Form 4136 Fuel Tax Credit

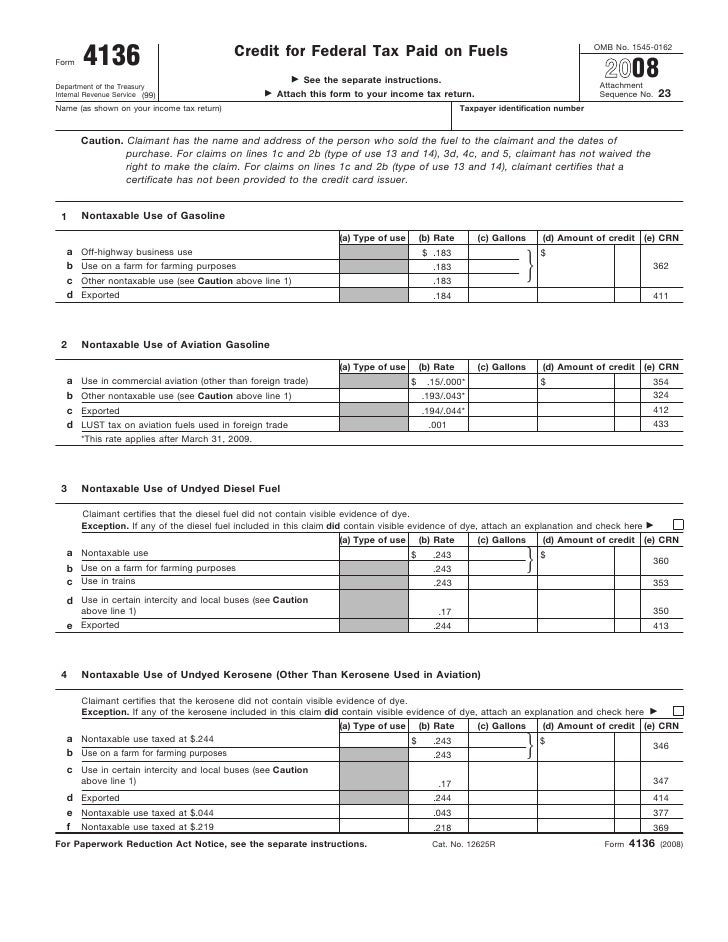

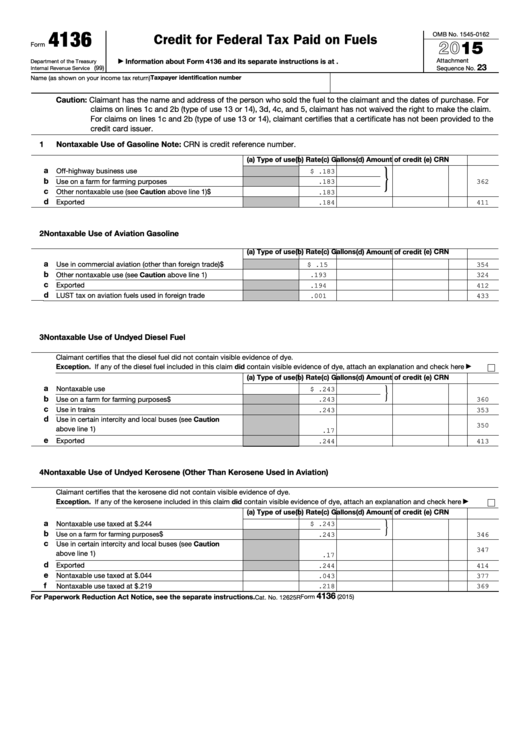

Form 4136 Fuel Tax Credit - 23 name (as shown on your income tax return) taxpayer identification number caution: The federal government imposes taxes on a variety of fuels. Web use form 4136 to claim the following. Web credit for federal tax paid on fuels go to www.irs.gov/form4136 for instructions and the latest information. Web however, if you operate a business that consumes a significant amount of fuel, you may be eligible for a federal fuel tax credit under certain circumstances by filing irs form 4136. Web certain uses of fuels are untaxed, however, and fuel users can get a credit for the taxes they’ve paid by filing form 4136. Web use form 4136 to claim a credit for federal taxes paid on certain fuels. Go to irs publication 510 excise taxes (including fuel tax credits and refunds) for definitions and information on nontaxable uses. Fuel tax for nontaxable uses, if less than $750 for the year. Web excise taxes paid for off highway use may be claimed as a refund on form 8849 or as a tax credit on form 4136.

Web use form 4136 to claim a credit for federal taxes paid on certain fuels. What irs form 4136 is used for what types of fuel use qualify for fuel credits The credits available on form 4136 are: Web certain uses of fuels are untaxed, however, and fuel users can get a credit for the taxes they’ve paid by filing form 4136. Web excise taxes paid for off highway use may be claimed as a refund on form 8849 or as a tax credit on form 4136. Go to irs publication 510 excise taxes (including fuel tax credits and refunds) for definitions and information on nontaxable uses. Any alternative fuel credit must first be claimed on form 720, schedule c, to reduce your section 4041 taxable fuel liability for alternative fuel and cng reported on form 720. The federal government imposes taxes on a variety of fuels. Web however, if you operate a business that consumes a significant amount of fuel, you may be eligible for a federal fuel tax credit under certain circumstances by filing irs form 4136. Fuel tax not included in a previously filed refund claim.

Web how to claim the credit. Web however, if you operate a business that consumes a significant amount of fuel, you may be eligible for a federal fuel tax credit under certain circumstances by filing irs form 4136. 23 name (as shown on your income tax return) taxpayer identification number caution: Web certain uses of fuels are untaxed, however, and fuel users can get a credit for the taxes they’ve paid by filing form 4136. Web information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file. Web credit for federal tax paid on fuels (form 4136) the government taxes gasoline, diesel fuel, kerosene, alternative fuels and some other types of fuel. Go to irs publication 510 excise taxes (including fuel tax credits and refunds) for definitions and information on nontaxable uses. A credit for exporting dyed fuels or gasoline blendstocks. Any alternative fuel credit must first be claimed on form 720, schedule c, to reduce your section 4041 taxable fuel liability for alternative fuel and cng reported on form 720. The one most familiar to taxpayers is probably the federal gas tax—18.4 cents/gallon as of 2021—which pays for road projects across the country.

3.12.217 Error Resolution Instructions for Form 1120S Internal

Turbotax does not support form 8849. Web excise taxes paid for off highway use may be claimed as a refund on form 8849 or as a tax credit on form 4136. Web use form 4136 to claim the following. However, there are certain uses of these fuels that are considered to be nontaxable. Web certain uses of fuels are untaxed,.

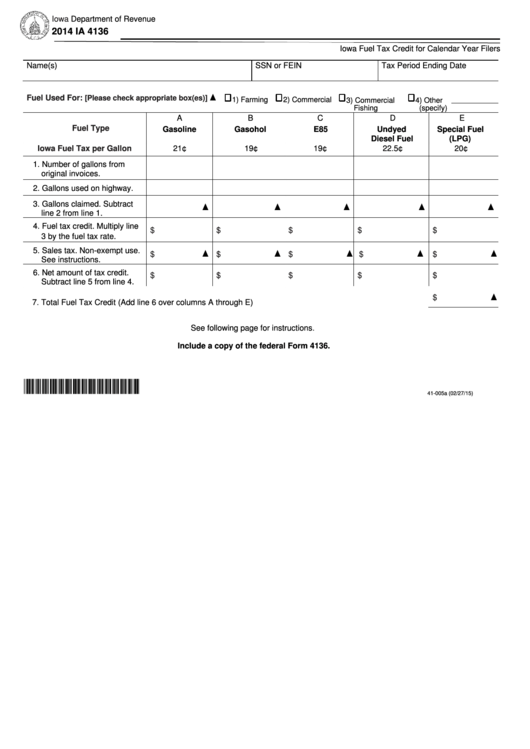

Fillable Form Ia 4136 Iowa Fuel Tax Credit For Calendar Year Filters

Fuel tax for nontaxable uses, if less than $750 for the year. You can claim the following taxes only as a credit on form 4136: The federal government imposes taxes on a variety of fuels. The one most familiar to taxpayers is probably the federal gas tax—18.4 cents/gallon as of 2021—which pays for road projects across the country. Go to.

Fill Free fillable Form 4136 Credit for Federal Tax Paid on Fuels

Web however, if you operate a business that consumes a significant amount of fuel, you may be eligible for a federal fuel tax credit under certain circumstances by filing irs form 4136. Web use form 4136 to claim the following. Web excise taxes paid for off highway use may be claimed as a refund on form 8849 or as a.

What is Form 4136 Credit for Federal Tax Paid on Fuels TurboTax Tax

Web how to claim the credit. Web certain uses of fuels are untaxed, however, and fuel users can get a credit for the taxes they’ve paid by filing form 4136. The biodiesel or renewable diesel mixture credit. Turbotax does not support form 8849. Fuel tax not included in a previously filed refund claim.

Fuel Tax Credit Eligibility, Form 4136 & How to Claim

The federal government imposes taxes on a variety of fuels. A credit for exporting dyed fuels or gasoline blendstocks. Web excise taxes paid for off highway use may be claimed as a refund on form 8849 or as a tax credit on form 4136. Fuel tax not included in a previously filed refund claim. Turbotax does not support form 8849.

Fill Free fillable Form 4136 Credit for Federal Tax Paid on Fuels

Web use form 4136 to claim a credit for federal taxes paid on certain fuels. The federal government imposes taxes on a variety of fuels. Web how to claim the credit. The biodiesel or renewable diesel mixture credit. A credit for exporting dyed fuels or gasoline blendstocks.

Form 4136Credit for Federal Tax Paid on Fuel

Go to irs publication 510 excise taxes (including fuel tax credits and refunds) for definitions and information on nontaxable uses. 23 name (as shown on your income tax return) taxpayer identification number caution: Web use form 4136 to claim the following. Schedule 3 (form 8849), or form 4136. You can claim the following taxes only as a credit on form.

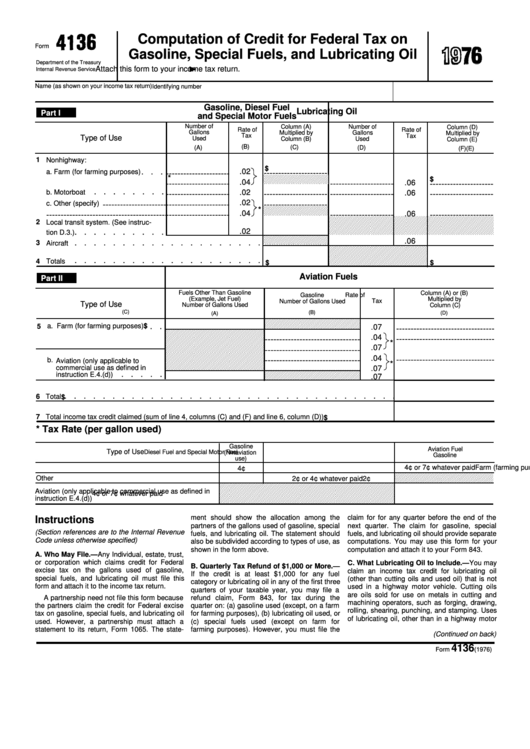

Form 4136 Computation Of Credit For Federal Tax On Gasoline, Special

Any excess credit may be claimed on form 720, schedule c; Web use form 4136 to claim a credit for federal taxes paid on certain fuels. Web credit for federal tax paid on fuels go to www.irs.gov/form4136 for instructions and the latest information. Web however, if you operate a business that consumes a significant amount of fuel, you may be.

Form 4136 Credit For Federal Tax Paid on Fuels (2015) Free Download

Fuel tax not included in a previously filed refund claim. Turbotax does not support form 8849. Web use form 4136 to claim a credit for federal taxes paid on certain fuels. Web certain uses of fuels are untaxed, however, and fuel users can get a credit for the taxes they’ve paid by filing form 4136. The biodiesel or renewable diesel.

Fillable Form 4136 Credit For Federal Tax Paid On Fuels 2015

This article will walk you through this tax form, so you understand: Turbotax does not support form 8849. 23 name (as shown on your income tax return) taxpayer identification number caution: Web certain uses of fuels are untaxed, however, and fuel users can get a credit for the taxes they’ve paid by filing form 4136. Web use form 4136 to.

The Credits Available On Form 4136 Are:

The federal government imposes taxes on a variety of fuels. This article will walk you through this tax form, so you understand: You can claim the following taxes only as a credit on form 4136: Turbotax does not support form 8849.

Web Excise Taxes Paid For Off Highway Use May Be Claimed As A Refund On Form 8849 Or As A Tax Credit On Form 4136.

Web certain uses of fuels are untaxed, however, and fuel users can get a credit for the taxes they’ve paid by filing form 4136. However, there are certain uses of these fuels that are considered to be nontaxable. Any alternative fuel credit must first be claimed on form 720, schedule c, to reduce your section 4041 taxable fuel liability for alternative fuel and cng reported on form 720. Web credit for federal tax paid on fuels (form 4136) the government taxes gasoline, diesel fuel, kerosene, alternative fuels and some other types of fuel.

What Irs Form 4136 Is Used For What Types Of Fuel Use Qualify For Fuel Credits

Any excess credit may be claimed on form 720, schedule c; Schedule 3 (form 8849), or form 4136. Web use form 4136 to claim a credit for federal taxes paid on certain fuels. Fuel tax not included in a previously filed refund claim.

Web How To Claim The Credit.

The biodiesel or renewable diesel mixture credit. Web credit for federal tax paid on fuels go to www.irs.gov/form4136 for instructions and the latest information. Web however, if you operate a business that consumes a significant amount of fuel, you may be eligible for a federal fuel tax credit under certain circumstances by filing irs form 4136. Web use form 4136 to claim the following.