Form 216 Appraisal

Form 216 Appraisal - Fannie mae form 1007 is used to provide an. Income and expense projections are provided by the applicant to be used in determining income approach to value. This form is to be prepared jointly by the loan applicant, the appraiser, and the lender's underwriter. It provides the benefit of a. What is the difference between 1007 and 216? Web the 216 form is usually ordered in conjunction with the 1007 form. How is rental income taxed when you have a mortgage? And meets any governmental regulations in effect when the mortgage loan was originated, including the financial institutions reform, recovery, and enforcement act of 1989. Conforms to the requirements in the uspap ; Appraisers may not add limiting conditions.

Appraisers may not add limiting conditions. How is rental income taxed when you have a mortgage? This form is to be prepared jointly by the loan applicant, the appraiser, and the lender's underwriter. It provides the benefit of a. Income and expense projections are provided by the applicant to be used in determining income approach to value. Fannie mae form 1007 is used to provide an. It is used to determine the operating income of the subject property. Web the 216 form is usually ordered in conjunction with the 1007 form. Web is an operating income statement for an appraisal required? It takes the market rent less operating expenses to determine the operating income.

Fannie mae form 1007 is used to provide an. It is used to determine the operating income of the subject property. Conforms to the requirements in the uspap ; It takes the market rent less operating expenses to determine the operating income. Income and expense projections are provided by the applicant to be used in determining income approach to value. What is a 216 and 1007 appraisal form? Web is an operating income statement for an appraisal required? It provides the benefit of a. And meets any governmental regulations in effect when the mortgage loan was originated, including the financial institutions reform, recovery, and enforcement act of 1989. Applicant provides income and expense projections to be used in determining income approach to value.

Real Estate Appraisal Form 216 Universal Network

It takes the market rent less operating expenses to determine the operating income. Web is an operating income statement for an appraisal required? It is used to determine the operating income of the subject property. Conforms to the requirements in the uspap ; Web the 216 form is usually ordered in conjunction with the 1007 form.

16. Appraisal form 2007

Conforms to the requirements in the uspap ; Appraisers may not add limiting conditions. Web the 216 form is usually ordered in conjunction with the 1007 form. Web each fannie mae appraisal report form includes an appraiser’s certification (and, if applicable, a supervisory appraiser’s certification) and a statement of assumptions and limiting conditions. Web is an operating income statement for.

Real Estate Appraisal Template Word Universal Network

What is a 216 and 1007 appraisal form? Conforms to the requirements in the uspap ; It takes the market rent less operating expenses to determine the operating income. Web 201.02 appraisal requirements you must obtain an appraisal that: What is the difference between 1007 and 216?

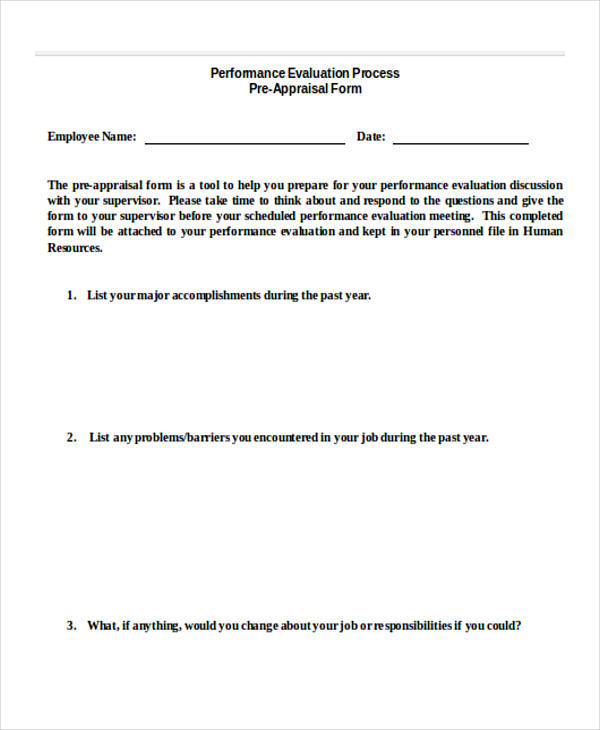

FREE 7+ PreAppraisal Forms in PDF MS Word

It provides the benefit of a. How is rental income taxed when you have a mortgage? Web each fannie mae appraisal report form includes an appraiser’s certification (and, if applicable, a supervisory appraiser’s certification) and a statement of assumptions and limiting conditions. The applicant must complete the following schedule indicating each unit's rental status, lease expiration date, current rent, market.

Appraisal form sample

What is the difference between 1007 and 216? Fannie mae form 1007 is used to provide an. Appraisers may not add limiting conditions. It provides the benefit of a. And meets any governmental regulations in effect when the mortgage loan was originated, including the financial institutions reform, recovery, and enforcement act of 1989.

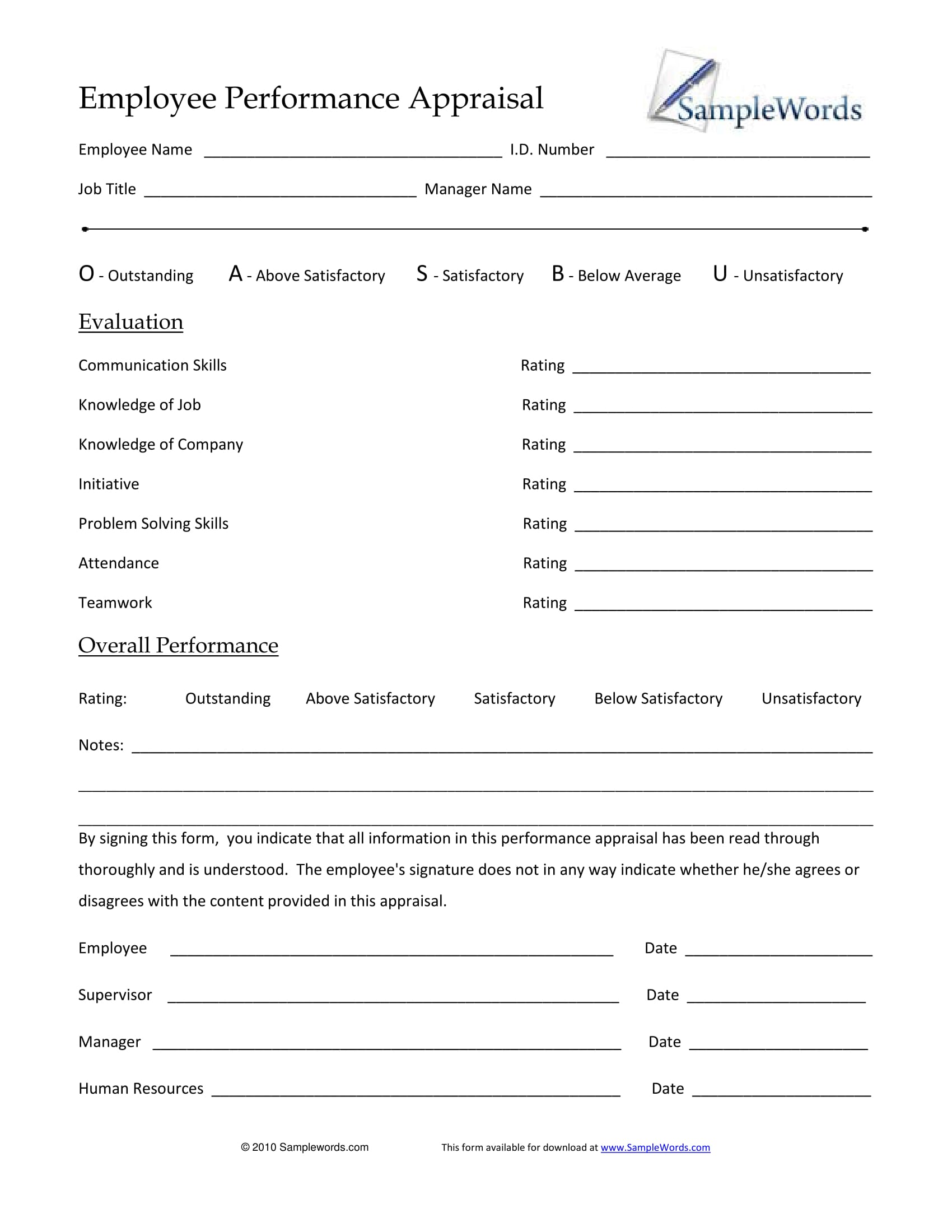

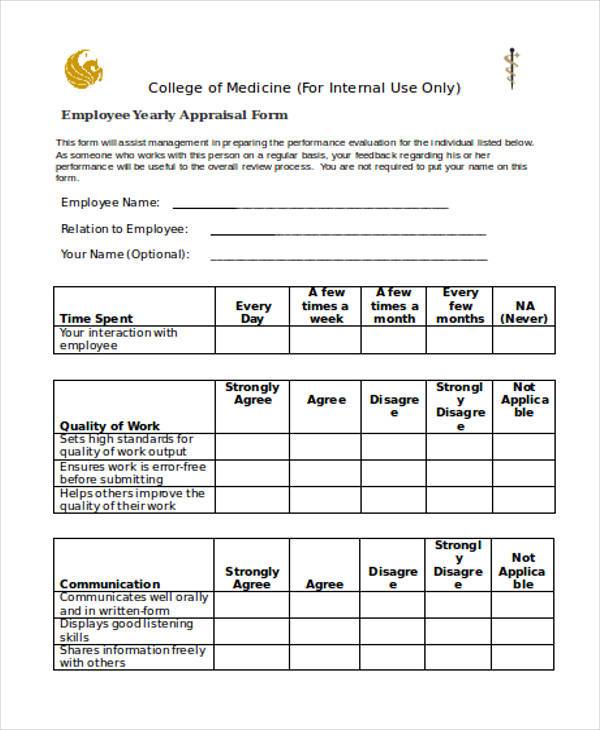

FREE 14+ Review Forms for Staff in PDF MS Word

Web 201.02 appraisal requirements you must obtain an appraisal that: Web the 216 form is usually ordered in conjunction with the 1007 form. What is the difference between 1007 and 216? Web each fannie mae appraisal report form includes an appraiser’s certification (and, if applicable, a supervisory appraiser’s certification) and a statement of assumptions and limiting conditions. What is a.

FREE 23+ Sample Appraisal Forms in MS Word

Conforms to the requirements in the uspap ; Applicant provides income and expense projections to be used in determining income approach to value. What is the difference between 1007 and 216? Appraisers may not add limiting conditions. Income and expense projections are provided by the applicant to be used in determining income approach to value.

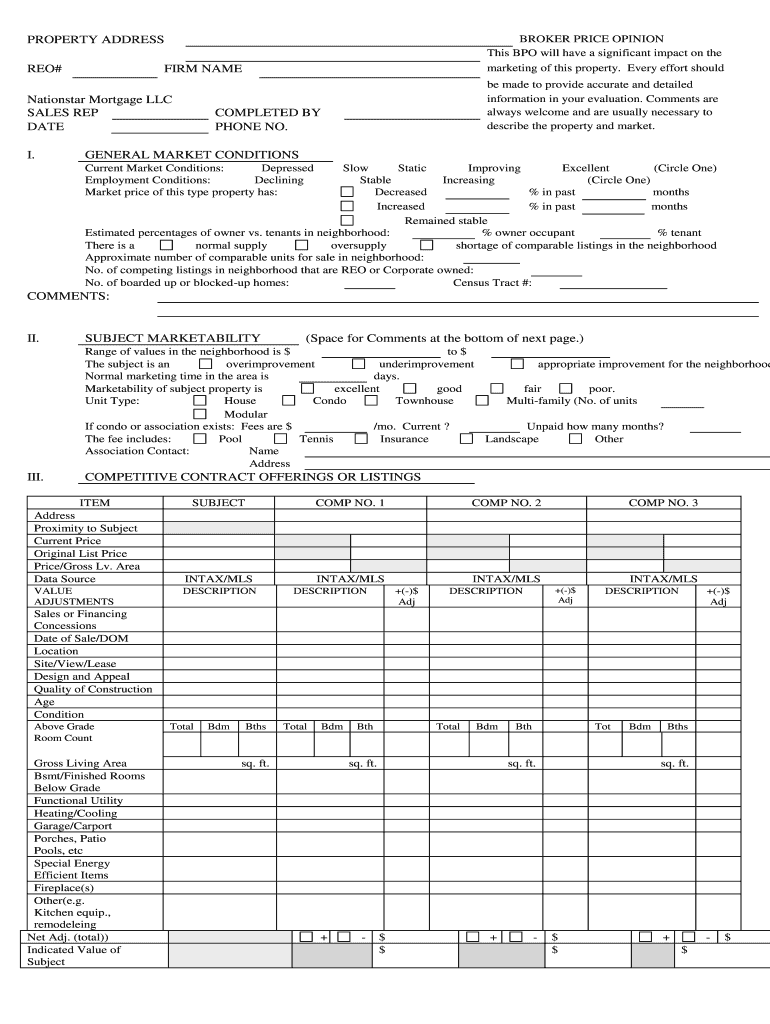

Nationstar Mortgage Broker Price Opinion Fill and Sign Printable

Applicant provides income and expense projections to be used in determining income approach to value. Fannie mae form 1007 is used to provide an. It provides the benefit of a. The applicant must complete the following schedule indicating each unit's rental status, lease expiration date, current rent, market rent, and the responsibility for utility expenses. Web is an operating income.

Analysis appraisal report Fill out & sign online DocHub

Web 201.02 appraisal requirements you must obtain an appraisal that: Web the 216 form is usually ordered in conjunction with the 1007 form. Web each fannie mae appraisal report form includes an appraiser’s certification (and, if applicable, a supervisory appraiser’s certification) and a statement of assumptions and limiting conditions. Appraisers may not add limiting conditions. Web is an operating income.

Appraisal Form

Web the 216 form is usually ordered in conjunction with the 1007 form. It takes the market rent less operating expenses to determine the operating income. What is a 216 and 1007 appraisal form? Web is an operating income statement for an appraisal required? It is used to determine the operating income of the subject property.

It Takes The Market Rent Less Operating Expenses To Determine The Operating Income.

Appraisers may not add limiting conditions. Web each fannie mae appraisal report form includes an appraiser’s certification (and, if applicable, a supervisory appraiser’s certification) and a statement of assumptions and limiting conditions. Web 201.02 appraisal requirements you must obtain an appraisal that: Web is an operating income statement for an appraisal required?

Income And Expense Projections Are Provided By The Applicant To Be Used In Determining Income Approach To Value.

What is a 216 and 1007 appraisal form? What is the difference between 1007 and 216? It is used to determine the operating income of the subject property. This form is to be prepared jointly by the loan applicant, the appraiser, and the lender's underwriter.

Applicant Provides Income And Expense Projections To Be Used In Determining Income Approach To Value.

The applicant must complete the following schedule indicating each unit's rental status, lease expiration date, current rent, market rent, and the responsibility for utility expenses. Web the 216 form is usually ordered in conjunction with the 1007 form. And meets any governmental regulations in effect when the mortgage loan was originated, including the financial institutions reform, recovery, and enforcement act of 1989. How is rental income taxed when you have a mortgage?

Conforms To The Requirements In The Uspap ;

Fannie mae form 1007 is used to provide an. It provides the benefit of a.