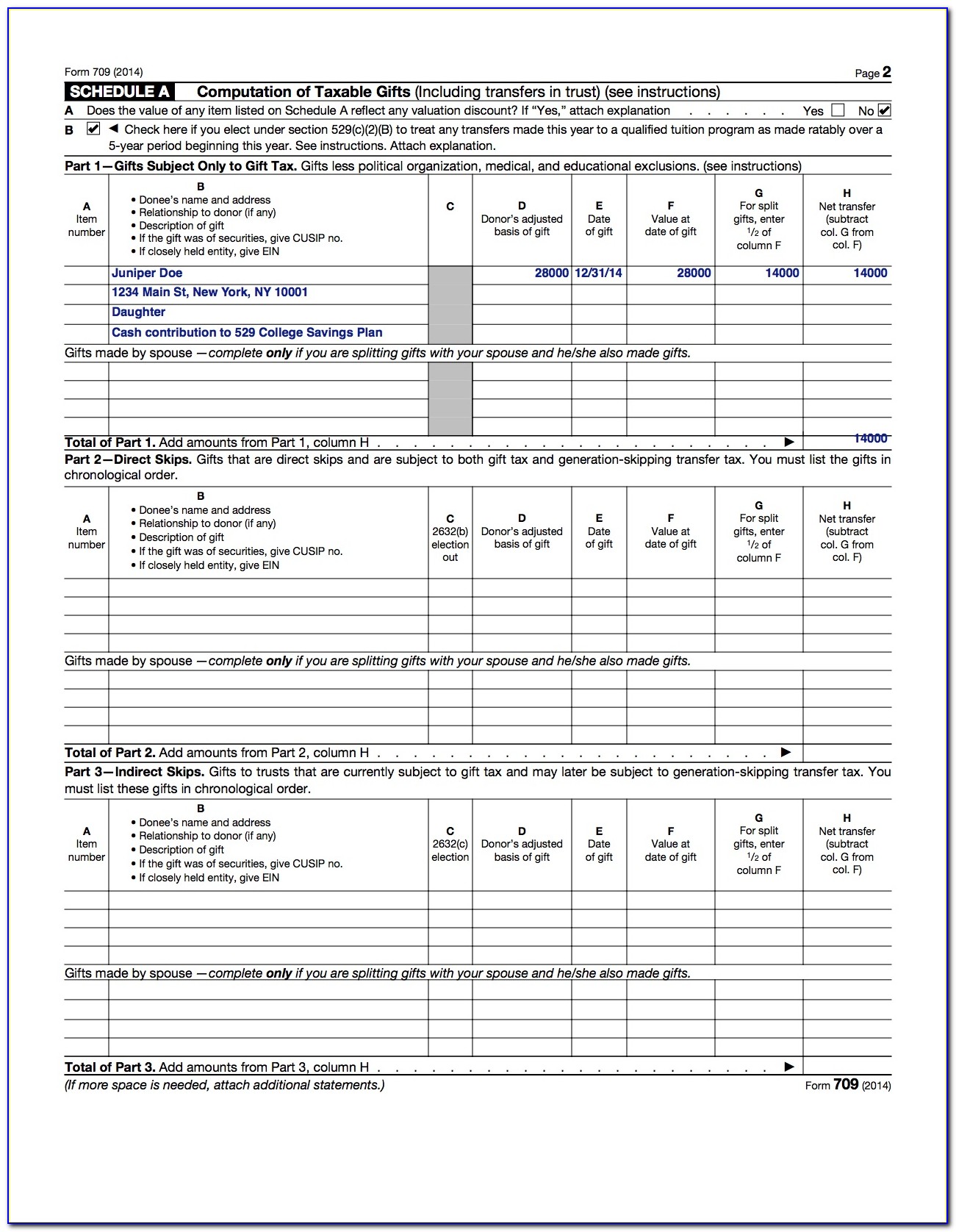

Best Tax Software For Form 1041 Form Resume Examples mL52wRnOXo

Web information about form 1042, annual withholding tax return for u.s. North carolina department of revenue. Web publication 515 is for withholding agents who pay income to foreign persons, including: Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

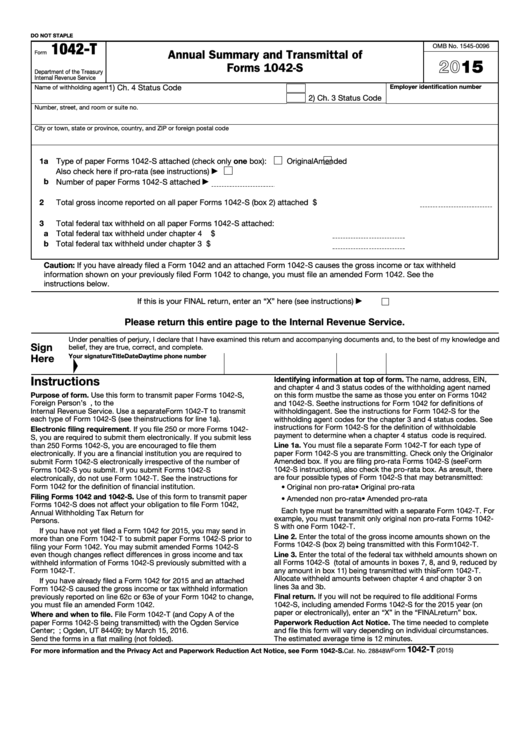

Fillable Form 1042T Annual Summary And Transmittal Of Forms 1042S

Source income subject to withholding 2010. Ad access irs tax forms. Source income subject to withholding (pdf) reports amounts paid to foreign persons (including persons presumed. Source income of foreign persons, including recent updates, related forms, and instructions on how to file. Source income subject to withholding go to www.irs.gov/form1042sfor.

IRS Form 1042S Download Fillable PDF or Fill Online Foreign Person's U

North carolina department of revenue. Source income subject to withholding (pdf) reports amounts paid to foreign persons (including persons presumed. Source income subject to withholding to assess penalties and to send out notices for incorrectly filed forms 1042. Generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with united states. Complete, edit or print tax forms instantly.

Form 1042S Edit, Fill, Sign Online Handypdf

Source income subject to withholding electronically, both state. Web publication 515 is for withholding agents who pay income to foreign persons, including: Source income subject to withholding 2010. Complete, edit or print tax forms instantly. Generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with united states.

form 1042s 2021 instructions Fill Online, Printable, Fillable Blank

Ad access irs tax forms. Complete, edit or print tax forms instantly. Source income subject to withholding go to www.irs.gov/form1042sfor. Web information about form 1042, annual withholding tax return for u.s. North carolina department of revenue.

1042S Software, 1042S eFile Software & 1042S Reporting

Income code code interest 01 02 03 04 05 22 29 30 31 33 51 54 dividend 06 07 08 34 40 52 other 53 09 10 11 12 13 14 15 16 17 18 19 20 23 24. Generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with united states. Source income subject to withholding, is used.

Form 1042S USEReady

Source income subject to withholding (pdf) reports amounts paid to foreign persons (including persons presumed. Ad get ready for tax season deadlines by completing any required tax forms today. Source income subject to withholding go to www.irs.gov/form1042sfor. North carolina department of revenue. Generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with united states.

Fillable Form 1042 Annual Withholding Tax Return For U.s. Source

Ad get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Source income of foreign persons, including recent updates, related forms, and instructions on how to file. Web 1042s explanation of codes box 1. Generally, every nonresident alien individual, nonresident alien fiduciary, and foreign.

Form 1042S Edit, Fill, Sign Online Handypdf

Web information about form 1042, annual withholding tax return for u.s. North carolina department of revenue. Source income subject to withholding go to www.irs.gov/form1042sfor. Complete, edit or print tax forms instantly. Web publication 515 is for withholding agents who pay income to foreign persons, including:

Source Income Subject To Withholding (Pdf) Reports Amounts Paid To Foreign Persons (Including Persons Presumed.

Source income subject to withholding electronically, both state. Web 1042s explanation of codes box 1. Department of the treasury internal revenue service foreign person’s u.s. Source income subject to withholding to assess penalties and to send out notices for incorrectly filed forms 1042.

Source Income Of Foreign Persons, Including Recent Updates, Related Forms, And Instructions On How To File.

Ad access irs tax forms. North carolina department of revenue. Source income subject to withholding multiple statements: Income code code interest 01 02 03 04 05 22 29 30 31 33 51 54 dividend 06 07 08 34 40 52 other 53 09 10 11 12 13 14 15 16 17 18 19 20 23 24.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with united states. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web information about form 1042, annual withholding tax return for u.s.

Source Income Subject To Withholding Go To Www.irs.gov/Form1042Sfor.

Web publication 515 is for withholding agents who pay income to foreign persons, including: Source income subject to withholding 2010. Complete, edit or print tax forms instantly. Source income subject to withholding, is used to report any payments made to foreign persons.