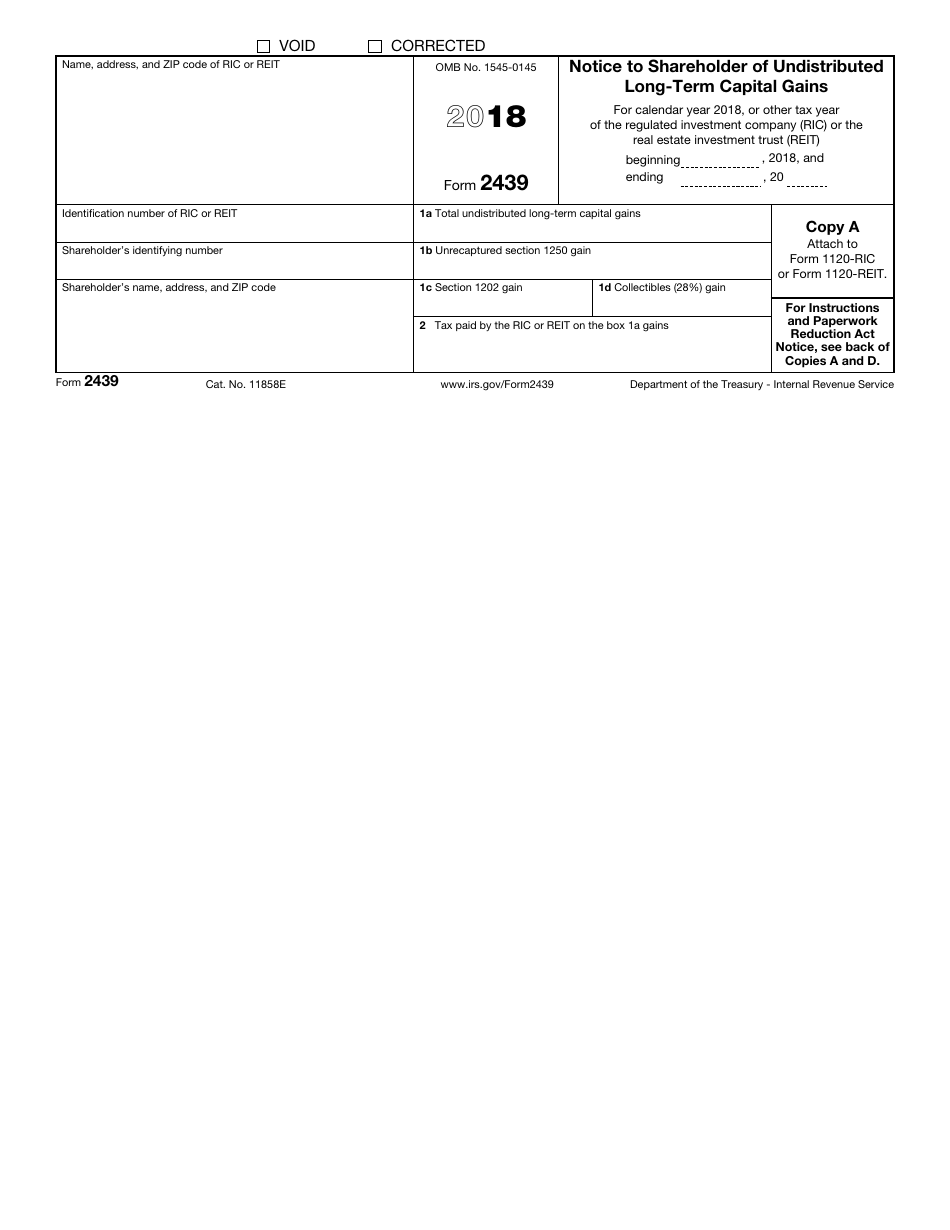

Form 2439 Irs

Form 2439 Irs - The above information will flow to: Internal revenue service (irs) for use by rics, reits, etfs, and mutual funds. For calendar year 20, or. Rics and mutual funds usually distribute all capital gains. Report these capital gains even though you don’t actually receive them. Web what is form 2439? Form 2439 is required by the u.s. However, since the mutual fund paid tax on the gains, you can claim a credit for the taxes they pay. If your mutual fund sends you a form 2439: For instructions and paperwork reduction act notice, see back of copies a and d.

Web when this happens, the mutual fund company will send you a form 2439: Rics and mutual funds usually distribute all capital gains. Web to enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right corner of your screen and select jump to that section. If you received a form 2439 with an amount in box 2 tax paid by the ric or reit on box 1a gains , you would report the amount on schedule 3 (form 1040) additional credits and. Report these capital gains even though you don’t actually receive them. If your mutual fund sends you a form 2439: Form 2439 is required by the u.s. For calendar year 20, or. This information is for amt purposes: For instructions and paperwork reduction act notice, see back of copies a and d.

Report these capital gains even though you don’t actually receive them. The tax paid by ric will flow to line 70 of the 1040. If you received a form 2439 with an amount in box 2 tax paid by the ric or reit on box 1a gains , you would report the amount on schedule 3 (form 1040) additional credits and. If your mutual fund sends you a form 2439: Internal revenue service (irs) for use by rics, reits, etfs, and mutual funds. Web what is form 2439? The capital gains will flow to the schedule d. For calendar year 20, or. This information is for amt purposes: Web to enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right corner of your screen and select jump to that section.

Fill Free fillable 2019 Form 1120REIT Tax Return for Real Estate

For calendar year 20, or. The above information will flow to: Web what is form 2439? This information is for amt purposes: Report these capital gains even though you don’t actually receive them.

Form 2439 Notice to Shareholder of Undistributed LongTerm Capital

Web what is form 2439? This information is for amt purposes: For instructions and paperwork reduction act notice, see back of copies a and d. Rics and mutual funds usually distribute all capital gains. For calendar year 20, or.

Fill Free fillable IRS PDF forms

Internal revenue service (irs) for use by rics, reits, etfs, and mutual funds. The above information will flow to: For instructions and paperwork reduction act notice, see back of copies a and d. Rics and mutual funds usually distribute all capital gains. Report these capital gains even though you don’t actually receive them.

Breanna Form 2439 Statements

Web to enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right corner of your screen and select jump to that section. The tax paid by ric will flow to line 70 of the 1040. Internal revenue service (irs) for use by rics, reits, etfs, and mutual.

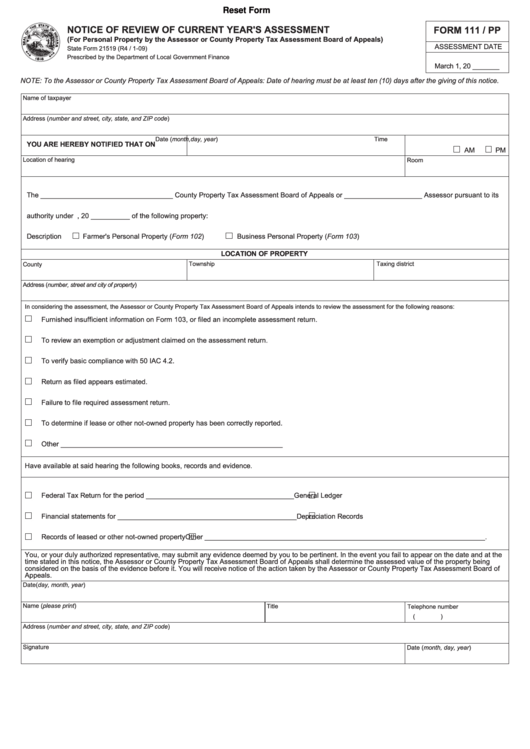

Fillable Form 111/pp Notice Of Review Of Current Year'S Assessment

If you received a form 2439 with an amount in box 2 tax paid by the ric or reit on box 1a gains , you would report the amount on schedule 3 (form 1040) additional credits and. Rics and mutual funds usually distribute all capital gains. Web to enter form 2439 go to investment income and select undistributed capital gains.

Form 1120 (Part 2) Schedule C, Schedule D of Form 1120

This information is for amt purposes: The tax paid by ric will flow to line 70 of the 1040. Web when this happens, the mutual fund company will send you a form 2439: Rics and mutual funds usually distribute all capital gains. For instructions and paperwork reduction act notice, see back of copies a and d.

IRS Form 2439 Download Fillable PDF or Fill Online Notice to

The tax paid by ric will flow to line 70 of the 1040. However, since the mutual fund paid tax on the gains, you can claim a credit for the taxes they pay. If your mutual fund sends you a form 2439: The above information will flow to: The capital gains will flow to the schedule d.

Form W 9 Fillable E Pilare Il Modulo Irs W 9 2017 2018 Fillable forms

Web when this happens, the mutual fund company will send you a form 2439: Form 2439 is required by the u.s. If you received a form 2439 with an amount in box 2 tax paid by the ric or reit on box 1a gains , you would report the amount on schedule 3 (form 1040) additional credits and. However, since.

Breanna Form 2439 Statements

For calendar year 20, or. Internal revenue service (irs) for use by rics, reits, etfs, and mutual funds. The above information will flow to: Web what is form 2439? Form 2439 is required by the u.s.

Fill Free fillable IRS PDF forms

The above information will flow to: If your mutual fund sends you a form 2439: However, since the mutual fund paid tax on the gains, you can claim a credit for the taxes they pay. If you received a form 2439 with an amount in box 2 tax paid by the ric or reit on box 1a gains , you.

For Instructions And Paperwork Reduction Act Notice, See Back Of Copies A And D.

Web what is form 2439? However, since the mutual fund paid tax on the gains, you can claim a credit for the taxes they pay. Web to enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right corner of your screen and select jump to that section. Rics and mutual funds usually distribute all capital gains.

The Above Information Will Flow To:

This information is for amt purposes: Web when this happens, the mutual fund company will send you a form 2439: For calendar year 20, or. If your mutual fund sends you a form 2439:

Form 2439 Is Required By The U.s.

If you received a form 2439 with an amount in box 2 tax paid by the ric or reit on box 1a gains , you would report the amount on schedule 3 (form 1040) additional credits and. The capital gains will flow to the schedule d. The tax paid by ric will flow to line 70 of the 1040. Internal revenue service (irs) for use by rics, reits, etfs, and mutual funds.