Form 3115 Catch Up Depreciation Example

Form 3115 Catch Up Depreciation Example - Web 1.6k views 1 year ago. This video uses a simple example to. Web if you answered “yes,” complete schedule a of form 3115. For example, an overall accounting method change includes a change from an accrual method to the cash receipts and disbursements method or vice versa. Web you can catch up missed depreciation thru a negative 481a adjustment. This blog post is designed as an example on how to apply a cost segregation study on a tax return. However, form 3115, part iv, section 481 (a) adjustment, line item 27, seems to limit the basis for the election to the two named. If you missed a few years depreciation on 1040 schedule e for your rental property, you may need to file irs form 3115 to catch up. With that said, you may want to check to see whether the missed depreciation was indeed an improper method, as opposed to not even having an established method in the first place. Web form 3115, change in accounting method, is used to correct most other depreciation errors, including the omission of depreciation.

If you forget to take depreciation on an asset, the irs treats this as the adoption of an incorrect method of accounting, which may only be corrected by filing form 3115. You’re changing from a depreciation method that’s not allowed to one that’s allowed. Web 1.6k views 1 year ago. Web when an accounting method change qualifies as an automatic change for purposes of filing irs form 3115, application for change in accounting method, there is no user fee. With that said, you may want to check to see whether the missed depreciation was indeed an improper method, as opposed to not even having an established method in the first place. Instead of filing amended returns, you must correct this on this year’s return. If you missed a few years depreciation on 1040 schedule e for your rental property, you may need to file irs form 3115 to catch up. However, form 3115, part iv, section 481 (a) adjustment, line item 27, seems to limit the basis for the election to the two named. Web you can catch up missed depreciation thru a negative 481a adjustment. This video uses a simple example to.

If you missed a few years depreciation on 1040 schedule e for your rental property, you may need to file irs form 3115 to catch up. With that said, you may want to check to see whether the missed depreciation was indeed an improper method, as opposed to not even having an established method in the first place. If you forget to take depreciation on an asset, the irs treats this as the adoption of an incorrect method of accounting, which may only be corrected by filing form 3115. Application for change in accounting method. However, form 3115, part iv, section 481 (a) adjustment, line item 27, seems to limit the basis for the election to the two named. Follow the steps outlined in the instructions to form 3115: This video uses a simple example to. Web when an accounting method change qualifies as an automatic change for purposes of filing irs form 3115, application for change in accounting method, there is no user fee. Web if you answered “yes,” complete schedule a of form 3115. This blog post is designed as an example on how to apply a cost segregation study on a tax return.

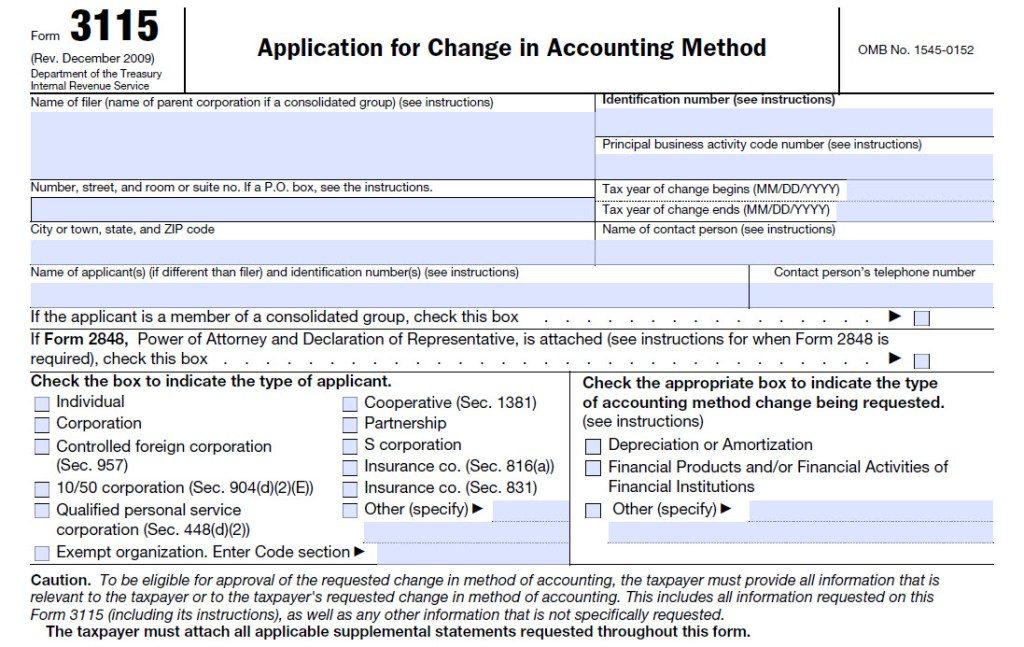

Form 3115 Edit, Fill, Sign Online Handypdf

Follow the steps outlined in the instructions to form 3115: Web 1.6k views 1 year ago. Web to effect the automatic change, a taxpayer must complete and file form 3115 in duplicate. For example, an overall accounting method change includes a change from an accrual method to the cash receipts and disbursements method or vice versa. Instead of filing amended.

Tax Accounting Methods

Form 3115 must be filed in duplicate. Web form 3115, change in accounting method, is used to correct most other depreciation errors, including the omission of depreciation. Web to effect the automatic change, a taxpayer must complete and file form 3115 in duplicate. However, form 3115, part iv, section 481 (a) adjustment, line item 27, seems to limit the basis.

How to catch up missed depreciation on rental property (part I) filing

Web form 3115, change in accounting method, is used to correct most other depreciation errors, including the omission of depreciation. Web when an accounting method change qualifies as an automatic change for purposes of filing irs form 3115, application for change in accounting method, there is no user fee. Instead of filing amended returns, you must correct this on this.

Correcting Depreciation Form 3115 LinebyLine

For example, an overall accounting method change includes a change from an accrual method to the cash receipts and disbursements method or vice versa. Application for change in accounting method. Follow the steps outlined in the instructions to form 3115: If you missed a few years depreciation on 1040 schedule e for your rental property, you may need to file.

How to catch up missed depreciation on rental property (part I) filing

Form 3115 must be filed in duplicate. Instead of filing amended returns, you must correct this on this year’s return. Web form 3115, change in accounting method, is used to correct most other depreciation errors, including the omission of depreciation. This video uses a simple example to. Follow the steps outlined in the instructions to form 3115:

Form 3115 Application for Change in Accounting Method

Instead of filing amended returns, you must correct this on this year’s return. If you missed a few years depreciation on 1040 schedule e for your rental property, you may need to file irs form 3115 to catch up. Form 3115 can be used to request a change in either an overall accounting method or. This blog post is designed.

Form 3115 Definition, Who Must File, & More

However, form 3115, part iv, section 481 (a) adjustment, line item 27, seems to limit the basis for the election to the two named. Web 1.6k views 1 year ago. With that said, you may want to check to see whether the missed depreciation was indeed an improper method, as opposed to not even having an established method in the.

Form 3115 Applying a Cost Segregation Study on a Tax Return The

You’re changing from a depreciation method that’s not allowed to one that’s allowed. Web you can catch up missed depreciation thru a negative 481a adjustment. Web form 3115, change in accounting method, is used to correct most other depreciation errors, including the omission of depreciation. Web 1.6k views 1 year ago. Form 3115 must be filed in duplicate.

Form 3115 Application for Change in Accounting Method(2015) Free Download

You’re changing from a depreciation method that’s not allowed to one that’s allowed. Web if you answered “yes,” complete schedule a of form 3115. However, form 3115, part iv, section 481 (a) adjustment, line item 27, seems to limit the basis for the election to the two named. Follow the steps outlined in the instructions to form 3115: Web form.

Form 3115 App for change in acctg method Capstan Tax Strategies

Web 1.6k views 1 year ago. You’re changing from a depreciation method that’s not allowed to one that’s allowed. Instead of filing amended returns, you must correct this on this year’s return. Form 3115 must be filed in duplicate. Web if you answered “yes,” complete schedule a of form 3115.

Form 3115 Must Be Filed In Duplicate.

If you missed a few years depreciation on 1040 schedule e for your rental property, you may need to file irs form 3115 to catch up. Web to effect the automatic change, a taxpayer must complete and file form 3115 in duplicate. Web 1.6k views 1 year ago. Form 3115 can be used to request a change in either an overall accounting method or.

Web When An Accounting Method Change Qualifies As An Automatic Change For Purposes Of Filing Irs Form 3115, Application For Change In Accounting Method, There Is No User Fee.

You’re changing from a depreciation method that’s not allowed to one that’s allowed. This blog post is designed as an example on how to apply a cost segregation study on a tax return. With that said, you may want to check to see whether the missed depreciation was indeed an improper method, as opposed to not even having an established method in the first place. However, form 3115, part iv, section 481 (a) adjustment, line item 27, seems to limit the basis for the election to the two named.

Application For Change In Accounting Method.

Instead of filing amended returns, you must correct this on this year’s return. Web form 3115, change in accounting method, is used to correct most other depreciation errors, including the omission of depreciation. Follow the steps outlined in the instructions to form 3115: Web if you answered “yes,” complete schedule a of form 3115.

If You Forget To Take Depreciation On An Asset, The Irs Treats This As The Adoption Of An Incorrect Method Of Accounting, Which May Only Be Corrected By Filing Form 3115.

This video uses a simple example to. Web you can catch up missed depreciation thru a negative 481a adjustment. For example, an overall accounting method change includes a change from an accrual method to the cash receipts and disbursements method or vice versa.