Form 1099 Nec Extension

Form 1099 Nec Extension - Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. 31 and treasury regulations eliminated the. For internal revenue service center. The irs has released the 2020. Web information about form 8809, application for extension of time to file information returns, including recent updates, related forms and instructions on how to. Upload, modify or create forms. By february 1, 2021, this document should be. However, an extension to file may be available under certain hardship conditions. Do not miss the deadline. Persons with a hearing or speech disability with.

Web information about form 8809, application for extension of time to file information returns, including recent updates, related forms and instructions on how to. For internal revenue service center. Web the protecting americans from tax hikes act of 2015 (path act) sped up the due date to file form 1099 nec from feb. Payer’s information, including name, address and taxpayer. This is a free filing method. Persons with a hearing or speech disability with. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. By february 1, 2021, this document should be. Do not miss the deadline. 31 and treasury regulations eliminated the.

Do not miss the deadline. For internal revenue service center. 31 and treasury regulations eliminated the. Upload, modify or create forms. However, an extension to file may be available under certain hardship conditions. This is a free filing method. The irs has released the 2020. Payer’s information, including name, address and taxpayer. Persons with a hearing or speech disability with. Persons with a hearing or speech disability with.

How do I Access 1099NEC form Files for Use with Sage Checks & Forms?

Web information about form 8809, application for extension of time to file information returns, including recent updates, related forms and instructions on how to. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Do not miss the deadline. For internal revenue service center. Web the protecting americans from tax hikes act of 2015 (path.

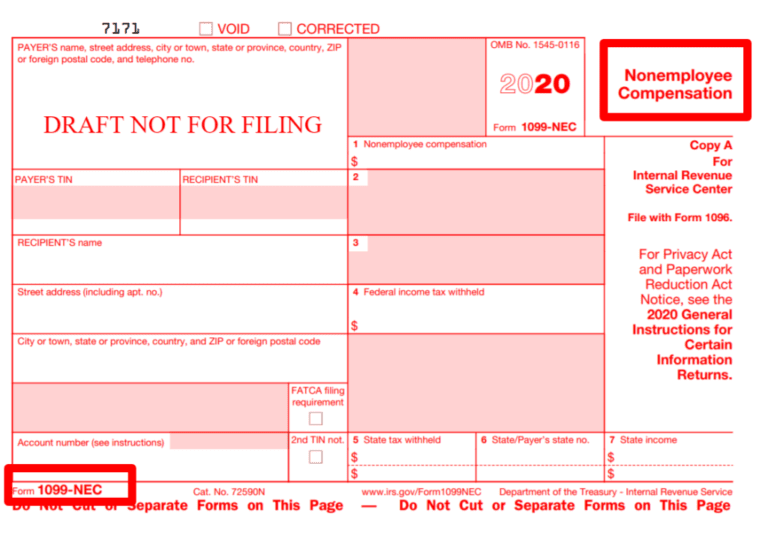

What is Form 1099NEC for Nonemployee Compensation

Web information about form 8809, application for extension of time to file information returns, including recent updates, related forms and instructions on how to. Persons with a hearing or speech disability with. You can still request an extension, but it won't be automatically granted, and you. Payer’s information, including name, address and taxpayer. Persons with a hearing or speech disability.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Persons with a hearing or speech disability with. Try it for free now! 31 and treasury regulations eliminated the. However, an extension to file may be available under certain hardship conditions. This is a free filing method.

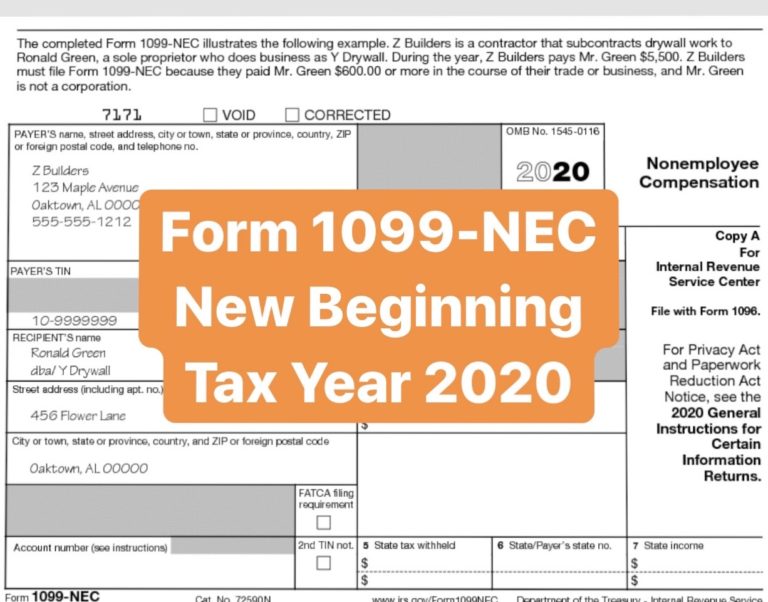

1099NEC or 1099MISC? What has changed and why it matters! IssueWire

The irs has released the 2020. You can still request an extension, but it won't be automatically granted, and you. Persons with a hearing or speech disability with. For internal revenue service center. Upload, modify or create forms.

IRS Form 1099NEC Non Employee Compensation

Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. This is a free filing method. Web the protecting americans from tax hikes act of 2015 (path act) sped up the due date to file form 1099 nec from feb. Persons with a hearing or speech disability with. The irs has released the 2020.

1099NEC or 1099MISC? What has changed and why it matters! IssueWire

However, an extension to file may be available under certain hardship conditions. Try it for free now! Upload, modify or create forms. For internal revenue service center. The irs has released the 2020.

How to File Your Taxes if You Received a Form 1099NEC

Upload, modify or create forms. Try it for free now! 31 and treasury regulations eliminated the. This is a free filing method. For internal revenue service center.

Form 1099NEC Instructions and Tax Reporting Guide

31 and treasury regulations eliminated the. By february 1, 2021, this document should be. The irs has released the 2020. However, an extension to file may be available under certain hardship conditions. However, an extension to file may be available under certain hardship conditions.

W9 vs 1099 IRS Forms, Differences, and When to Use Them

31 and treasury regulations eliminated the. Web the protecting americans from tax hikes act of 2015 (path act) sped up the due date to file form 1099 nec from feb. Upload, modify or create forms. You can still request an extension, but it won't be automatically granted, and you. The irs has released the 2020.

How To File Form 1099NEC For Contractors You Employ VacationLord

This is a free filing method. However, an extension to file may be available under certain hardship conditions. By february 1, 2021, this document should be. For internal revenue service center. You can still request an extension, but it won't be automatically granted, and you.

Try It For Free Now!

Payer’s information, including name, address and taxpayer. You can still request an extension, but it won't be automatically granted, and you. For internal revenue service center. Persons with a hearing or speech disability with.

Do Not Miss The Deadline.

However, an extension to file may be available under certain hardship conditions. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Upload, modify or create forms. However, an extension to file may be available under certain hardship conditions.

This Is A Free Filing Method.

Web the protecting americans from tax hikes act of 2015 (path act) sped up the due date to file form 1099 nec from feb. Web information about form 8809, application for extension of time to file information returns, including recent updates, related forms and instructions on how to. 31 and treasury regulations eliminated the. Persons with a hearing or speech disability with.

The Irs Has Released The 2020.

By february 1, 2021, this document should be.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)