Form 2290 V

Form 2290 V - Web the heavy highway vehicle use tax is based on a vehicle gross taxable weight. Easy, fast, secure & free to try. Easy2290 is an irs authorized and approved hvut provider for. Web in the instructions for form 2290 for information on alternative methods to pay the tax. Web i declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2021, through june 30, 2022, were not subject to the tax for that period except for any. Web about form 2290, heavy highway vehicle use tax return. Then, complete your heavy highway vehicle use tax. Download and print the pdf file. Web the deadline to file and pay heavy highway vehicle use tax is monday, august 31. Web file your form 2290.

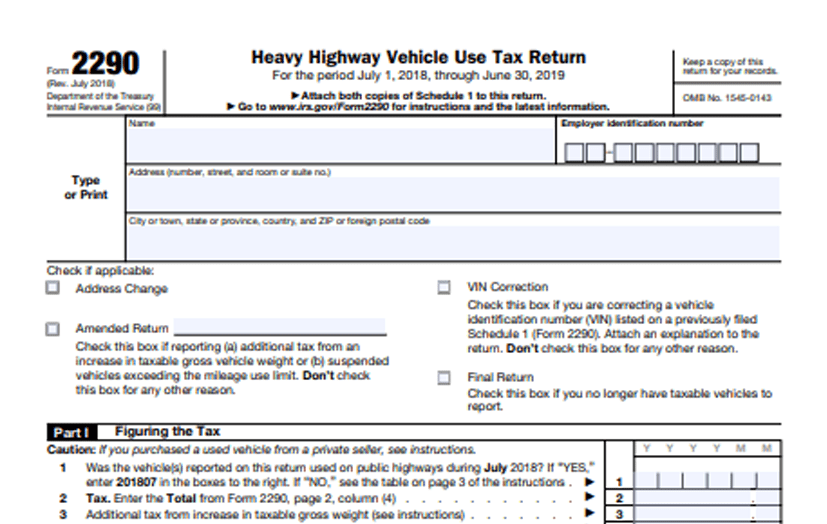

Web file your form 2290. Form 2290 is used to figure and pay the tax due on highway motor vehicles for any taxable period with a taxable gross weight of 55,000 pounds or more.it is. Web i declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2021, through june 30, 2022, were not subject to the tax for that period except for any. Complete, edit or print tax forms instantly. Web “form 2290,” and the tax period on your check or money order. Web the heavy highway vehicle use tax is based on a vehicle gross taxable weight. For vehicles first used on a public highway during the month of july, file form 2290 and pay the appropriate tax between july 1 and august 31. Web free printable 2023 form 2290 and instructions booklet sourced from the irs. Web when form 2290 taxes are due. Web about form 2290, heavy highway vehicle use tax return.

Web when form 2290 taxes are due. All taxpayers who file form 2290 are encouraged to do so electronically. Ad complete irs tax forms online or print government tax documents. Take a look at the details about using a check or money order. Enter the total here and on form 2290, line 2. Web free printable 2023 form 2290 and instructions booklet sourced from the irs. Download and print the pdf file. Easy, fast, secure & free to try. Web about form 2290, heavy highway vehicle use tax return. Web the heavy highway vehicle use tax is based on a vehicle gross taxable weight.

Form 2290 V Payment Voucher Beautiful N Csr 1 Cib Ncsrm N Csr United

Easy, fast, secure & free to try. Do your truck tax online & have it efiled to the irs! Then, complete your heavy highway vehicle use tax. Download and print the pdf file. For vehicles first used on a public highway during the month of july, file form 2290 and pay the appropriate tax between july 1 and august 31.

Form 2290 V Payment Voucher Best Of Omega‐3 Fatty Acid Addition During

Web i declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2021, through june 30, 2022, were not subject to the tax for that period except for any. Ad complete irs tax forms online or print government tax documents. Web about form 2290, heavy highway vehicle use tax return. Do your truck.

Form This Page Intentionally Left Blank Pdf Irs Cost Jj

Do your truck tax online & have it efiled to the irs! Web the heavy highway vehicle use tax is based on a vehicle gross taxable weight. All taxpayers who file form 2290 are encouraged to do so electronically. Easy2290 is an irs authorized and approved hvut provider for. Web i declare that the vehicles listed as suspended on the.

Heavy Highway Vehicle Use Tax Return Free Download

Enter the total here and on form 2290, line 2. Take a look at the details about using a check or money order. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Form 2290 is used to figure and pay the tax due on highway motor vehicles for any taxable period with a taxable.

202021 Form 2290 Generator Fill, Create & Download 2290

This july 2020 revision is for the tax period beginning on july 1, 2020, and ending on june 30,. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Web c.) add the amounts in column (4). Easy, fast, secure & free to try. Figure and pay the tax due on highway motor vehicles used.

IRS Form 2290 Instructions for 20232024 How to fill out 2290?

Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Do your truck tax online & have it efiled to the irs! All taxpayers who file form 2290 are encouraged to do so electronically. Ad complete irs tax forms online or print government tax documents. Take a look at the details about using a check.

Form 2290 V Payment Voucher Awesome 52 Beautiful form 2290 V Payment

Web in the instructions for form 2290 for information on alternative methods to pay the tax. Web free printable 2023 form 2290 and instructions booklet sourced from the irs. Enter the total here and on form 2290, line 2. This july 2020 revision is for the tax period beginning on july 1, 2020, and ending on june 30,. Web when.

PDF Accelerators as start up infrastructure for

For vehicles first used on a public highway during the month of july, file form 2290 and pay the appropriate tax between july 1 and august 31. Complete, edit or print tax forms instantly. Download and print the pdf file. Easy, fast, secure & free to try. And it does apply on highway motor vehicles with a taxable gross weight.

Form 2290 V Payment Voucher Beautiful form This Page Intentionally Left

Web in the instructions for form 2290 for information on alternative methods to pay the tax. Take a look at the details about using a check or money order. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Web when form 2290 taxes are due. Ad complete irs tax forms online or print government.

Form 2290 V Payment Voucher Inspirational 3 11 10 Revenue Receipts

Ad complete irs tax forms online or print government tax documents. Take a look at the details about using a check or money order. File your 2290 online & get schedule 1 in minutes. Web the deadline to file and pay heavy highway vehicle use tax is monday, august 31. Enter the total here and on form 2290, line 2.

Do Your Truck Tax Online & Have It Efiled To The Irs!

Complete, edit or print tax forms instantly. Web c.) add the amounts in column (4). Enter the total here and on form 2290, line 2. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs.

Download And Print The Pdf File.

Web when form 2290 taxes are due. And it does apply on highway motor vehicles with a taxable gross weight of 55,000 pounds or. Web about form 2290, heavy highway vehicle use tax return. This july 2020 revision is for the tax period beginning on july 1, 2020, and ending on june 30,.

For Vehicles First Used On A Public Highway During The Month Of July, File Form 2290 And Pay The Appropriate Tax Between July 1 And August 31.

Web “form 2290,” and the tax period on your check or money order. Web free printable 2023 form 2290 and instructions booklet sourced from the irs. Then, complete your heavy highway vehicle use tax. Easy2290 is an irs authorized and approved hvut provider for.

Easy, Fast, Secure & Free To Try.

Web file your form 2290. File your 2290 online & get schedule 1 in minutes. Ad complete irs tax forms online or print government tax documents. Web i declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2021, through june 30, 2022, were not subject to the tax for that period except for any.