Form 2553 Vs 8832

Form 2553 Vs 8832 - You may have recently set up a limited liability company or a corporation. An eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as: To elect classification as an s corporation, the llc must. Ask an expert tax questions ★★★★ what’s the. United states (english) united states (spanish) canada (english) canada. Use form 2553, election by small. But how do you want that new. Web the corrected form 8832, with the box checked entitled: The information you provide impacts whether the irs will. Understanding the difference between form 8832 and form 2553 is of the utmost importance if you're interested in changing your.

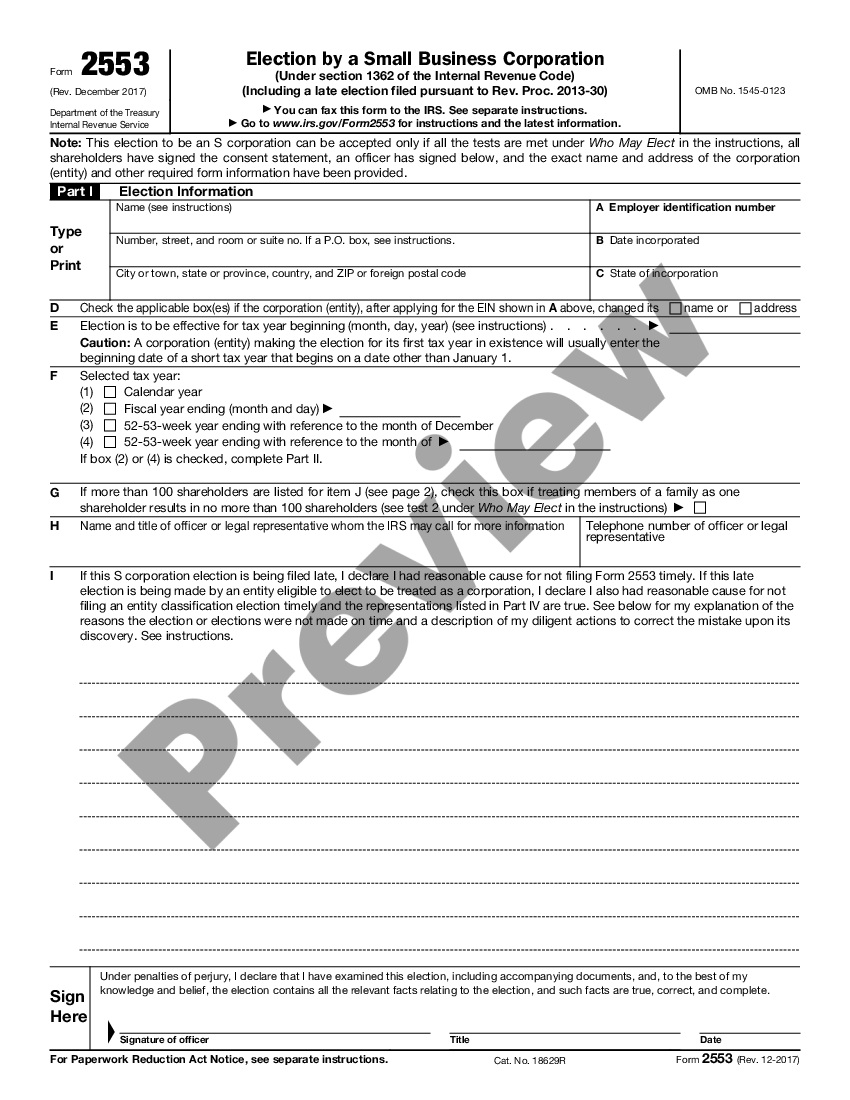

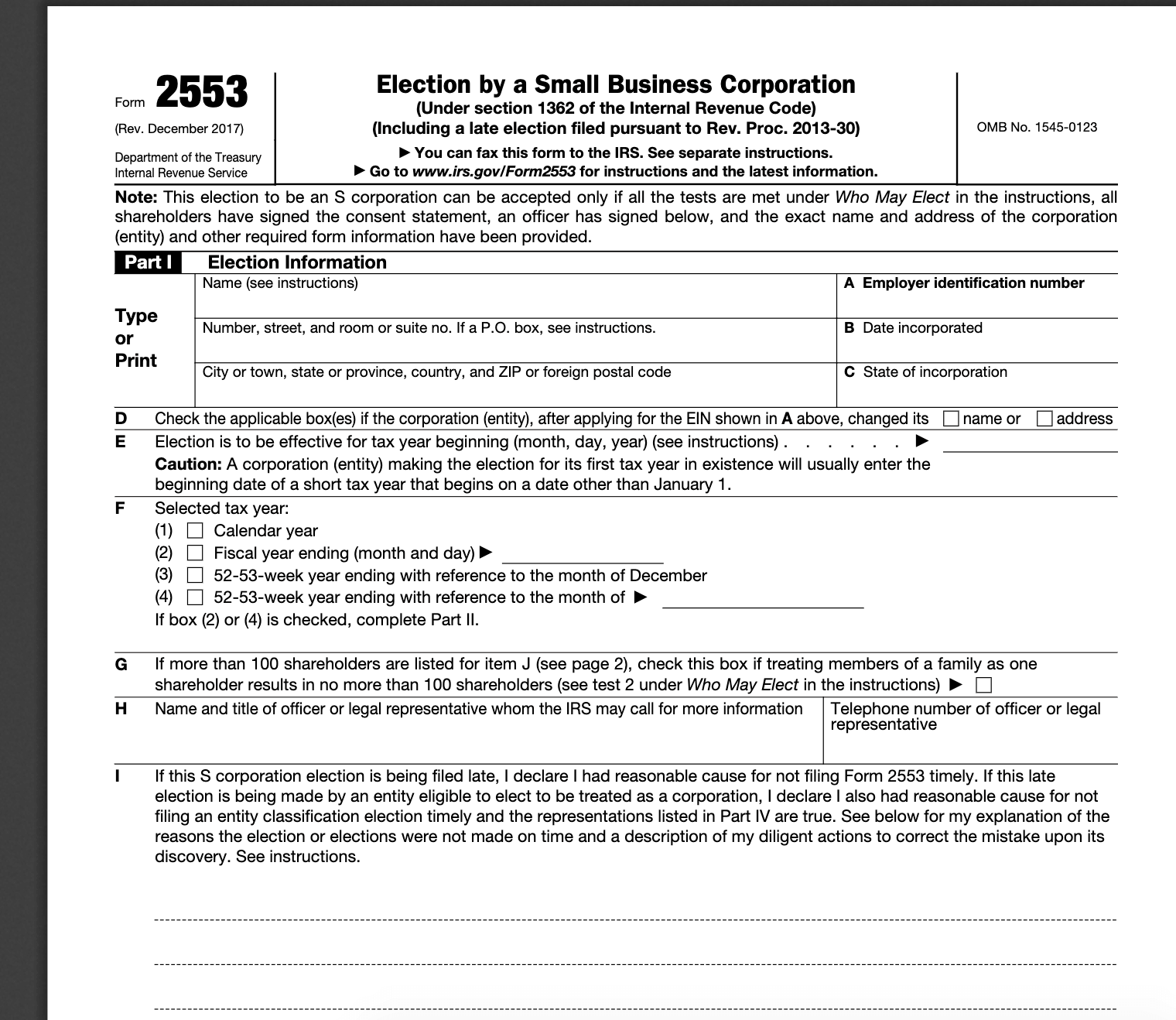

Web form 8832 vs. Sign here under penalties of perjury, i declare that i have examined this election, including accompanying documents, and, to the best of my knowledge and. Web form 8832 vs. Use form 2553, election by small. Ask an expert tax questions ★★★★ what’s the. If you are an llc with a single member, you are by default classified as a sole proprietorship for federal tax purposes—there is no need to. Web an entity eligible to elect to be treated as a corporation that meets certain tests discussed below will be treated as a corporation as of the effective date of the s. The information you provide impacts whether the irs will. United states (english) united states (spanish) canada (english) canada. An eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as:

If you're an llc or partnership, use form 8832 if. If you are an llc with a single member, you are by default classified as a sole proprietorship for federal tax purposes—there is no need to. Web form 8832 vs. An eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as: Understanding the difference between form 8832 and form 2553 is of the utmost importance if you’re interested in changing your. Understanding the difference between form 8832 and form 2553 is of the utmost importance if you're interested in changing your. Web our brains are jelly after reading far too many irs 'instruction' forms. Use form 2553, election by small. Web what about irs form 8832 vs 2553? Web selected as best answer.

What is Form 8832 and How Do I File it?

To elect classification as an s corporation, the llc must. Understanding the difference between form 8832 and form 2553 is of the utmost importance if you're interested in changing your. Web an entity eligible to elect to be treated as a corporation that meets certain tests discussed below will be treated as a corporation as of the effective date of.

Election of 'S' Corporation Status and Instructions Form 2553 S Corp

Web selected as best answer. Web an entity eligible to elect to be treated as a corporation that meets certain tests discussed below will be treated as a corporation as of the effective date of the s. Web use form 8832, entity classification election to make an election to be an association taxable as a corporation. When it comes to.

(PDF) Form 8832 Shane Dorn Academia.edu

When it comes to drafting a legal form, it is easier to delegate it. If you're an llc or partnership, use form 8832 if. If you are an llc with a single member, you are by default classified as a sole proprietorship for federal tax purposes—there is no need to. You may have recently set up a limited liability company.

Como usar el Formulario 8832 para cambiar la clasificación fiscal de su

Web use form 8832, entity classification election to make an election to be an association taxable as a corporation. Web selected as best answer. If you are an llc with a single member, you are by default classified as a sole proprietorship for federal tax purposes—there is no need to. Use form 2553, election by small. You may have recently.

Irs Form 8832 Fillable Pdf Printable Forms Free Online

Web use form 8832, entity classification election to make an election to be an association taxable as a corporation. If you are an llc with a single member, you are by default classified as a sole proprietorship for federal tax purposes—there is no need to. Ask an expert tax questions ★★★★ what’s the. Understanding the difference between form 8832 and.

Steps for Electing Sub S Status for Washington LLC or Corp Evergreen

United states (english) united states (spanish) canada (english) canada. If you are an llc with a single member, you are by default classified as a sole proprietorship for federal tax purposes—there is no need to. Web selected as best answer. Use form 2553, election by small. Web our brains are jelly after reading far too many irs 'instruction' forms.

Form 8832 Entity Classification Election (2013) Free Download

The information you provide impacts whether the irs will. An eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as: Web what about irs form 8832 vs 2553? Web about form 8832, entity classification election. Understanding the difference between form 8832 and form 2553 is of the utmost importance if you’re interested in.

What Is Irs Form 8832?

Sign here under penalties of perjury, i declare that i have examined this election, including accompanying documents, and, to the best of my knowledge and. But how do you want that new. Web an entity eligible to elect to be treated as a corporation that meets certain tests discussed below will be treated as a corporation as of the effective.

Form 2553 How To Qualify And An S Corporation Silver Tax Group

The information you provide impacts whether the irs will. When it comes to drafting a legal form, it is easier to delegate it. Sign here under penalties of perjury, i declare that i have examined this election, including accompanying documents, and, to the best of my knowledge and. Web what about irs form 8832 vs 2553? United states (english) united.

What is IRS Form 2553? Bench Accounting

When it comes to drafting a legal form, it is easier to delegate it. Understanding the difference between form 8832 and form 2553 is of the utmost importance if you’re interested in changing your. Web about form 8832, entity classification election. Ask an expert tax questions ★★★★ what’s the. You may have recently set up a limited liability company or.

Web Selected As Best Answer.

You may have recently set up a limited liability company or a corporation. Web the corrected form 8832, with the box checked entitled: Form 8832 can also be used to change a prior election. Web use form 8832, entity classification election to make an election to be an association taxable as a corporation.

Use Form 2553, Election By Small.

Web what about irs form 8832 vs 2553? Understanding the difference between form 8832 and form 2553 is of the utmost importance if you're interested in changing your. The information you provide impacts whether the irs will. If you're an llc or partnership, use form 8832 if.

When It Comes To Drafting A Legal Form, It Is Easier To Delegate It.

Web in either of those cases if the llc wants to elect to be taxed as a corporation the form 8832 is used. But how do you want that new. United states (english) united states (spanish) canada (english) canada. Web form 8832 vs.

To Elect Classification As An S Corporation, The Llc Must.

Ask an expert tax questions ★★★★ what’s the. Web form 8832 vs. Web an entity eligible to elect to be treated as a corporation that meets certain tests discussed below will be treated as a corporation as of the effective date of the s. Web the biggest difference between form 8832 and form 2553 is the tax classification that you're requesting.