Form 4 Wisconsin

Form 4 Wisconsin - Every newly‑hired employee is required. After missing the entire 2022 season with a torn acl, senior safety travian blaylock is expected back in action during fall camp. If too little is withheld, you will generally owe tax when you file your tax return. Web form4wisconsin corporationfranchise or income tax return for 2011 or taxable year beginning and ending m d d c c y y m d d c c y y 2011 due date: Every child ready to read @ your library. 7‑22) wisconsin department of revenue. Web form 4 amendment to articles of incorporation business corporation sec. Save or instantly send your ready documents. Form 4t is a wisconsin corporate income tax form. Easily fill out pdf blank, edit, and sign them.

After missing the entire 2022 season with a torn acl, senior safety travian blaylock is expected back in action during fall camp. Form 4t is a wisconsin corporate income tax form. Web we last updated wisconsin form 4 in march 2023 from the wisconsin department of revenue. If too little is withheld, you will generally owe tax when you file your tax return. Web we last updated wisconsin form 4t from the department of revenue in february 2023. Effective on or after january 1, 2020, every newly‑hired. Please read the instructions first before using this option. Web the wisconsin court system protects individuals' rights, privileges and liberties, maintains the rule of law, and provides a forum for the resolution of disputes. See page 2 for more information on each step, who can claim. If no change is needed for current.

7‑22) wisconsin department of revenue. Form 4t is a wisconsin corporate income tax form. August 1, 2023 news local. Please read the instructions first before using this option. This option will not electronically file your form. Public library association early literacy resources. This form is for income earned in tax year 2022, with tax returns due in april. Every newly‑hired employee is required. Risk to life and property. If too little is withheld, you will generally owe tax when you file your tax return.

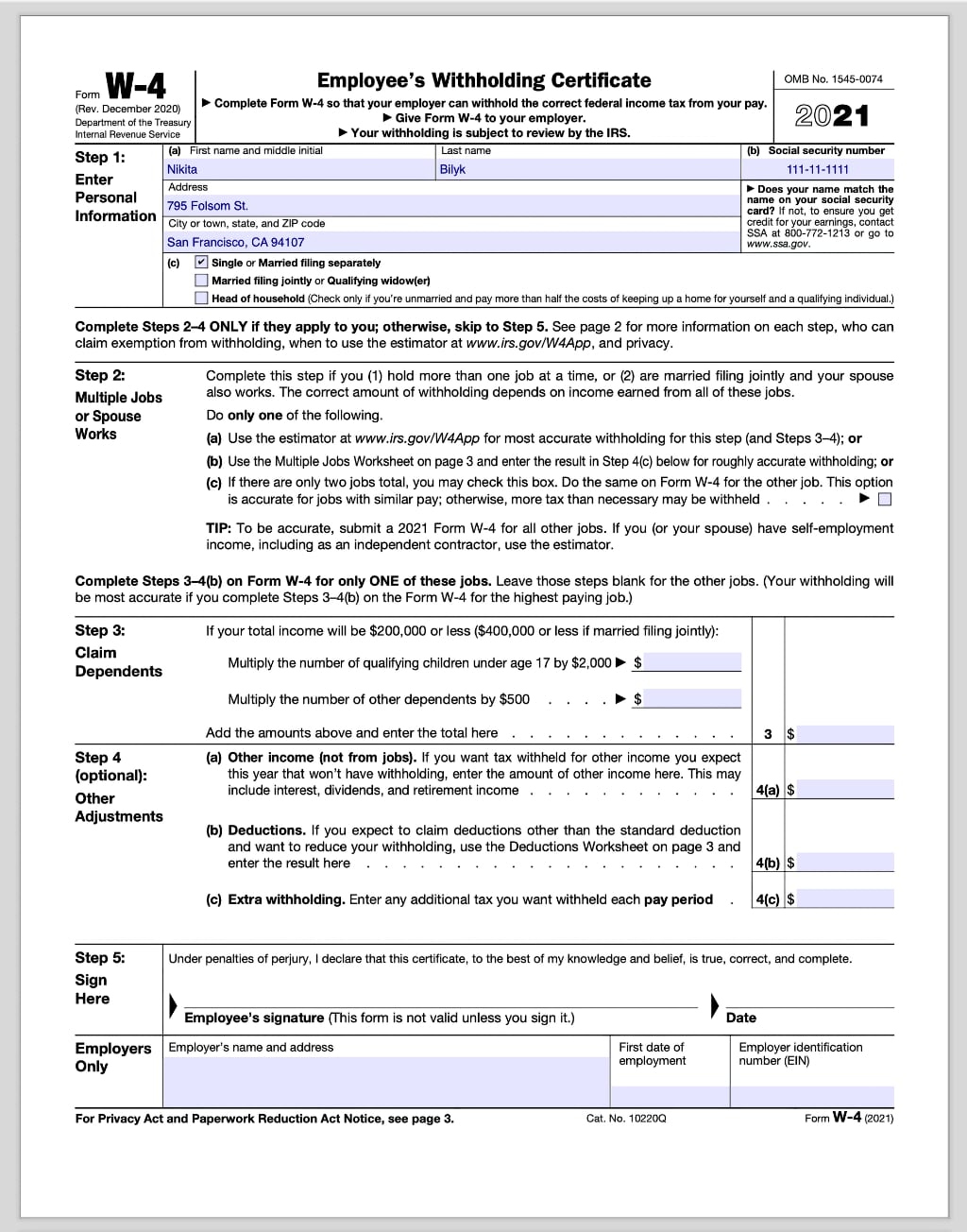

Wisconsin W4 2021 2022 W4 Form

Save or instantly send your ready documents. August 1, 2023 news local. This option will not electronically file your form. Otherwise, skip to step 5. If too little is withheld, you will generally owe tax when you file your tax return.

4+ Wisconsin Probate Forms Free Download

Save or instantly send your ready documents. This option will not electronically file your form. 6‑20) wisconsin department of revenue. Every newly‑hired employee is required. The corporate name (prior to any change effected by this.

Wisconsin Withholding Printable PDF In Spanish 2022 W4 Form

Public library association early literacy resources. Web form 4 amendment to articles of incorporation business corporation sec. Web we last updated wisconsin form 4t from the department of revenue in february 2023. See page 2 for more information on each step, who can claim. August 1, 2023 news local.

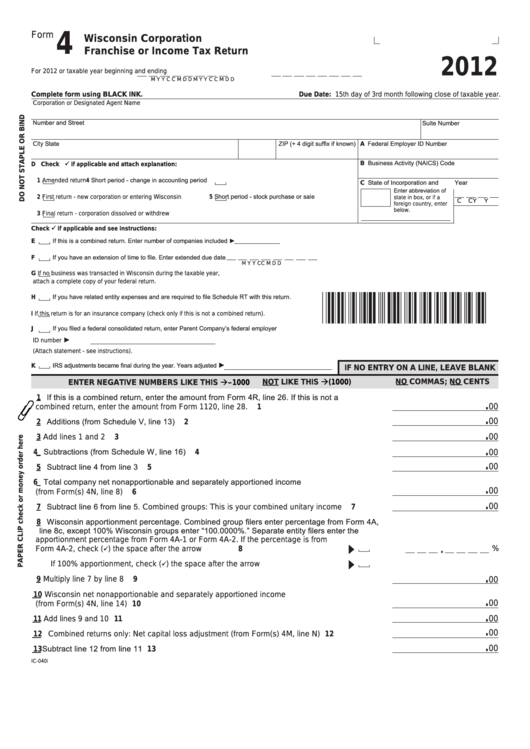

Fillable Form 4 Wisconsin Corporation Franchise Or Tax Return

Effective on or after january 1, 2020, every newly‑hired. Complete, edit or print tax forms instantly. The level of risk due to high winds, flooding rain, surge, and tornado. Form 4t is a wisconsin corporate income tax form. The corporate name (prior to any change effected by this.

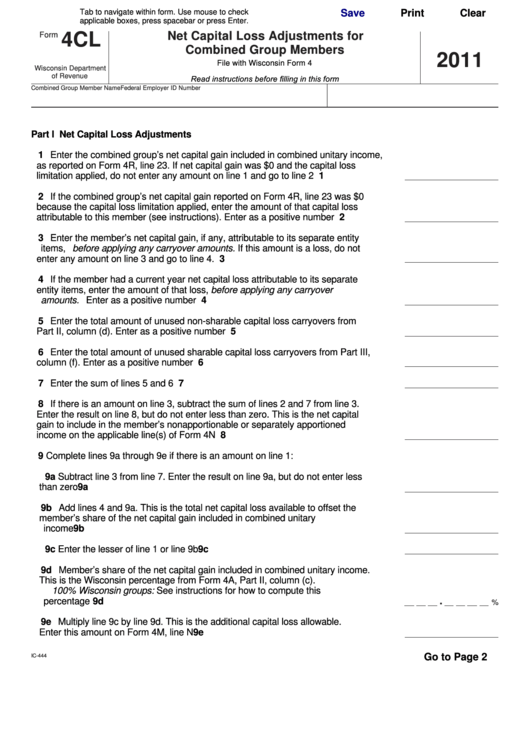

Fillable Form 4cl Wisconsin Net Capital Loss Adjustments For Combined

This option will not electronically file your form. Web early literacy and childhood development. Web we last updated wisconsin form 4t from the department of revenue in february 2023. Form 4t is a wisconsin corporate income tax form. August 1, 2023 news local.

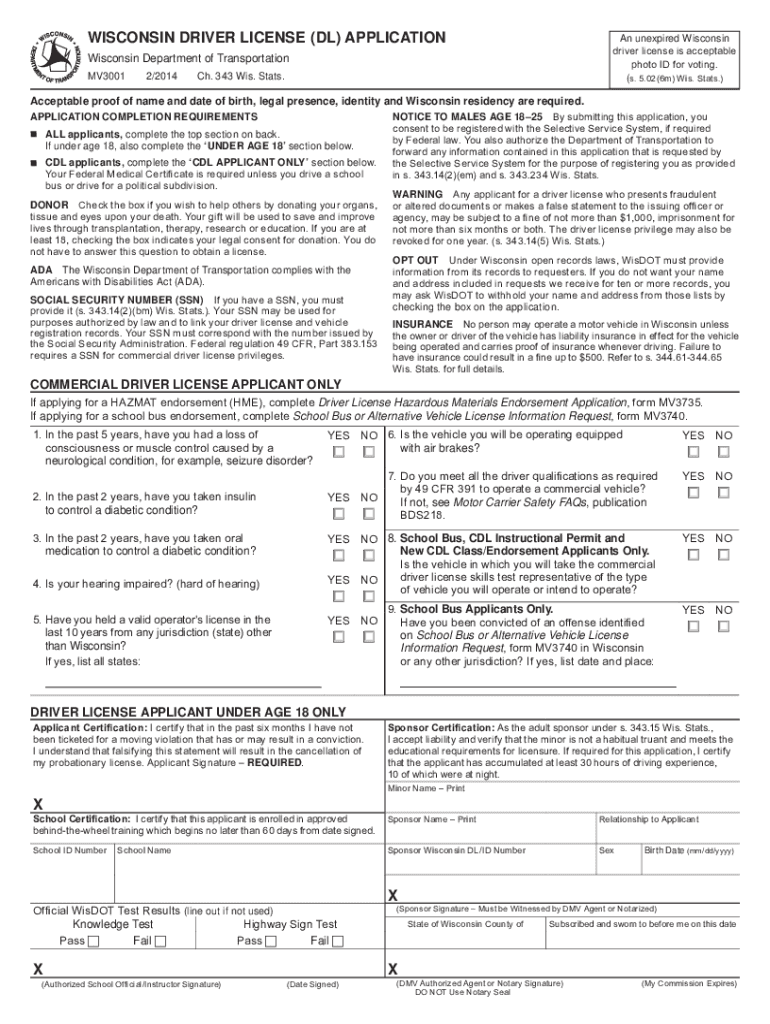

Wisconsindmv Gov Mv3001 Fill Online, Printable, Fillable, Blank

If no change is needed for current. See page 2 for more information on each step, who can claim. Effective on or after january 1, 2020, every newly‑hired. Web 11 hours agomeanwhile, trump advisers were pursuing a fake elector scheme, pushing republican officials in states like arizona, wisconsin and georgia to put forward an. 7‑22) wisconsin department of revenue.

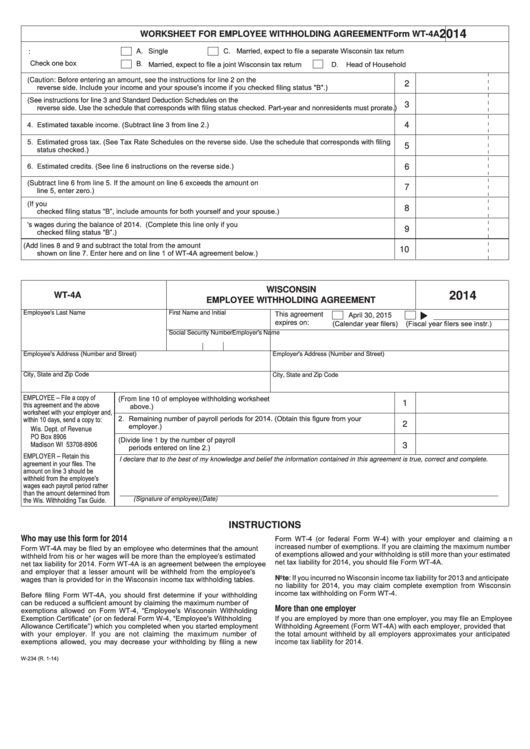

Form WT4 Wisconsin Department of Revenue dor state wi Fill out

If too little is withheld, you will generally owe tax when you file your tax return. Otherwise, skip to step 5. Easily fill out pdf blank, edit, and sign them. Form 4t is a wisconsin corporate income tax form. August 1, 2023 news local.

Wisconsin Rental Application Form PDFSimpli

See page 2 for more information on each step, who can claim. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Effective on or after january 1, 2020, every newly‑hired. Web 11 hours agomeanwhile, trump advisers were pursuing a fake elector scheme, pushing republican officials in states like arizona, wisconsin and georgia to.

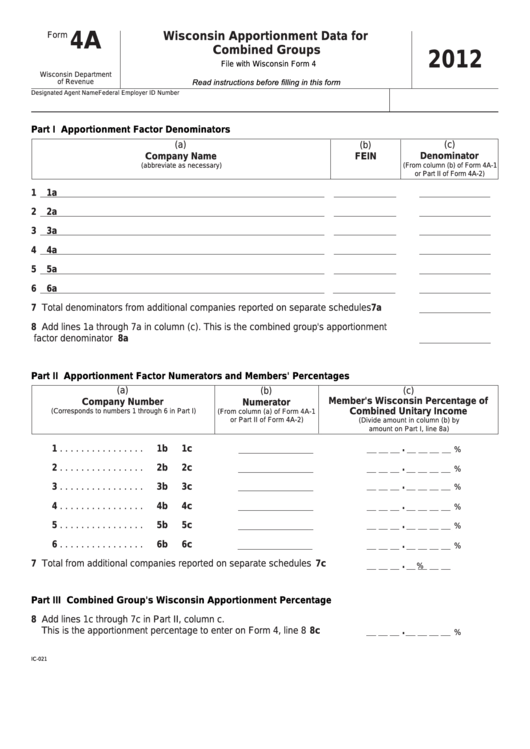

Fillable Form 4a Wisconsin Apportionment Data For Combined Groups

Form 4t is a wisconsin corporate income tax form. This option will not electronically file your form. Effective on or after january 1, 2020, every newly‑hired. This is not available for all the forms. Save or instantly send your ready documents.

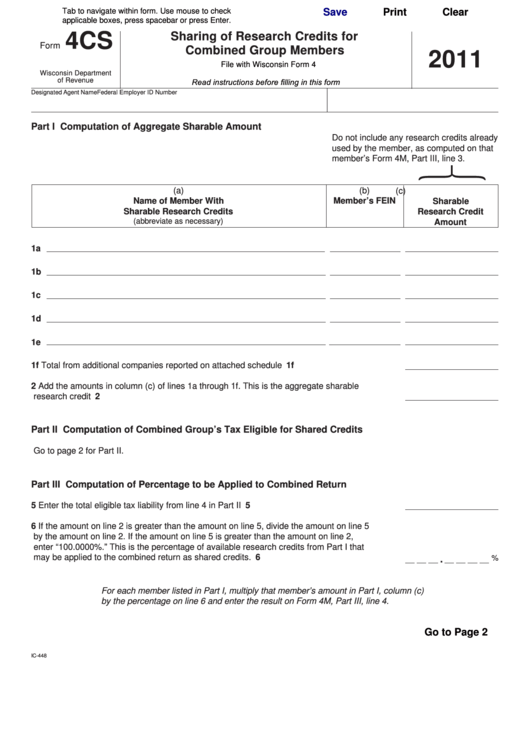

Fillable Form 4cs Wisconsin Sharing Of Research Credits For Combined

Web form 4 amendment to articles of incorporation business corporation sec. Web we last updated wisconsin form 4 in march 2023 from the wisconsin department of revenue. Every newly‑hired employee is required. Easily fill out pdf blank, edit, and sign them. Otherwise, skip to step 5.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Web the wisconsin court system protects individuals' rights, privileges and liberties, maintains the rule of law, and provides a forum for the resolution of disputes. Every newly‑hired employee is required. This is not available for all the forms. This form is for income earned in tax year 2022, with tax returns due in april.

The Corporate Name (Prior To Any Change Effected By This.

See page 2 for more information on each step, who can claim. If no change is needed for current. Web form4wisconsin corporationfranchise or income tax return for 2011 or taxable year beginning and ending m d d c c y y m d d c c y y 2011 due date: Effective on or after january 1, 2020, every newly‑hired.

After Missing The Entire 2022 Season With A Torn Acl, Senior Safety Travian Blaylock Is Expected Back In Action During Fall Camp.

August 1, 2023 news local. Web 11 hours agomeanwhile, trump advisers were pursuing a fake elector scheme, pushing republican officials in states like arizona, wisconsin and georgia to put forward an. Web we last updated wisconsin form 4t from the department of revenue in february 2023. If too little is withheld, you will generally owe tax when you file your tax return.

Save Or Instantly Send Your Ready Documents.

Web we last updated wisconsin form 4 in march 2023 from the wisconsin department of revenue. Web early literacy and childhood development. Otherwise, skip to step 5. Please read the instructions first before using this option.