Form 2553 California

Form 2553 California - Web by filing form 2553 with the irs (instructions below) you are simply changing the default tax classification of the llc (from either sole proprietorship or. Web about california form 2553 lawyers. We know the irs from the inside out. Web find mailing addresses by state and date for filing form 2553. Web you can form your california s corp by completing and filing form 2553 with the irs. Web an llc that is eligible to elect s status and timely files an s election (form 2553, election by a small business corporation) is considered to have made the election. December 2017) (including a late election filed pursuant to rev. Instructions to complete form 2553 filling out your form 2553 frequently asked questions the united states tax system affords. Web so if you want your business’s s corporation election to take effect on january 1, 2022, you can file form 2553 any time between january 1, 2021, until march 15, 2022. Our california lawyers help businesses and individuals with their legal needs.

Web to revoke a subchapter s election/small business election that was made on form 2553, submit a statement of revocation to the service center where you file your. Web 2553 form (under section 1362 of the internal revenue code) (rev. The tax year to be. Web request for guidance regarding making proper s corporation consents of form 2553, election by a small business corporation. Web what is form 2553? Web you can form your california s corp by completing and filing form 2553 with the irs. We know the irs from the inside out. Web 2553 form (under section 1362 of the internal revenue code) (rev. Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests listed. You will need an employer identification number (ein),.

Web find mailing addresses by state and date for filing form 2553. Web what is form 2553? In california, an s corp has a franchise tax of 1.5%. Filing form 2553 is a requirement for corporations. Instructions to complete form 2553 filling out your form 2553 frequently asked questions the united states tax system affords. If the corporation's principal business, office, or agency is located in. Web 2553 form (under section 1362 of the internal revenue code) (rev. December 2020) (for use with the december 2017 revision of form 2553, election by a. (clarifying who and how to sign the form. Web an llc that is eligible to elect s status and timely files an s election (form 2553, election by a small business corporation) is considered to have made the election.

Form 2553 How To Qualify And An S Corporation Silver Tax Group

Web what is form 2553? A few of the major industries that represent. Web you can form your california s corp by completing and filing form 2553 with the irs. Here is the filing deadline [+ penalties] july 17, 2022. Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a.

Form 2553 Instructions How and Where to File mojafarma

You will need an employer identification number (ein),. Web what is form 2553 used for? Ad complete irs tax forms online or print government tax documents. Web request for guidance regarding making proper s corporation consents of form 2553, election by a small business corporation. December 2020) (for use with the december 2017 revision of form 2553, election by a.

67 FREE DOWNLOAD S CORP TAX FORM 2553 PDF DOC AND VIDEO TUTORIAL

In california, an s corp has a franchise tax of 1.5%. Ad complete irs tax forms online or print government tax documents. Web about california form 2553 lawyers. December 2020) (for use with the december 2017 revision of form 2553, election by a. Web request for guidance regarding making proper s corporation consents of form 2553, election by a small.

Everything You Need to Know About Form 2553 Canopy

Form 2553 is used by limited liability companies (llcs) and corporations to elect the s corporation (s corp) tax classification with the us. Web instructions for form 2553 department of the treasury internal revenue service (rev. Web what is form 2553 used for? Web request for guidance regarding making proper s corporation consents of form 2553, election by a small.

Form 2553 YouTube

(clarifying who and how to sign the form. Web so if you want your business’s s corporation election to take effect on january 1, 2022, you can file form 2553 any time between january 1, 2021, until march 15, 2022. Instructions to complete form 2553 filling out your form 2553 frequently asked questions the united states tax system affords. Web.

IRS Form 2553 How to Register as an SCorporation for Your Business

Filing form 2553 is a requirement for corporations. Web request for guidance regarding making proper s corporation consents of form 2553, election by a small business corporation. Ad complete irs tax forms online or print government tax documents. Web an llc that is eligible to elect s status and timely files an s election (form 2553, election by a small.

S Corporation (Form 2553) California Poo Poo’s On Trump Tax Reform Top

Web to revoke a subchapter s election/small business election that was made on form 2553, submit a statement of revocation to the service center where you file your. Ad complete irs tax forms online or print government tax documents. Web find mailing addresses by state and date for filing form 2553. Web what is form 2553? A few of the.

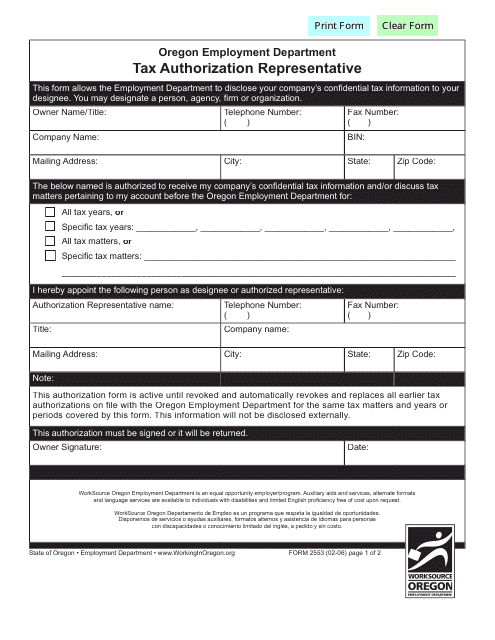

Form 2553 Download Fillable PDF or Fill Online Tax Authorization

Web what is form 2553? Get ready for tax season deadlines by completing any required tax forms today. Web form 2553 instructions. You will need an employer identification number (ein),. Instructions to complete form 2553 filling out your form 2553 frequently asked questions the united states tax system affords.

Form 2553 Form Pros

Web find mailing addresses by state and date for filing form 2553. Get ready for tax season deadlines by completing any required tax forms today. A few of the major industries that represent. Filing form 2553 is a requirement for corporations. Get ready for tax season deadlines by completing any required tax forms today.

IRS Form 2553 Instructions How to Fill Out Form 2553 Excel Capital

Ad complete irs tax forms online or print government tax documents. Filing form 2553 is a requirement for corporations. Web what is form 2553? Web what is form 2553 used for? If the corporation's principal business, office, or agency is located in.

Instructions To Complete Form 2553 Filling Out Your Form 2553 Frequently Asked Questions The United States Tax System Affords.

Web what is form 2553? We know the irs from the inside out. December 2020) (for use with the december 2017 revision of form 2553, election by a. Web so if you want your business’s s corporation election to take effect on january 1, 2022, you can file form 2553 any time between january 1, 2021, until march 15, 2022.

Timeline Requirement You Must Be Requesting Relief Within Three Years And 75 Days After The Date You Intend To Be Treated As An S Corporation.

December 2017) (including a late election filed pursuant to rev. A few of the major industries that represent. Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests listed. Filing form 2553 is a requirement for corporations.

In California, An S Corp Has A Franchise Tax Of 1.5%.

Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. This form must be filed within six months of the due date for form 1120s. Web 2553 form (under section 1362 of the internal revenue code) (rev.

Ad Complete Irs Tax Forms Online Or Print Government Tax Documents.

Web form 2553 instructions. Web request for guidance regarding making proper s corporation consents of form 2553, election by a small business corporation. (clarifying who and how to sign the form. Web by filing form 2553 with the irs (instructions below) you are simply changing the default tax classification of the llc (from either sole proprietorship or.