Form 4720 Instructions

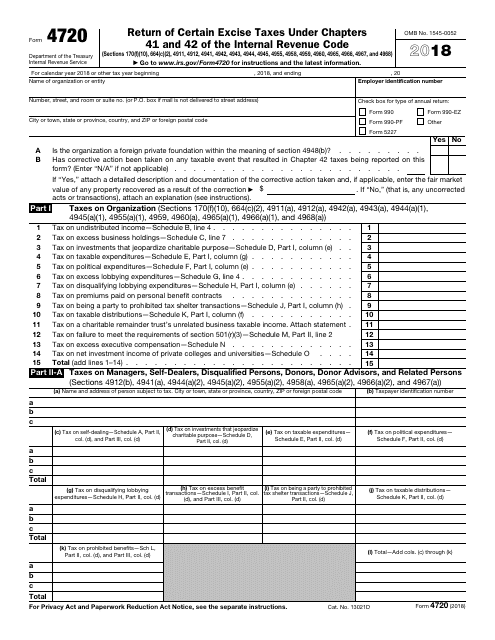

Form 4720 Instructions - Use this form to figure and pay certain excise taxes in chapters 41 and 42 of the internal revenue code. Web although not all organizations are required to file form 4720 electronically, form 4720 instructions indicate that organizations may choose to file electronically. The irs also revised form 1024, application for recognition of exemption under section 501 (a). Instructions for form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code 2022 12/21/2022 form 4720: The 4720 can be generated for exempt organization returns (990), fiduciary returns (1041), and individual returns (1040) in proconnect. Return of certain excise taxes under chapters 41 and 42 of the internal revenue code (sections 170(f)(10), 664(c)(2), 4911, 4912, 4941, 4942, 4943, 4944, 4945, 4955, 4958, 4959, 4960, 4965, 4966, 4967 and 4968) department of the treasury internal revenue service. For initial taxes imposed under sections 4941 through 4944, form 4720 must be filed for each year (or. Web instructions for form 4720. Form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code. Web an organization that has violated a tax rule that makes it liable for private foundation excise taxes must file form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code pdf, to report and pay such taxes.

The irs also revised form 1024, application for recognition of exemption under section 501 (a). Web a person filing form 4720 should enter their tax year at the top of form 4720. Use this form to figure and pay certain excise taxes in chapters 41 and 42 of the internal revenue code. Web instructions for form 4720. For initial taxes imposed under sections 4941 through 4944, form 4720 must be filed for each year (or. Web although not all organizations are required to file form 4720 electronically, form 4720 instructions indicate that organizations may choose to file electronically. Web an organization that has violated a tax rule that makes it liable for private foundation excise taxes must file form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code pdf, to report and pay such taxes. The 4720 can be generated for exempt organization returns (990), fiduciary returns (1041), and individual returns (1040) in proconnect. Instructions for form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code 2022 12/21/2022 form 4720: Return of certain excise taxes under chapters 41 and 42 of the internal revenue code (sections 170(f)(10), 664(c)(2), 4911, 4912, 4941, 4942, 4943, 4944, 4945, 4955, 4958, 4959, 4960, 4965, 4966, 4967 and 4968) department of the treasury internal revenue service.

For initial taxes imposed under sections 4941 through 4944, form 4720 must be filed for each year (or. Web this article will give the instructions for generating and filing form 4720. Return of certain excise taxes under chapters 41 and 42 of the internal revenue code 2022 12/08/2022 form 5472 The 4720 can be generated for exempt organization returns (990), fiduciary returns (1041), and individual returns (1040) in proconnect. Web read rsm tax alert. The instructions remind filers that treas. Web information about form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code, including recent updates, related forms and instructions on how to file. Return of certain excise taxes under chapters 41 and 42 of the internal revenue code (sections 170(f)(10), 664(c)(2), 4911, 4912, 4941, 4942, 4943, 4944, 4945, 4955, 4958, 4959, 4960, 4965, 4966, 4967 and 4968) department of the treasury internal revenue service. Form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code. Web although not all organizations are required to file form 4720 electronically, form 4720 instructions indicate that organizations may choose to file electronically.

Form 4720 Return of Certain Excise Taxes under Chapters 41 and 42 of

Instructions for form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code 2022 12/21/2022 form 4720: Web information about form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code, including recent updates, related forms and instructions on how to file. Web instructions for form 4720. Return.

IRS Form 4720 Download Fillable PDF or Fill Online Return of Certain

Use this form to figure and pay certain excise taxes in chapters 41 and 42 of the internal revenue code. Web this article will give the instructions for generating and filing form 4720. Return of certain excise taxes under chapters 41 and 42 of the internal revenue code (sections 170(f)(10), 664(c)(2), 4911, 4912, 4941, 4942, 4943, 4944, 4945, 4955, 4958,.

Fill Free fillable Form 4720 Return of Certain Excise Taxes PDF form

Use this form to figure and pay certain excise taxes in chapters 41 and 42 of the internal revenue code. Return of certain excise taxes under chapters 41 and 42 of the internal revenue code 2022 12/08/2022 form 5472 The instructions remind filers that treas. The irs also revised form 1024, application for recognition of exemption under section 501 (a)..

Form 4720 Return of Certain Excise Taxes under Chapters 41 and 42 of

Web read rsm tax alert. The 4720 can be generated for exempt organization returns (990), fiduciary returns (1041), and individual returns (1040) in proconnect. The irs also revised form 1024, application for recognition of exemption under section 501 (a). Web this article will give the instructions for generating and filing form 4720. Return of certain excise taxes under chapters 41.

Form 4720 Return of Certain Excise Taxes under Chapters 41 and 42 of

The instructions remind filers that treas. Web read rsm tax alert. Web although not all organizations are required to file form 4720 electronically, form 4720 instructions indicate that organizations may choose to file electronically. For initial taxes imposed under sections 4941 through 4944, form 4720 must be filed for each year (or. The 4720 can be generated for exempt organization.

Form 4720 Return of Certain Excise Taxes under Chapters 41 and 42 of

Web instructions for form 4720. Web read rsm tax alert. Use this form to figure and pay certain excise taxes in chapters 41 and 42 of the internal revenue code. Return of certain excise taxes under chapters 41 and 42 of the internal revenue code (sections 170(f)(10), 664(c)(2), 4911, 4912, 4941, 4942, 4943, 4944, 4945, 4955, 4958, 4959, 4960, 4965,.

Fill Free fillable Form 4720 Return of Certain Excise Taxes PDF form

For initial taxes imposed under sections 4941 through 4944, form 4720 must be filed for each year (or. Web read rsm tax alert. Use this form to figure and pay certain excise taxes in chapters 41 and 42 of the internal revenue code. Web a person filing form 4720 should enter their tax year at the top of form 4720..

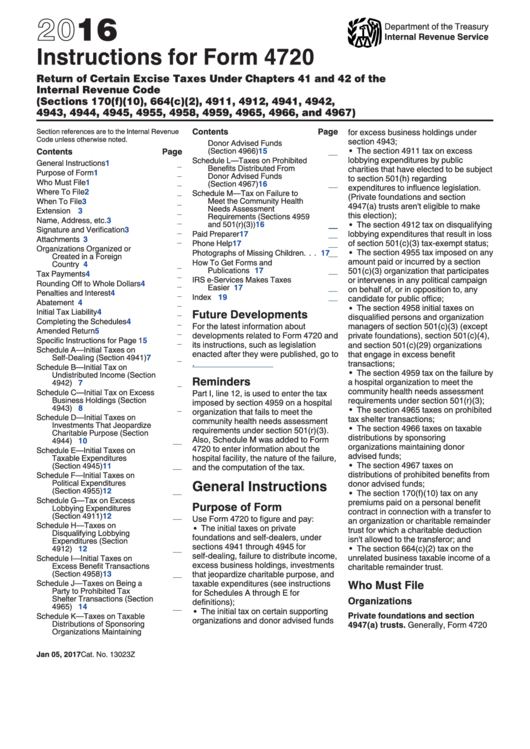

Instructions For Form 4720 2016 printable pdf download

Instructions for form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code 2022 12/21/2022 form 4720: The 4720 can be generated for exempt organization returns (990), fiduciary returns (1041), and individual returns (1040) in proconnect. Web this article will give the instructions for generating and filing form 4720. For initial taxes imposed under.

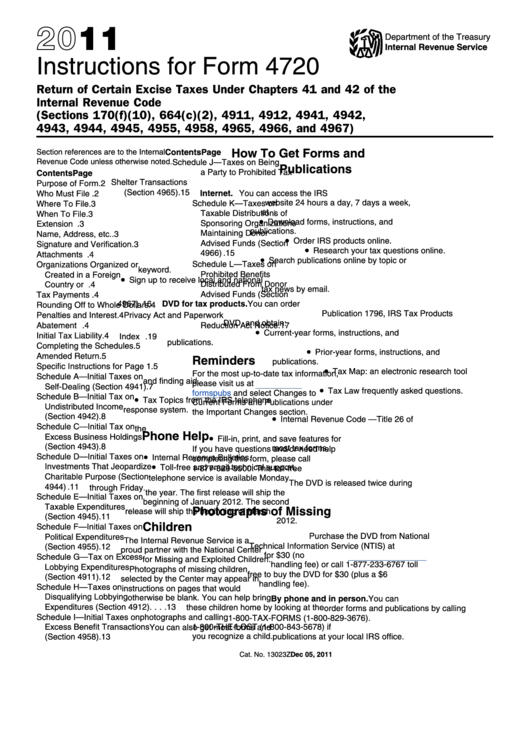

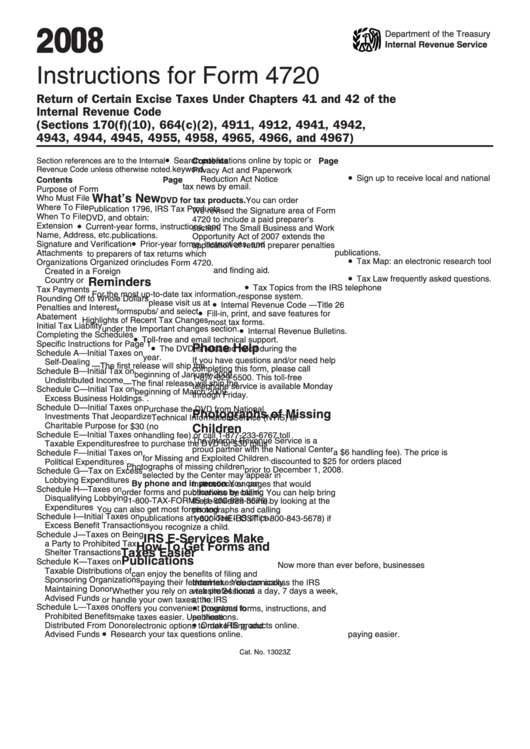

Instructions For Form 4720 Return Of Certain Excise Taxes

Return of certain excise taxes under chapters 41 and 42 of the internal revenue code 2022 12/08/2022 form 5472 Use this form to figure and pay certain excise taxes in chapters 41 and 42 of the internal revenue code. Instructions for form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code 2022 12/21/2022.

Instructions For Form 4720 Return Of Certain Excise Taxes

The 4720 can be generated for exempt organization returns (990), fiduciary returns (1041), and individual returns (1040) in proconnect. Web read rsm tax alert. Web an organization that has violated a tax rule that makes it liable for private foundation excise taxes must file form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue.

The Instructions Remind Filers That Treas.

Web a person filing form 4720 should enter their tax year at the top of form 4720. Return of certain excise taxes under chapters 41 and 42 of the internal revenue code 2022 12/08/2022 form 5472 The irs also revised form 1024, application for recognition of exemption under section 501 (a). Form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code.

Web Instructions For Form 4720.

Instructions for form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code 2022 12/21/2022 form 4720: Web information about form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code, including recent updates, related forms and instructions on how to file. Use this form to figure and pay certain excise taxes in chapters 41 and 42 of the internal revenue code. Return of certain excise taxes under chapters 41 and 42 of the internal revenue code (sections 170(f)(10), 664(c)(2), 4911, 4912, 4941, 4942, 4943, 4944, 4945, 4955, 4958, 4959, 4960, 4965, 4966, 4967 and 4968) department of the treasury internal revenue service.

Web This Article Will Give The Instructions For Generating And Filing Form 4720.

Web read rsm tax alert. The 4720 can be generated for exempt organization returns (990), fiduciary returns (1041), and individual returns (1040) in proconnect. Web although not all organizations are required to file form 4720 electronically, form 4720 instructions indicate that organizations may choose to file electronically. Web an organization that has violated a tax rule that makes it liable for private foundation excise taxes must file form 4720, return of certain excise taxes under chapters 41 and 42 of the internal revenue code pdf, to report and pay such taxes.