Form 472 Ct

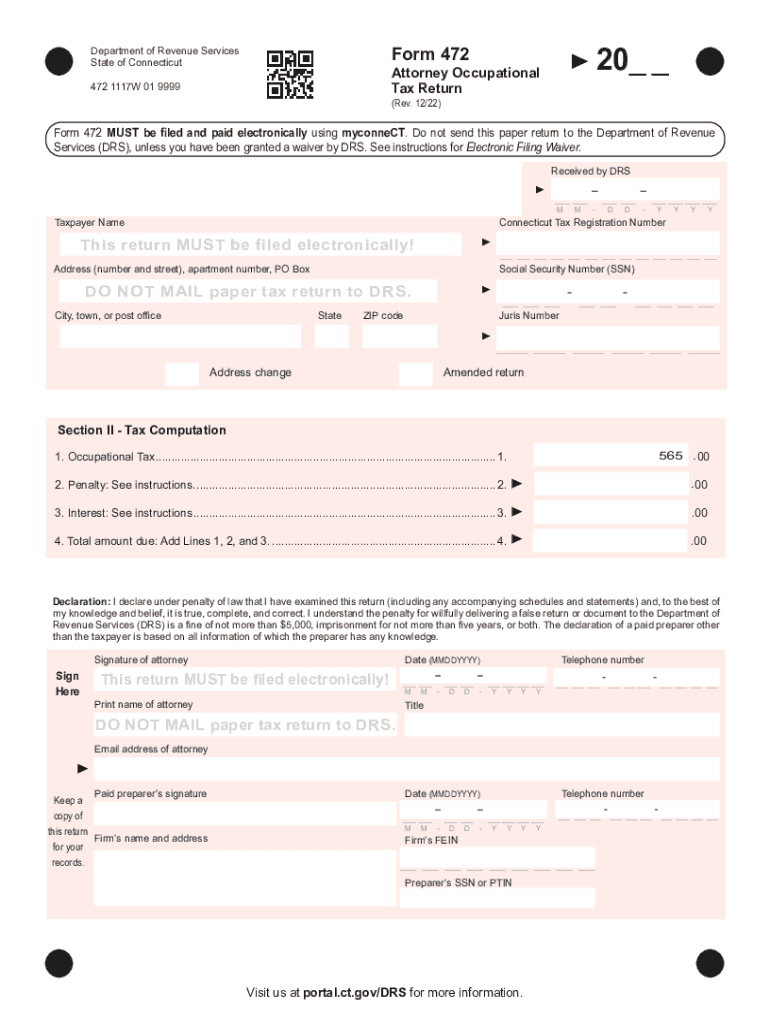

Form 472 Ct - Web the attorney occupational tax of $565 is due for ct attorneys on or before january 15, 2023 for the calendar year of 2022. If the attorney becomes legally incompetent or dies before filing the attorney occupational tax return, the. Save or instantly send your ready documents. Form 472 must be filed and paid electronically using myconnect. Web current 472 connecticut state department of revenue services featured items for businesses for individuals practitioners forms publications research library search. Do not send this paper return to the department of revenue services (drs), unless you have been granted a waiver by. 2013 attorney occupational tax return: Do not send this paper return to the department of. Web form 472 is a document that companies use to report their stock transactions. The tax is paid when submitting form 472 which.

Web asked to enter the connecticut jurisdiction code: Internal revenue service form 5472 is an informational form that discloses the transactions during the tax year of a reporting. Web attorneys admitted to practice law in connecticut for calendar year 2015 must file form 472, attorney occupational tax return with the connecticut department. Web 13 rows connecticut's official state website search bar for ct.gov. Select the document template you need in the collection of legal forms. Web file form 472, attorney occupational tax return, on or before january 15, 2008. The attorney must sign and date form 472. With our platform filling in ct dor 472 requires just a. Web purpose of the form. Experience all the benefits of completing and submitting forms on the internet.

Web fill out ct dor 472 in a couple of clicks by simply following the instructions listed below: Web follow the simple instructions below: Web purpose of the form. Easily fill out pdf blank, edit, and sign them. Internal revenue service form 5472 is an informational form that discloses the transactions during the tax year of a reporting. Select the document template you need in the collection of legal forms. Web form 472 must be filed and paid electronically. Experience all the benefits of completing and submitting forms on the internet. The attorney must sign and date form 472. Form 472 must be filed and paid electronically using myconnect.

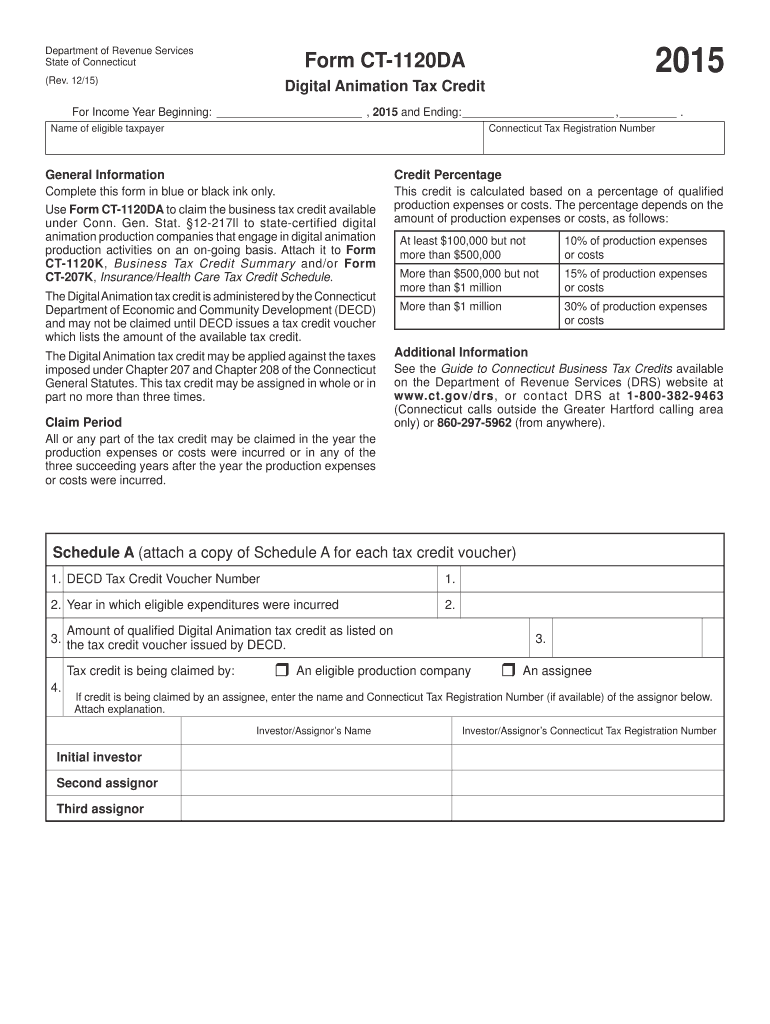

CT DRS CT1120DA 2015 Fill out Tax Template Online US Legal Forms

Form 472 must be filed and paid electronically using myconnect. If the due date falls on a saturday, sunday or legal holiday,. Save or instantly send your ready documents. Web form 472 must be filed and paid electronically. Web complete form ct 472 online with us legal forms.

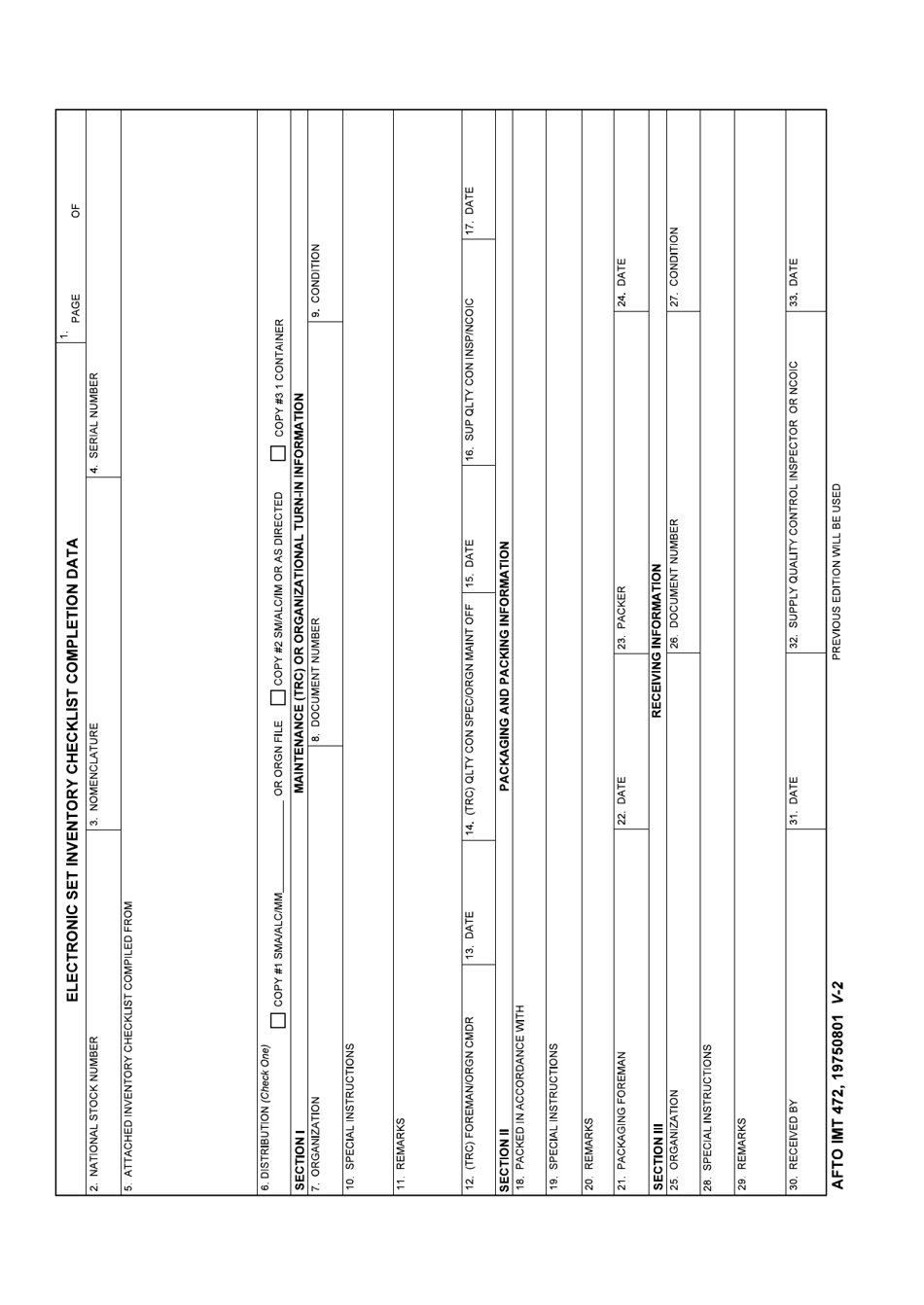

AFTO IMT Form 472 Download Fillable PDF or Fill Online Electronic Set

Make check payable to commissioner of. Web what is ct form 472? Web 13 rows connecticut's official state website search bar for ct.gov. Internal revenue service form 5472 is an informational form that discloses the transactions during the tax year of a reporting. Select the document template you need in the collection of legal forms.

ECF FCC Form 472 Walkthrough Emergency Connectivity Fund

Your payment will be effective on the date you make the charge. Web current 472 connecticut state department of revenue services featured items for businesses for individuals practitioners forms publications research library search. Do not send this paper return to the department of revenue services (drs), unless you have been granted a waiver by. Form 472 must be filed and.

2022 Form CT DoR 472 Fill Online, Printable, Fillable, Blank pdfFiller

Web attorneys admitted to practice law in connecticut for calendar year 2015 must file form 472, attorney occupational tax return with the connecticut department. The tax is paid when submitting form 472 which. Click on the orange button directly below to. Web purpose of the form. Web form 472 must be filed and paid electronically.

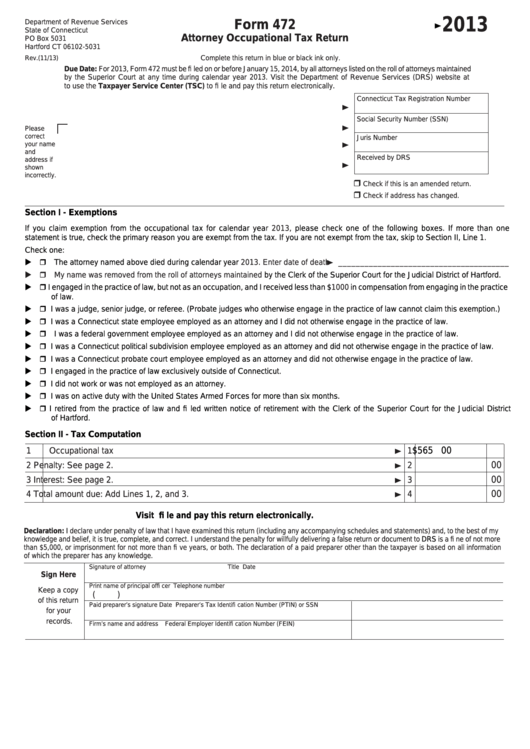

Form 472 Attorney Occupational Tax Return 2013 printable pdf download

Web file form 472, attorney occupational tax return, on or before january 15, 2008. Click on the orange button directly below to. Web file form 472, attorney occupational tax return, on or before january 15, following the close of the calendar year. Web complete form ct 472 online with us legal forms. Experience all the benefits of completing and submitting.

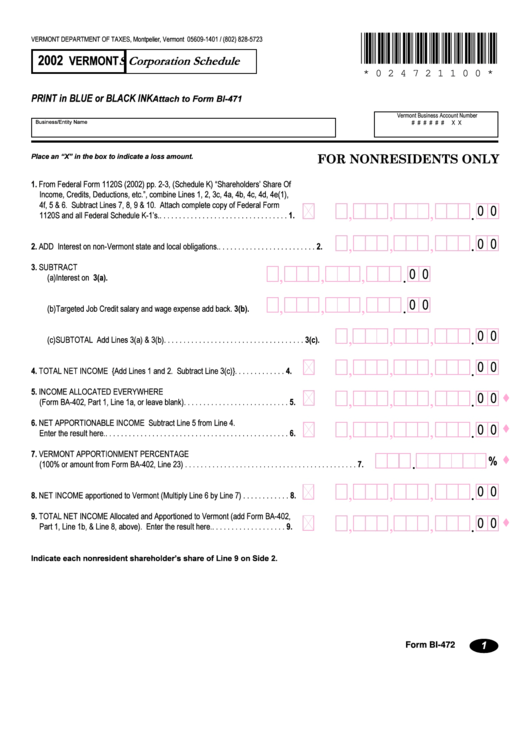

Vermont Form Bi472 S Corporation Schedule 2002 printable pdf download

Make check payable to commissioner of. Web attorneys admitted to practice law in connecticut for calendar year 2015 must file form 472, attorney occupational tax return with the connecticut department. Web file form 472, attorney occupational tax return, on or before january 15, following the close of the calendar year. Web form 472 is a document that companies use to.

Latest Mangalsutra Designs In Diamond 0.472 Ct Gold Festive Gold

2013 attorney occupational tax return: Make check payable to commissioner of. Internal revenue service form 5472 is an informational form that discloses the transactions during the tax year of a reporting. Do not send this paper return to the department of revenue services (drs), unless you have been granted a waiver by. Web corporations file form 5472 to provide information.

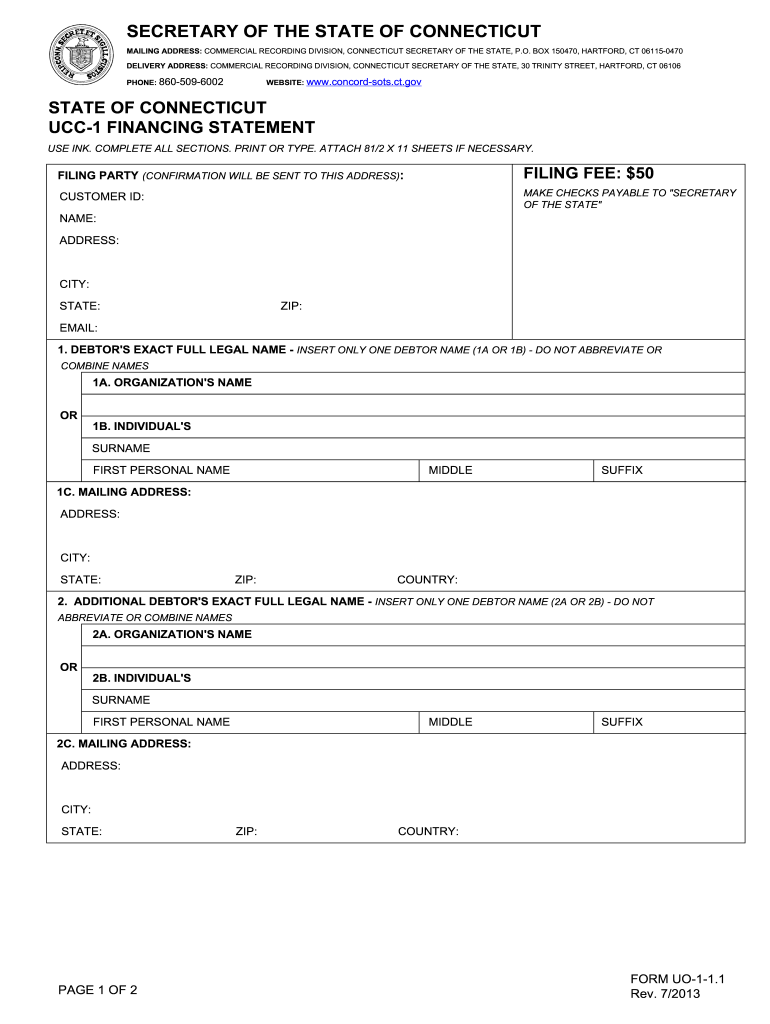

Ucc1 Koppel Pa Fill Out and Sign Printable PDF Template signNow

Web visit us at portal.ct.gov/drs for more information. Web form 472 must be filed and paid electronically. Click on the orange button directly below to. Do not send this paper return to the department of. Web the attorney occupational tax of $565 is due for ct attorneys on or before january 15, 2023 for the calendar year of 2022.

Missouri Power Of Attorney Form 5086 Fill Out and Sign Printable PDF

Make check payable to commissioner of. Web fill out ct dor 472 in a couple of clicks by simply following the instructions listed below: Your payment will be effective on the date you make the charge. Web file form 472, attorney occupational tax return, on or before january 15, following the close of the calendar year. Easily fill out pdf.

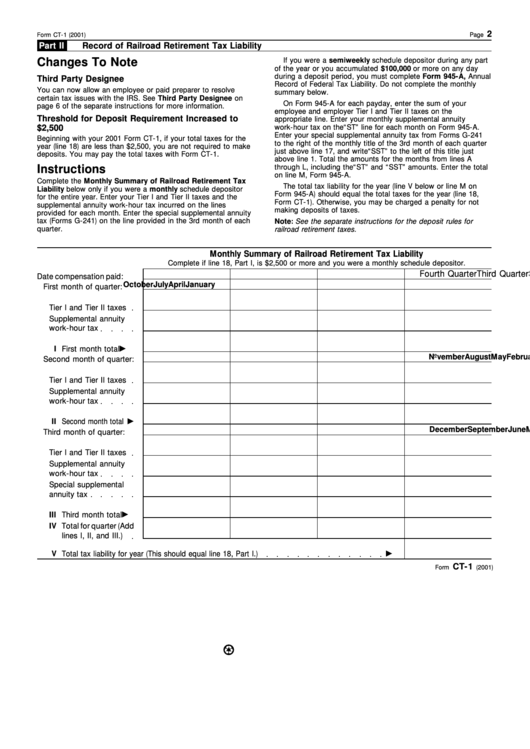

Instructions For Form Ct1 Employer'S Annual Railroad Retirement Tax

Your payment will be effective on the date you make the charge. Web form 472 is a document that companies use to report their stock transactions. Web file form 472, attorney occupational tax return, on or before january 15, following the close of the calendar year. Web what is ct form 472? Web file form 472, attorney occupational tax return,.

Web 13 Rows Connecticut's Official State Website Search Bar For Ct.gov.

Click on the orange button directly below to. Select the document template you need in the collection of legal forms. Web form 472 is a document that companies use to report their stock transactions. Web fill out ct dor 472 in a couple of clicks by simply following the instructions listed below:

If The Attorney Becomes Legally Incompetent Or Dies Before Filing The Attorney Occupational Tax Return, The.

Web file form 472, attorney occupational tax return, on or before january 15, following the close of the calendar year. Web follow the simple instructions below: Web corporations file form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur with a foreign or domestic related. Easily fill out pdf blank, edit, and sign them.

Do Not Send This Paper Return To The Department Of Revenue Services (Drs), Unless You Have Been Granted A Waiver By.

Web current 472 connecticut state department of revenue services featured items for businesses for individuals practitioners forms publications research library search. Make check payable to commissioner of. Web the attorney occupational tax of $565 is due for ct attorneys on or before january 15, 2023 for the calendar year of 2022. Web asked to enter the connecticut jurisdiction code:

Web Visit Us At Portal.ct.gov/Drs For More Information.

Web attorneys admitted to practice law in connecticut for calendar year 2015 must file form 472, attorney occupational tax return with the connecticut department. Web file form 472, attorney occupational tax return, on or before january 15, 2008. Do not send this paper return to the department of. Web what is ct form 472?