Form 2210 Calculator

Form 2210 Calculator - If you need to calculate late filing or late payment penalties, you will need to work directly with the irs. 06 name(s) shown on tax return Does any box in part il below apply? A recent kiplinger tax letter reported that the irs has a backlog of some 6 million 2010 paper returns yet to be processed. The irs will generally figure your penalty for you and you should not file form 2210. You may need this form if: Department of the treasury internal revenue service. Even if you underpaid your taxes during the year, the irs might not charge a penalty if you meet one of the safe harbor tests. Taxpayers who owe underpayment penalties are not always required to file form 2210 because. You can use form 2210, underpayment of estimated tax.

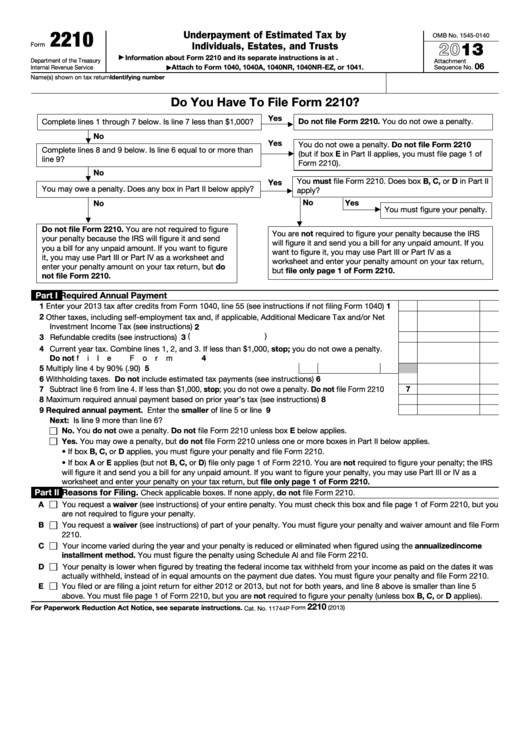

You can, however, use form 2210 to figure your penalty if you wish and include the penalty on your return. Dispute a penalty if you don’t qualify for penalty removal or reduction due to retirement or disability, we can't adjust the underpayment of estimated tax by individuals penalty for reasonable cause. The interest rate for underpayments, which is updated by the irs each quarter. You must file form 2210. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Underpayment of estimated tax by individuals, estates, and trusts. Web to make things easier, irs form 2210 actually provides a useful flowchart that can help you determine whether or not you need to file it. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Taxpayers who owe underpayment penalties are not always required to file form 2210 because.

This form contains both a short and regular method for determining your penalty. No yes you may owe a penalty. Web form 2210 calculator for taxpayers who are liable to pay penalty for underpayment of estimated tax is based on the section §6654 of the internal revenue code that is titled “failure by individual to pay estimated income tax.” No yes complete lines 8 and 9 below. The irs will generally figure your penalty for you and you should not file form 2210. 06 name(s) shown on tax return You can use form 2210, underpayment of estimated tax. In order to make schedule ai available, part ii of form 2210 underpayment of estimated tax by individuals, estates, and trusts must be entered. Web instructions for form 2210 underpayment of estimated tax by individuals, estates, and trusts department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and Trusts

You owe a sum of less than $1,000 after deducting your withholding and any refundable tax credits. Web to make things easier, irs form 2210 actually provides a useful flowchart that can help you determine whether or not you need to file it. Department of the treasury internal revenue service. Taxact cannot calculate late filing nor late payment penalties. Is.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. 06 name(s) shown on tax return Is line 6 equal to or more than line 9? You can, however, use form 2210 to figure your penalty if you wish and include the penalty on your.

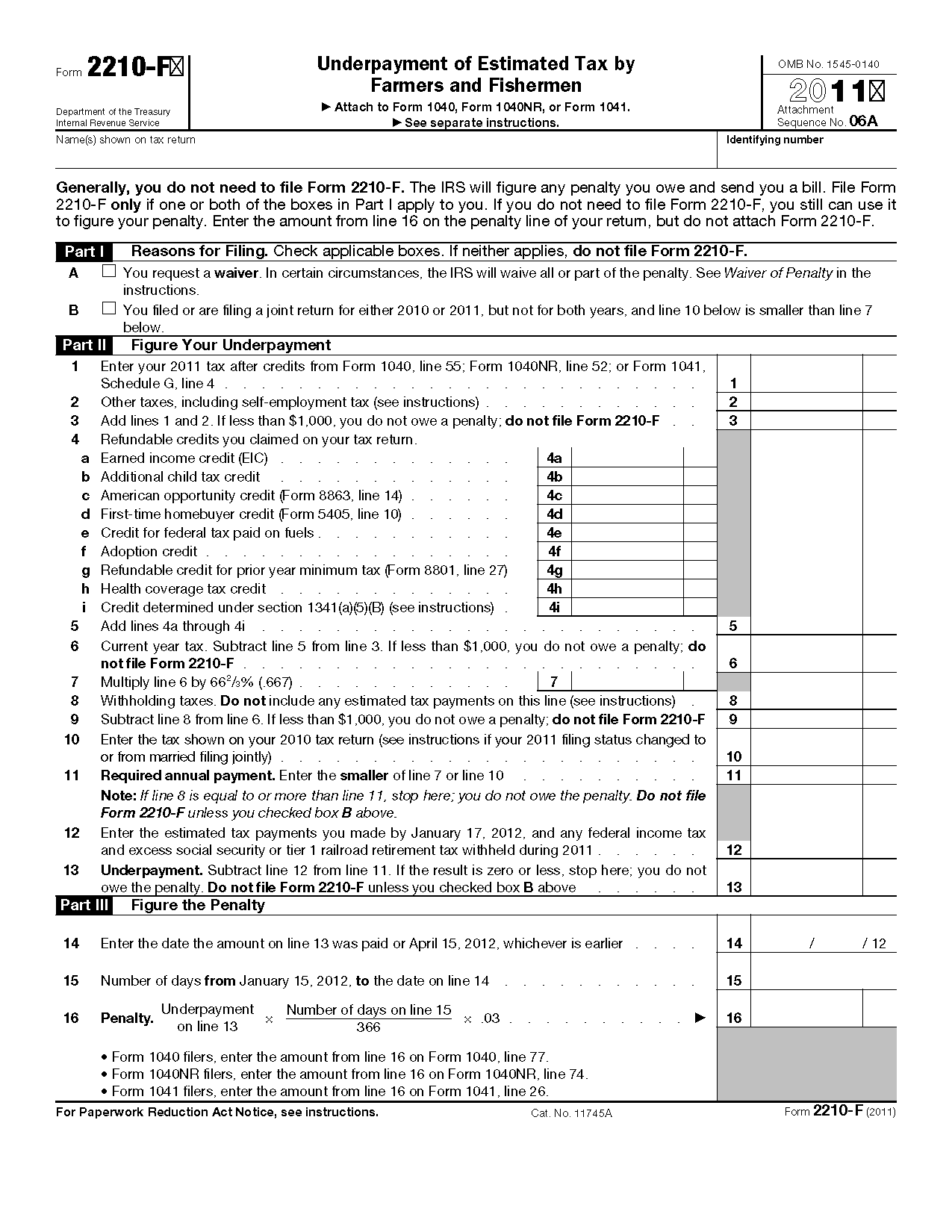

Form 2210 F Underpayment Of Estimated Tax By Farmers And 1040 Form

Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form). The interest rate for underpayments, which is updated by the irs each quarter. You should figure out the amount of tax you have underpaid. You may need this form if: Web form 2210 is a federal individual income tax form.

تعليمات نموذج الضريبة الفيدرالية 2210 أساسيات 2021

You should figure out the amount of tax you have underpaid. 06 name(s) shown on tax return The form doesn't always have to be completed; Yes you must figure your penalty. The irs will generally figure any penalty due and send the taxpayer a bill.

Form 2210 Calculator Find if you owe estimated tax penalty ? https

The quarter that you underpaid. Web form 2210 is a federal individual income tax form. You must file form 2210. What is your tax after credits from form line 22? Web you can use this form to calculate your penalty or determine if the irs won’t charge a penalty.

Fillable Form 2210 Fill Online, Printable, Fillable, Blank pdfFiller

Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form). Even if you underpaid your taxes during the year, the irs might not charge a penalty if you meet one of the safe harbor tests. Department of the treasury internal revenue service. A recent kiplinger tax letter reported that the irs has a backlog of.

Fillable Form 2210 Underpayment Of Estimated Tax By Individuals

No yes you may owe a penalty. Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount. You can, however, use form 2210 to figure your penalty if you wish and include the penalty on your return. You can use form 2210, underpayment of estimated tax. Is line 6 equal to or more than line.

Ssurvivor Form 2210 Line 4

Web form 2210 department of the treasury internal revenue service underpayment of estimated tax by individuals, estates, and trusts go to www.irs.gov/form2210 for instructions and the latest information. Web the irs will send you a bill to notify you of the amount of the penalty owed. Is line 7 less than $1 ,ooo? Web your total underpayment amount. Web form.

Ssurvivor Form 2210 Line 4

Underpayment of estimated tax by individuals, estates, and trusts. If you need to calculate late filing or late payment penalties, you will need to work directly with the irs. * trial calculations for tax after credits under $12,000. Purchase calculations underpayment of estimated tax penalty calculator tax year: No don't file form 2210.

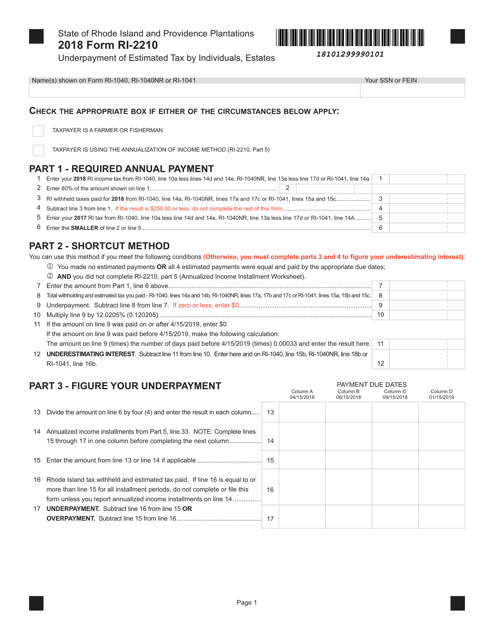

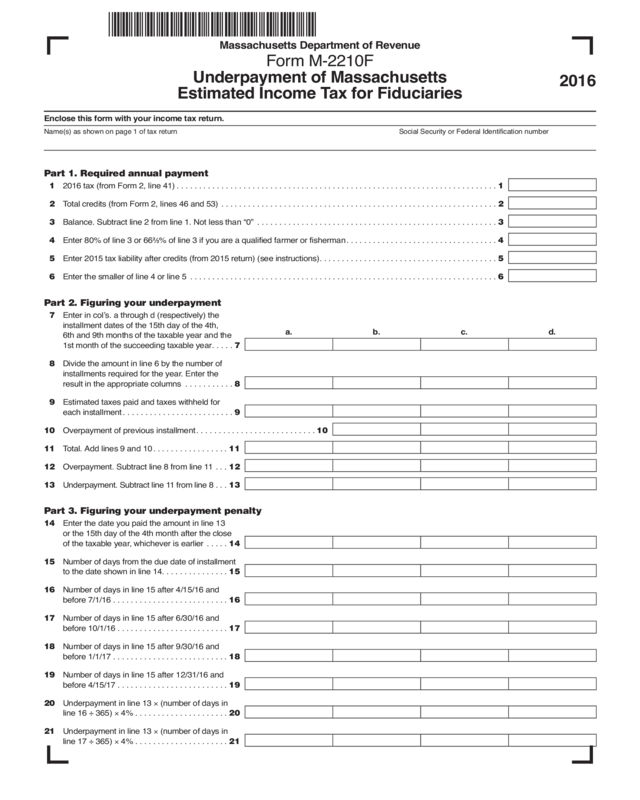

Form M2210F Edit, Fill, Sign Online Handypdf

Taxact will calculate the underpayment penalty of estimated tax payments only. Web the irs will send you a bill to notify you of the amount of the penalty owed. You must file form 2210. Yes you must figure your penalty. Web 2021 form 2210 calculation error submitting via paper is an undesireable solution especially if you have a refund coming.

Yes You Must Figure Your Penalty.

Dispute a penalty if you don’t qualify for penalty removal or reduction due to retirement or disability, we can't adjust the underpayment of estimated tax by individuals penalty for reasonable cause. The irs will generally figure any penalty due and send the taxpayer a bill. No yes you may owe a penalty. Web instructions for form 2210 underpayment of estimated tax by individuals, estates, and trusts department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted.

Web Calculate Form 2210 The Underpayment Of Estimated Tax Penalty Calculator Prepares And Prints Form 2210.

Web to make things easier, irs form 2210 actually provides a useful flowchart that can help you determine whether or not you need to file it. Purchase calculations underpayment of estimated tax penalty calculator tax year: The form doesn't always have to be completed; Taxpayers who owe underpayment penalties are not always required to file form 2210 because.

Web Form 2210 Is Used By Individuals (As Well As Estates And Trusts) To Determine If A Penalty Is Owed For The Underpayment Of Income Taxes Due.

Web your total underpayment amount. Is line 6 equal to or more than line 9? Web the irs will send you a bill to notify you of the amount of the penalty owed. You can use form 2210, underpayment of estimated tax.

Web Form 2210 Department Of The Treasury Internal Revenue Service Underpayment Of Estimated Tax By Individuals, Estates, And Trusts Go To Www.irs.gov/Form2210 For Instructions And The Latest Information.

Web you can use this form to calculate your penalty or determine if the irs won’t charge a penalty. If you need to calculate late filing or late payment penalties, you will need to work directly with the irs. The irs states that you do not need to file form 2210 if: 06 name(s) shown on tax return