Form 42 Meaning

Form 42 Meaning - Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Web form 42 [refer rule 76(1)] form 42 application for registration of motor vehicle by or on behalf of diplomatic/consular officer (to be. Web a 1 indicates that you’re a permanent, career employee and have completed three years of service. Web form 1042, annual withholding tax return for u.s. Following the introduction of the finance bill 2003 there is now an obligation to notify the inland revenue of any reportable events using form 42 relating. The form is no longer in use, and the scheme is now known as employment related securities. The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign. Web form 1042, also annual withholding tax return for u.s. The sequence b ( n ), which is the sum of the powers of six,.

Web form 1042 — annual withholding tax return for u.s. Web what is form 42? Web form 1042, also annual withholding tax return for u.s. The form is no longer in use, and the scheme is now known as employment related securities. Web use form 1042 to report the following: Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Web form42 login log in with your payroll number. Source income of foreign persons. The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign. Web did they know you're a us citizen?

Source income of foreign persons. Get the form 42 you need. Web form 42 was used to tell hmrc about employee share schemes. The form is no longer in use, and the scheme is now known as employment related securities. Web a 1 indicates that you’re a permanent, career employee and have completed three years of service. Web did they know you're a us citizen? Web use form 1042 to report the following: Web form 1042, annual withholding tax return for u.s. Web what is form 42? Web form 1042, also annual withholding tax return for u.s.

Form 42 Entry 27911 Fileupload 5 Ronen Bekerman 3D Architectural

Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Web did they know you're a us citizen? Web a 1 indicates that you’re a permanent, career employee and have completed three years of service. Source income of foreign persons. Web form 1042, also annual withholding tax return for u.s.

Form 42

Get the form 42 you need. Web form 1042 — annual withholding tax return for u.s. Web form 42 was used to tell hmrc about employee share schemes. Source income of foreign persons. Source income of foreign persons, is used to report tax withheld on certain income of foreign persons.

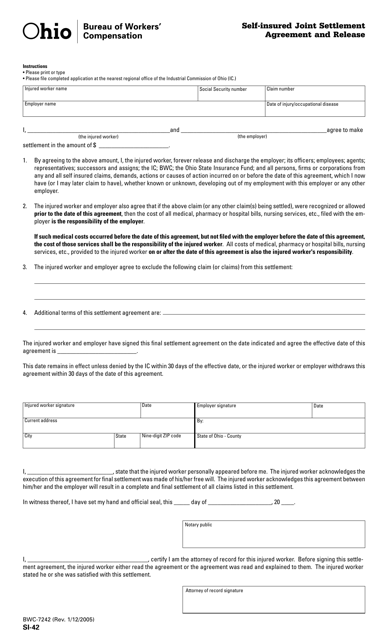

20142022 UK Form 42 Fill Online, Printable, Fillable, Blank pdfFiller

Web what is form 42? Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. Get the form 42 you need. The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign.

Angel Number 42 Meaning & Reasons why you are seeing Angel Manifest

Source income of foreign persons. Web use form 1042 to report the following: Web a 1 indicates that you’re a permanent, career employee and have completed three years of service. Web did they know you're a us citizen? Web form 42 [refer rule 76(1)] form 42 application for registration of motor vehicle by or on behalf of diplomatic/consular officer (to.

The Answer is 42 Douglas Adams venn diagram Answer Kids TShirt

Web form42 login log in with your payroll number. Web form 1042, also annual withholding tax return for u.s. The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign. Web form 42 [refer rule 76(1)] form 42 application for registration of motor vehicle by or on behalf of diplomatic/consular officer (to be..

Angel Number 42 Meaning Discover Your Life's Purpose

The sequence b ( n ), which is the sum of the powers of six,. Web form 1042, also annual withholding tax return for u.s. Web form 1042, annual withholding tax return for u.s. The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign. Web did they know you're a us citizen?

Form SI42 (BWC7242) Download Printable PDF or Fill Online Self

Web form 1042 — annual withholding tax return for u.s. The sequence b ( n ), which is the sum of the powers of six,. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Web the number 42 is the sum of the first two nonzero integer powers of six—that is, 6 1.

Meaning Angel Number 42 Interpretation Message of the Angels >>

Source income of foreign persons. Web form 1042 — annual withholding tax return for u.s. Source income of foreign persons. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. The sequence b ( n ), which is the sum of the powers of six,.

Could 42 Be The Meaning To Everything? YouTube

Web form 42 [refer rule 76(1)] form 42 application for registration of motor vehicle by or on behalf of diplomatic/consular officer (to be. Web did they know you're a us citizen? Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. Web form 1042, also annual withholding tax return for u.s. Web form42.

Angel Number 42 Meanings Why Are You Seeing 42?

Source income of foreign persons. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. The form is no longer in use, and the scheme is now known as employment related securities. Web form 42 [refer rule 76(1)] form 42 application for registration of motor vehicle by or on behalf of diplomatic/consular officer (to.

Web Form 42 Was Used To Tell Hmrc About Employee Share Schemes.

The form is no longer in use, and the scheme is now known as employment related securities. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Web did they know you're a us citizen? The sequence b ( n ), which is the sum of the powers of six,.

Web Use Form 1042 To Report The Following:

Web form42 login log in with your payroll number. Web form 1042, also annual withholding tax return for u.s. Get the form 42 you need. The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign.

Source Income Of Foreign Persons.

Web what is form 42? Web a 1 indicates that you’re a permanent, career employee and have completed three years of service. Source income of foreign persons. Web the number 42 is the sum of the first two nonzero integer powers of six—that is, 6 1 + 6 2 = 42.

Web Form 1042 — Annual Withholding Tax Return For U.s.

Source income of foreign persons, is used to report tax withheld on the income of foreign persons. Web form 1042, annual withholding tax return for u.s. Web form 42 [refer rule 76(1)] form 42 application for registration of motor vehicle by or on behalf of diplomatic/consular officer (to be. Following the introduction of the finance bill 2003 there is now an obligation to notify the inland revenue of any reportable events using form 42 relating.