Form 3115 Instructions 2022

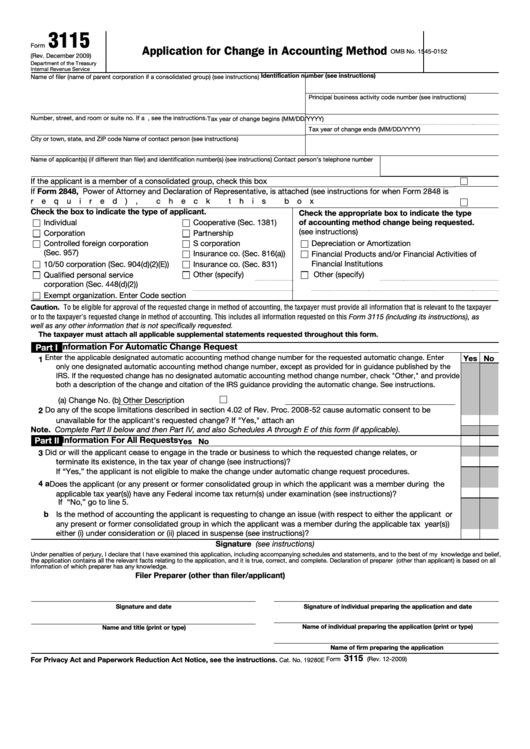

Form 3115 Instructions 2022 - To obtain the irs's consent, taxpayers file form 3115, application for change in accounting method. Regardless of the version of form 3115 used, taxpayers must provide all the information required by rev. Even when the irs's consent is not required, taxpayers must file form 3115. 46 (1) facts and other information requested on form 3115 and in applicable revenue. File this form to request a change in either: Web form 3115 application for change in accounting method form 3115 (rev. Web generally, unless otherwise provided, a taxpayer must secure the irs’s consent before changing its accounting method. The form instructions provides a list of possible dcns. December 2022) department of the treasury internal revenue service application for change in accounting method go to www.irs.gov/form3115 for instructions and the latest information. About form 3115, application for change in accounting method | internal revenue service

46.03 information required with a form 3115: 46 (1) facts and other information requested on form 3115 and in applicable revenue. December 2022) department of the treasury internal revenue service application for change in accounting method go to www.irs.gov/form3115 for instructions and the latest information. Even when the irs's consent is not required, taxpayers must file form 3115. Web general instructions purpose of form file form 3115 to request a change in either an overall accounting method or the accounting treatment of any item. File this form to request a change in either: Method change procedures when filing form 3115, you must determine if the irs has issued any new published guidance which includes revenue procedures, revenue rulings, notices, Web.02 ordinarily only one change in method of accounting on a form 3115, application for change in accounting method, and a separate form 3115 for each taxpayer and for each separate and distinct trade or business: Taxpayers filing forms 3115 after april 18, 2023, must use the december 2022 form 3115. The form instructions provides a list of possible dcns.

Web the internal revenue bulletin. Regardless of the version of form 3115 used, taxpayers must provide all the information required by rev. Automatic consent is granted for changes that have an assigned designated change number (dcn). Web form 3115 is used to request this consent. Method change procedures when filing form 3115, you must determine if the irs has issued any new published guidance which includes revenue procedures, revenue rulings, notices, File this form to request a change in either: 46.03 information required with a form 3115: Web the irs will accept either the december 2022 form 3115 or the december 2018 form 3115 if filed by a taxpayer on or before april 18, 2023, unless the use of the december 2022 form 3115 is specifically required by guidance published in the internal revenue bulletin. Web.02 ordinarily only one change in method of accounting on a form 3115, application for change in accounting method, and a separate form 3115 for each taxpayer and for each separate and distinct trade or business: To obtain the irs's consent, taxpayers file form 3115, application for change in accounting method.

Fillable Form 3115 Application For Change In Accounting Method

Web generally, unless otherwise provided, a taxpayer must secure the irs’s consent before changing its accounting method. Even when the irs's consent is not required, taxpayers must file form 3115. Automatic consent is granted for changes that have an assigned designated change number (dcn). Web the irs will accept either the december 2022 form 3115 or the december 2018 form.

Fill Free fillable Form 3115 2018 Application for Change in

Web form 3115 application for change in accounting method form 3115 (rev. December 2022) is the current form 3115 (december 2022 form 3115) and replaces the december 2018 version of the form 3115 (december 2018 form 3115). Web form 3115 is used to request this consent. Taxpayers filing forms 3115 after april 18, 2023, must use the december 2022 form.

Form 3115 Instructions (Application for Change in Accounting Method)

Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. 46 (1) facts and other information requested on form 3115 and in applicable revenue. To obtain the irs's consent, taxpayers file form 3115, application for change in accounting method. Regardless of the version of form 3115 used, taxpayers.

Fill Free fillable Form 3115 2018 Application for Change in

To obtain the irs's consent, taxpayers file form 3115, application for change in accounting method. Even when the irs's consent is not required, taxpayers must file form 3115. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. December 2022) is the current form 3115 (december 2022 form.

Form 3115 Application for Change in Accounting Method(2015) Free Download

46 (1) facts and other information requested on form 3115 and in applicable revenue. Taxpayers filing forms 3115 after april 18, 2023, must use the december 2022 form 3115. The form instructions provides a list of possible dcns. Even when the irs's consent is not required, taxpayers must file form 3115. File this form to request a change in either:

Temporary Procedures Allow Taxpayers to Fax Required Duplicate Copy of

Web form 3115 application for change in accounting method form 3115 (rev. Even when the irs's consent is not required, taxpayers must file form 3115. Web.02 ordinarily only one change in method of accounting on a form 3115, application for change in accounting method, and a separate form 3115 for each taxpayer and for each separate and distinct trade or.

Form 3115 Application for Change in Accounting Method(2015) Free Download

Automatic consent is granted for changes that have an assigned designated change number (dcn). Web form 3115 is used to request this consent. Method change procedures when filing form 3115, you must determine if the irs has issued any new published guidance which includes revenue procedures, revenue rulings, notices, To obtain the irs's consent, taxpayers file form 3115, application for.

Form 3115 Missed Depreciation printable pdf download

December 2022) is the current form 3115 (december 2022 form 3115) and replaces the december 2018 version of the form 3115 (december 2018 form 3115). Method change procedures when filing form 3115, you must determine if the irs has issued any new published guidance which includes revenue procedures, revenue rulings, notices, Web form 3115 is used to request this consent..

Form 3115 Application for Change in Accounting Method(2015) Free Download

Automatic consent is granted for changes that have an assigned designated change number (dcn). Regardless of the version of form 3115 used, taxpayers must provide all the information required by rev. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. The form instructions provides a list of.

Form 3115 Definition, Who Must File, & More

Automatic consent is granted for changes that have an assigned designated change number (dcn). Web general instructions purpose of form file form 3115 to request a change in either an overall accounting method or the accounting treatment of any item. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how.

46 (1) Facts And Other Information Requested On Form 3115 And In Applicable Revenue.

Web the internal revenue bulletin. Web form 3115 is used to request this consent. Regardless of the version of form 3115 used, taxpayers must provide all the information required by rev. Web general instructions purpose of form file form 3115 to request a change in either an overall accounting method or the accounting treatment of any item.

Web The Irs Will Accept Either The December 2022 Form 3115 Or The December 2018 Form 3115 If Filed By A Taxpayer On Or Before April 18, 2023, Unless The Use Of The December 2022 Form 3115 Is Specifically Required By Guidance Published In The Internal Revenue Bulletin.

About form 3115, application for change in accounting method | internal revenue service To obtain the irs's consent, taxpayers file form 3115, application for change in accounting method. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. Even when the irs's consent is not required, taxpayers must file form 3115.

46.03 Information Required With A Form 3115:

Web generally, unless otherwise provided, a taxpayer must secure the irs’s consent before changing its accounting method. December 2022) department of the treasury internal revenue service application for change in accounting method go to www.irs.gov/form3115 for instructions and the latest information. Web form 3115 application for change in accounting method form 3115 (rev. File this form to request a change in either:

Method Change Procedures When Filing Form 3115, You Must Determine If The Irs Has Issued Any New Published Guidance Which Includes Revenue Procedures, Revenue Rulings, Notices,

December 2022) is the current form 3115 (december 2022 form 3115) and replaces the december 2018 version of the form 3115 (december 2018 form 3115). Automatic consent is granted for changes that have an assigned designated change number (dcn). Taxpayers filing forms 3115 after april 18, 2023, must use the december 2022 form 3115. Web.02 ordinarily only one change in method of accounting on a form 3115, application for change in accounting method, and a separate form 3115 for each taxpayer and for each separate and distinct trade or business: