Form 1045 Refund Status

Form 1045 Refund Status - Download or email irs 1045 & more fillable forms, register and subscribe now! Ad learn how to track your federal tax refund and find the status of your direct deposit. Complete, edit or print tax forms instantly. Mail the form 1139, corporation application for tentative refund, or form 1045, application for. Web complete the questions at the top of the form. Web form 1045 (1996) page 2 schedule a—net operating loss (nol). Web the gao found that interest on the carryback refunds owed, which generally is triggered at 45 days after a processable claim is filed (see secs. Before checking on your refund, have your social security number, filing status, and the exact whole dollar amount of your. Web the internal revenue service posted a set of questions and answers monday to help companies claim net operating losses and tax credits for prior years so they can. Web explanation of the problem the irs relies on taxpayers to do their part by filing accurate and timely tax returns.

Web advise the taxpayer that while irs has 90 days to process a tentative carryback application (form 1045 or form 1139), every effort will be made to process the application and. Download or email irs 1045 & more fillable forms, register and subscribe now! Before checking on your refund, have your social security number, filing status, and the exact whole dollar amount of your. Web explanation of the problem the irs relies on taxpayers to do their part by filing accurate and timely tax returns. Web form 1045 computation of decrease in tax (continued) preceding tax year ended: Mail the form 1139, corporation application for tentative refund, or form 1045, application for. Web form 1045 (1996) page 2 schedule a—net operating loss (nol). Web the gao found that interest on the carryback refunds owed, which generally is triggered at 45 days after a processable claim is filed (see secs. Estates and trusts, skip lines 1. Check for the latest updates and resources throughout the tax season

Web the internal revenue service posted a set of questions and answers monday to help companies claim net operating losses and tax credits for prior years so they can. Form 1045 is an application for a tentative refund, which allows taxpayers to receive a refund on taxes paid in advance. Web the gao found that interest on the carryback refunds owed, which generally is triggered at 45 days after a processable claim is filed (see secs. Web therefore, if the irs does not process a form 1045 or 1139 and issue the appropriate refund (s), the taxpayer must file the claim or claims (i.e., amended tax. Web form 1045 (1996) page 2 schedule a—net operating loss (nol). This form is for when a. Web status of processing form 1139 or form 1045 expect long delays. Web form 1045 computation of decrease in tax (continued) preceding tax year ended: Complete, edit or print tax forms instantly. Provides refund information for the 2020, 2021, and 2022 tax years.

Form 1045 Application for Tentative Refund (2014) Free Download

Web therefore, if the irs does not process a form 1045 or 1139 and issue the appropriate refund (s), the taxpayer must file the claim or claims (i.e., amended tax. Web explanation of the problem the irs relies on taxpayers to do their part by filing accurate and timely tax returns. Web the internal revenue service posted a set of.

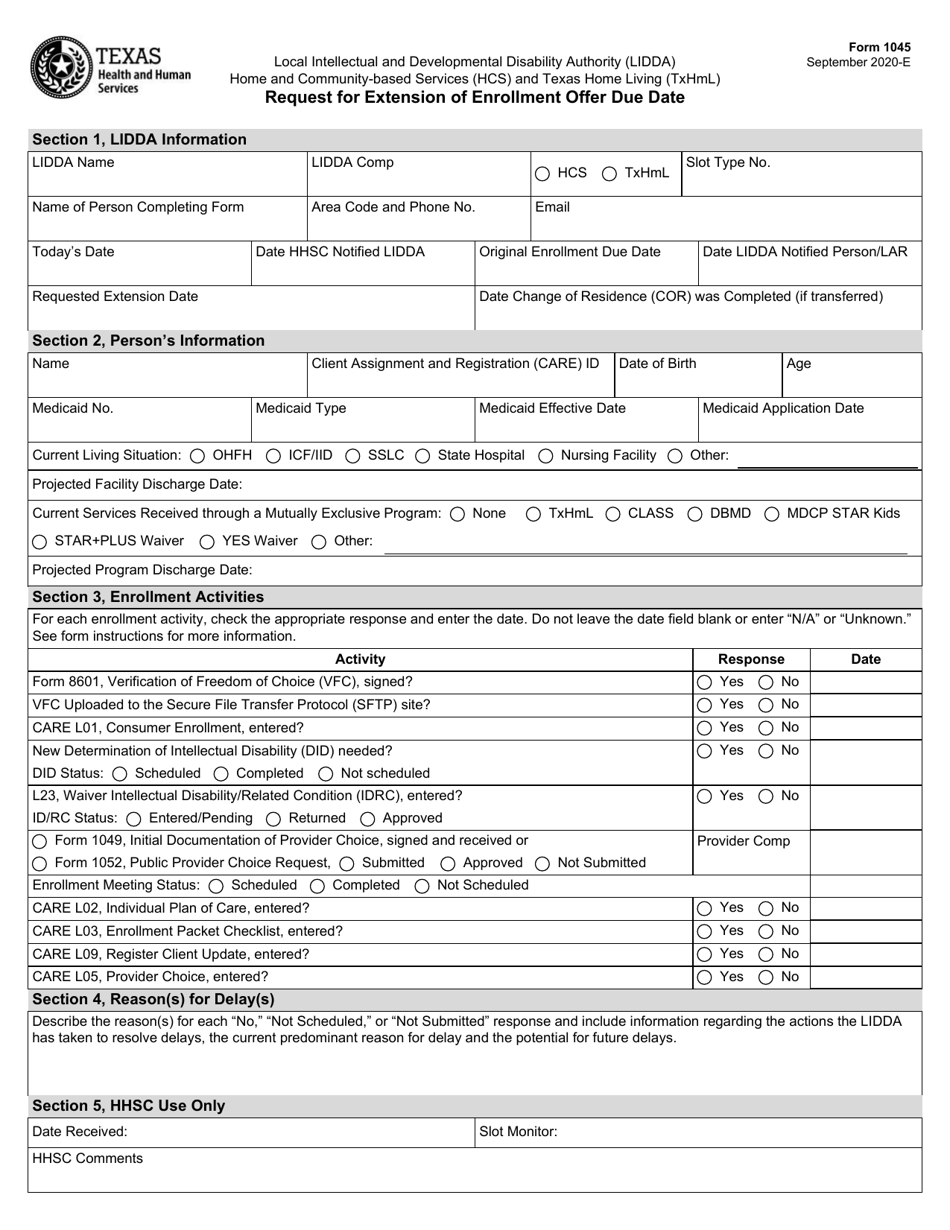

Form 1045 Download Fillable PDF or Fill Online Request for Extension of

Web the internal revenue service posted a set of questions and answers monday to help companies claim net operating losses and tax credits for prior years so they can. Form 1045 is an application for a tentative refund, which allows taxpayers to receive a refund on taxes paid in advance. This form is for when a. Before checking on your.

Form 1045 Application for Tentative Refund (2014) Free Download

You can check on the status of your refund: Provides refund information for the 2020, 2021, and 2022 tax years. Check for the latest updates and resources throughout the tax season Download or email irs 1045 & more fillable forms, register and subscribe now! Form 1045 is an application for a tentative refund, which allows taxpayers to receive a refund.

Form 1045 Application for Tentative Refund (2014) Free Download

Web the internal revenue service posted a set of questions and answers monday to help companies claim net operating losses and tax credits for prior years so they can. Complete, edit or print tax forms instantly. Web form 1045 computation of decrease in tax (continued) preceding tax year ended: Application for tentative refund is an internal revenue service (irs) form.

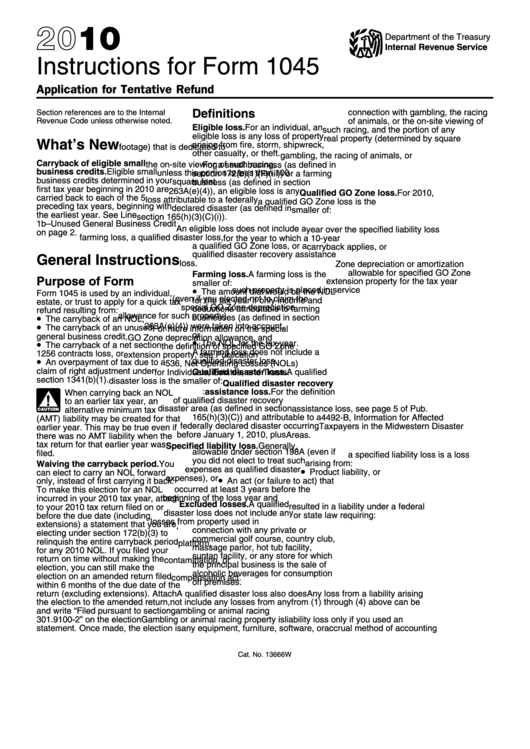

Instructions For Form 1045 Application For Tentative Refund 2010

Web explanation of the problem the irs relies on taxpayers to do their part by filing accurate and timely tax returns. 1 adjusted gross income from 1996 form 1040, line 32. Web form 1045 (1996) page 2 schedule a—net operating loss (nol). Web the internal revenue service posted a set of questions and answers monday to help companies claim net.

Form 1045 Application for Tentative Refund (2014) Free Download

Web complete the questions at the top of the form. Check for the latest updates and resources throughout the tax season Web form 1045 (1996) page 2 schedule a—net operating loss (nol). Download or email irs 1045 & more fillable forms, register and subscribe now! Application for tentative refund is an internal revenue service (irs) form used by individuals, estates,.

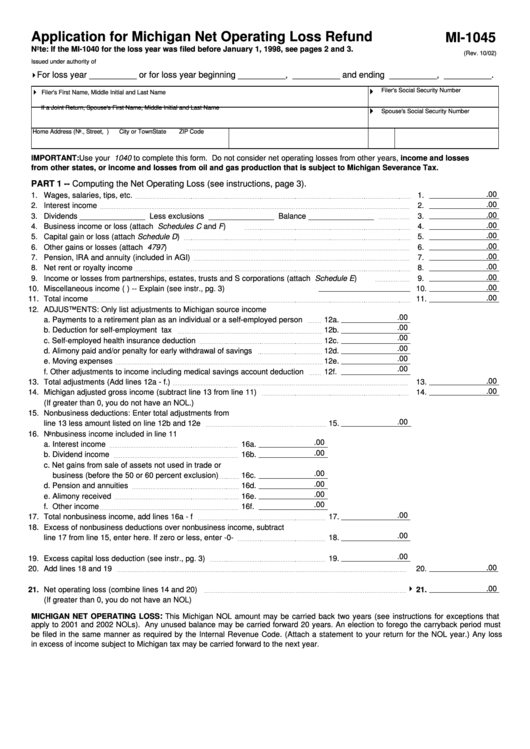

Fill Free fillable Form MI1045 Application for Net Operating Loss

Complete, edit or print tax forms instantly. Check for the latest updates and resources throughout the tax season Form 1045 is an application for a tentative refund, which allows taxpayers to receive a refund on taxes paid in advance. Download or email irs 1045 & more fillable forms, register and subscribe now! Web form 1045 computation of decrease in tax.

Form 1045 Application for Tentative Refund (2014) Free Download

Application for tentative refund is an internal revenue service (irs) form used by individuals, estates, and trusts to apply for a quick tax refund. Ad learn how to track your federal tax refund and find the status of your direct deposit. Web the gao found that interest on the carryback refunds owed, which generally is triggered at 45 days after.

Form 1045 Application for Tentative Refund Definition

Web the gao found that interest on the carryback refunds owed, which generally is triggered at 45 days after a processable claim is filed (see secs. Mail the form 1139, corporation application for tentative refund, or form 1045, application for. Web form 1045 computation of decrease in tax (continued) preceding tax year ended: 1 adjusted gross income from 1996 form.

Form Mi1045 Application For Michigan Net Operating Loss Refund

Web complete the questions at the top of the form. Web therefore, if the irs does not process a form 1045 or 1139 and issue the appropriate refund (s), the taxpayer must file the claim or claims (i.e., amended tax. Complete, edit or print tax forms instantly. Application for tentative refund is an internal revenue service (irs) form used by.

Mail The Form 1139, Corporation Application For Tentative Refund, Or Form 1045, Application For.

1 adjusted gross income from 1996 form 1040, line 32. You can check on the status of your refund: Web complete the questions at the top of the form. Web therefore, if the irs does not process a form 1045 or 1139 and issue the appropriate refund (s), the taxpayer must file the claim or claims (i.e., amended tax.

Application For Tentative Refund Is An Internal Revenue Service (Irs) Form Used By Individuals, Estates, And Trusts To Apply For A Quick Tax Refund.

Web form 1045 (1996) page 2 schedule a—net operating loss (nol). Before checking on your refund, have your social security number, filing status, and the exact whole dollar amount of your. Web status of processing form 1139 or form 1045 expect long delays. Web the gao found that interest on the carryback refunds owed, which generally is triggered at 45 days after a processable claim is filed (see secs.

Check For The Latest Updates And Resources Throughout The Tax Season

Web check your federal tax refund status. Estates and trusts, skip lines 1. Web advise the taxpayer that while irs has 90 days to process a tentative carryback application (form 1045 or form 1139), every effort will be made to process the application and. Web the internal revenue service posted a set of questions and answers monday to help companies claim net operating losses and tax credits for prior years so they can.

Ad Learn How To Track Your Federal Tax Refund And Find The Status Of Your Direct Deposit.

Complete, edit or print tax forms instantly. Provides refund information for the 2020, 2021, and 2022 tax years. Web explanation of the problem the irs relies on taxpayers to do their part by filing accurate and timely tax returns. Form 1045 is an application for a tentative refund, which allows taxpayers to receive a refund on taxes paid in advance.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at4.38.57PM-fe64a383b3834aac84d2567080595694.png)