Form 3903 Instructions

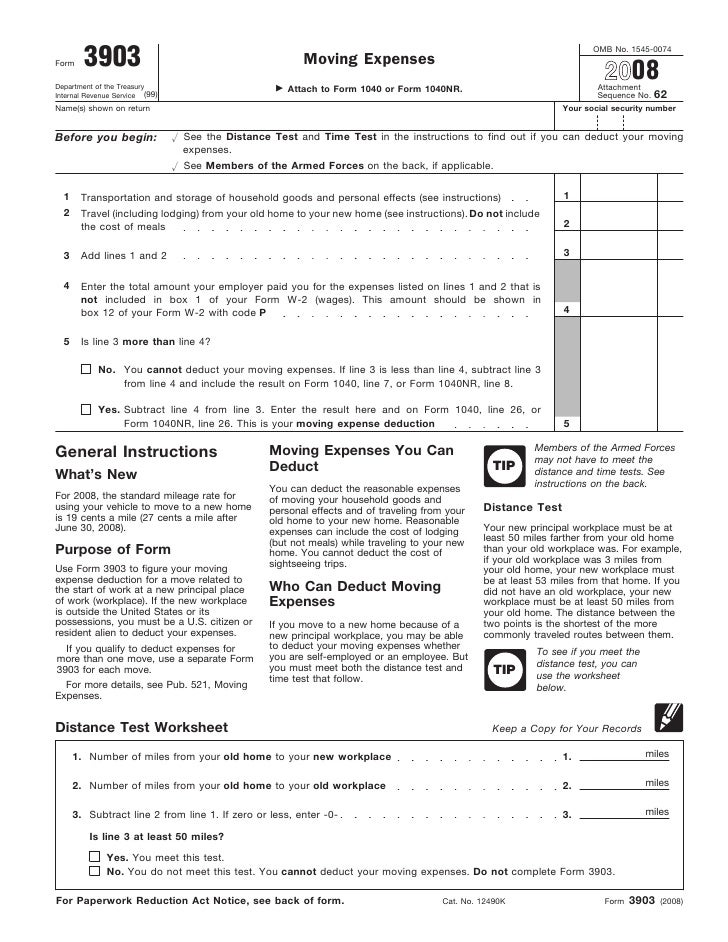

Form 3903 Instructions - Attach to form 1040 or form. 2022 instructions for form 3903 — irs use form 3903 to figure your moving expense deduction for a move related to the start of work at a new. Web page 1 of 2 of instructions for form 3903 5 the type and rule above prints on all proofs including departmental reproduction proofs. Web use form 3903 to figure your moving expense deduction for a move related to the start of work at a new principal place of work (workplace). Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web form 3903 department of the treasury internal revenue service (99) moving expenses go to www.irs.gov/form3903 for the latest information. Moving expense deduction eliminated, except for certain armed forces members. Purpose of form use form 3903 to figure your moving expense. Web form 3903 department of the treasury internal revenue service (99) moving expenses go to www.irs.gov/form3903 for instructions and the latest information.

Web to generate form 3903: See specific instructions, later, for how to report this deduction. Web use form 3903 to figure your moving expense deduction for a move related to the start of work at a new principal place of work (workplace). Try it for free now! Web requirements to claim moving expenses. Complete, edit or print tax forms instantly. Web instructions for form 3903 moving expenses department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. You can't deduct expenses that are reimbursed or. Web the instructions to form 3903 explain the distance and time tests and include a worksheet for determining whether the distance test is met. Purpose of form use form 3903 to figure your moving expense.

Form 3903 instructions as a resource for additional information. Web requirements to claim moving expenses. Try it for free now! This publication has detailed information on deductible and nondeductible. Must be removed before printing. Web if you file form 2555, foreign earned income, to exclude any of your income or housing costs, report the full amount of your deductible moving expenses on form 3903 and on. Moving expense deduction eliminated, except for certain armed forces members. Web to enter moving expenses for tax years 2018 and later in taxslayer proweb, from the federal section of the tax return (form 1040) select: Web to generate form 3903: Web form 3903 2021 moving expenses department of the treasury internal revenue service (99) go to www.irs.gov/form3903 for instructions and the latest.

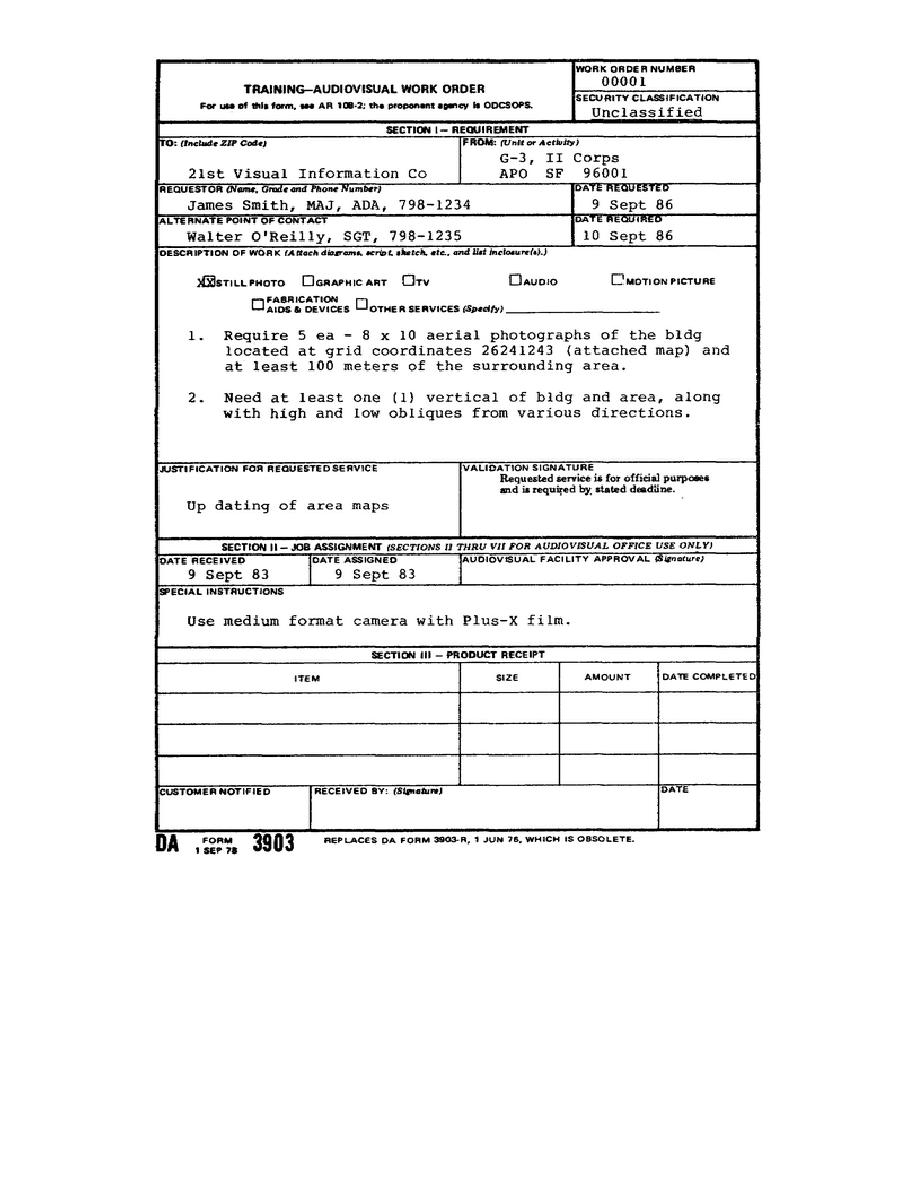

Figure 22. DA Form 3903, TrainingAudiovisual Work Order (Example 2)

Complete, edit or print tax forms instantly. Must be removed before printing. Web you can deduct your unreimbursed moving expenses for you, your spouse, and your dependents. See specific instructions, later, for how to report this deduction. Attach to form 1040 or form.

Fill Free fillable Form 3903 Moving Expenses 2019 PDF form

Go to input return ⮕ deductions ⮕ moving expenses 3903. See specific instructions, later, for how to report this deduction. Complete, edit or print tax forms instantly. Web requirements to claim moving expenses. This publication has detailed information on deductible and nondeductible.

Figure 11. . VI work order DA Form 3903R (back)cont.

Web use form 3903 to figure your moving expense deduction for a move related to the start of work at a new principal place of work (workplace). Select whether the form 3903 applies to the taxpayer, spouse, or joint. Upload, modify or create forms. Get ready for tax season deadlines by completing any required tax forms today. Form 3903 instructions.

2017 form 3903 instructions

Complete, edit or print tax forms instantly. If the new workplace is outside the. Go to input return ⮕ deductions ⮕ moving expenses 3903. Moving expense deduction eliminated, except for certain armed forces members. See specific instructions, later, for how to report this deduction.

Form 3903Moving Expenses

Moving expense deduction eliminated, except for certain armed forces members. Web instructions for form 3903 moving expenses department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Web to enter moving expenses for tax years 2018 and later in taxslayer proweb, from the federal section of the tax return (form 1040) select:.

3903 Moving Expenses

Attach to form 1040 or form. Web instructions for form 3903 moving expenses department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Try it for free now! If the new workplace is outside the. Moving expense deduction eliminated, except for certain armed forces members.

Form 3903 Moving Expenses (2015) Free Download

Complete, edit or print tax forms instantly. Purpose of form use form 3903 to figure your moving expense. Web form 3903 2021 moving expenses department of the treasury internal revenue service (99) go to www.irs.gov/form3903 for instructions and the latest. Web the instructions to form 3903 explain the distance and time tests and include a worksheet for determining whether the.

Form 3903Moving Expenses

Ad download or email irs 3903 & more fillable forms, register and subscribe now! Web instructions for form 3903 moving expenses department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Web form 3903 2021 moving expenses department of the treasury internal revenue service (99) a go to www.irs.gov/form3903 for instructions and.

7 Form 3903 Templates free to download in PDF, Word and Excel

Web retrieved jan 3, 2018, from. Web if you file form 2555, foreign earned income, to exclude any of your income or housing costs, report the full amount of your deductible moving expenses on form 3903 and on. Web use form 3903 to figure your moving expense deduction for a move related to the start of work at a new.

2023 IL1040 Schedule NR Instructions Illinoisgov Fill Online

Web form 3903 department of the treasury internal revenue service (99) moving expenses go to www.irs.gov/form3903 for the latest information. This publication has detailed information on deductible and nondeductible. Upload, modify or create forms. Select whether the form 3903 applies to the taxpayer, spouse, or joint. Web the irs instructions for form 3903, under what's new, states:

Web Form 3903 2021 Moving Expenses Department Of The Treasury Internal Revenue Service (99) Go To Www.irs.gov/Form3903 For Instructions And The Latest.

2022 instructions for form 3903 — irs use form 3903 to figure your moving expense deduction for a move related to the start of work at a new. Get ready for tax season deadlines by completing any required tax forms today. Web you can deduct your unreimbursed moving expenses for you, your spouse, and your dependents. Go to input return ⮕ deductions ⮕ moving expenses 3903.

Web To Enter Moving Expenses For Tax Years 2018 And Later In Taxslayer Proweb, From The Federal Section Of The Tax Return (Form 1040) Select:

If the new workplace is outside the. Edit, sign and save moving expenses form. Complete, edit or print tax forms instantly. See specific instructions, later, for how to report this deduction.

Try It For Free Now!

Web instructions for form 3903 moving expenses department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Purpose of form use form 3903 to figure your moving expense. Web form 3903 2021 moving expenses department of the treasury internal revenue service (99) a go to www.irs.gov/form3903 for instructions and the latest information. Web the irs instructions for form 3903, under what's new, states:

You Can't Deduct Expenses That Are Reimbursed Or.

Web form 3903 department of the treasury internal revenue service (99) moving expenses go to www.irs.gov/form3903 for instructions and the latest information. Ad download or email irs 3903 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Web use form 3903 to figure your moving expense deduction for a move related to the start of work at a new principal place of work (workplace).