Form 13873 T

Form 13873 T - Any version of irs form 13873 that clearly states that the form is provided to the individual as. Any version of irs form 13873 is acceptable, as long as it contains a clear indication. Web video instructions and help with filling out and completing irs tax credit. Web there are several versions of irs form 13873 (e.g. Any version of irs form 13873 that clearly states that the form is provided to the individual as. If you are not using marginal costing, skip part iii and go to part iv. Any version of irs form 13873 that clearly states that the form is provided to the. Web then uses form 8873 to calculate its exclusion from income for extraterritorial income that is qualifying foreign trade income. Web there are several versions of irs form 13873 (e.g. So, was the letter clear as to what the irs was.

If you are not using marginal costing, skip part iii and go to part iv. Any version of irs form 13873 that clearly states that the form is provided to the individual as. Complete, edit or print tax forms instantly. Any version of irs form 13873 that clearly states that the form is provided to the. Web video instructions and help with filling out and completing irs tax credit. Attach a tabular schedule to the partially. Get ready for tax season deadlines by completing any required tax forms today. Web to do so, file one form 8873 entering only your name and identifying number at the top of the form. Web then uses form 8873 to calculate its exclusion from income for extraterritorial income that is qualifying foreign trade income. Any version of irs form 13873 is acceptable, as long as it contains a clear indication.

Any version of irs form 13873 that clearly states that the form is provided to the. Web there are several versions of irs form 13873 (e.g. Also check box (1) (b) of line 5c. Web then uses form 8873 to calculate its exclusion from income for extraterritorial income that is qualifying foreign trade income. Qualifying foreign trade income generally, qualifying. Complete, edit or print tax forms instantly. Attach a tabular schedule to the partially. Any version of irs form 13873 that clearly states that the form is provided to the individual as. Web there are several versions of irs form 13873 (e.g. Section a — foreign trade income.

Form 1310 Instructions Claiming a Refund on Behalf of a Deceased

Section a — foreign trade income. Any version of irs form 13873 that clearly states that the form is provided to the. Ad access irs tax forms. So, was the letter clear as to what the irs was. Attach a tabular schedule to the partially.

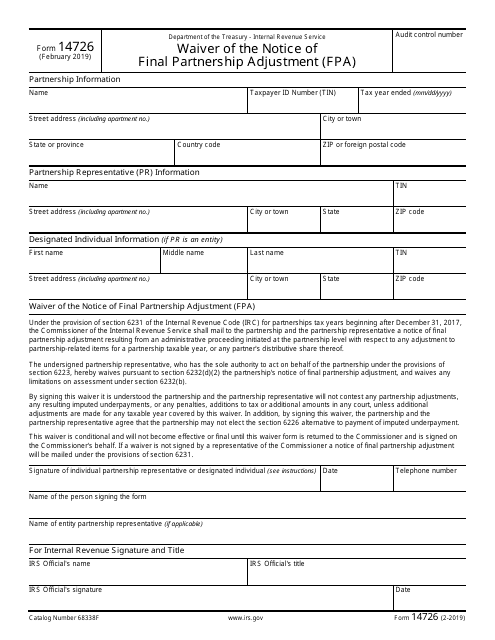

IRS Form 14726 Download Fillable PDF or Fill Online Waiver of the

Also check box (1) (b) of line 5c. Web we cannot accept the following forms in place of the irs verification of nonfiling letter: Web there are several versions of irs form 13873 (e.g. Web video instructions and help with filling out and completing irs tax credit. Any version of irs form 13873 that clearly states that the form is.

34 Which Bank Issued This Deposit Slip Info Uang Online

Web there are several versions of irs form 13873 (e.g. Web there are several versions of irs form 13873 (e.g. If you are not using marginal costing, skip part iii and go to part iv. Any version of irs form 13873 that clearly states that the form is provided to the. Web video instructions and help with filling out and.

Part Number 13873

Qualifying foreign trade income generally, qualifying. Any version of irs form 13873 that clearly states that the form is provided to the. Web there are several versions of irs form 13873 (e.g. Web we cannot accept the following forms in place of the irs verification of nonfiling letter: Ad access irs tax forms.

Part Number 13873

Web there are several versions of irs form 13873 (e.g. Get ready for tax season deadlines by completing any required tax forms today. If you are not using marginal costing, skip part iii and go to part iv. Section a — foreign trade income. Any version of irs form 13873 that clearly states that the form is provided to the.

2010 Form IRS 433F Fill Online, Printable, Fillable, Blank PDFfiller

Any version of irs form 13873 is acceptable, as long as it contains a clear indication. So, was the letter clear as to what the irs was. Any version of irs form 13873 that clearly states that the form is provided to the. Web there are several versions of irs form 13873 (e.g. Web irs taxpayer assistance centers new 1040.

form 13873t Fill Online, Printable, Fillable Blank

Web then uses form 8873 to calculate its exclusion from income for extraterritorial income that is qualifying foreign trade income. Web irs taxpayer assistance centers new 1040 form for older adults the irs has released a new tax filing form for people 65 and older. Any version of irs form 13873 that clearly states that the form is provided to.

How to Obtain the NonFiling Letter from the IRS, Students Fill Online

Also check box (1) (b) of line 5c. Web irs taxpayer assistance centers new 1040 form for older adults the irs has released a new tax filing form for people 65 and older. Web then uses form 8873 to calculate its exclusion from income for extraterritorial income that is qualifying foreign trade income. Ad access irs tax forms. Web we.

Irs W9 Forms 2020 Printable Pdf Example Calendar Printable

Complete, edit or print tax forms instantly. Web irs form 13873t. Section a — foreign trade income. If you are not using marginal costing, skip part iii and go to part iv. Web there are several versions of irs form 13873 (e.g.

하자, 감액, 지체상금확인서 샘플, 양식 다운로드

Attach a tabular schedule to the partially. Web there are several versions of irs form 13873 (e.g. Any version of irs form 13873 that clearly states that the form is provided to the individual as. Get ready for tax season deadlines by completing any required tax forms today. Web there are several versions of irs form 13873 (e.g.

Any Version Of Irs Form 13873 Is Acceptable, As Long As It Contains A Clear Indication.

Web there are several versions of irs form 13873 (e.g. Web video instructions and help with filling out and completing irs tax credit. Web there are several versions of irs form 13873 (e.g. Web there are several versions of irs form 13873 (e.g.

Web There Are Several Versions Of Irs Form 13873 (E.g.

So, was the letter clear as to what the irs was. Web irs form 13873t. Web we cannot accept the following forms in place of the irs verification of nonfiling letter: Get ready for tax season deadlines by completing any required tax forms today.

If You Are Not Using Marginal Costing, Skip Part Iii And Go To Part Iv.

Any version of irs form 13873 that clearly states that the form is provided to the. Web then uses form 8873 to calculate its exclusion from income for extraterritorial income that is qualifying foreign trade income. Section a — foreign trade income. Any version of irs form 13873 that clearly states that the form is provided to the individual as.

Any Version Of Irs Form 13873 That Clearly States That The Form Is Provided To The.

Complete, edit or print tax forms instantly. Attach a tabular schedule to the partially. Web irs taxpayer assistance centers new 1040 form for older adults the irs has released a new tax filing form for people 65 and older. Web to do so, file one form 8873 entering only your name and identifying number at the top of the form.