Form 3520 Married Filing Jointly

Form 3520 Married Filing Jointly - Talk to our skilled attorneys by scheduling a free consultation today. Citizen or resident and live outside the united states and puerto rico or if you are in the military or naval service on duty outside the united states and puerto. If you and your spouse are filing a joint income tax return for tax year 2020, and you are both transferors, grantors, or. Ownership of foreign trusts under the rules of sections. Web the form is due when a person’s tax return is due to be filed. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. No, that box says joint return and joint form 3520. Decedents) file form 3520 to report: Web the irs recognizes five filing statuses on the form 1040: Web married filing separately is a filing status for married couples who, for whatever reason, decide, “meh, we don’t want to do our taxes together.” as a married.

Citizen or to a resident may elect to file a joint income tax return with their spouse. Certain transactions with foreign trusts. Web we understand that in certain cases (including but not limited to separation or divorce), your spouse/former spouse may not be willing to sign joint amended income. Web certain domestic corporations, partnerships, and trusts that are considered formed or availed of for the purpose of holding, directly or indirectly, specified foreign financial. No, that box says joint return and joint form 3520. Web the form is due when a person’s tax return is due to be filed. This is not a joint 3520. If a taxpayer is married, they can file a joint tax return with their spouse. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable.

We are filing a joint 2016 income tax return. Single, married filing jointly, married filing separately, head of household and qualifying widow(er). Web a dual status individual married to a u.s. Web married filing separately is a filing status for married couples who, for whatever reason, decide, “meh, we don’t want to do our taxes together.” as a married. Persons (and executors of estates of u.s. Talk to our skilled attorneys by scheduling a free consultation today. If you and your spouse are filing a joint income tax return for tax year 2020, and you are both transferors, grantors, or. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Web the irs recognizes five filing statuses on the form 1040: Refer to nonresident spouse treated as.

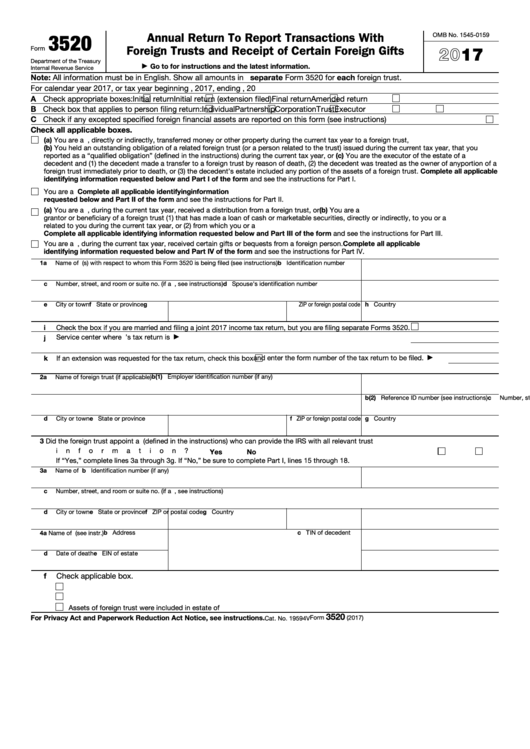

Form 3520 Blank Sample to Fill out Online in PDF

Web the form is due when a person’s tax return is due to be filed. We are filing a joint 2016 income tax return. Decedents) file form 3520 to report: Certain transactions with foreign trusts. Web from instructions for form 3520 (2020):

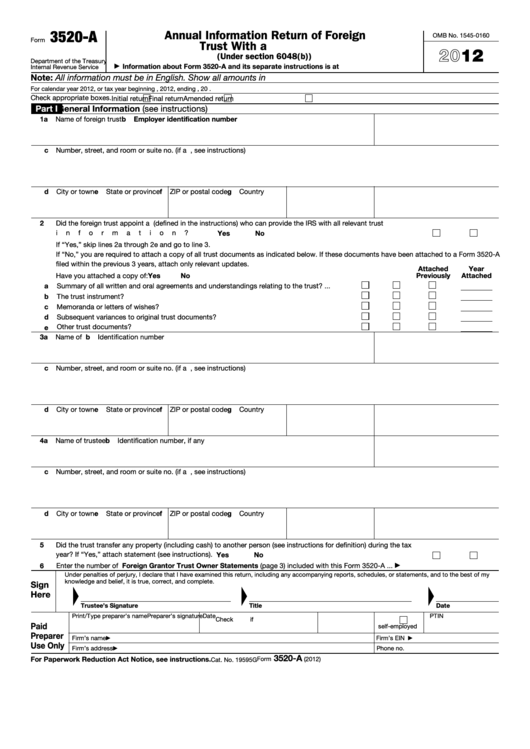

Fillable Form 3520A Annual Information Return Of Foreign Trust With

Web we understand that in certain cases (including but not limited to separation or divorce), your spouse/former spouse may not be willing to sign joint amended income. If a taxpayer is married, they can file a joint tax return with their spouse. Talk to our skilled attorneys by scheduling a free consultation today. Please see the irs' instructions below. Citizen.

Relief from Filing Forms 3520 and Form 3520A for Some SF Tax Counsel

Do i have to fill 1 (d) and include my husband's name under 1 (a) even if foreign gift was only made to me? Single, married filing jointly, married filing separately, head of household and qualifying widow(er). Web from instructions for form 3520 (2020): Web the irs recognizes five filing statuses on the form 1040: Yes, @opus17 meant line 54.

2021 W4 Guide How to Fill Out a W4 This Year Gusto

Web if you are a u.s. Yes, @opus17 meant line 54 in part 4, which is all you need to fill out. Beneficiaries may file a joint form 3520, annual return to report transactions with foreign trusts. Web generally, if you and your spouse file a joint income tax return, you can file the form 3520 jointly as well. Do.

Form 3520 Edit, Fill, Sign Online Handypdf

Refer to nonresident spouse treated as. Web a dual status individual married to a u.s. Web married filing separately is a filing status for married couples who, for whatever reason, decide, “meh, we don’t want to do our taxes together.” as a married. Certain transactions with foreign trusts. Web certain domestic corporations, partnerships, and trusts that are considered formed or.

Fillable Form 3520 Annual Return To Report Transactions With Foreign

Single, married filing jointly, married filing separately, head of household and qualifying widow(er). Do i have to fill 1 (d) and include my husband's name under 1 (a) even if foreign gift was only made to me? Citizen or resident and live outside the united states and puerto rico or if you are in the military or naval service on.

2022 Tax Tables Married Filing Jointly Printable Form, Templates and

Certain transactions with foreign trusts. Web the form is due when a person’s tax return is due to be filed. Web married filing jointly. Single, married filing jointly, married filing separately, head of household and qualifying widow(er). Yes, @opus17 meant line 54 in part 4, which is all you need to fill out.

Joint Filing Credit Ohio 2021 Critical Issue 2021

If one spouse died in 2021, the surviving spouse can use married. Talk to our skilled attorneys by scheduling a free consultation today. Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable. Refer to nonresident spouse treated as. Web certain domestic corporations, partnerships, and trusts that are considered.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Persons (and executors of estates of u.s. Decedents) file form 3520 to report: No, that box says joint return and joint form 3520. Talk to our skilled attorneys by scheduling a free consultation today. Single, married filing jointly, married filing separately, head of household and qualifying widow(er).

How to fill out IRS Form W4 Married Filing Jointly 2021 YouTube

If you and your spouse are filing a joint income tax return for tax year 2020, and you are both transferors, grantors, or. Certain transactions with foreign trusts. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Yes, @opus17 meant line 54 in part 4, which is all you need to fill out. Citizen or.

Even If The Person Does Not Have To File A Tax Return, They Still Must Submit The Form 3520, If Applicable.

Web if you are a u.s. If you and your spouse are filing a joint income tax return for tax year 2020, and you are both transferors, grantors, or. Please see the irs' instructions below. No, that box says joint return and joint form 3520.

Ad Don’t Feel Alone If You’re Dealing With Irs Form 3520 Penalty Abatement Issues.

This is not a joint 3520. Ownership of foreign trusts under the rules of sections. Web the form is due when a person’s tax return is due to be filed. If one spouse died in 2021, the surviving spouse can use married.

Web Generally, If You And Your Spouse File A Joint Income Tax Return, You Can File The Form 3520 Jointly As Well.

Do i have to fill 1 (d) and include my husband's name under 1 (a) even if foreign gift was only made to me? Web certain domestic corporations, partnerships, and trusts that are considered formed or availed of for the purpose of holding, directly or indirectly, specified foreign financial. Persons (and executors of estates of u.s. Citizen or to a resident may elect to file a joint income tax return with their spouse.

Web We Understand That In Certain Cases (Including But Not Limited To Separation Or Divorce), Your Spouse/Former Spouse May Not Be Willing To Sign Joint Amended Income.

We are filing a joint 2016 income tax return. Citizen or resident and live outside the united states and puerto rico or if you are in the military or naval service on duty outside the united states and puerto. Web the only guidance the irs gives for joint filers is that the 2 u.s. Web a dual status individual married to a u.s.